July’s auto sales saw plugin EVs at 59.6% share in Sweden, almost flat YoY from 59.9%. BEV volumes were down YoY by 15%, while PHEVs grew by 9%. Overall auto volume was 16,337 units, down 6% YoY. The Tesla Model Y remained the best selling BEV.

The July market data showed combined plugin EVs at 59.6% share in Sweden, with full electric BEVs at 33.8% and plugin hybrids (PHEVs) at 25.8%. These figures compare YoY against 59.9% combined, 37.5% BEV and 22.4% PHEV.

Next year BYD will start to produce its electric cars also outside Asia - in Brazil and Hungary - and legacy carmakers aren’t ready for that. Except one.

While tariffs on Chinese-made electric cars imposed by the European Union and the US will give traditional carmakers some time to prepare, they will not stop Chinese carmakers from gaining a substantial market share in the coming years.

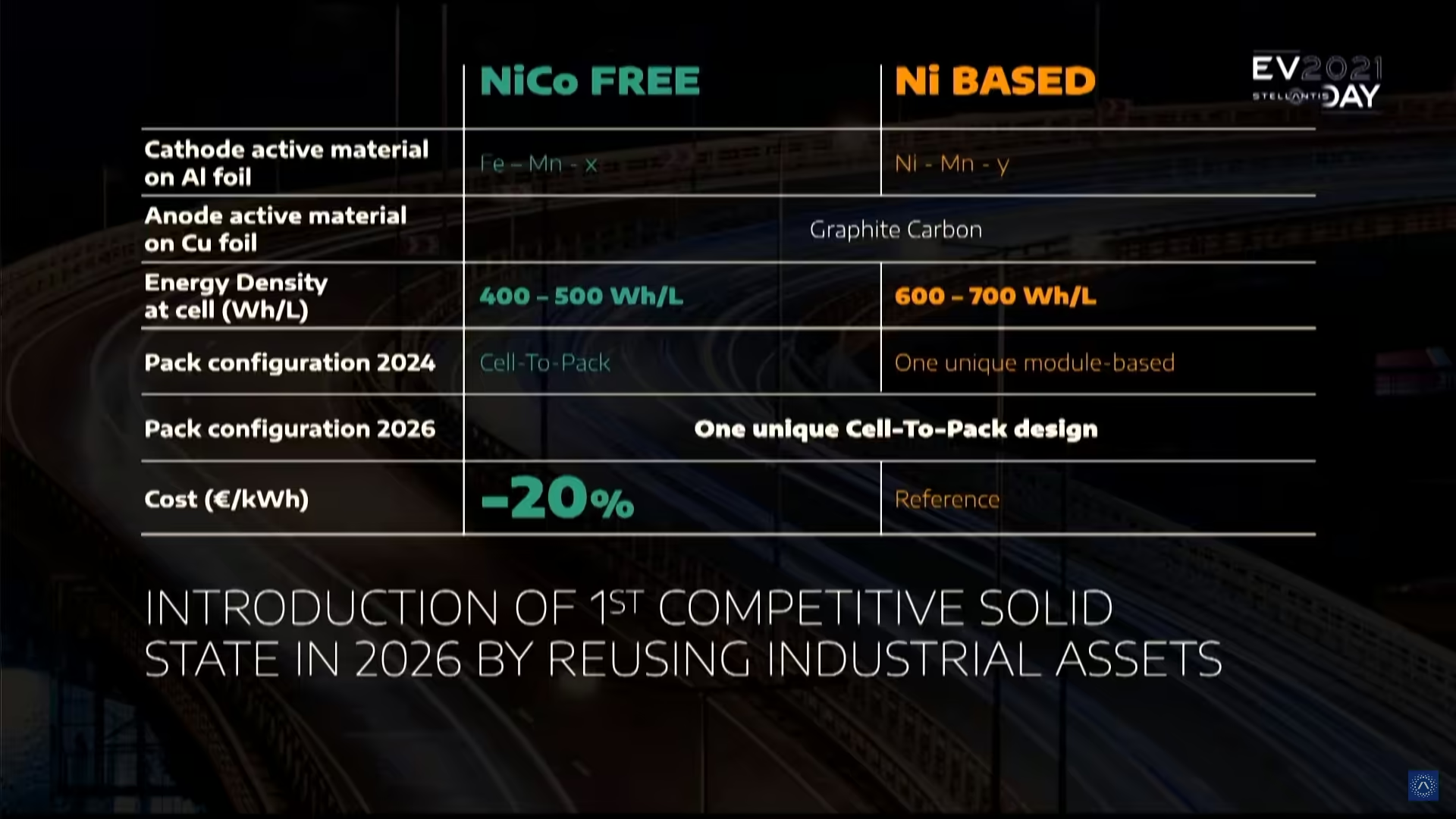

Carlos Tavares, the CEO of Stellantis, recently said that the company is now ready and welcomes the competition from the Chinese carmakers in the affordable electric car segment.

The ZEEKR 009 electric MPV, part of Geely’s innovative EV lineup, now features CATL’s cutting-edge Qilin battery technology, enabling it to recharge from 10% to 80% in just under 11 minutes. This updated model is set to launch in Hong Kong this Friday.

The ZEEKR’s super-fast charging ability is enabled by CATL’s Qilin battery technology, which integrates advanced chemistry, form factor, cooling, and intelligent battery management to improve performance. The next time someone tells you that EVs take hours to refill, you can counter with the ZEEKR 009 and its 11-minute refill capability.

June saw plugin EVs take 19.8% share in Germany, down YoY from 24.6%, as macroeconomic woes, stubbornly high entry EV prices, and incentive cancellation, all took their toll. Overall auto volume was 297,329 units, up by some 6% YoY, but still at least 10% below 2017–2019 seasonal norms (~330,000 units). The bestselling BEV in June was again the Volkswagen ID.3.

The market saw combined EVs take 19.8% share in Germany, with full electrics (BEVs) at 14.6% and plugin hybrids (PHEVs) at 5.2% share. These compare with YoY figures of 24.6% combined, with 18.9% BEV and 5.7% PHEV.

June’s auto market saw plugin EVs take 28.2% share in the UK, up from 25.1% year on year. BEVs grew volume modestly, while PHEVs grew more strongly. Overall auto volume was 179,263 units, up 1% YoY and well below pre-2020 seasonal norms (~225,000). The UK’s leading battery-electric vehicle brand in June was Tesla.

June’s sales saw plugin EVs take 28.2% share in the UK, with full electrics (BEVs) taking 19.0% and plugin hybrids (PHEVs) taking 9.3%. These are an increase from shares a year ago of 25.1% combined, 17.9% BEV and 7.2% PHEV.

June saw plugin EVs take 56.5% share in Sweden, down YoY from 59.2% in June 2023. BEV share fell YoY, while PHEV share was flat, and both lost volume. Overall auto volume was 25,401 units, down 10% YoY. The Tesla Model Y was the best selling BEV.

June’s result saw combined plugin EVs take 56.5% share in Sweden, with full battery-electrics (BEVs) at 35.9% and plugin hybrids (PHEVs) at 20.6%. These shares compare YoY against 59.2% combined, 38.7% BEV and 20.5% PHEV.

The June auto market saw plugin EVs take 85.3% share in Norway, down from 90.9% year on year. BEVs took 80.0% share, down from 82.2% YoY, despite volume growth. Overall auto volume in June was 17,512 units, up 12.5% YoY, while year-to-date volume remains 8% down. The best selling BEV was the Tesla Model Y, with the Tesla Model 3 as runner up.

June’s sales saw combined EVs take 85.3% share in Norway, consisting of 80.0% full battery electrics (BEVs) and 5.3% plugin hybrids (PHEVs). These compare with YoY figures of 90.9% combined, with 82.2% BEV and 8.7% PHEV.

The June auto market saw plugin EVs at 24.1% share in France, down from 26.9% year on year. Volume of both BEVs and PHEVs was down YoY, declining more than the overall market drop. Overall auto volume was 181,711 units, down 4.8% YoY, and far below 2016–2019 seasonal norms (~235,000). The Renault Megane was France’s best selling full electric vehicle in June.

June saw combined EVs at 24.1% share in France, with full battery electrics (BEVs) at 16.4% and plugin hybrids (PHEVs) at 7.7%. These compare with respective YoY figures of 26.9% combined, 17.4% BEV and 9.4% PHEV.

The small BYD Seagull, or as it’s known in South America, BYD Dolphin Mini, debuted with 4 seats, however in Colombia it now gets 5 seats instead.

BYD Colombia’s technical documents now show the BYD Dolphin Mini only available with 5 seats. However, we still don’t know if the 4 and 5 seat versions will be sold side-by-side in other markets.

Brazil will soon also get this 5 seat version - that has been long awaited by brazilian potential customers.

May saw plugin EVs at 18.5% share in Germany, down from 22.9% in May 2023, in a continuing hangover from the unexpected incentive abandonment in late December. BEVs were down some 31% in YoY volume, while PHEVs were up 2%. Overall auto volume was 236,413 units, down 4% YoY, and down 27% from 2017–2019 seasonal norms (~325,000 units). The best selling BEV in May was the Volkswagen ID.3.

May’s sales figures saw combined EVs at 18.5% share, with full electrics (BEVs) at 12.6% and plugin hybrids (PHEVs) at 5.9% share. These compare with YoY figures of 22.9% combined, with 17.3% BEV and 5.6% PHEV.

May’s auto sales saw plugin EVs take 24.1% share in France, roughly flat from 24.3% year-on-year. BEV share was up, while PHEV share dropped. Overall auto volume was 141,298 units, down by some 3% YoY. The Peugeot e-208 now has a strong lead in the BEV rankings.

May’s results saw combined plugin EVs take 24.1% share in France, comprising 16.9% full battery-electrics (BEVs), with 7.2% plugin hybrids (PHEVs). These compare with YoY figures of 24.3% combined, with 15.6% BEV, and 8.7% PHEV.

May saw plugin EVs take 25.7% share of the UK auto market, up from 23.1% year on year. Most of the gain was from PHEVs, whilst BEVs barely improved. Overall auto volume was 147,678 units, up by some 2% YoY, and still below pre-2020 norms (~175,000). The UK’s leading BEV brand in May remained Tesla.

May’s result saw combined plugin EVs take 25.7% share of the UK, with full electrics (BEVs) taking 17.6%, and plugin hybrids (PHEVs) taking 8.0%. These compare with YoY shares of 23.1% combined, with 16.9% BEV, and 6.2% PHEV.