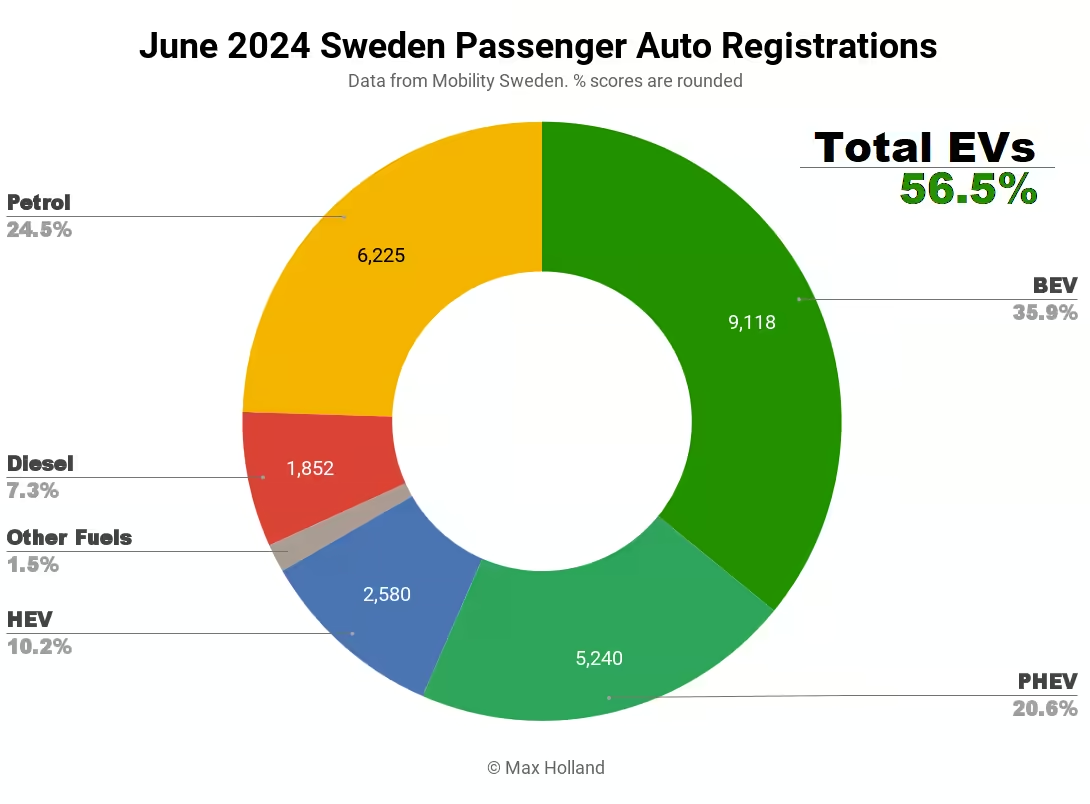

June saw plugin EVs take 56.5% share in Sweden, down YoY from 59.2% in June 2023. BEV share fell YoY, while PHEV share was flat, and both lost volume. Overall auto volume was 25,401 units, down 10% YoY. The Tesla Model Y was the best selling BEV.

June’s result saw combined plugin EVs take 56.5% share in Sweden, with full battery-electrics (BEVs) at 35.9% and plugin hybrids (PHEVs) at 20.6%. These shares compare YoY against 59.2% combined, 38.7% BEV and 20.5% PHEV.

The 2024 trend of BEV decline continues — after incentives dried up throughout 2023, the economy is in a squeeze, and many legacy manufacturers refuse to market their half-hearted BEV offerings at anything other than grossly over-inflated prices while pushing (and in some cases growing) their ICE sales. Looking at you, Stellantis.

June’s volume saw BEVs down 14% YoY (underperforming the overall market) and PHEVs down almost 10% (on par with the market).

Stepping back to look at 2024 year to date, BEV share has fallen to 32.4% share, from 37.3% last June, due to BEV volumes underperforming the overall market decline. H1 2024 saw BEV volume more than 20% down YoY, at 42,757 units. Indeed, the overall market is down in volume (by 6% YoY) largely because of the drop in BEV volumes.

The only bright(ish) spot is that PHEVs have taken up some of the slack, and grown in volume YoY across H1, by 8.4%. Even this is not enough to prevent combined plugins from losing share YoY, however. Cumulative 2024 combined plugin share stands at 56.3%, from 58.0% YoY.

None of this is impressive. Meanwhile, the Chinese market’s domestic EV penetration rate is catching up with Sweden, and has increased plugin share to 47% as of May, even whilst incentives have reduced YoY. How is this possible? The selection, the cost, and the pricing of BEVs (and EREVs, and PHEVs) continues to improve in China, more than compensating for the trimming of incentives.

This pricing improvement — the normal pattern in the ramp up of any new technology — is not the case in Europe, including Sweden. Instead, European EV prices have increased over the past few years (even whilst batteries and other EV components have become cheaper)! This should be a major scandal, but the legacy auto industry (and its profits, and vested interests) are powerful, and the political class appears to be complicit. #neoliberalcapitalism.

As a result of Sweden’s weakening performance of plugin EVs, petrol-only powertrains actually increased their share in June YoY, from 23.4% to 24.5%, since their volume shrinkage was better than the market average. One small piece of good news is that diesel share continues to steadily drop, down to 7.3% in June, from 8.1% YoY.

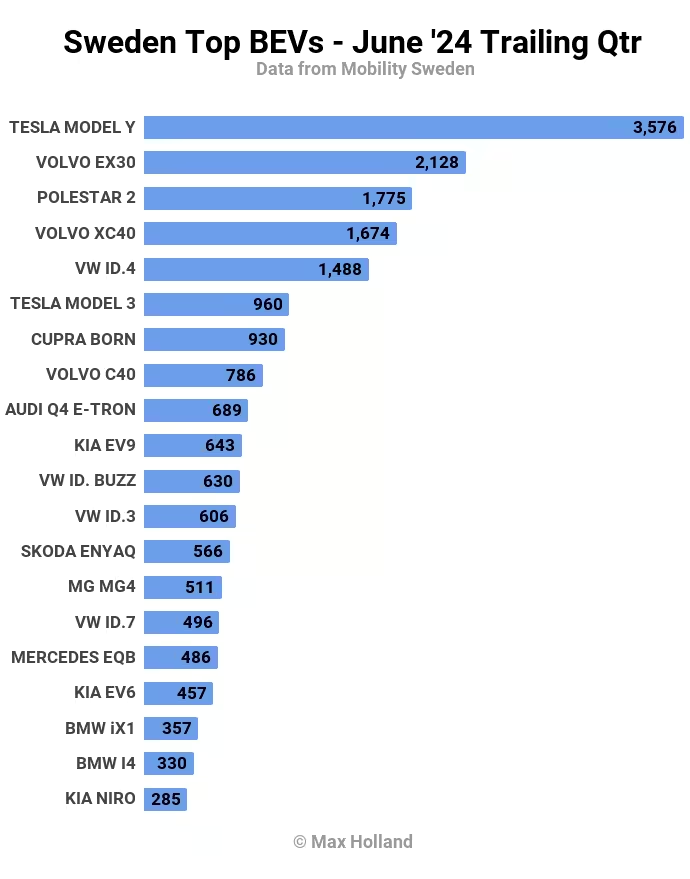

Best selling BEVs

Back to its usual position, the Tesla Model Y was the best selling BEV in June, with 2,106 registrations.

The Polestar 2 has returned to form in recent months, now taking second place with 937 units. The Volkswagen ID.4 took 3rd place, with 732 units.

The Polestar 2 has returned to great health (4th overall year to date), from an average rank of 10th in H2 2023.

The new Volvo EX30 stepped back slightly to 4th in June (from 2nd in May), but still maintains steady numbers not far from its 700 unit recent monthly average.

Other than the usual jostling for position, there were no big surprises in the top 20 (or even in the top 30).

We saw one debutant BEV come onto the Swedish market in June, the new Audi Q6 e-tron, with an initial 3 units. This is an expensive midsized premium SUV, with length of 4,771 mm and pricing from SEK 885,000 (€77,930). It is rated for up to 625 km (WLTP) range, and DC charging 10–80% in 21 minutes. On the upside, the Q6 e-tron is based on Volkswagen Group’s new BEV platform, the PPE (shared with the new Porsche Macan and the upcoming Audi A6 e-tron), which is fairly innovative in both technical ability and in overall efficiency.

On the downside, obviously, this lofty price point is already saturated with BEV offerings, and won’t translate to enough volume by itself to move the needle on the transition. Yet, the innovation and likely success of this Volkswagen Group platform in the upper segments will keep the pressure on competing premium brands (BMW, Mercedes, Volvo, Jaguar Land Rover, Alfa Romeo, Maserati, Lexus, etc.) to up their own game. The resulting R&D and technology (and cost) improvements will eventually make it down to more affordable segments.

In terms of recently launched models, the Peugeot e-3008 (9 units) and the BYD Seal-U (7 units) had quieter months after their May debut. The Mini Countryman (14 units) and Smart #1 (4 units) were also quieter following their April launch, and the Polestar 4 was silent (0 units). It’s still early days for all of these models, with uneven shipping, so we’ll keep an eye on them.

Let’s turn to the longer-term picture:

The Tesla Model Y is still dominant, with volume not far from that of the next two models combined. Its strong June performance actually led it to slightly increase the gap over the runner-up, the Volvo EX30.

Whilst there were several small ranking changes, and some well established models waxed or waned (e.g., the Cupra Born is back to volumes it last saw at the end of 2022), there are no great surprises, beyond the fast ascent of the Volvo EX30.

Another relatively decent performer is the Volkswagen ID.7, which had a slow start after its Swedish debut in November but has seen good volumes over the past two months. It climbed to the 15th position. A similar pattern, at a lower magnitude, is present for the BMW i5 (September debut), which almost made this list. It was in 24th place. It seems that large sedans still have fans in Sweden.

For a recent look at Sweden’s fleet transition trajectory, check my February report.

Outlook

The auto market drop of 10% YoY echoes the weak state of the broader economy. The latest available macroeconomic data from Q1 2024 was revised from a provisional GDP calculation of negative 1.1% to a positive 0.7%. This was a positive turn from the previous 3 quarters (all negative), but let’s see if that is sustained in Q2.

The inflation rate cooled further to 3.7% in May (latest data), from 3.9% in April. Interest rates remained at 3.75% throughout June, unchanged since early May. Manufacturing PMI fell back slightly to 53.6 points in June, from 54.0 points in May.

The auto industry association Mobility Sweden notes that the EV market has “stagnated” and urges government action, but — real talk — beyond asking for more handouts subsidies, shouldn’t they also check their own behaviour, and urge their own members to stop overpricing their BEVs? After all, the UK BEV market has kept growing EV share despite cancelling subsidies two years ago.

At what point does continuing the culture of subsidies counter-productively support the false narrative that BEVs “are [inherently] more expensive” than ICE cars, and become an excuse for foot-dragging? The Chinese auto market shows that BEVs are no longer more expensive.

What are your thoughts on Sweden’s EV market and trajectory of transition? Please jump into the discussion below.