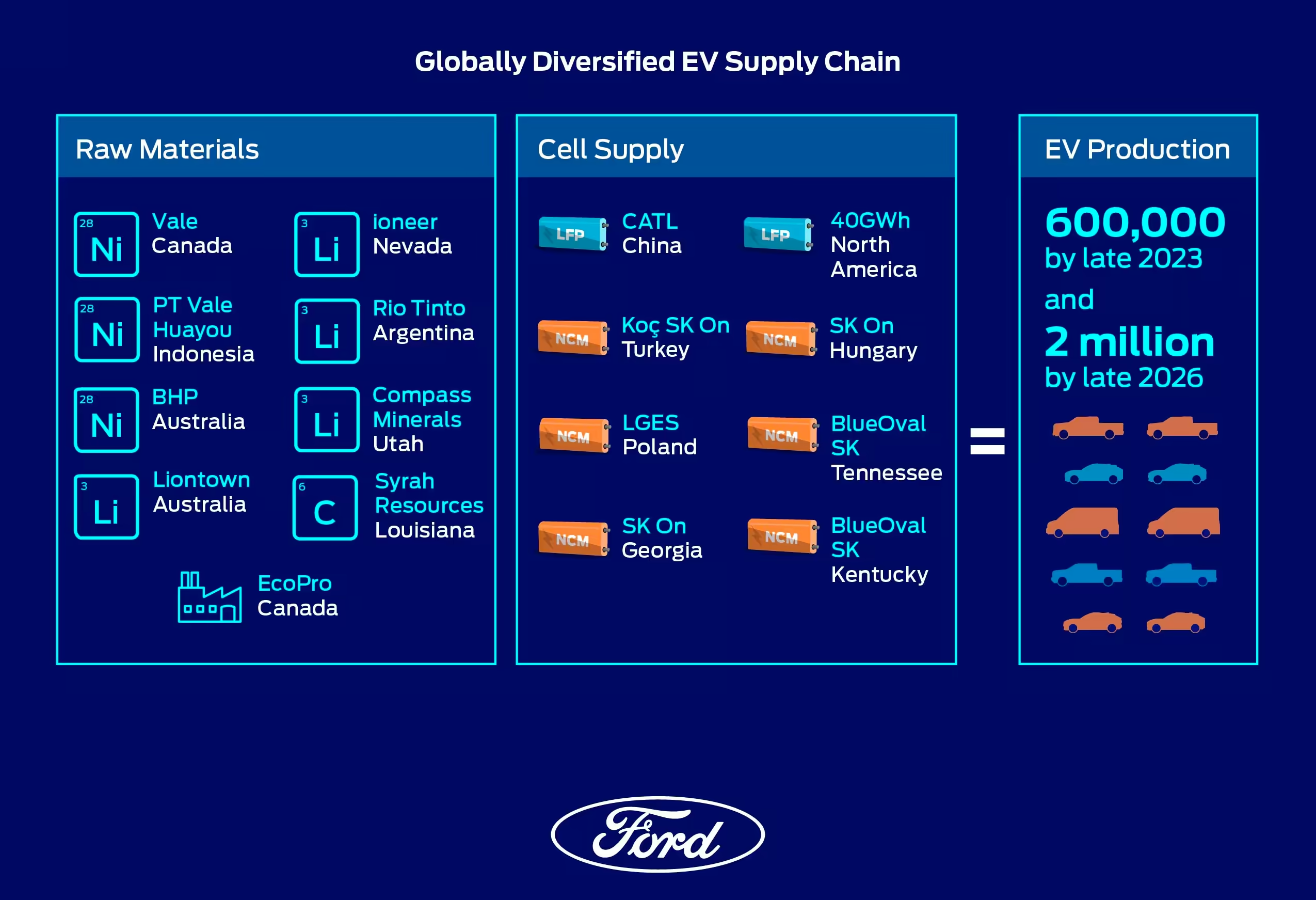

Finally! Ford will use module-less LFP (LiFePO4) batteries from CATL to cut costs by 10-15 percent starting next year. Moreover, the carmaker plans to localize and use 40 GWh of LFP capacity in North America starting in 2026.

DEARBORN, Mich., July 21, 2022 – Building on strong demand for its new EVs, Ford today announced a series of initiatives for sourcing battery capacity and raw materials that light a clear path to reach its targeted annual run rate of 600,000 electric vehicles by late 2023 and more than 2 million by the end of 2026.

The Chinese battery cell maker SVOLT is now testing solid-state battery cells to power electric cars with range superior to 1.000 km on a single charge.

The cells have an energy density of 350-400 Wh/kg and has now successfully passed tests including pin prick and 200°C hot box tests.

WeLion and Volkswagen-backed Gotion High-tech are also developing solid-state batteries. With a 150 kWh solid-state battery pack the super-efficient NIO ET7 is expected to get a 1.000 km range on a single charge.

Starting to arrive at dealers in China with a pre-sale price range between 212.800 and 289.800 yuan (31.482 and 42.874 euros) the BYD Seal is a game changer. Technology-wise, it’s my favorite electric car, by far, leaving the awesome Kia EV6 in a distant second.

With this electric car BYD introduces for the first time a 800-volt battery that is also structural and replaces the floor of the car.

Let’s see some details of the three available variants.

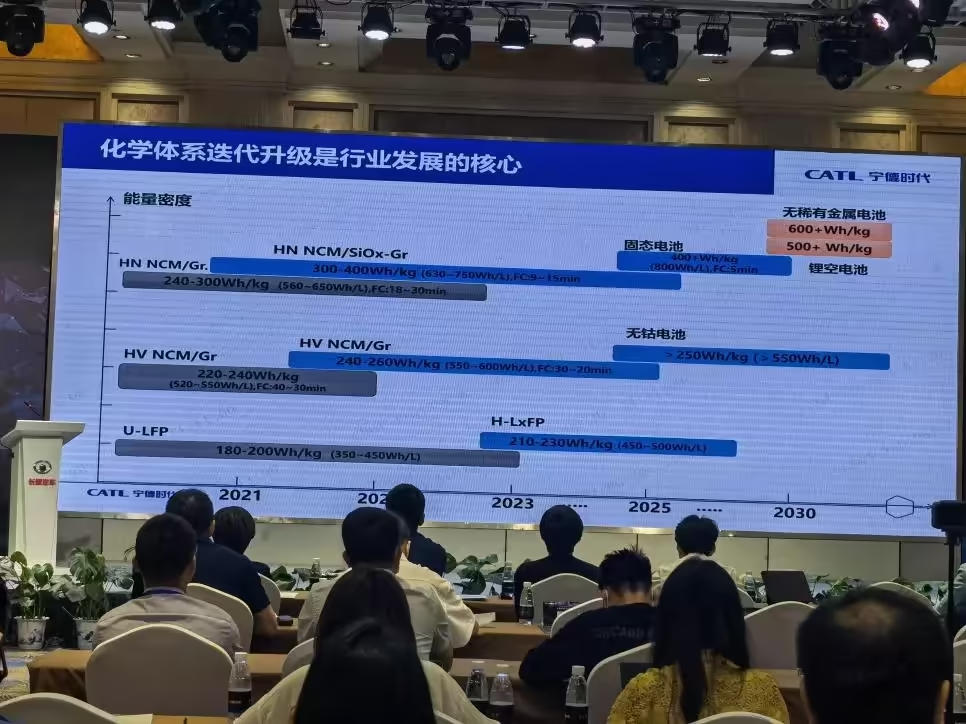

Chinese media is reporting that CATL will mass produce lithium manganese iron phosphate (LMFP or LFMP) batteries already this year, on track with the company’s roadmap.

Adding manganese to the popular LFP formula increases the voltage and energy density of the battery cells, without a noticeable cost increase, since manganese is particularly cheap. However, I’m curious to see the impact of the voltage increase on the cycle life.

CATL’s LMFP goals Gravimetric energy density: 210-230 Wh/kg Volumetric energy density: 450-500 Wh/L Considering a GCTP (gravimetric cell to pack) ratio of 90 % and a VCTP (volume cell to pack) ratio of 72 % of a module-less CTP battery, at the pack level we can reach 207 Wh/kg and 360 Wh/L.

CATL basically announced the death of the ICE (Internal Combustion Engine) powertrains.

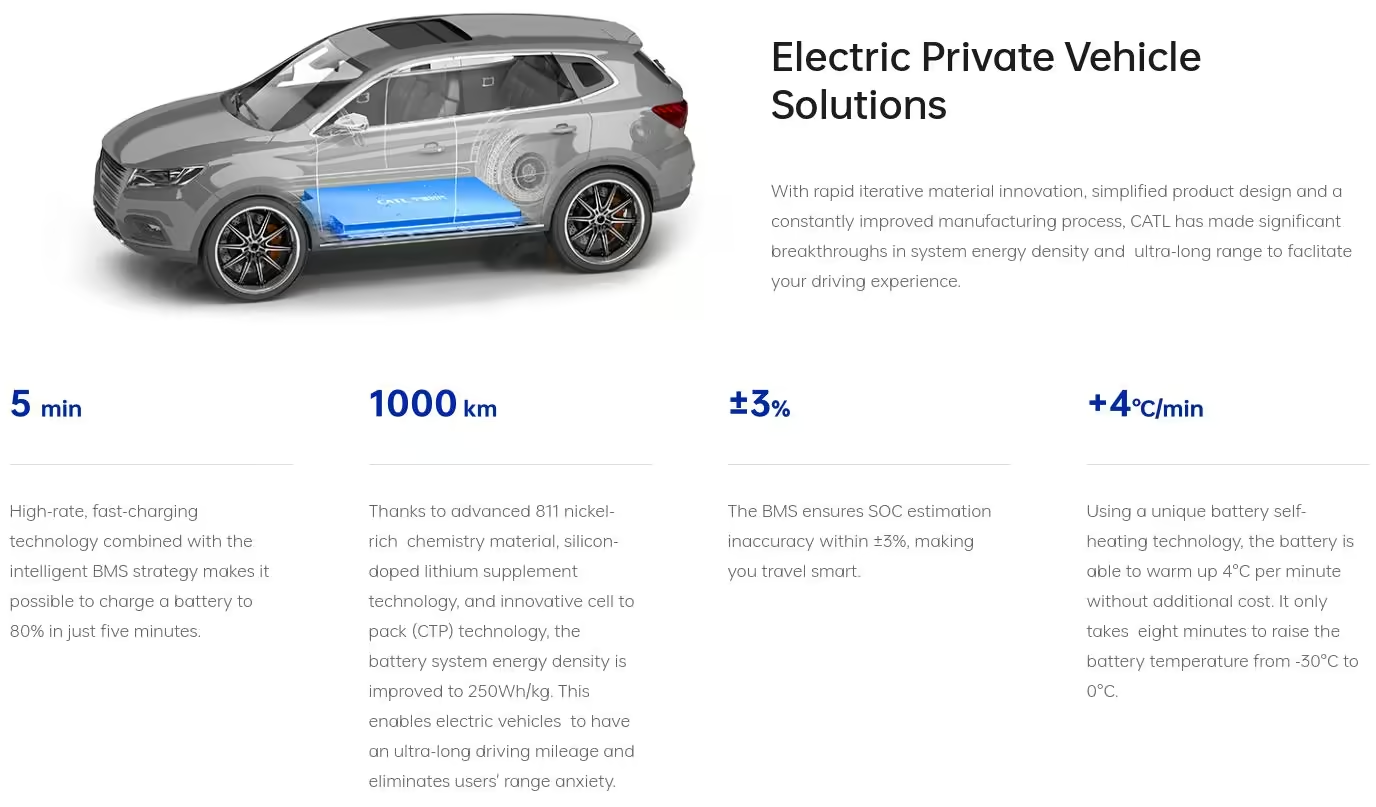

In its recent presentation of the Qilin battery CATL promised the ability to charge from 10 to 80 % in just 10 minutes, this represents a 4 C-rate charge. However, in its official website, CATL is now promising a much better charging rate.

What do you think about charging 80 % of an electric car’s battery in just 5 minutes? This is what CATL is now announcing.

GAC Tech day was held at GAC R&D Center, where the company announced its new generation of LFP batteries.

GAC GROUP also launched its new-generation super iron lithium battery built on microcrystalline technology (SmLFP), which provides batteries with 13.5% higher cell quality energy density and 20% greater volume energy density than regular mass-produced iron phosphate lithium battery cells available on the market.

Highlights:

Battery chemistry: SmLFP Volumetric energy density increase: 20 % Gravimetric energy density increase: 13,5 % Low temperature (-20 ºC) capacity increase: 10 % Fast charging: above 2 C-rate Life cycle: 1,5 million kilometers Nonetheless, GAC isn’t the only company that expects to greatly improve the energy density of LFP batteries in 2023. Battery makers such as SVOLT and Guoxuan High-Tech expect to reach 230 Wh/kg with LFP battery cells, which translates to an energy density around 200 Wh/kg at the pack level - if the CTP (cell to pack) approach is used.

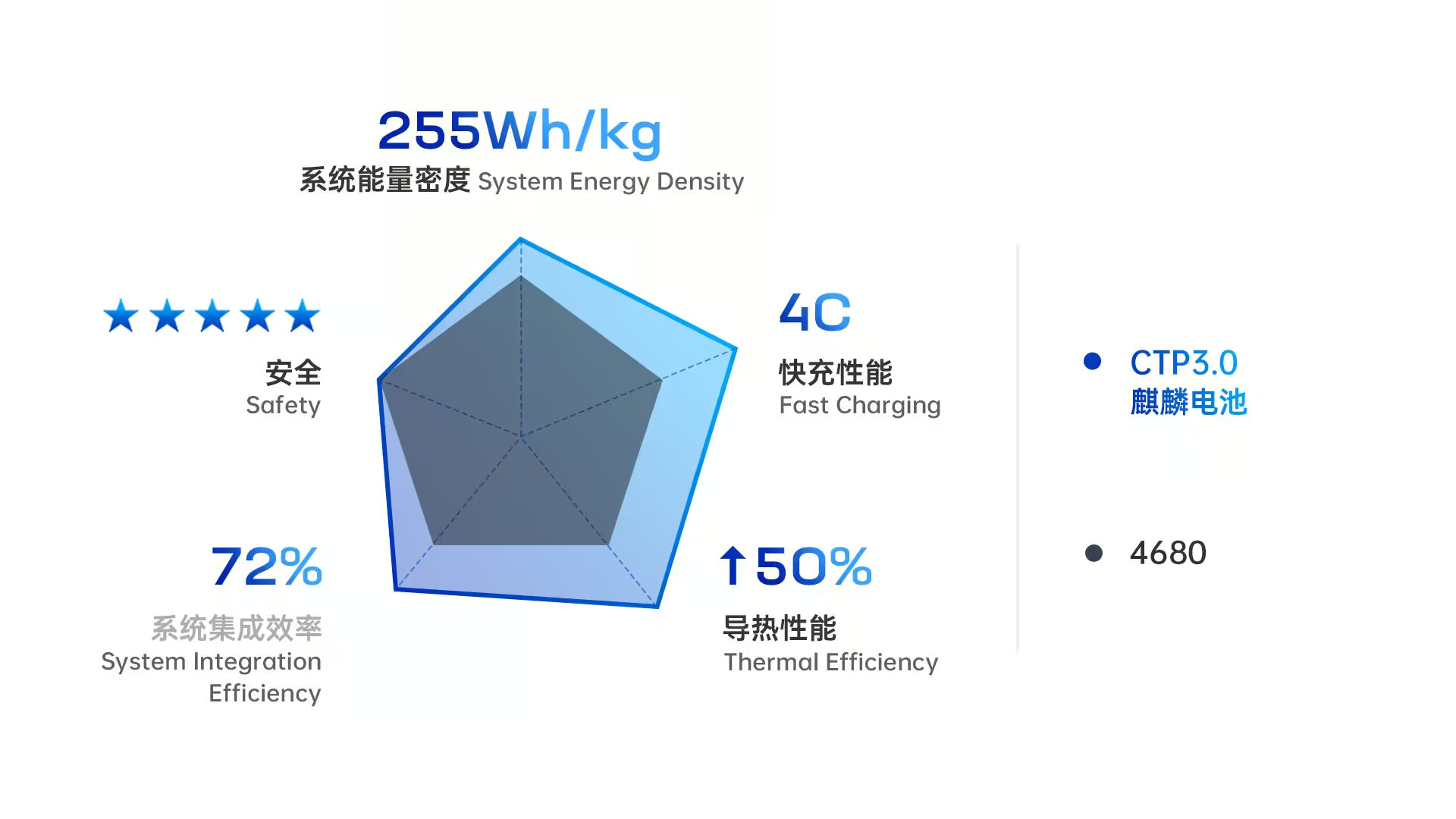

CATL released more details on its new module-less battery packs called Qilin, which are expected to be mass produced and come on the market in 2023.

First, let’s see the press release.

On June 23, CATL launched Qilin, the third generation of its CTP (cell-to-pack) technology. With a record-breaking volume utilization efficiency of 72% and an energy density of up to 255 Wh/kg, it achieves the highest integration level worldwide so far, capable of delivering a range of over 1,000 km in a breeze.

It’s no longer a rumor, BYD will supply batteries to Tesla.

Lian Yubo, BYD‘s executive vice president confirmed the deal in an interview to the Chinese TV channel CGTN.

Tesla is a very successful company no matter what, BYD respects Tesla and we admire Tesla.

We are good friends with Elon Musk, and we will soon supply him with batteries. We are friends.

It (Tesla) has a high starting point and adopts a high-profile strategy, including in the US capital market.

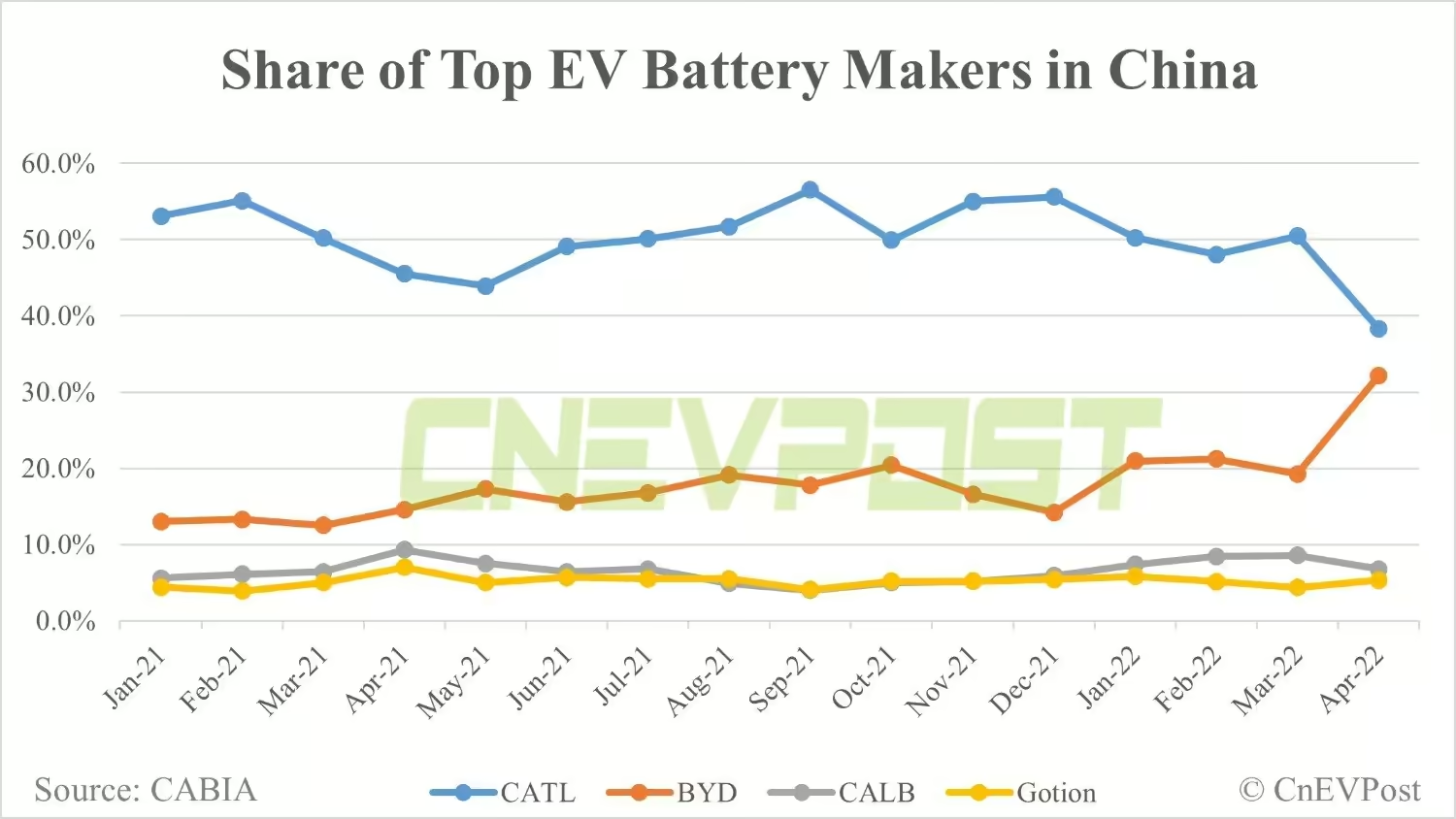

The gap between BYD and CATL in China as been narrowing… Ultimately, I think that BYD will become the world’s biggest battery maker.

Both battery makers have their pros.

CATL:

Vast lineup of different battery chemistries, such as NCM, LFP and upcoming sodium-ion Supplies Tesla (but this can also be a problem) Factory in Europe (Germany) BYD:

Great CTP (cell-to-pack) technology combined with cobalt-free battery chemistry: Blade Battery (currently my favorite EV battery pack, by far) It’s also an automaker, so all batteries produced have destination In the long run, I think that BYD has the best advantages.

Renault finally renewed its all-electric LCV (light commercial vehicle) lineup with faster charging and more range.

Let’s see some details of the two improved electric vehicles.

Renault Kangoo E-TECH

Motor: 90 kW Battery capacity: 45 kWh TMS: liquid cooling on the versions with the 22 kW charger Battery warranty: 8 years or 160.000 km (70 % of SoH) Range: 300 km (WLTP) Regenerative braking regimes: Sailing (display light B1), Drive (B2) and Brake (B3) On-board charger: 11 kW (standard) or 22 kW (optional) Fast charging: 80 kW (optional) Comes standard with a heat pump that “provides optimal performance when the temperature is between -15 and +15°C.”

The Chinese battery maker partly owned by Volkswagen, Guoxuan, also known as Gotion Hi-Tech will start mass producing its first generation of semi-solid state battery cells later this year.

Let’s see some details of Guoxuan’s first generation semi-solid state battery packs.

Gravimetric energy density at the cell level: 360 Wh/kg Gravimetric energy density at the pack level: 260 Wh/kg GCTP (gravimetric cell-to-pack) ratio: 72 % Capacity: 160 kWh Range: 1.000 km Cathode chemistry: NCM Considering that it still requires some cobalt, it doesn’t seem to be a cost-friendly battery technology for the masses. Moreover, the poor GCTP ratio of 72 % makes the battery pack less impressive, which suggests that this technology still requires a lot of passive material to work properly.

Based in Poland and part of the Spanish CAF Group, Solaris was in 2021 the leading electric bus manufacturer in Europe with 11,9 % of the market share.

To reinforce its leading position, the European bus manufacturer signed a partnership agreement with the giant Chinese battery maker CATL, to use its cobalt-free battery chemistry LFP (LiFePO4) and CTP (cell-to-pack) technology.

Nonetheless, unfortunately diesel still has a huge market share in Europe.