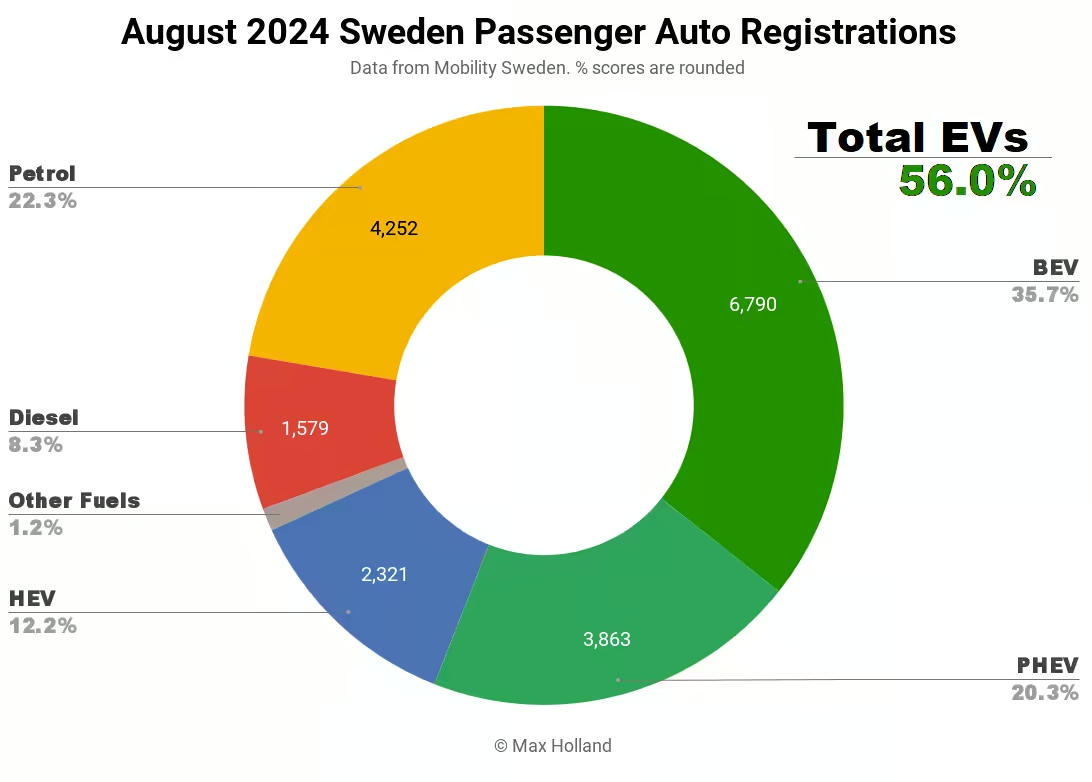

August saw plugin EVs take 56.0% share in Sweden, down YoY from 60.1%. BEV share fell YoY, while PHEV share was up. Overall auto volume was 19,036 units, down 20% YoY. The Tesla Model Y was the best selling BEV.

August’s auto sales saw combined plugin EVs take 56.0% share in Sweden, with full battery-electrics (BEVs) at 35.7%, and plugin hybrids (PHEVs) at 20.3%. These shares compare YoY against 60.1% combined, with 41.0% BEV and 19.1% PHEV.

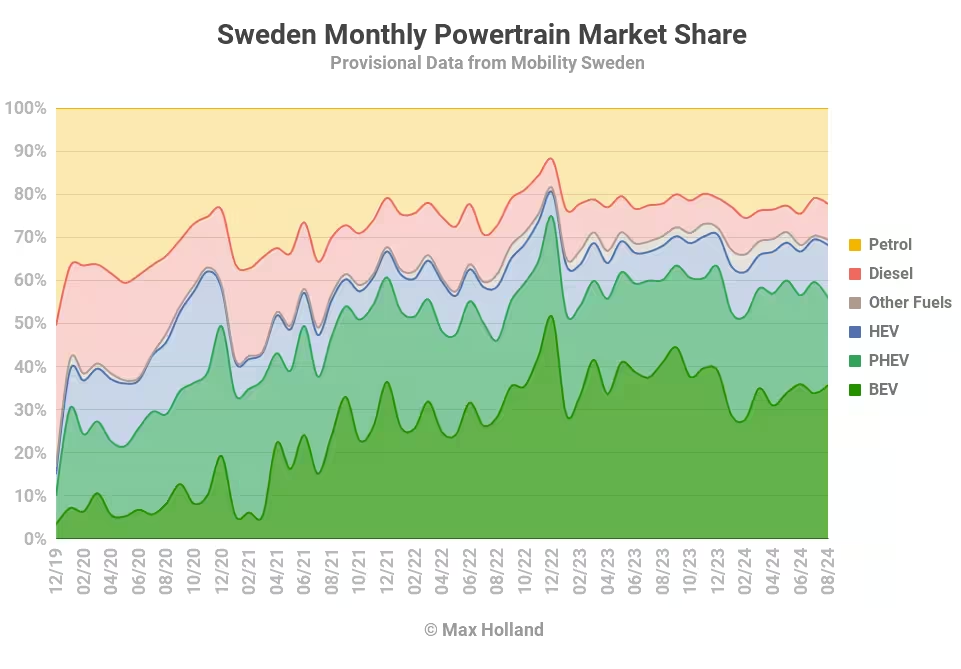

Sweden’s BEV decline is still present, with no sign of relief.

Year to date, the three dominant powertrains are BEVs, PHEVs, and petrol-only vehicles (with roughly 32%, 23%, and 24% share, respectively — see graph below).

Whereas petrol-only sales have stayed relatively flat year to date, compared to last year (down in volume just 3%, and 1,200 units), BEV sales have fallen by 21% (and by over 14,400 units). PHEVs are the only minor good news story here, with sales up by a modest 3.9% (and up 1,450 units).

Looked at differently, we can say that the fall in the overall market’s YTD volume — by 14,118 units — is all attributable to the BEV sales decline. This is not helped by legacy auto increasing the prices of their entry level BEVs over the past two years (e.g., the Peugeot 208 BEV priced at double the 208 ICE), just as recession has hit in Sweden, and in other parts of Europe.

Legacy auto are still clinging to their old ways — squeezing more economic rent out of their old ICE investments, not sufficiently investing in EVs, and instead paying out record profits to shareholders, and in management bonuses.

Choices, choices … and consequences. Let’s see how many of the legacy automakers remain viable 5 years from now.

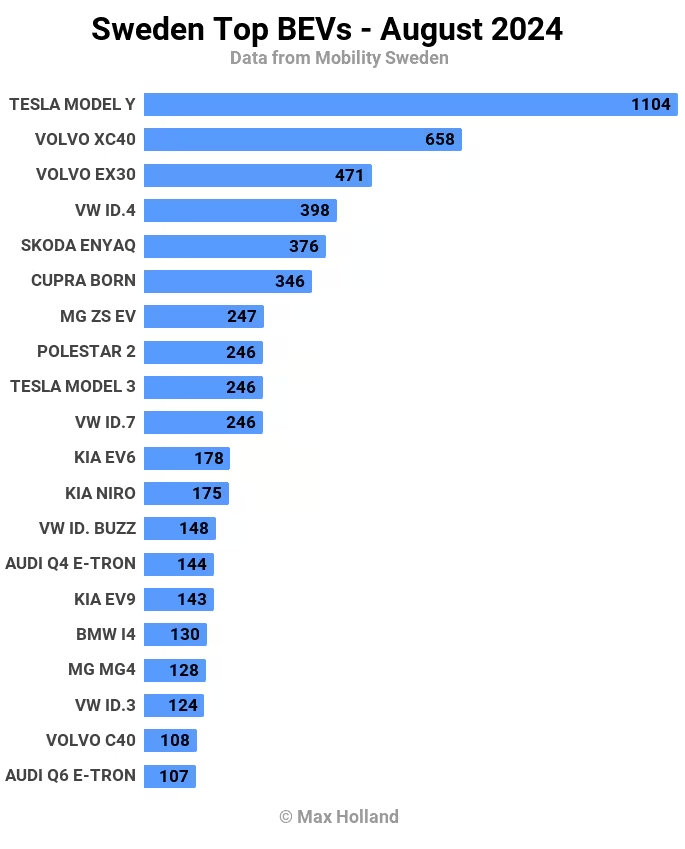

Best selling BEVs

Talking of automakers with future viability — which brands are producing the most popular BEVs in Sweden right now?

The Tesla Model Y was yet again the best seller in August, with 1,104 units registered. The Model Y has only been out of the top spot 3 times over the past 12 months! In the €40,000 to €50,000 segment, it is evidently still considered to represent great value.

In second place was the Volvo XC40, with 658 units, and in third was its younger sibling, the Volvo EX30, with 471 units.

Not until a very compelling BEV arrives — likely at a lower price point — will the Tesla Model Y come under threat.

There are no big surprises in the top 20 ranks, just shufflings that are normal in a smaller market subject to the whims of varying batch shipments.

There were three new BEV models debuting in August. Perhaps most symbolically important, the home-grown Volvo EX90 has finally arrived after several delays and seen 14 initial deliveries. These may be mostly demonstration units for now, but no doubt customer deliveries are also imminent, or already starting.

The Volvo EX90 is a BEV version of Volvo classic large XC90 boxy SUV, which does have the option of a 7 seat version. It is very expensive, currently only available from SEK 997,000 (€87,500), but more affordable trim levels will no doubt arrive in the future. It now joins the Kia EV9 and the Volkswagen ID. Buzz as another 7-seat BEV option for large families.

Next up was the Ford Explorer, which we have noted also debuted in France and Norway in August, following its German launch last month. See that Germany report for a summary of the vehicle. Sweden saw its initial 27 units of the Explorer in August. Let’s see how it gets on.

Finally, the Cupra Tavascan also saw its Swedish debut in August, with 16 deliveries. The Tavascan is based on the Volkswagen Group MEB platform in a mid-sized SUV coupe format. It is essentially Cupras’s take on the Volkswagen ID.5, or the Audi Q4 e-tron Sportback, though about 1% longer at 4,644 mm. The technical specs and capabilities are similar to its MEB cousins — so, decent, if not groundbreaking.

Cupra’s brand emphasis is slightly more on “sportiness” compared to Volkswagen, Skoda, and Audi, both in the design language, and to a lesser degree, in the on-road dynamics. Think Cupra Born, relative to Volkswagen ID.3.

The pricing of the new Tavascan starts at SEK 564900 (€49,600), a slight bit higher than the ID.5’s price in Sweden. Its older sibling, the Cupra Born, has proven popular in the country, often standing at around 10th place in the BEV rankings, so perhaps the Tavascan can achieve similar success.

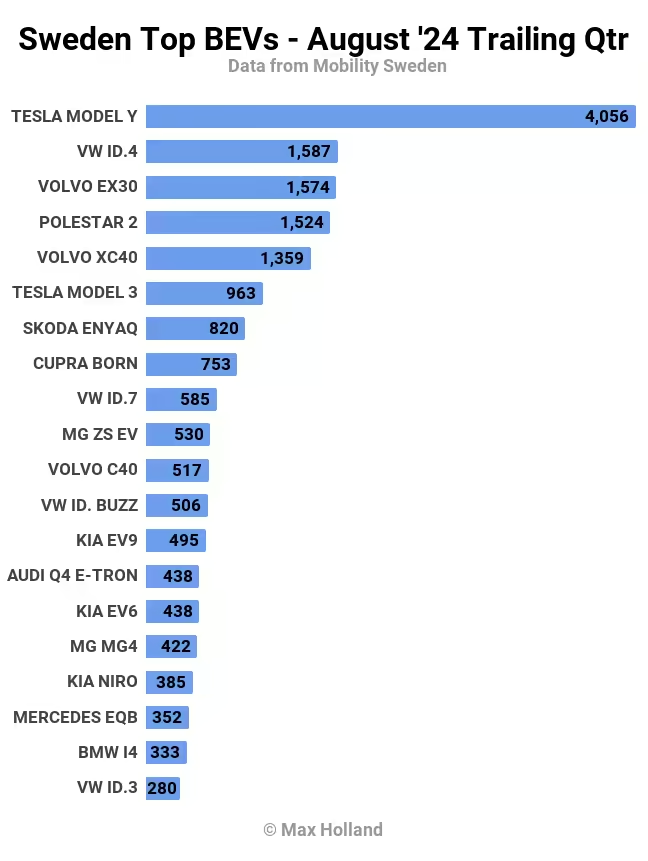

Let’s now check in on the 3-month rankings:

The Tesla Model Y remains very dominant, not far off the summed sales volume of the next 3 models combined.

The 2nd to 5th spots are closely competed by the Volkswagen ID.4, Volvo EX30, Polestar 2, and Volvo XC40. It’s not a coincidence that these are all compact or medium SUVs/CUVs, by far the most popular vehicle format in Sweden, and in many other markets.

There are no imminent disruptions in the pipeline for the top 20 BEVs — the Volvo EX30 did achieve that a few months ago, and has now become a regular in the top 3. The Audi Q6 e-tron, however, is set to be relatively successful, already at 107 units in August, from its 66 unit volume debut in July. The Q6 may squeeze in at the bottom of the table by the end of this year (depending on production volumes). In the longer run, the Cupra Tavascan may enter the top 20 also, especially if more modest trims improve its pricing in due course.

Outlook

As noted earlier, the lacklustre Swedish economy (and still fairly high interest rates) are not helping the BEV transition, given the overpricing habit of major automakers. The Q2 YoY GDP figure was 0.5%, down from 0.9% in Q1.

Inflation is at 2.6%, flat over the previous update, and interest has improved slightly to 3.5% (from 3.75%). Manufacturing PMI improved to 52.7 points in August, from 49.2 points in July.

Until BEV affordability improves significantly, and the economic situation alleviates, I don’t think we can expect BEVs in Sweden to get back to the strong growth of the 2020–2023 era.

What do you think? Please join in the discussion in the comment section below.