August saw plugin EVs take 20.6% share in Germany, down from (an outlier) 37.0% share YoY. BEVs are now around the level they were in 2022, but PHEV share has halved since then. Overall auto volume was 197,322 units, down some 28% YoY, and far below 2015–2019 seasonal norms (~273,000 units). The bestselling BEV in August was the Tesla Model Y.

The August auto market saw combined EVs take 20.6% share in Germany, with full electric vehicles (BEVs) at 13.7% share and plugin hybrids (PHEVs) at 6.9%. These compare with (anomalous) YoY figures of 37.0% combined, 31.7% BEV and 5.3% PHEV. The August 2023 market was distorted by a huge pull-forward of BEV sales ahead of the incentive cancellation for commercial buyers from September.

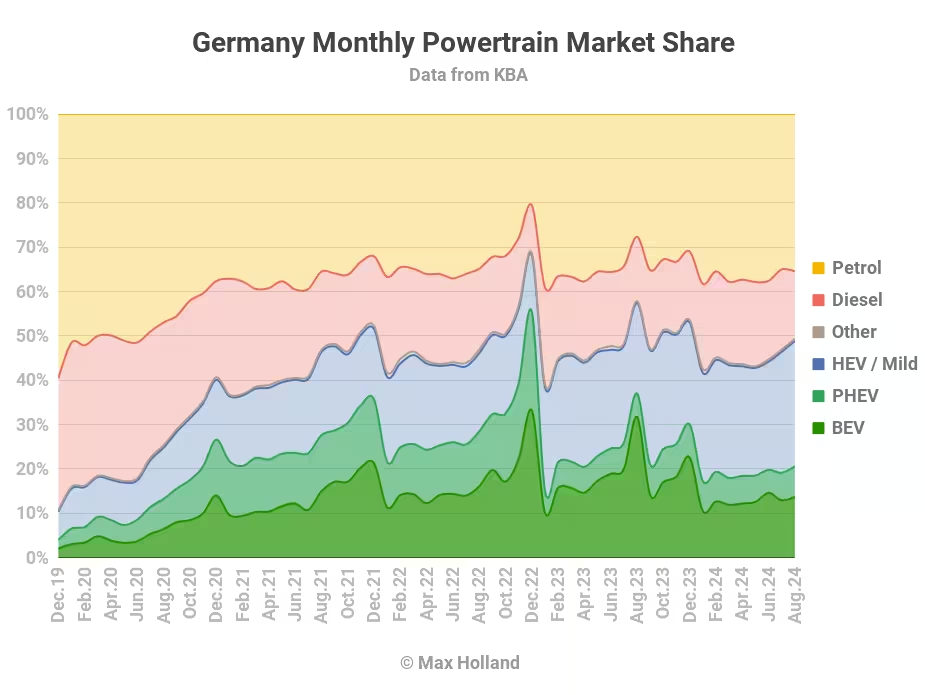

From the market share timeline graph (below), we can see that the BEV share over the past few months has roughly mirrored the seasonal pattern from two years ago (albeit around 1.5% down in share from then). Since that time, PHEVs have halved, however, denting the combined plugin EV share.

The mirrored seasonal pattern for BEV share might suggest that September will show an uptick. Although, the economic context is now a lot weaker now than it was two years ago. Let’s see.

I’m not going to repeat again the full story of why Germany is backsliding on EVs (see, e.g., the June and July reports for details). In short, a weak economy, recent incentive cancellation, and overpriced BEVs (now aided by Washington-ordered protectionism against China-made BEVs) are the main reasons. Until these factors change significantly, Germany’s EV transition will remain in the doghouse.

Conversely, plugless vehicles are enjoying a temporary renaissance. Although — as a small silver lining — the main growth here is coming from HEVs, rather than combustion-only powertrains. The latter remain just above 50% of the market (combined), with diesel remaining weak, at 15.2% share.

Best selling BEV models

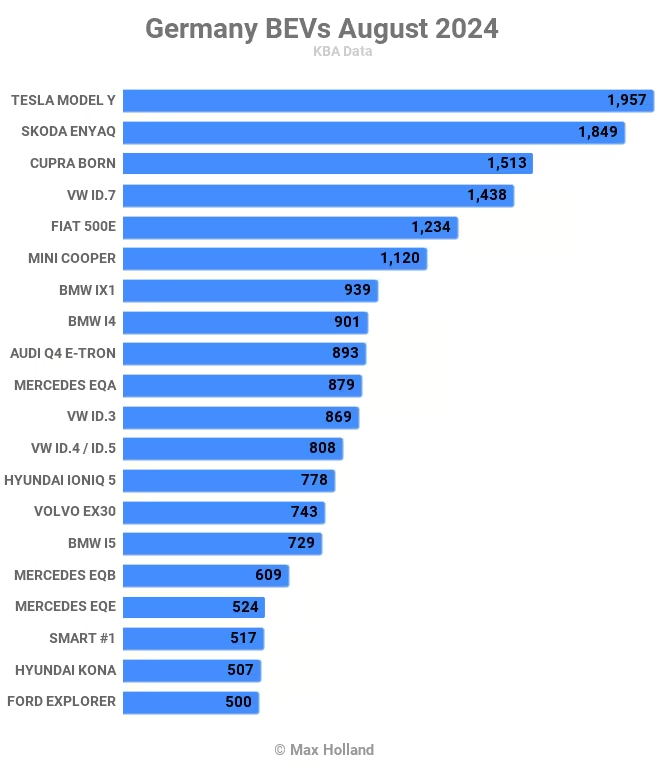

The Tesla Model Y was back on top of the best selling BEVs ranking in August, just ahead of the Skoda Enyaq and Cupra Born. These are the same top 3 as seen in July.

The rest of the top 20 was also mostly stable, with just a few notable points of interest.

Now achieving its highest ever ranking — in the 4th spot — the Volkswagen ID.7 sedan (aided by a touring-wagon format recently arriving) is proving popular in Germany. The ID.7 is probably the best executed model in the ID lineup, as it should be, given that it is the brand’s official “flagship” vehicle.

The new Mini Cooper, now with decent battery size options, continued to ramp up in August, reaching a new high of 1,120 units, and taking the 6th spot.

The new Ford Explorer saw a big step up from its 16 debut units in July to an impressive 500 units in August. This was enough to launch it into 20th place. The Explorer is built in Köln, Germany (on Volkswagen Group’s MEB platform), so it’s no great surprise that Germany will be its main European market.

August also saw several new BEV models making their debut in the German market. The model with the largest debut volume was the Cupra Tavascan, with 133 units. The Tavascan is a sporty mid-sized (4,644 mm) crossover built on Volkswagen Group’s MEB platform (see the Sweden report for more info). It is priced from €53,240 MSRP in Germany.

Next up is a slightly larger (4,784 mm) premium SUV, also from Volkswagen Group, the new Porsche Macan, with 122 registrations. This one is built on Volkswagen Group’s newer PPE platform (shared with the new Audi Q6 e-tron, amongst others). The Porsche is expensive, starting from around €80,000. It is, however, priced slightly lower than the ICE-powered Macan, which is good to see.

The Alfa Romeo brand, now part of Stellantis Group, launched its first BEV in August, the Junior Elettrica, seeing 61 units in Germany. This shares a platform with its group cousins, the Fiat 600e and Jeep Avenger, and is priced in between them. For more details, see the UK report.

Perhaps most interesting, the new Renault R5 BEV also saw 25 German registered units in August — although, these may be dealer units for now (a similar number were also just registered in France). It is still expected that decent volume customer deliveries will have to wait until December, or even until early 2025.

The Peugeot e-5008 also saw its first German registrations in August, just 7 units — again likely for dealer demonstrations rather than intended for customer deliveries. The official commercial launch is still scheduled for October, and will probably focus on the native French market initially.

Don’t expect great volumes from the Peugeot e-5008 in the first few months — Stellantis is notorious for overpricing its BEVs in most European markets currently. In 2025, when EU emissions regulations see more tightening, they will have to get serious about actually selling their BEVs in somewhat decent numbers.

Let’s now turn to the 3-month rankings:

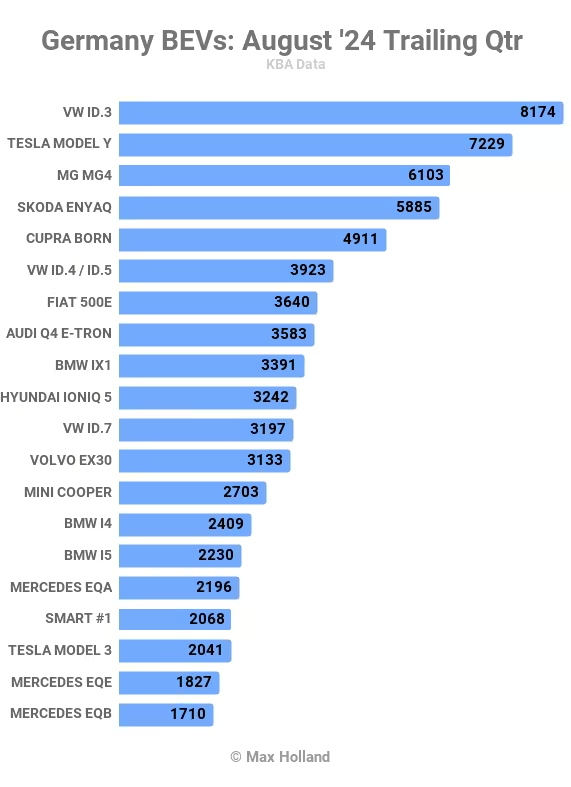

Despite a lacklustre performance in August (11th spot), the Volkswagen ID.3 still holds on to the top spot in the trailing 3-month chart. In second is the Tesla Model Y, and in third the MG4.

The MG4 is in third mainly by virtue of a huge push in June, just ahead of the EU’s protectionist tariffs kicking in. Its August volume was just 188 units, so it will soon exit these rankings.

Due to their increasing August volumes, noted earlier, both the Volkswagen ID.7 and the new Mini Cooper climbed into the top 20 ranks and may stay for a while.

We might expect the new Ford Explorer to enter the top 20 in the next couple of months, depending on whether its 500 unit monthly volume, seen in August, is representative of sustained demand (rather than one-off catchup on a months-long backlog).

Here’s a brief look at the manufacturing group rankings over the trailing 3 months:

As usual, Volkswagen Group has a very strong lead, with almost 40% share of Germany’s BEV market. This is close to matching the next 4 groups combined.

There were only minor shufflings in most positions, compared to the standings 3 months ago.

SAIC, still holding on to 7th spot for now, will soon fall out of the rankings for the reasons mentioned above regarding the MG4.

Ford — thanks to the new Explorer — has already grown its share by 1.5× since the prior period, albeit from a dismally low base of 0.8%. Ford may be able to creep onto the tail of this list in two months time, helped by SAIC stepping down.

Let’s not ignore the pathetic efforts of Toyota Group, which only made 383 BEV sales in Germany over the past 3 months. For perspective, of its 60,057 passenger vehicle sales in Germany so far in 2024, only 1,382 have been BEVs. That’s just 2.3%. Ouch! Dustbin of history, here we come.

Outlook

The auto market volume is still far down from pre-2020 norms, and is emblematic of the overall German economy. 2024 Q2’s YoY GDP calculation has improved from recent quarterly figures of -0.2%, to 0.0% growth. In relative terms, this is good — it’s the first time over the past 12 months that the economy has not been negative.

Inflation fell to 1.9% in August, from 2.3% in July. Interest rates have remained at 4.25% since early in June. Manufacturing PMI weakened to 42.4 points in August, from 43.2 points in July.

Germany’s EV transition won’t pick up noticeably until more affordable BEV models are offered, and the economy improves. This won’t happen before 2025, at the earliest.

What are your thoughts on Germany’s auto market transition? Please jump into the discussion below.