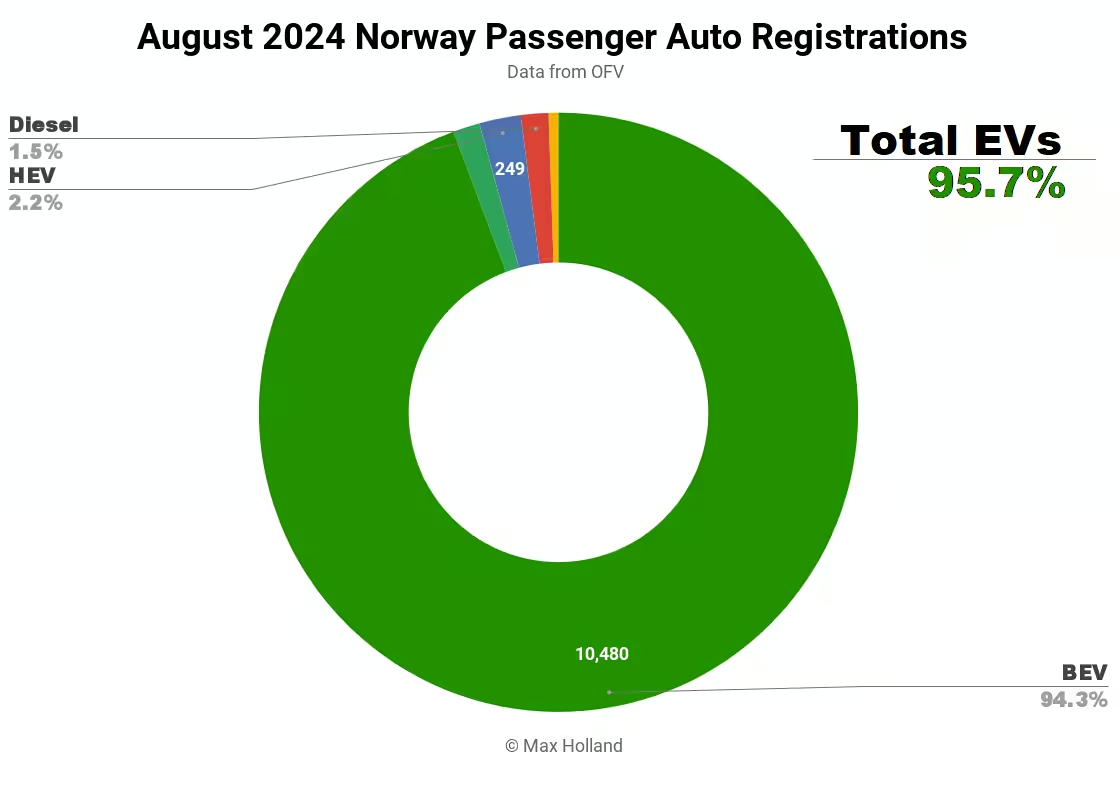

The August auto market saw plugin EVs take 95.7% share in Norway, a new record, up from 90.0% year on year. BEVs alone took 94.3% share, with all other powertrains now only collecting crumbs. Overall auto volume in August was 11,114 units, flat YoY. The best selling BEV was the Tesla Model Y.

August’s sales saw combined EVs take 95.7% share in Norway, with a record 94.3% full battery electrics (BEVs) and just 1.4% plugin hybrids (PHEVs). These compare with YoY figures of 90.0% combined, with 83.5% BEV and 6.5% PHEV.

BEVs are now entering the end-game in Norway, and even PHEVs are fast fading out.

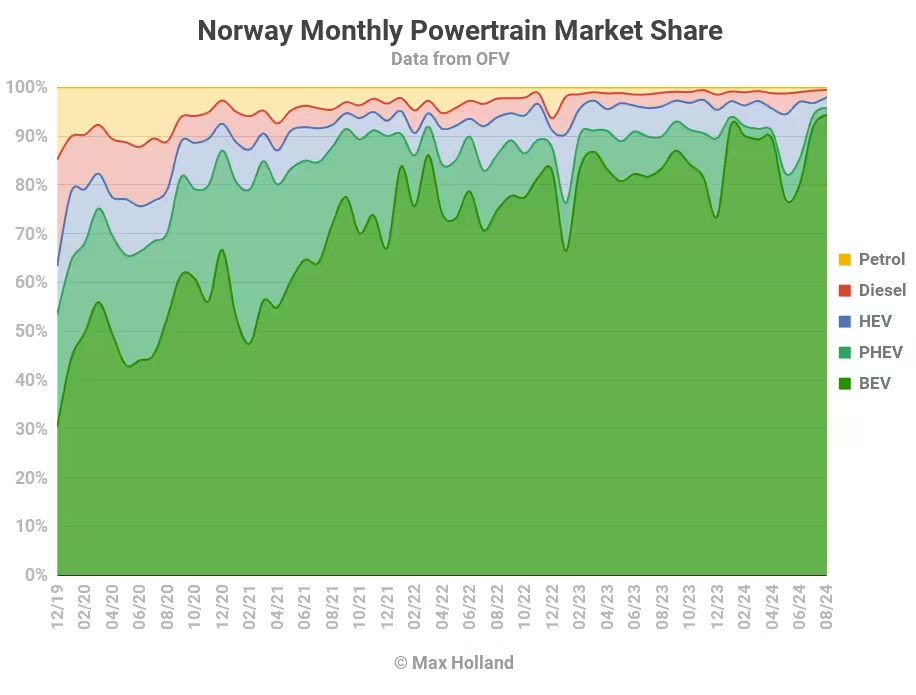

Recall that the new GSR2 vehicle safety regulations became mandatory on all new vehicles in early July. Models that were designed before the new rules were agreed upon (2019), or were unable to be updated to meet the rules, are now no longer on sale. These include a few of the early generation of modern BEV platforms, like the Renault Zoe and Nissan Leaf, but many more combustion and hybrid platforms — which are more often based on older vehicle architectures — fell foul of the new rules.

June saw a last-minute sell-off of remaining stocks of these older platforms, with HEVs temporarily jumping to 11.7% share (see graph below) as a result. July and now August have seen the aftermath, with BEVs — most of which are new designs incorporating newer safety architectures — taking further market share as a result.

Combustion-only platforms also reached a new low, with petrol-only and diesel-only sales (combined) only taking 2% market share. HEVs are now at 2.2% share, and PHEVs at 1.4% share. Except for other short term sell-offs (e.g., if Toyota was to decide to exit Norway and quickly dispose of its HEV stocks), BEVs will likely remain in the 90% to 95% territory from now on and steadily climb higher. When will we see BEVs beat 95% share? Place your bets in the comments below.

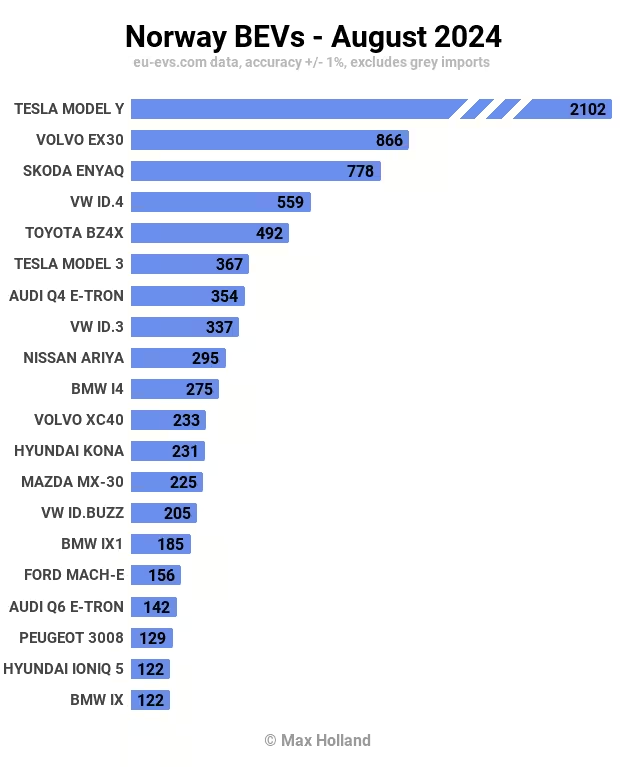

Best selling models

BEV models now take a clean sweep of Norway’s top 10 best selling autos, without the likes of a Toyota Yaris HEV spoiling the party.

The Tesla Model Y was August’s overall best seller, with 2,102 units — alone taking 19% of the entire passenger auto market. This was a bounce back from a quiet July with only 307 shipments.

The Volvo EX30 again took second place, with 866 units. The Skoda Enyaq came in third with 778 units.

There were few other big moves in the top 20, mostly just familiar faces with normal variations in shipping allocations. The new Audi Q6 e-tron is the one exception, having now entered the top 20 in just its second month on sale, with 142 units. As mentioned last month, this should be a popular model in Norway and will likely climb higher still.

There was one debutant in August, the Ford Explorer, which saw 4 initial units. It is Ford’s rehash of the Volkswagen ID.4, built on a version of the MEB platform borrowed from Volkswagen Group. I don’t expect it to get much traction in Norway, but let’s see.

Recently launched models continued to grow. Beyond the Audi Q6 mentioned above, the new Xpeng G6 grew from its initial 19 units in July to 46 in August. Likewise, the new Polestar 4 grew from 12 units to 38 in its 2nd month.

Others, like the new BYD Seal U, are still taking their time, with 44 sales in August, up from 20 units at its debut back in May. BYD is evidently not in any rush to boost itself up in Norway, and besides, it has dozens of much larger markets to cater to, all around the world (see our other EV market reports).

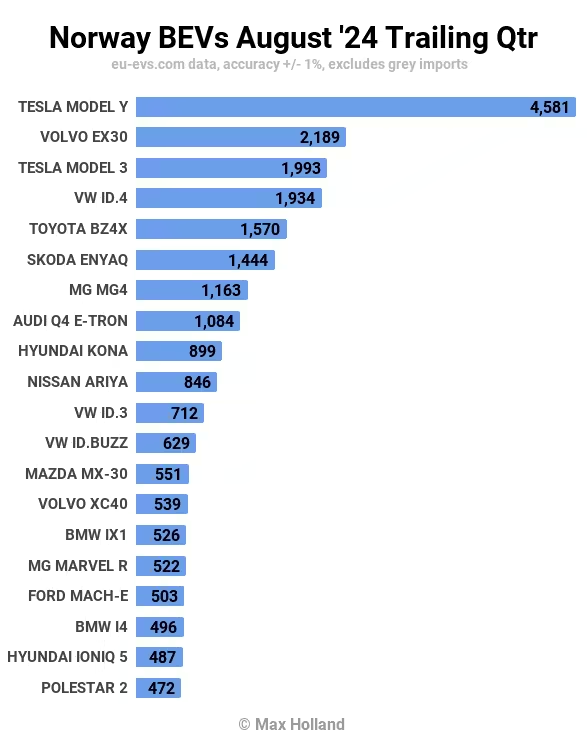

Let’s now check up on the longer term rankings:

Notwithstanding habitual monthly shipping variations, the Tesla Model Y remains the best selling model in Norway, by a large margin, with more volume than the combined sales of the 2nd and 3rd placed models. Those are the Volvo EX30 and … the Tesla Model 3.

The Skoda Enyaq continues its volume revival after a quiet first half of the year, now up to the 6th spot. The new Audi Q6 e-tron is still in the 30th spot for now, but should enter the top 20 by November, if not sooner.

The membership of the top 5 spots now looks fairly well set for the rest of this year — though with rank shuffling still possible — and perhaps with the Skoda Enyaq nipping at their heels.

For a recent fleet transition update, see last month’s report.

Outlook

Along with the flat YoY auto market, the Norwegian economy has recently seen an uptick in the national accounts compared YoY to the Q2 2023 baseline (which was relatively weak). According to the national statistics bureau (SSB), much of this recent uptick is thanks to export growth from the oil and gas sector, combined with the national currency being down in value (making exports more beneficial, and imports more expensive).

There has also been a boost from increased government spending (see this summaryy, and the SSB for more analysis). The headline GDP value is 4.2% YoY in Q2 2024, from negative 0.9% in Q1. These wild quarterly swings are normal in Norway’s relatively small and oil-export-weighted economy.

Inflation increased to 2.8% in July (latest), from 2.6% in June. Interest rates were flat at 4.5%. Manufacturing PMI in August fell to 52.1 points, from 59.8 in July.

Since Norway is already now in the 90% to 95% range for BEVs, and the charging infrastructure is largely keeping up with demand, the national economic outlook is mostly going to influence the speed at which the fleet transitions over to EVs and the proportion of kilometers driven on electricity. A more buoyant economy will increase sales of autos (now almost all BEVs) and thus increase the early retirement (or relegation to only occasional use) of the previous generation of vehicles (now almost all gas-guzzlers).

What are your thoughts on Norway’s transition? Please share them in the discussion below.