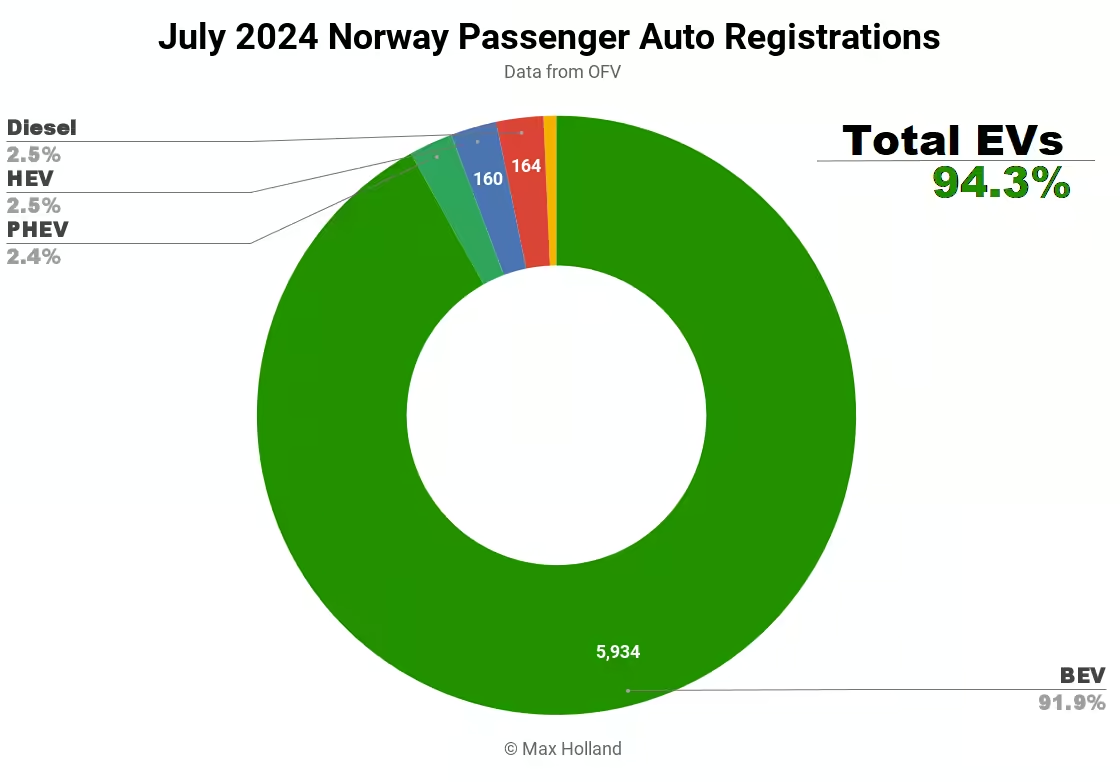

July saw plugin EVs take 94.3% share in Norway, up from 89.9% year on year. BEVs alone took almost 92% of the market, close to a record, and PHEVs contributed 2.4%. Overall auto volume was 6,456 units, down 14% YoY. The Volkswagen ID.4 was the month’s best seller.

July’s market results saw combined EVs take 94.3% share in Norway, a new record high, comprising 91.9% full electrics (BEVs), and 2.4% plugin hybrids (PHEVs). These compare with YoY figures of 89.9% combined, 81.7% BEV and 8.1% PHEV.

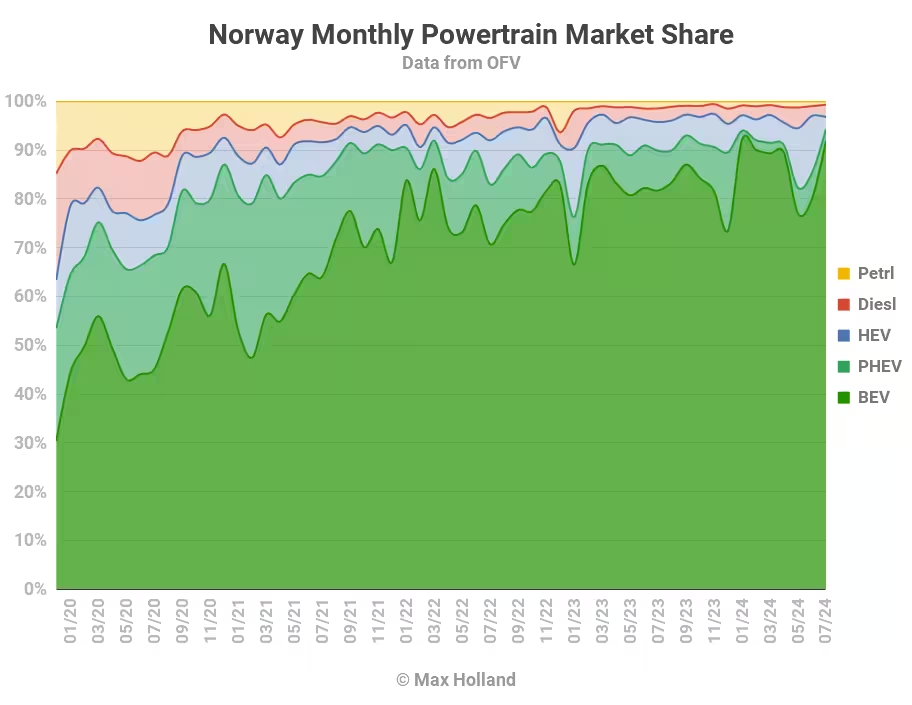

The trend so far in 2024 has been a decline in PHEV sales, due to the tighter emissions taxes starting from January, and a growth in BEV share as a result. Non-plugins are steadily declining also, but are proving tenacious and hard to completely displace.

Nevertheless, there was a hangover in non-plugins in July, following a pull-forward of sales in June, ahead of tighter safety regulations. We covered the new “GSR2” safety regulations in last month’s report.

Not only were the remaining stocks of long-in-the-tooth models given a firesale in June, some were self-registered by dealers (i.e. sold to themselves), before they became unsellable due to the new regulations. This helps explain the bump in YoY overall auto volume in June (against a backdrop of 2024 volumes being down YoY), and a slight hangover in July.

After this slight disjuncture, we may see the auto market settle into a new equilibrium in August or September, we will have to wait and see.

The upshot of all this was that July saw combined plugin share break new highs, on the cusp of 95%. Conversely, non-plugins were weak, especially HEVs, whose share more than halved YoY from 5.9% to 2.5%. Meanwhile petrol-only vehicles also halved their share, from 1.4% to 0.7% (and just 45 units sold).

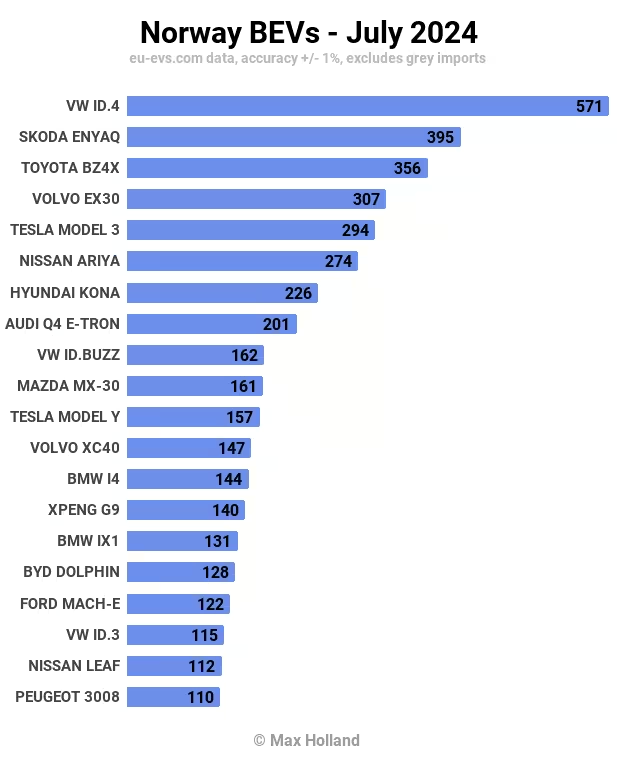

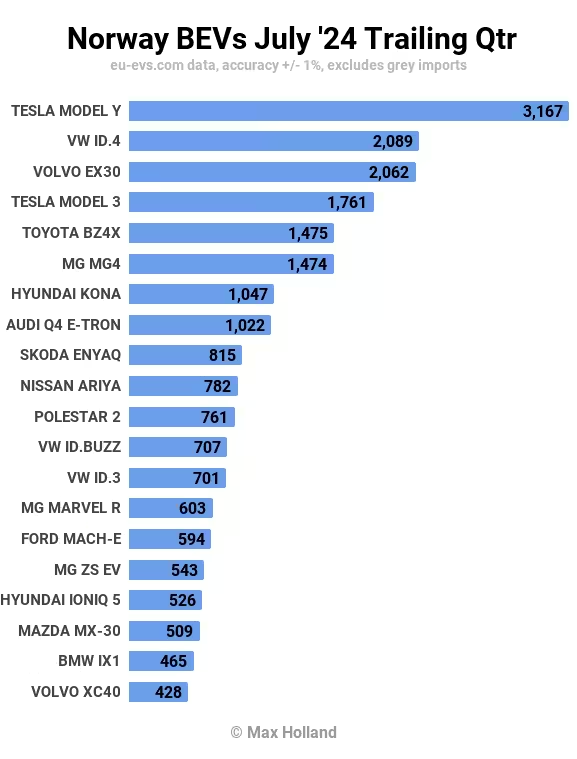

Best selling BEV models

The Volkswagen ID.4 took the pole position in the sales charts in July, with 571 registrations, down in volume by 40% from July last year, though from a strong baseline.

In second place was its Volkswagen Group MEB cousin, the Skoda Enyaq, with 395 units, down by 44% YoY, again from a high baseline. The Toyota bZ4x came in third.

The long term leader, the Tesla Model Y, was down in 11th spot, but this is normal for July in Norway (it was 9th in July 2023), after the end-of-quarter push. Its YoY volume was down by 19%, within normal variation.

There were two new entrants into the top 20 ranks in July, the BYD Dolphin (17th up from 33rd in June), and the new Peugeot e-3008 (20th up from 60th). Let’s see if these can become regulars in the chart.

The popular MG Motors BEV models were not shipping in July, but will no doubt be back in strength in the coming months.

In terms of all-new debutants, there were several in Norway in July. The most significant is the new Audi Q6 e-tron mid-large premium SUV, which saw 62 initial units. This takes Volkswagen Group’s past BEV learnings and applies them to a next generation premium BEV platform shared between Audi and Porsche. I described the new Q6 e-tron in June’s Sweden report, check there for basic details.

A key point is that the original Audi e-tron (now renamed the Audi Q8 e-tron) was outlandishly popular in Norway (given the high price point), and the Q6 is a much better vehicle, with similar interior space. The Q6 should therefore be very popular in Norway, for its segment. However, the market segment is a lot more crowded with offerings than it was when the original e-tron launched, so similar domination is no longer guaranteed. Let’s see how far up the ranks it can climb.

Another July debutant was the new Xpeng G6, with 19 registrations. The G6 is a mid-large premium SUV, like the Audi Q6 above, though not quite as premium, and more tightly priced. See yesterday’s Sweden report for the overview specs on the new Xpeng G6.

There were a couple of Zeekr models that saw initial registrations in July, but in very low digits, so perhaps testing units for now. I will update on these models if they see customer-relevant volumes.

The new Lotus Emeya sports sedan also saw one registration, but is very high priced (over €100,000) and thus unlikely to change market dynamics much. The expensive high end performance sedan segment is by now overflowing with BEV offerings from all comers. Meanwhile, where are the BEVs in sub-€20,000 segments in Europe? That’s a rhetorical question, we all know the answer. They are in China.

Let’s check up on the 3 month rankings:

The Tesla Model Y is obviously still highly dominant in Norway, even if less so than a year ago.

The Volvo EX30 has quickly climbed to be a regular in the top 3 spots, and may emerge mostly ahead of the ID.4 in the future, since it has more accessible pricing, and a robust LFP battery in the entry variant.

A brief update on the fleet transition — as of the end of Q2, BEVs had 25.5% share of the Norwegian passenger vehicle fleet, and PHEVs had 7.26% share. Since their sales are now shrinking, PHEV share of fleet is about to plateau, and likely won’t get above 7.5% share.

BEVs were previously often growing share of the fleet by 1.2% per quarter (e.g. in late 2021 and in 2022). This growth rate has slowed as BEV sales volumes in Norway have fallen, despite BEV share of new sales creeping higher. Over the past 12 months, BEV share of the fleet has only grown by 3.4%, from 22.6% to 25.5%. Obviously at this rate, it would take another 20 years for BEVs to reach around 90% of the fleet — not great progress in absolute terms.

Bear in mind, however, that new cars (now almost all BEVs) tend to get driven much more than 10, 15, or 20 year-old cars (almost all ICE). This means that the proportion of Norway’s total passenger kilometres driven on electricity will nevertheless cross 50% in just the next two or three years. For more on the nitty-gritty of fleet dynamics, including modelling of the implications for fossil fuel demand, check my previous fleet transition analysis.

Outlook

As mentioned earlier, Norway’s auto market is 6% down so far this year compared to 2023, and is 28% down compared to 2021. The broader economy recorded a 0.8% YoY decline in GDP in Q1 2024 (latest data).

Inflation fell to 2.6% in June, from 3% in May. Interest rates remained flat at 4.5%, the highest level since 2008. Manufacturing PMI saw an uptick in July to 56.9 points, though this seems to be a seasonal effect, and may return to the recent range of 48 to 52 points in the months ahead.

What are your thoughts on Norway’s point along the EV transition, and the likely road ahead? What needs to happen now for BEVs to grow towards 99%+ of the auto market? Please jump into the discussion below and let us know.