May saw plugin EVs take 82.3% share in Norway’s auto market, down from 88.9% year on year. The dip was likely due to a low ebb of shipping by three of the biggest BEV manufacturers — BEV share is still climbing overall this year. Total monthly auto volume was 7,893 units, down 23% YoY. The new Volvo EX30 remained the best selling auto.

May’s results saw combined EVs take 82.3% share in Norway, comprising 77.0% full electrics (BEVs), and 5.3% plugin hybrids (PHEVs). These compare with YoY figures of 88.9% combined, 80.7% BEV and 8.2% PHEV.

May’s auto sales saw plugin EVs at 53.6% share in Sweden, down YoY from 61.9%. Plugin volumes were down YoY by 24%, with BEV faring worse than PHEVs. Overall auto volume was 25,094 units, down 12% YoY. The Tesla Model Y was May’s bestselling BEV.

May saw combined EVs at 53.6% share in Sweden, with full battery-electrics (BEVs) at 30.3% and plugin hybrids (PHEVs) at 23.2%. These figures are down YoY, with 61.9% combined in May 2023 — 40.9% BEV and 21.0% PHEV.

April saw plugin EVs take an 18.4% share in Germany, down YoY from 20.5% — still reeling after the abrupt cancellation of incentive schemes in late December. Overall auto volume was 243,087 units, up by some 20% YoY, but still 20% below 2017–2019 seasonal norms (~305,000 units). The bestselling BEV in April was the Volkswagen ID.4.

BEV sales remain weak, in a hangover from the unexpected and abrupt cancellation of eco-bonus purchase incentives in mid December 2023. In an overall auto market that grew in volume by some 20% YoY, BEV sales volume was essentially flat YoY, at 29,668 units.

April’s auto market saw plugin EVs take a 24.7% share in the UK, up from 21.9%, year on year. Volume growth was modest for battery-electric vehicles, and decent for plugin hybrid EVs. Overall auto volume was 134,274 units, up just 1% YoY, and remaining far below pre-2020 norms. The UK’s leading battery-electric vehicle brand in April was BMW.

April’s sales saw combined plugin EVs take 24.7% share in the UK, with full electrics (BEVs) taking 16.9%, and plugin hybrids (PHEVs) taking 7.8%. These build on shares a year ago of 21.9% combined, with 15.4% BEV and 6.5% PHEV.

The auto market saw plugin EVs at 24.3% share in France in April 2024, growing from 21.1% year on year. Full electric volume was up by a strong 45% YoY, while plugin hybrid volume was flat. Overall auto volume was 146,979 units, up 11% YoY, though remaining below 2017–2019 seasonal norms (~185,000). The Peugeot e-208 was once again the best selling full electric vehicle.

April saw combined plugin EVs at 24.3% share in France, with full battery electrics (BEVs) at 16.9% and plugin hybrids (PHEVs) at 7.4%. These compare with respective YoY figures of 21.1% combined, with 12.9% BEV and 8.2% PHEV.

The auto market saw plugin EVs take 91.0% share in Norway in April, roughly flat from 91.1% year on year. BEVs alone took 89.4% share, up from 83.3% YoY. Overall auto volume was 11,241 units, up 25% YoY, a recovery over recent months. April’s best selling BEV was the Volvo EX30. April’s sales data saw combined EVs take 91.0% share in Norway, comprising 89.4% full electrics (BEVs), and 1.6% plugin hybrids (PHEVs). These compare with YoY figures of 91.1% combined, 83.3% BEV and 7.8% PHEV.

April saw plugin EVs take a 56.9% share in Sweden, up modestly YoY from 55.7%. The BEV share fell slightly YoY, while PHEV share climbed higher. Overall auto volume was 21,977 units, up some 7% YoY. The new Volvo EX30 was March’s bestselling BEV, its first time in the top spot.

April’s result saw plugin EVs take 56.9% share in Sweden, with full battery-electrics (BEVs) at 30.9%, and plugin hybrids (PHEVs) at 26.0%. These shares compare YoY against 55.7% combined, with 33.7% BEV and 22.1% PHEV in April 2023.

If you ever had the suspicion that there are BEVs that international automakers sell in China but don’t want to offer to those of us in other markets, well … you were right.

China is currently the epicentre of the global EV revolution, representing 60% of the world’s plugin vehicle sales in 2023.

It’s also by far the most price-competitive plugin vehicle market, with BEVs, PHEVs, and EREVs (BEVs with a range-extender generator) already competing on price with traditional combustion vehicles across most segments of the auto market.

Stella Li, vice president at BYD just confirmed that the BYD Seagull made for the European market will come next year:

Yes, we plan to bring the Seagull to Europe next year. But it’s not the Chinese-market Seagull, it will be a European-market Seagull; a new Seagull. You haven’t seen it yet; even myself, I have not seen it yet.

The BYD Seagull is already enjoying great success in South America, particularly in Brazil, where it is called BYD Dolphin Mini and the Chinese manufacturer has already confirmed that a 5-seater version is coming.

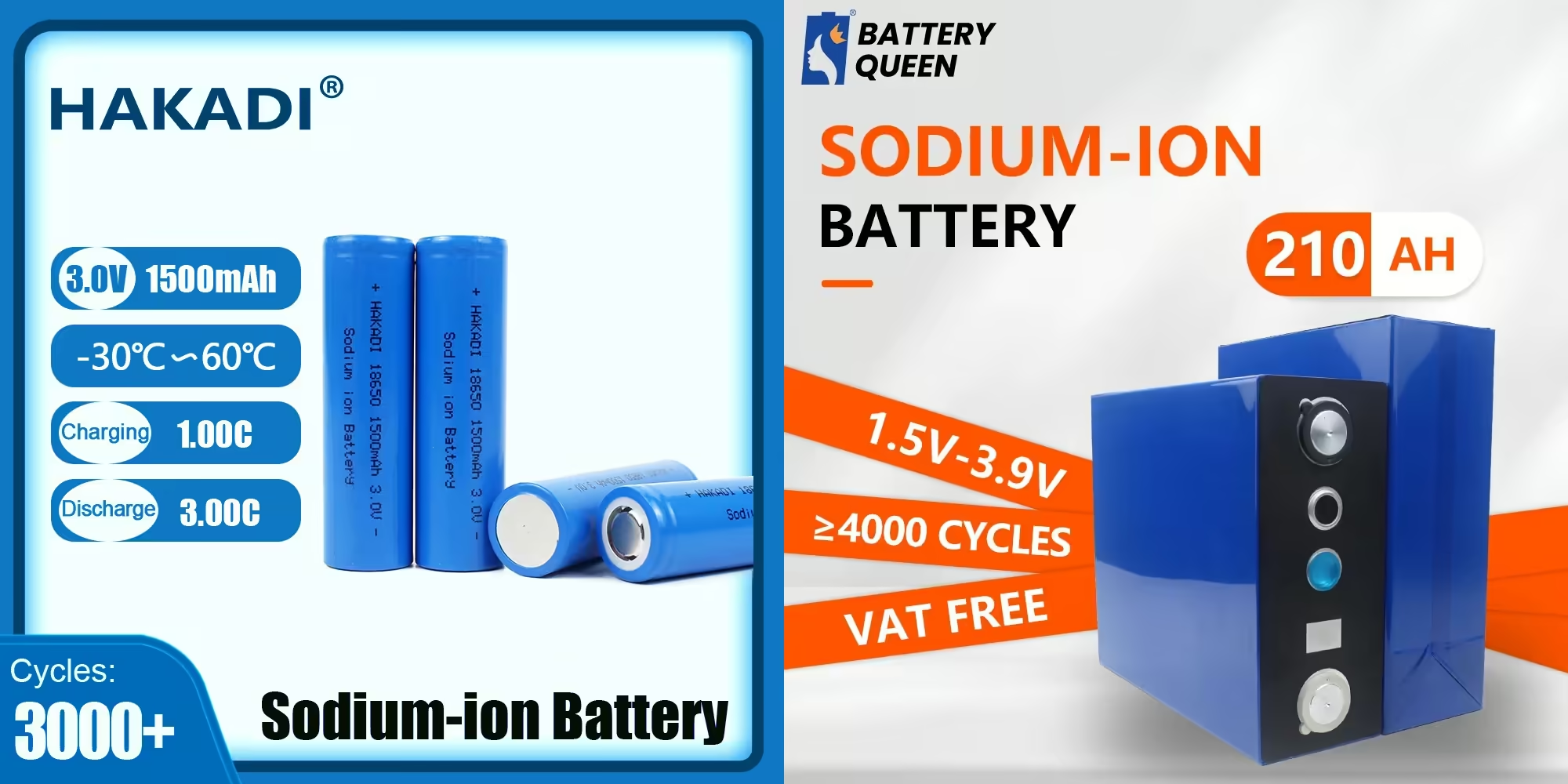

In case you haven’t noticed, we can already buy sodium-ion (Na-ion) batteries.

For example, with a simple search on AliExpress we can already find sodium-ion battery cells in cylindrical and prismatic formats for consumer use.

Depending on the manufacturer, the advertised cycle life varies between 1.500 and 4.000 cycles, while energy density stays between 125 and 140 Wh/kg.

However, since the mass production of this battery chemistry is extremely recent, production efficiency (mainly yield rate) and capacity are still low, so you can get much better deals on LFP (LiFePO4) batteries for now…

The Dacia Spring is the by far most affordable battery-electric vehicle on sale in Europe, typically starting under €20,000. It was also Europe’s 9th bestselling battery-electric vehicle (BEV) in 2023, registering almost 60,000 units. Where are the Dacia Spring’s competitors? The legacy auto brands are for the most part refusing to make affordable BEVs, so what’s available in China, and will it come to Europe?

Dacia Spring

March saw plugin EVs take 18.0% share in Germany, down year on year, remaining stuck in a hangover from sudden incentive abandonment in late December. BEVs were down some 29% in YoY volume, while PHEVs were down 4.5%. Overall auto volume was 263,844 units, down 6% YoY, and down 25% from 2017-2019 seasonal norms (~350,000 units). The best selling BEV was the Tesla Model Y.

The market data saw combined EVs at 18.0% share, with full electrics (BEVs) at 11.9% and plugin hybrids (PHEVs) at 6.1% share. These compare with 21.6% combined, with 15.7% BEV, and 6.0% PHEV, year on year.