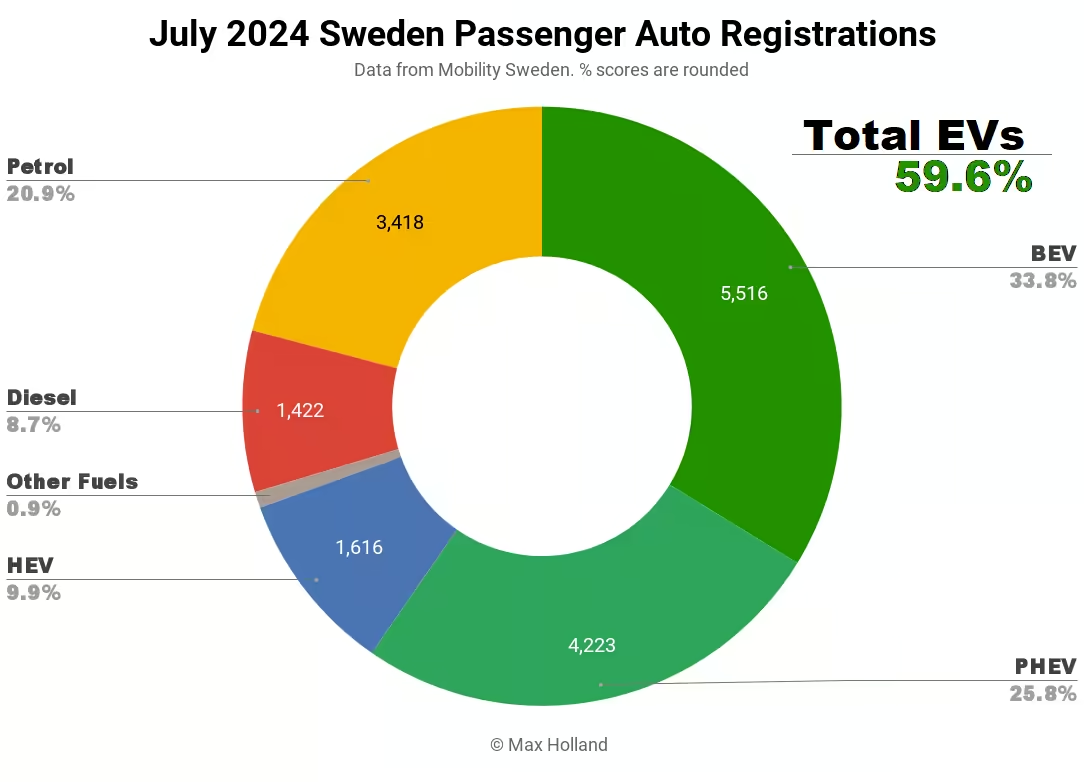

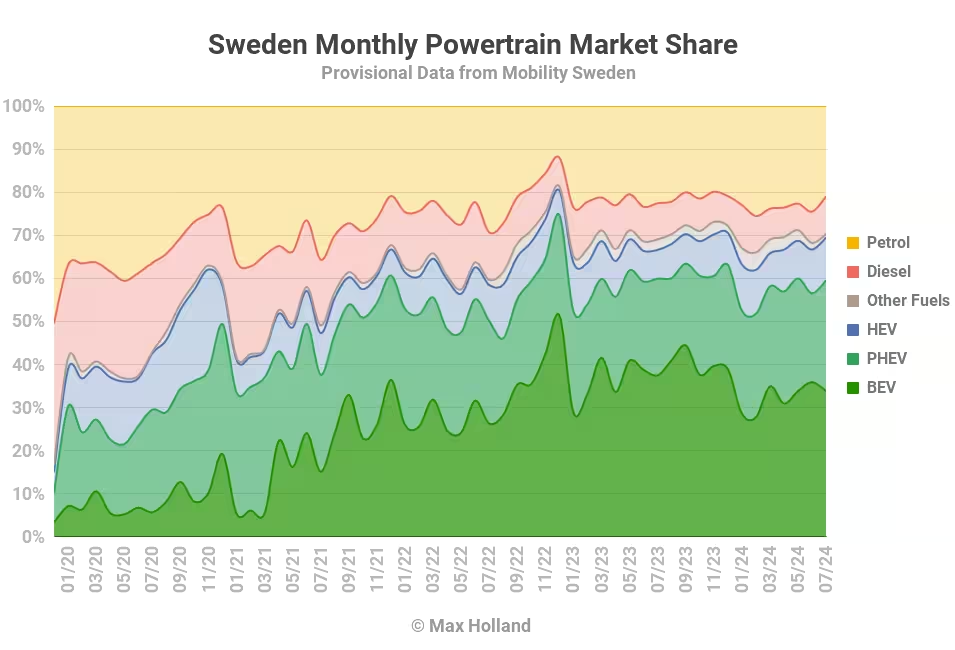

July’s auto sales saw plugin EVs at 59.6% share in Sweden, almost flat YoY from 59.9%. BEV volumes were down YoY by 15%, while PHEVs grew by 9%. Overall auto volume was 16,337 units, down 6% YoY. The Tesla Model Y remained the best selling BEV.

The July market data showed combined plugin EVs at 59.6% share in Sweden, with full electric BEVs at 33.8% and plugin hybrids (PHEVs) at 25.8%. These figures compare YoY against 59.9% combined, 37.5% BEV and 22.4% PHEV.

Sweden’s progress in the EV transition continues to go backwards, with BEV share again lower in July than a year ago. Year to date, cumulative BEV share now stands at 32.5% compared to 37.3% at this point a year ago. PHEVs have grown YoY to take up some of the slack, but not enough to outweigh the drop in BEV sales.

Why is this happening? There’s one major reason, and two minor influences. The minor ones include the weak economy and the curtailment of BEV purchase incentives (compared to still being somewhat present a year ago). The major reason is the continued over-pricing of BEVs and an absence of affordable BEVs from legacy European automakers.

As of June, this overpricing of legacy brand BEVs is now combined with the added headwind of the world’s best value BEVs (those made in China) being made 20% to 38% more expensive by protectionist tariffs by EU politicians (read: protection of legacy auto’s outlandish margins and record profits paid out to shareholders and in executive salaries).

For a detailed report on how legacy auto increased its BEV prices and made record profits over the past two years, see this recent briefing by Transport & Environment (download the full PDF from there).

In China, the world’s most competitive consumer marketplace, BEVs are now competing with ICE vehicles on sticker price, and are winning. Jose’s latest China market report shows normal steady growth in market share continues, with the top BEV and PHEV models now outselling ICE models in most vehicle segments. EVs are now able to compete with ICE on price because costs of BEV powertrains have steadily reduced (as the cost of any new technology does over time) and sticker prices are not being over-inflated by profit-seeking legacy auto. There’s too much competition, and consumers won’t stand for it.

This is not the case in Europe. To repeat a clear example, in Sweden, the Peugeot e-208 from Stellantis has an MSRP over twice that of the ICE version (SEK 489,900 vs. 239,900). This overpricing by legacy auto is deliberate, it may well indicate collusion (aka price fixing), and it is obviously blocking the progress of the EV transition.

Fine, you might say, they can play their games — just let outside brands come in and compete; that will show them, right? Well, no. The actually affordable BEVs from outside brands “must” be subjected to additional tariffs (otherwise they would erode the excess margins and excess profits of legacy European auto) — such that consumers cannot easily purchase them either.

Why don’t legacy auto companies want to produce more BEVs? Because they want to squeeze as much profit as possible out of their decades-old ICE technologies and investments (rent-seeking).

Let’s be honest — they have only ever done the minimum legally possible on the EV front. The growth in 2020 and 2021 in Europe was due to legislation, not from their genuine desire to transition to EVs. Meanwhile, most European governments and/or the EU — which are in thrall to these same kinds of powers-that-be corporations (neo-liberal corporate capitalism, or “profits over people”) — have paused any tightening of emissions requirements until 2025. There is therefore no regulatory “stick” motivating legacy auto to increase BEV sales until then. Meanwhile, the EU tariffs on outside EVs ensure there is minimal competitive stick, too.

Thus, across the sample of 15 European markets covered by the EU-EVs database, Europe’s highest volume car brand, Volkswagen, sold 41,532 BEVs in the first quarter of 2023 but had reduced sales down to 24,749 in Q1 2024. The same figures for Renault were from 19,432 down to 17,371. Stellantis’s three high-volume EV brands in Europe (Peugeot, Fiat, and Citroen, combined) together went from 39,999 down to 37,328.

Thus, overall European BEV volumes (and market share) are actually shrinking, and this is especially visible in medium and large markets like Sweden and Germany.

Note that, if European legacy auto companies were sincere about moving to BEVs, they could do so, just like many auto companies in China are doing (China is now passing 50% plugin share as of June 2024). But these legacy auto companies are not sincere. Let’s repeat the sad truth — they are instead doing the minimum legally required, they are overpricing their BEVs (even whilst EV-component costs are getting much cheaper). They are instead making record profits (paid out to investors and management, not re-invested in EV research).

Those of us European consumers who want to make the switch to BEVs, even just a simple, affordable, no-frills BEV, are flat out of luck. European volume automakers don’t want to sell you an affordable one, and China’s automakers are being restricted from selling you an affordable one.

The European EV situation will temporarily improve in 2025 — only because slightly tighter emissions requirements will resume in that year, forcing the laggards to speed up a bit — but the transition will thereafter stagnate again until the next tightening.

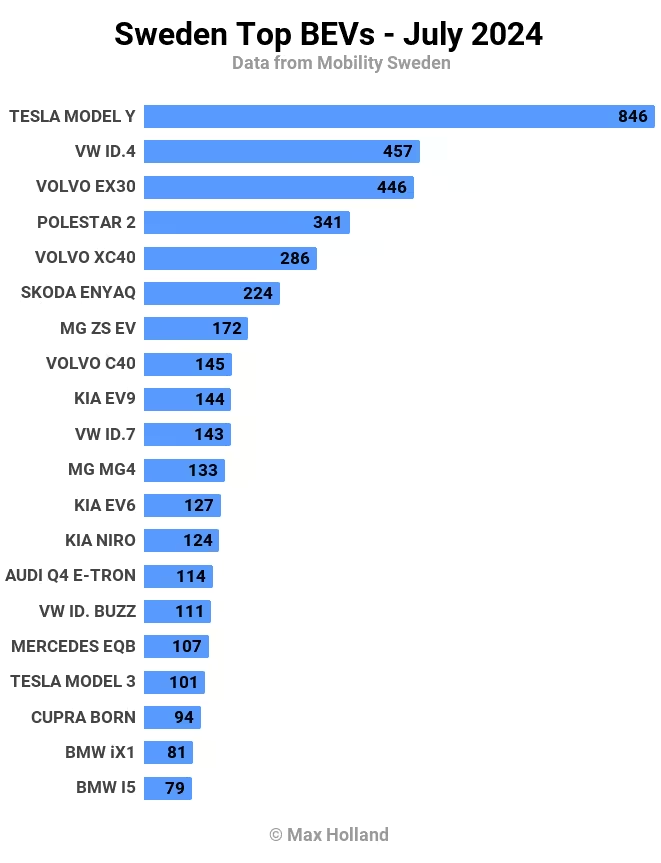

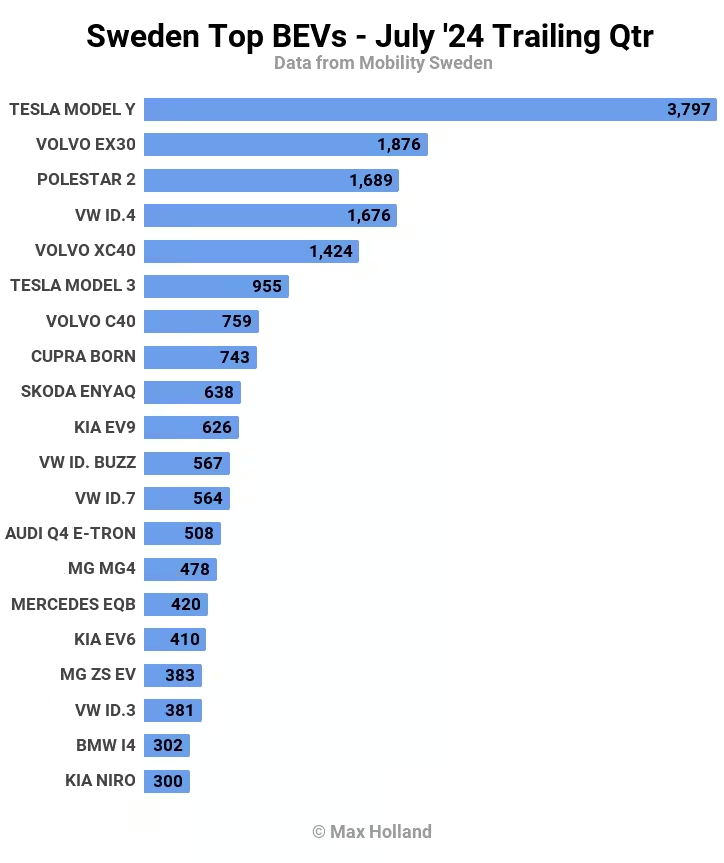

Best selling BEV models

Tesla, not a legacy automaker, again had by far the best selling BEV model in July, the Tesla Model Y, with 846 units delivered. This is up YoY from a more modest 359 units in July 2023.

In second place was the Volkswagen ID.4 with 457 units, down from 710 units YoY. In third was the new Volvo EX30, close behind with 446 units (after launching in December).

All of the top 20 are familiar faces, with few significant changes in position.

In terms of newly debuting models, there was only one in Sweden in July, the Xpeng G6, with 7 initial units. The Xpeng G6 is a mid-sized premium SUV coupe (4,753 mm) priced from SEK 540,000 (€46,650). It has 435 km of range (WLTP cycle), very fast charging (21 minutes from 10% to 80%), and is competitive on pricing compared to peers. Other variants, with longer range and more performance, are also available. Let’s see how it gets on.

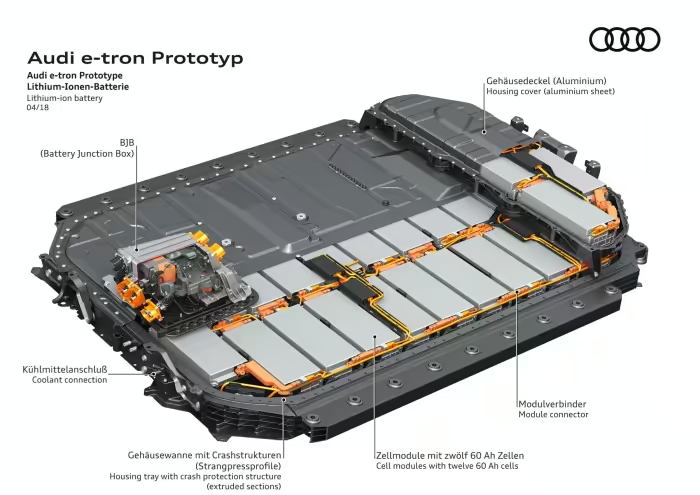

Last month’s debutant, the new Audi Q6 e-tron, stepped up from its initial 3 units to a healthy 66 units in July, and almost entered the top 20 in just its second month on the market. It will certainly be a relatively popular model within its segment. Though, absolute volumes will obviously be constrained by its very high price point (SEK 899,000, €77,680).

Let’s now look at the longer term rankings:

The Tesla Model Y has over twice the volume of the runner up Volvo EX30. Though, there may be some scope for the gap to narrow slightly, since the EX30 is not yet demand constrained.

The Kia EV9 continues to climb slowly, now achieving the 10th spot, up from 13th. Hot on its tail is the VW ID. Buzz, in the 11th spot. Let’s see who wins this race once the 7-seat version of the Buzz becomes more available in the coming months.

There are mostly only very minor shufflings in the top 12 spots. In thirteenth comes the Volkswagen ID.7, which launched back in November, up from 33rd in the prior three-month period.

Outlook

The overall auto market is down YoY by 6% year to date, with July in line with this trend. The broader Swedish economy is also relatively weak, with Q2 figures showing a 0.8% contraction of GDP year on year.

Inflation, however, reduced to 2.6% in June (latest) from 3.7% in May. Interest rates were static at 3.75%. The manufacturing PMI for July fell back to 49.2 points, from 53.0 points in June, suggesting further slowing ahead.

I’ve discussed above the main influences on Sweden’s backtracking on the EV transition this year. The central bank has signaled a likely reduction of interest rates sometime in the autumn, which may give a slight bump to demand but not significantly change anything. That will have to wait for 2025 when legacy automakers have to sell more BEVs to comply with tighter regulations, so don’t hold your breath.

What are your thoughts on Sweden’s EV transition and its short and mid-term prospects? Please jump into the discussion below.