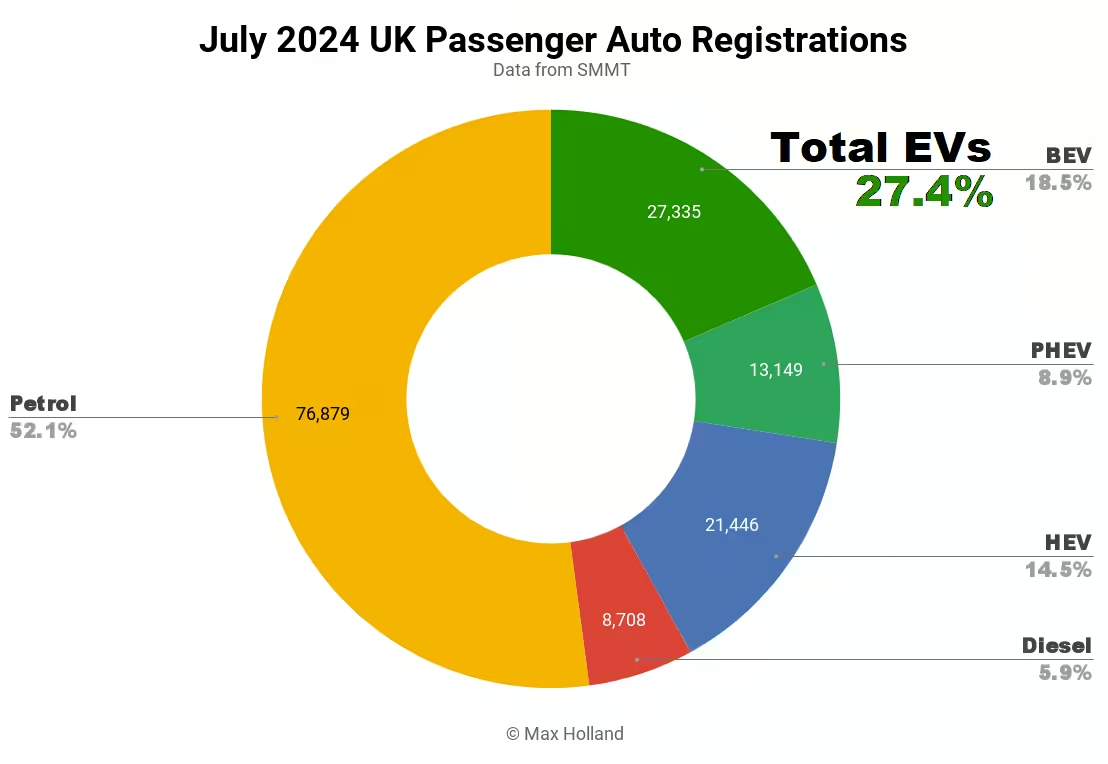

July saw plugin EVs take 27.4% share of the UK auto market, up from 24.1% year on year. Both BEVs and PHEVs grew volume YoY, outperforming the broader market. Overall auto volume was 147,517 units, up 2.5% YoY, still below pre-2020 seasonal norms (~160,000). The UK’s leading BEV brand in July was BMW.

July’s sales tally saw combined plugin EVs take 27.4% share of the UK auto market, with full electrics (BEVs) taking 18.5%, and plugin hybrids (PHEVs) taking 8.9%. These compare with YoY shares of 24.1% combined, 16.0% BEV and 8.1% PHEV.

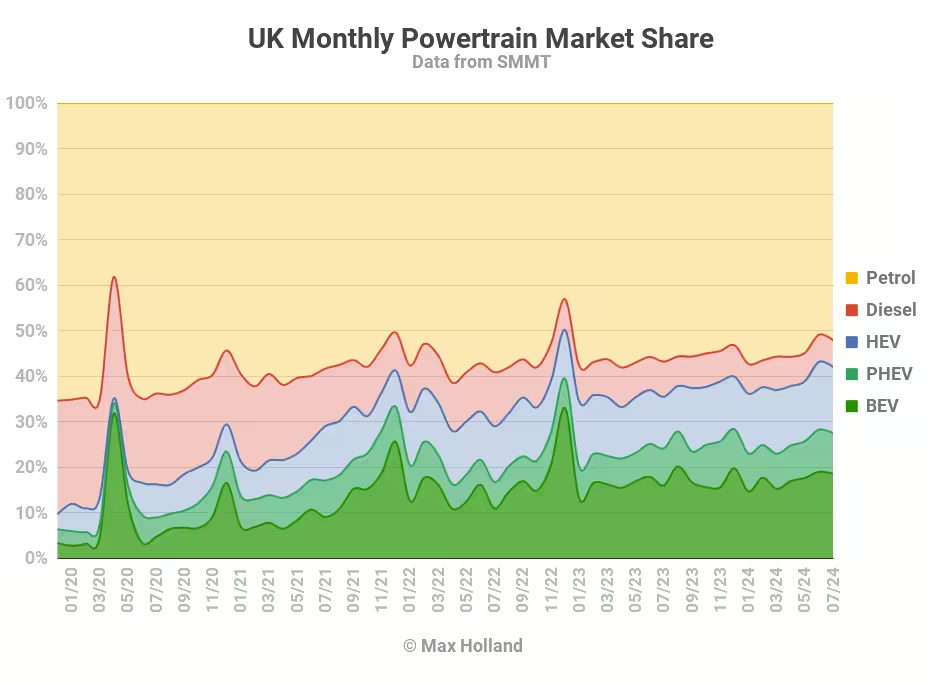

July saw a slight dip in EV share from June, but that’s a seasonal norm. The year-on-year result was positive for both BEVs and PHEVs, in terms of volume and market share.

BEV volume grew by 18.8% YoY, to 27,335 units. PHEVs grew in volume by 12.4%, to 12,149 units. Since the overall market only grew 2.5% YoY, both BEVs and PHEVs saw increases in share.

The biggest volume growth overall came from plugless hybrids (HEVs), up 31.4% YoY to 21,446 units and 14.5% market share. These old-school hybrid vehicles necessarily source all of their energy from combustion of fuels, not from electricity alone (as plugins can). HEVs are only a relatively cheap stop-gap solution for manufacturers to lower their fleet emissions — one which was somewhat innovative 27 years ago but is now old-hat. Their growth is temporary — HEVs will eventually give way to plugins, and ultimately, to almost entirely BEVs.

Petrol-only and diesel-only vehicles both fell in volume YoY, with diesels hitting a new record low of just 5.9% market share.

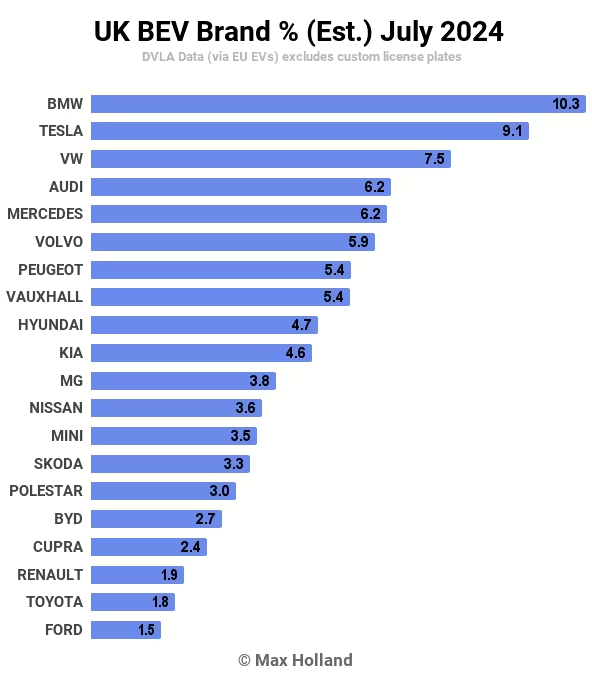

UK’s best selling BEV brands

The UK’s top ranked BEV brand in July was BMW, taking 10.3% share of the BEV market, reclaiming the title from Tesla (9.1% share) that BMW last saw in April (as well as in January).

It is not a coincidence that BMW shines in the UK in the first months of each quarter and then loses out to Tesla almost every other month. The first-month-of-quarter is when Tesla’s logistics habitually prioritise other markets, rather than the UK. Year to date, Tesla is still around 30% ahead of BMW in BEV sales in the UK. Although, this is a smaller gap than a year ago (over 50% ahead).

In third spot in July was the Volkswagen brand, some way back with 7.5% of the BEV market.

Audi took 4th place, close to its usual ranking, and other brands were also mostly unchanged.

The new Audi Q6 e-tron has just launched in the UK market, with at least 86 initial units delivered in July (see an overview of the Q6 specs). Its older, smaller sibling, the Q4 e-tron, has been very popular in the UK for several years (and was the third best selling BEV model in 2023). We can thus expect the Q6 e-tron to also be popular, relative to its (high) price point. The Q6 e-tron starts from £64,200 (on-the-road price) in the UK, almost 25% more than the Q4 e-tron (just under £52,000).

At the more affordable end of the BEV market, the Dacia Spring finally launched in the UK, with 2 initial units registered in July. The Dacia Spring has consistently been a top 10 best selling BEV in Europe over recent years, and finally now comes to the UK market, priced from £14,995 and up. This is the first affordable BEV in the UK and should sell well.

These initial Dacia Spring units registered in July are likely intended for showrooms and test drives, and more will soon join. We will keep an eye out for significant customer volumes of the Spring, likely in the next two months.

There were no major changes in brand rankings in July, just minor shuffles. Perhaps if Dacia gets rolling at high volumes with the Spring in the UK market (possible now that the EU politicians are imposing extra tariffs on this vehicle elsewhere), we will see the brand quickly climb the UK rankings towards the top 10. Let’s see what happens.

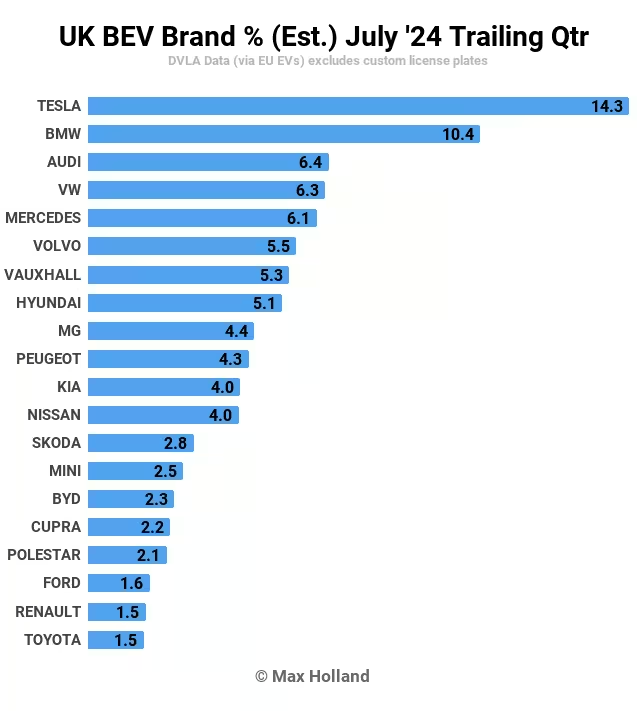

Now let’s get an update on the longer-term brand rankings:

Tesla’s pole position in the UK is clear. It has a 38% volume lead over BMW in the UK market over the trailing quarter. Audi and others are a long way back from the two frontrunners.

Infamous BEV laggards Toyota and Honda have fallen several spots since 3 months prior and more than halved their prior volume. Perhaps they feel they did enough at the start of the year to be on a trajectory to end up within sight of the ZEV mandate, and will make up the difference by buying excess ZEV credits from the likes of Tesla and others towards the end of the year. Let’s track their market share in the months ahead and monitor the situation.

MINI saw a climb over the prior period (up to 15th, from 29th) thanks to its new generation of BEVs now arriving in decent volumes, after a prior lull. It will be interesting to see whether this climb comes from sustained volumes or simply from a temporary period of fulfilling pent-up demand before settling back to somewhat lower volume.

Outlook

The UK’s BEV progress is modest, but at least still positive, whereas France is now standing still on further growth, and Sweden and Germany are going in reverse.

The broader UK economy is weak, with Q4 2023 GDP slightly negative (0.2% YoY) and Q1 2024 mildly positive (+ 0.3% YoY). Inflation remained flat at 2% in June (latest), and interest rates remained high at 5%. Manufacturing PMI was 52.1 points in July, slightly up from 50.9 points in June.

One ricochet of positive influence is that the UK will not (for now) follow the EU region in imposing additional import tariffs on BEVs made in China. This will likely mean that some proportion of BEVs that would otherwise have sold into the EU region might instead get diverted to open markets like the UK (and to other non-EU markets like Norway and Switzerland). This trend, alongside the UK’s ZEV mandate, should help to keep the country’s BEV trajectory positive in 2024.

What are your thoughts about the UK’s auto market and transition towards EVs? Please jump into the comments below and join the discussion.