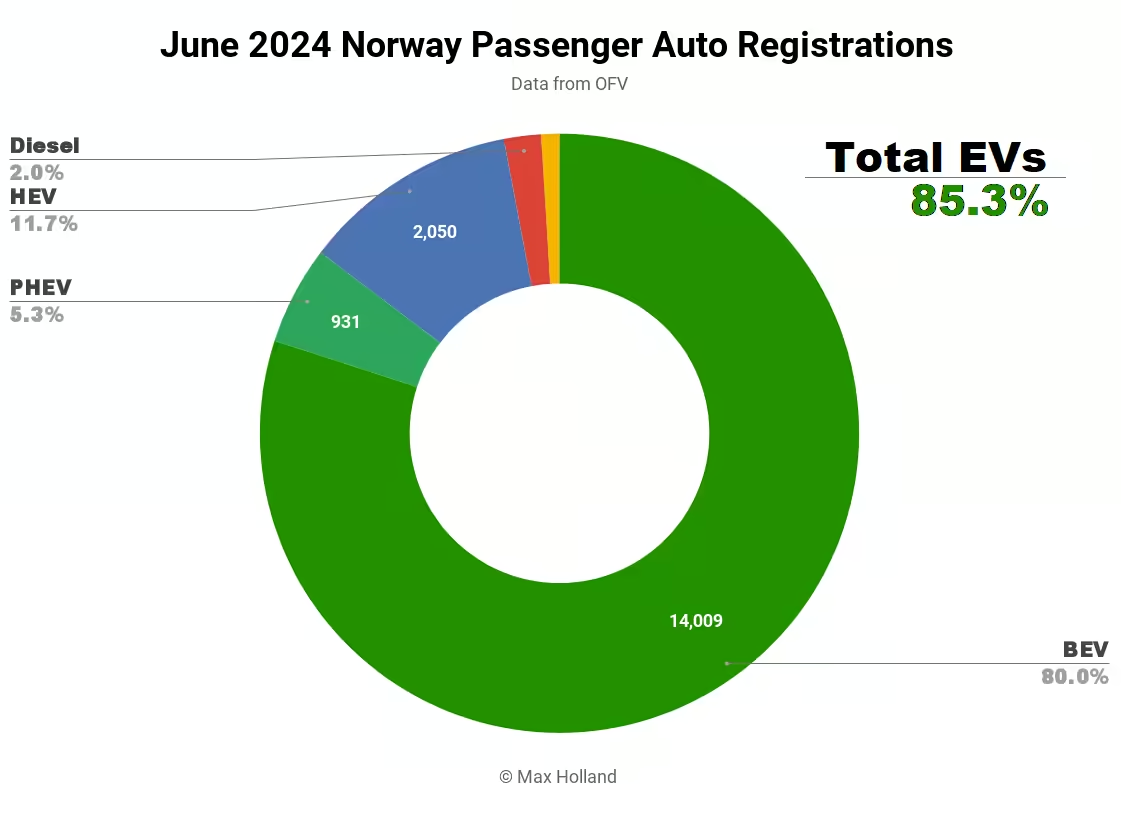

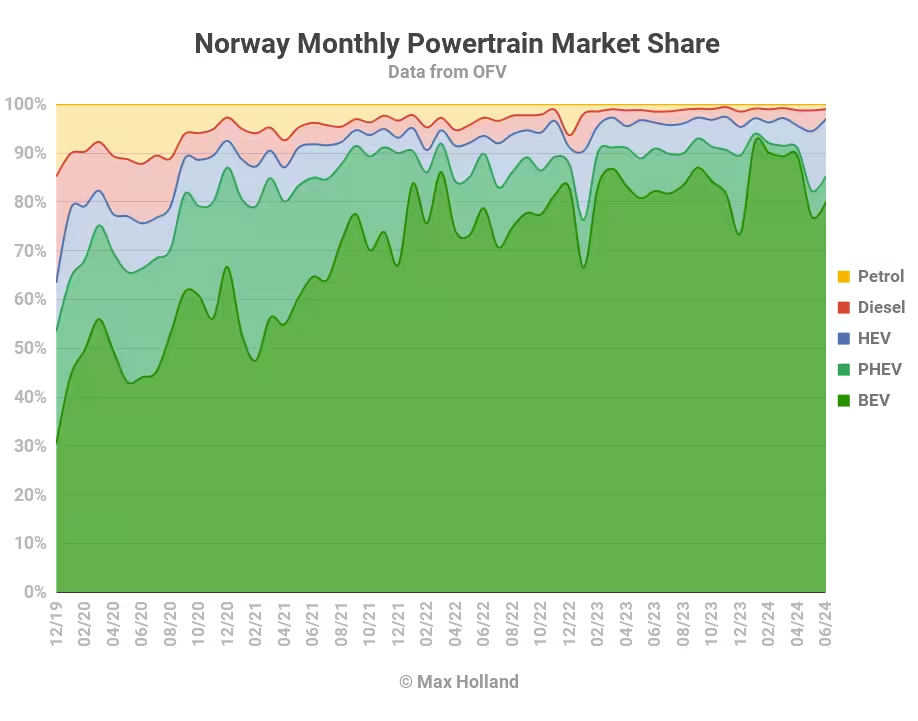

The June auto market saw plugin EVs take 85.3% share in Norway, down from 90.9% year on year. BEVs took 80.0% share, down from 82.2% YoY, despite volume growth. Overall auto volume in June was 17,512 units, up 12.5% YoY, while year-to-date volume remains 8% down. The best selling BEV was the Tesla Model Y, with the Tesla Model 3 as runner up.

June’s sales saw combined EVs take 85.3% share in Norway, consisting of 80.0% full battery electrics (BEVs) and 5.3% plugin hybrids (PHEVs). These compare with YoY figures of 90.9% combined, with 82.2% BEV and 8.7% PHEV.

In terms of volumes, BEVs grew 9.4% YoY to 14,009 units, the highest monthly volume since March 2023. Meanwhile, PHEVs shrank by 31.2% to 931 units. Both underperformed the overall market growth of 12.5%, pulled up by HEV volume growth of 2.5x YoY to 2,050 units. Combustion-only vehicles saw reduced volume.

It’s not clear why HEV volumes (mostly Toyota) were so much higher than a year ago. It could possibly be related to a pull-forward (or firesale, if you prefer) ahead of new vehicle safety regulations about to hit (more on these below). I would have guessed that almost all of Toyota’s HEV vehicles are already compliant, however (unlike their combustion GR86, which is not compliant, and will be cancelled in Europe). If you have insights on this, or other factors around HEVs, please let us know in the comments.

In the May report, we noted that the YoY fall in that month’s BEV volume was likely due to an unusual shipping shortfall from each of the most popular manufacturers (Tesla, BMW Group, and Volkswagen Group). BMW Group was back close to seasonal norms in June, whereas Volkswagen Group is still down by around 40% from June 2023 (likely prioritising shipping to other markets). Tesla, however, recovered and was 6.5% up in volume from June 2023.

MG Motor, Polestar, and Volvo brands were all substantially up in volume YoY, supporting the 9.4% overall BEV volume growth. Again, in a small market like Norway, vagaries of shipping mean we can’t read too much into the data for a single month, however.

New EU Vehicle Safety Regulations

June was the last full month of sale before new EU vehicle safety rules (GSR2 rules, hammered out in 2019–2020) become mandatory for all new vehicle sales in the region. Because it doesn’t make sense for manufacturers to make substantially different models for small individual markets which are part of the same regional logistics group, these rules also spill over to EU-adjacent markets like Norway, and to some extent, the UK. Previously, models launched prior to 2022 and not originally designed with the new rules in mind were given a temporary pass (while all-new models launched after 2022 had to comply).

From the 7th of July, after 4 years of lead time from when the rules were formulated, there are no more exceptions. Now mandatory on all new vehicles sold are automatic safety features such as: speed limit assistance, emergency braking assist, collision avoidance assist, lane keep assist, drowsiness monitoring and warning, reversing sensors/camera, and event data recorder (aka “blackbox”).

Vehicles based on older platforms and architectures which preclude the practical addition of these features are thus stopping sale in the region. For example, this is the main reason why the Renault Zoe — on a vehicle architecture launched in 2011 — ceased selling earlier this year.

The Norwegian OFV notes that business registrations of new vehicles spiked up in June, compared to registrations for private individuals. They estimate that this is due to some manufacturers and dealers “selling” some end-of-the-line models ahead of the July 7th rules — by registering those units to themselves — with the plan to sell them on later as pre-registered vehicles.

Since these newly mandated safety systems add significant cost to vehicles, these new rules are a main reason why economy cars (that start well under €15,000) have largely been removed from the European market over the past few years. For BEVs, this includes the Volkswagen e-Up! and group cousins the Skoda Citigo and Seat Mii, which were based on an older non-BEV-specific platform.

ICE economy vehicles which have recently been phased out include the ICE versions of those three just mentioned, as well as the Peugeot 108 and Citroen C1 cousins, and the Ford Ka+ (amongst several others). Other economy ICE cars (e.g., the Dacia Sandero, Fiat 500, Fiat Panda, Hyundai i10, and Kia Picanto) are still offered, but have all seen their prices increased, in large part to accommodate the added cost of the new safety systems.

In time, the supply costs of these systems (which mainly consist of cameras, CPUs, and software) will reduce to commodity levels. The international version of BYD’s Dolphin Mini (aka Seagull) is already largely compliant, ready for when it comes to Europe in the next year or so (probably in a slightly upsized version), and still at very affordable prices.

Returning to Norway’s June results, combined ICE-only share stayed close to record lows, at just 3.0% share in June. Petrol-only share was just 1.0%.

Best Selling BEVs

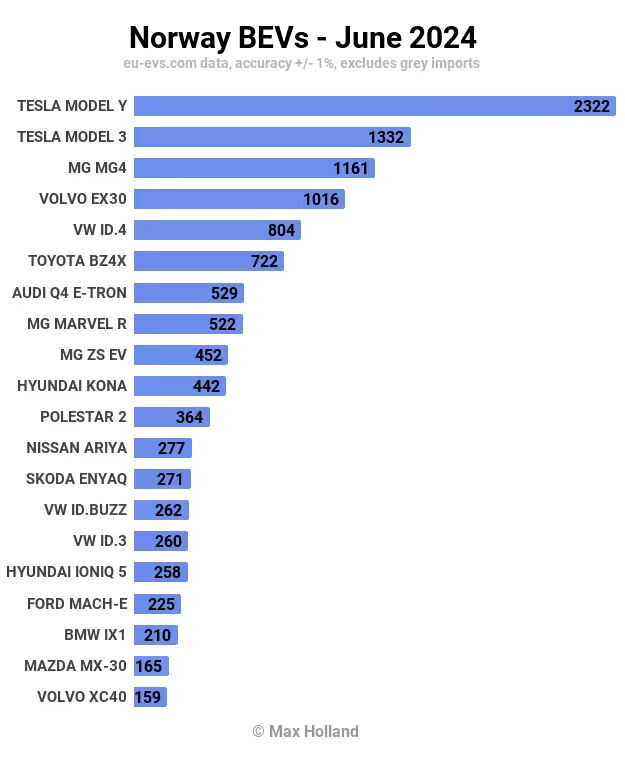

June saw Tesla retaking the lead in Norway, displacing the young pretender, the Volvo EX30. The Tesla Model Y led with 2,322 units, and the Model 3 came in second with 1,322 units.

The MG4 came third, with 1,161 units, its highest ever volume.

The new Volvo EX30 wasn’t far away, with 1,016 sales, still a very respectable volume.

The Tesla Model 3 saw its highest monthly volume since March 2022! Along with the MG4’s big numbers, one might think this is a last-minute push of these made-in-China BEVs ahead of the EU’s proposed higher tariffs, which apply from July 4th 2024. Norway, however, has already made clear that it will not follow the EU in applying such tariffs.

Almost all BEV models in the top 20 saw higher than average volume, thus contributing to the relatively high overall BEV result.

In terms of new BEV model debuts, there was only one, the new Polestar 3. Although we noted the registration of 2 units in May, June saw it step up to a more substantial 15 units.

The Polestar 3 is a premium large SUV (4,900 mm) with a 107 kWh (usable) battery, a WLTP range of 650 km, and 32 minutes DC charging (10% to 80%). It is priced from NOK 725,000 (€63,700) and up. At these prices, it won’t add huge volume to the BEV market, but may prove relatively popular in its segment.

Let’s now check up on the 3 month figures:

Here the Tesla Model Y still leads, although the Volvo EX30 is closing the gap. We will see how close it can get.

Other popular BEV models remain the usual crew of the Volkswagen ID.4, MG4, Tesla Model 3, Toyota BZ4x, and Volkswagen ID.3. This is a return to more normal position for the Volkswagen siblings, which had both had a very quiet Q1 2024.

Most of the top 20 are familiar faces. Although, the MG Marvel R is a long-absent returnee, having been consistently trickling along well outside the top 20 since the beginning of 2023.

There were no other surprise entrants to the top 20. Although, it bears repeating that the Volvo EX30 — in second place — has quickly disrupted the top ranks of the BEV market since its recent launch in January. I’d like to see more such disruption in the months ahead, but there are no obvious candidates, for now at least. Let us know in the comments which models you would bet on as future disruptors.

I made a fleet transition update back in the April report, and should be able to make another one in the next couple of months.

Outlook

Despite decent YoY auto market growth in June, across 2024 H1 as a whole, volume is down by 8% compared to the same period last year. The broader Norwegian economy is still weak, and interest rates remain high at 4.5%. The latest macroeconomic data is from Q1 2024, which saw economic output at negative 0.8% YoY, from +0.3% in Q4 and -2.0% in Q3.

Inflation reduced to 3% in May (latest data), from 3.6% in April. Manufacturing PMI in June fell to 47.7 points, from 52.3 points in May, a dramatic downturn which doesn’t bode well for the near-term macro figures.

I’ll again reiterate the simple and direct statement that the OFV recently made: “People have a more strained economy.… We now show greater moderation and buy smaller and more affordable new cars.… We will probably have to wait until the first interest rate cut before optimism returns to new car buyers” (OFV April statement, machine translated).

What are your thoughts on Norway’s continuing journey towards EV nirvana? Please jump in to the comments below and join the discussion.