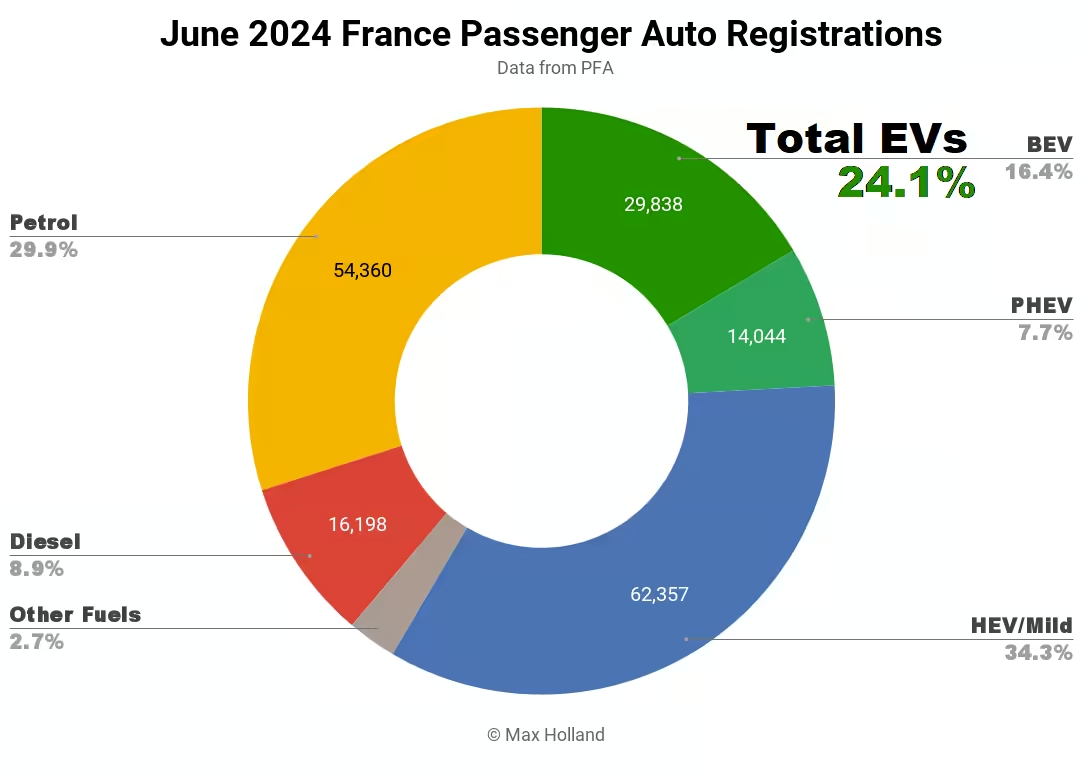

The June auto market saw plugin EVs at 24.1% share in France, down from 26.9% year on year. Volume of both BEVs and PHEVs was down YoY, declining more than the overall market drop. Overall auto volume was 181,711 units, down 4.8% YoY, and far below 2016–2019 seasonal norms (~235,000). The Renault Megane was France’s best selling full electric vehicle in June.

June saw combined EVs at 24.1% share in France, with full battery electrics (BEVs) at 16.4% and plugin hybrids (PHEVs) at 7.7%. These compare with respective YoY figures of 26.9% combined, 17.4% BEV and 9.4% PHEV.

BEV volume dropped by 10.3% YoY, and PHEV volume dropped by almost 22% — both far underperforming the overall market and thus losing market share.

Let’s recap the forces acting on the French plugin market this year. March 15th saw the cancellation of the eco-bonus for BEV models made outside Europe. The models left out in the cold included many of the most popular BEVs: Tesla Model 3, Dacia Spring, Kia Niro, Kia EV6, BYD Atto 3, Volvo EX30, MG4, Ford Mustang Mach-e, Fisker Ocean, Nissan Ariya, Toyota BZ4X, and many others.

The other main influence was the “social leasing” programme, running from January to mid February, which resulted in contracts being signed for up to 50,000 new BEV leases (double the number anticipated). Most of the contracted BEVs were not necessarily delivered “at signing,” but instead several weeks or months later. April 2024, for example, saw a strong bump in BEV registrations (up 44.9% in volume year on year) — almost certainly an effect of deliveries from the social leasing programme.

As time has passed, most of these leased vehicles have now been delivered. Since this was a short-duration “good deal” in terms of consumer value, it effectively pulled-forward BEV sales, and once deliveries from the leasing programme tailed off, there was always going to be a hangover.

The timing of the close-out of the programme (all signed leases fulfilled with vehicles in the hands of customers) is somewhat blurred. Most have now been delivered, but there were reportedly a number of Citroen e-C3 “social leases” signed, which will only get closed out once the model debuts later this year (I estimate a few units in August, expanding from September onwards). Aside from this forthcoming model, the overall market is already in the post-lease hangover phase.

The hangover is exacerbated by cancellation of the eco-bonus for many popular and relatively affordable BEV models. The combined effect of these two influences is reflected in the weak BEV performance in May, and especially now in June. This will almost certainly continue into July and August, and only perhaps begin to return to growth if the new Citroen e-C3 arrives in volume towards the end of this year.

EU Protectionism

Another variable to look out for is the impact of the EU’s proposed trade barriers on Chinese-made BEVs (and additional ~18% to ~38% tariffs on top of the existing 10% EU import tariff). An alternative form of trade barrier was already active in the French BEV market, since the early eco-bonus cancellation for non-Europe-made models had already cut China-made BEV deliveries to a low ebb.

In the short term, the imminent arrival of additional barriers for made-in-China EVs seems to be motivating MG Motors to try to pull forward “last chance” sales of its MG4 before the additional tariffs hit. Tesla seems to be making similar short-term moves with the Model 3.

Beyond just the French market, the EU commission’s proposed higher tariffs — to apply all across the EU economic area — have been called “illegal customs barriers” by chancellor Scholz of Germany. They are illegal under WTO trading rules.

Putting up illegal barriers against affordable BEVs from the world’s highest volume BEV makers in China is not good news for European consumers, nor for the progress of the European EV transition. In the end — because trade barriers shelter the European automakers from the sobering winds of competition — it will mean that European autos become uncompetitive on price (and value) in the much larger global auto market outside Europe. So, ultimately it is not even good news for the long term health of the European auto industry.

Most of the push for these tariffs is coming not from European automakers themselves (most have said they don’t support the tariffs), nor necessarily from European national governments (e.g., Scholz above), and certainly not from European consumers who have long been crying out for affordable BEVs.

So, who exactly is pushing for these tariffs? They are being pursued by EU-commission functionaries (not attached to a particular country), whose ultimate goal seems to be attempting to poison Europe’s trade ties with China (which have existed for well over two thousand years). The negative impact of hurting European consumers, delaying the EV transition, and ultimately weakening European industry appears to be acceptable damage.

Not coincidentally, all this comes within a few weeks of the US political class ramping up the US trade war with China with unprecedented tariffs, and continuously escalating belligerent (and supremacist) rhetoric towards China. Steve Hanley recently quoted from the US Neoconservative think tank CSIS, which has been central in making arguments directed at EU commission policy makers about allegedly “unfair” EV subsidies in China.

What the CSIS don’t publicise is that its board of directors, advisors, and key members include big players in fossil fuels, like Rex Tillerson (former CEO of Exxon), John Hess (Hess Corporation), San Nunn (former chair of Chevron), James L. Jones (Chevron Board), Karen Knutson (VP, Chevron), Kenneth A. Hersh, Ray Hunt, Trevor Rees-Jones, amongst others. Unsurprisingly for a “strategic planning” body, there’s also a revolving door between the CSIS and US weapons manufacturers, and US intelligence agencies, and other “US Primacy” cheerleaders and fellow travellers.

Back at the time of the “WMDs” hoax used by the US and UK to justify the Iraq invasion (2003) — which most European countries were opposed to — CSIS created a report proposing that in the future; “At the ongoing European Convention and at the upcoming Intergovernmental Conference, for appropriate issues and at appropriate levels, U.S. representatives should have the opportunity to observe [EU] proceedings and debates … both houses of the U.S. Congress should increase their contacts with the European Parliament at all levels, including members and their relevant staffs. … The issue is not one of U.S. membership in the European Union or any of its distinctive institutional bodies, but one of association, dialogue, and cooperation before decisions are reached.” (Source: CSIS “Renewing the Transatlantic Partnership” 2003, emphasis mine).

Note that, far beyond just “observing,” the goal of having “association, dialogue, and cooperation before decisions are reached” actually means direct US influence on EU foreign policy.

Just to be clear, and unsurprisingly, nowhere did the CSIS propose a reciprocal arrangement, whereby European politicians would be invited to US policy-making bodies for “association, dialogue, and cooperation before decisions are reached.” It is clear which side the CSIS consider to be the master in this relationship. So much for pretending to promote equality, sovereignty, and democracy.

Returning to June’s market data, whilst BEV and PHEV performance was weak, HEVs hit a record high share of 34.3%. This meant that combined traditional ICE-only powertrains hit their lowest ever share, with just 38.8% of the auto market. Petrol-only vehicles were a standout, hitting a record low share of 29.9%.

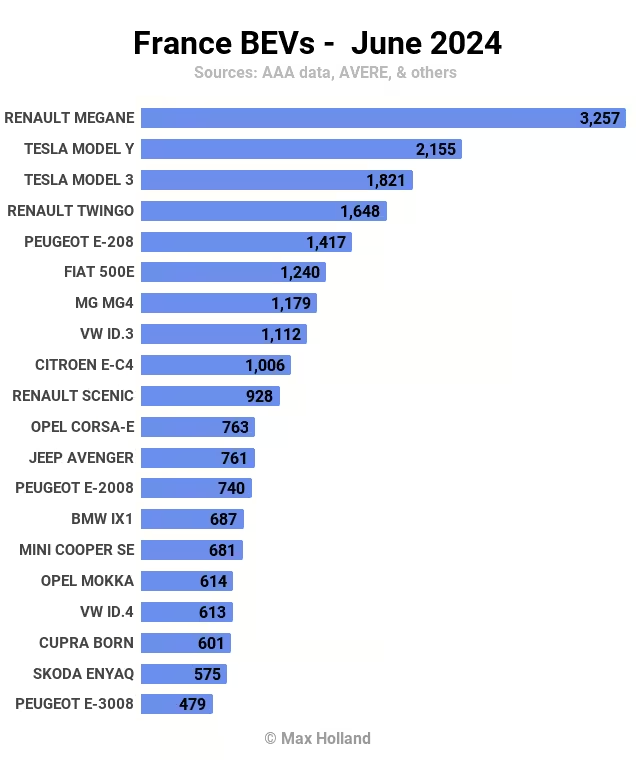

Best selling BEVs

The Renault Megane took the top spot in June, with 3,257 units delivered. This is only the second time the Megane has taken the lead, the first being almost two years ago in July 2022 (1,937 units back then). Year to date, it has more typically been in around 5th position.

In second place was the Tesla Model Y, with 2,155 units, ahead of its sibling the Model 3, with 1,821 units.

Year to date, the Megane has more typically been in 5th position, with volume of around 1,600 per month. Stepping up to 3,257 units is a big departure.

As noted in the above discussion regarding the MG4 making a last chance pull-forward, the same appears to be happening for the Tesla Model 3. Although the new-and-additional tariffs on Tesla’s Shanghai vehicles are not yet decided (likely to end up close to the 18% proposed for BYD), they are lower than those on MG (close to 38%). Still, in both cases, coming on top of being shut out of the eco-bonus, the new tariffs will severely erode (or turn negative) any remaining profit margin when selling these vehicles into the French market.

Dacia, on the other hand, has already given up on last-chance sales of the Spring — formerly a frequent best selling BEV in France — which was down to just 40 units in June.

We don’t have enough depth of sales data to detect new models debuting onto the French market. Keep an eye out for the other European reports to see what’s arriving in neighbouring countries.

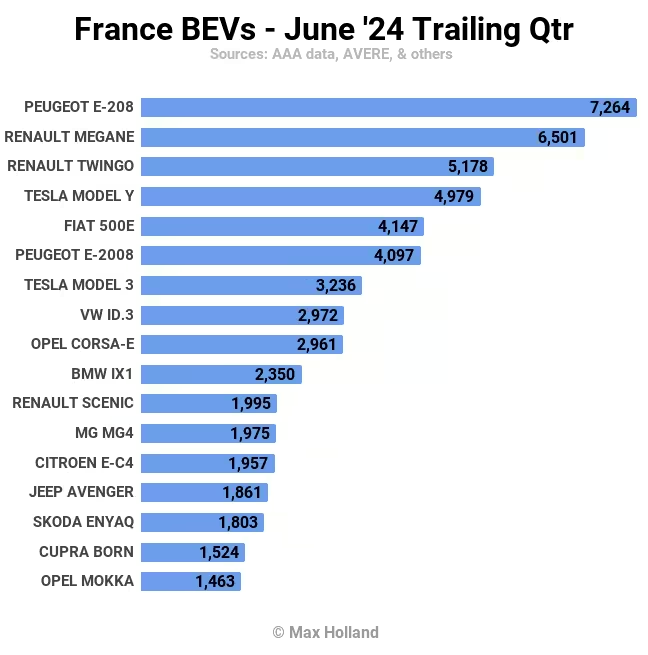

Let’s check the trailing 3-month picture:

Here, too, non-European made models have fallen away, leaving local BEVs to take the upper rankings. 6 months ago, the top 4 were the Tesla Model 3, Model Y, Dacia Spring, and MG4. Now only the Model Y is still in the top 4, with the others rapidly falling away, and the Dacia Spring already far outside the top 20. The Spring — the most affordable BEV in Europe — only sold 75 units over the past three months, compared to 8,658 in Q4 2023!

The Tesla Model 3 and MG4 are still present in the top 20 due to the last chance pull-forward already discussed. This will soon end, and we can expect to see them quickly fall in rank, perhaps outside the top 20, over the coming months.

Outlook

Beyond the 4.8% YoY drop in auto market volume, France’s broader economy saw 1.1% YoY growth in Q1 2024 (no newer data yet). This is better than the Euro-area average of 0.4% in Q1, and healthier than countries like Germany (-0.2%), the Netherlands (-0.7%), and Norway (-0.8%).

Inflation was 2.1% in June, down from 2.2% in May. Interest rates remained at 4.25%. Manufacturing PMI worsened to 45.4 points, from 46.3 points in May.

The various French and EU policies discussed above mean that the progress of BEVs in the French auto market is likely to reverse (in YoY terms) in the coming few months. The arrival of the Citroen e-C3 in Q3 or Q4 (and subsequent pricing response by rivals) may halt the decline towards the end of the year, depending on how quickly production ramps up.

What are your thoughts on France’s auto policies and the EV transition? Please share your insights in the discussion below. If you are going to weigh in on the geopolitics, for transparency, perhaps mention your location and whether you are a supporter of the west’s “hegemony” as Boris Johnson recently called it.