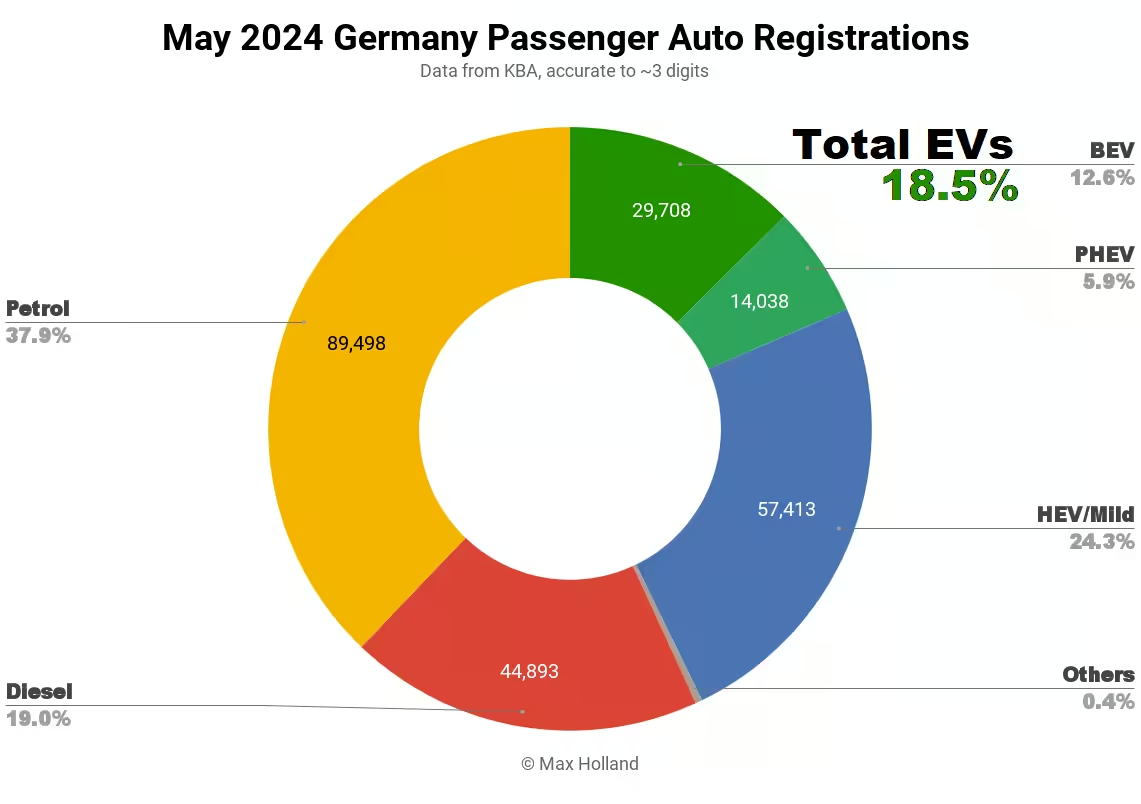

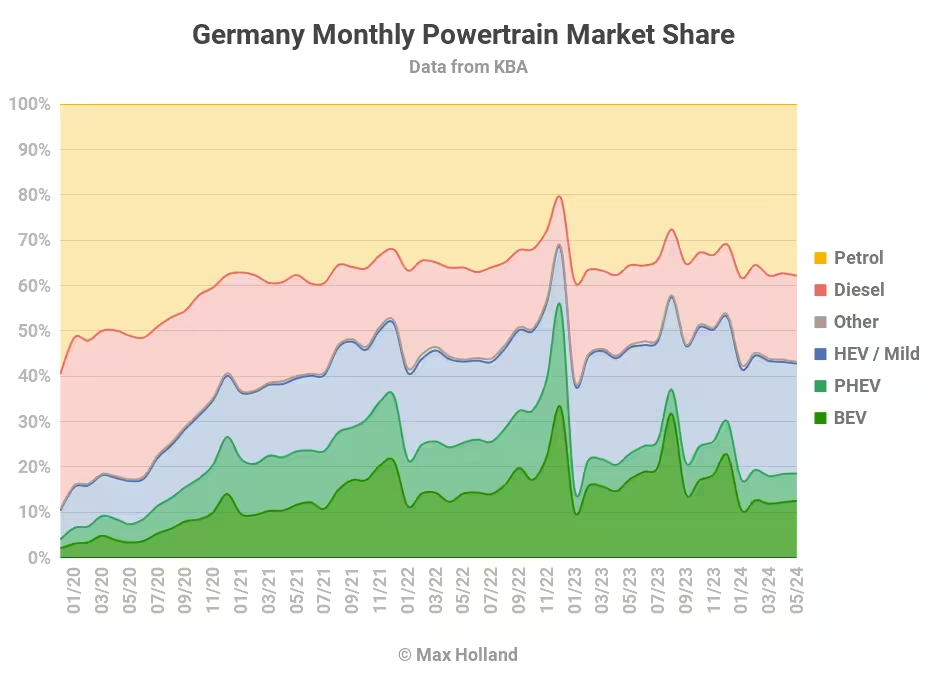

May saw plugin EVs at 18.5% share in Germany, down from 22.9% in May 2023, in a continuing hangover from the unexpected incentive abandonment in late December. BEVs were down some 31% in YoY volume, while PHEVs were up 2%. Overall auto volume was 236,413 units, down 4% YoY, and down 27% from 2017–2019 seasonal norms (~325,000 units). The best selling BEV in May was the Volkswagen ID.3.

May’s sales figures saw combined EVs at 18.5% share, with full electrics (BEVs) at 12.6% and plugin hybrids (PHEVs) at 5.9% share. These compare with YoY figures of 22.9% combined, with 17.3% BEV and 5.6% PHEV.

The fallout from the abrupt cancellation of BEV incentives in mid December continues. Relative to prices before the cancellation, BEVs are more expensive now, and are perceived as more expensive, since the change is firmly within memory. The idea of paying more for the same thing is obviously holding people back. If BEVs were roughly price competitive with other powertrains, folks might be prepared to swallow a modest bump in BEV prices, but that’s not the case.

The Fiat 500 BEV (€34,990) is over twice the price of the combustion mild-hybrid version — a price premium of €17,500! Given that EV battery cells are now priced at €49 per kWh, a 42 kWh battery pack need cost no more than €2,700. The remainder of the BEV powertrain (motors, power electronics, etc.) should cost less still (so, under €5,400 in sum). Then there’s the saving of around ~€2,000 on the foregone ICE powertrain. The cost premium of the BEV variant over the mild-hybrid should thus be less than €3,400. Why is Stellantis charging €17,500 more for the BEV? #FootDragging.

Germany’s economic situation is not helping either, with formal recession present in Q1 and Q4 prior. Folks tend to avoid purchase options perceived as expensive during a recession — and most BEVs are perceived as expensive.

All of these factors are combining to put a squeeze on BEV purchases, relative to other powertrains, and thus we are seeing BEV volume drops, and loss of share, this year. Year to date 2024, cumulative BEV share now stands at 12%. At this point in 2023, it stood at 15.0%. That’s a YoY shrinking in BEV share of 20%, in Europe’s largest auto market — not good news for the transition in Europe.

Meanwhile, China’s BEV share has grown to 26% (latest data until April YTD), from 23% year on year. If we include EREVs and PHEVs, China’s YTD plugin share (to April) is 40%, whereas Germany’s is just 18%.

May saw combustion-only powertrains in Germany increasing their share YoY. Diesel-only increased to 19.0% share (from 17.6% YoY). Petrol-only increased to 37.9% (from 35.5%).

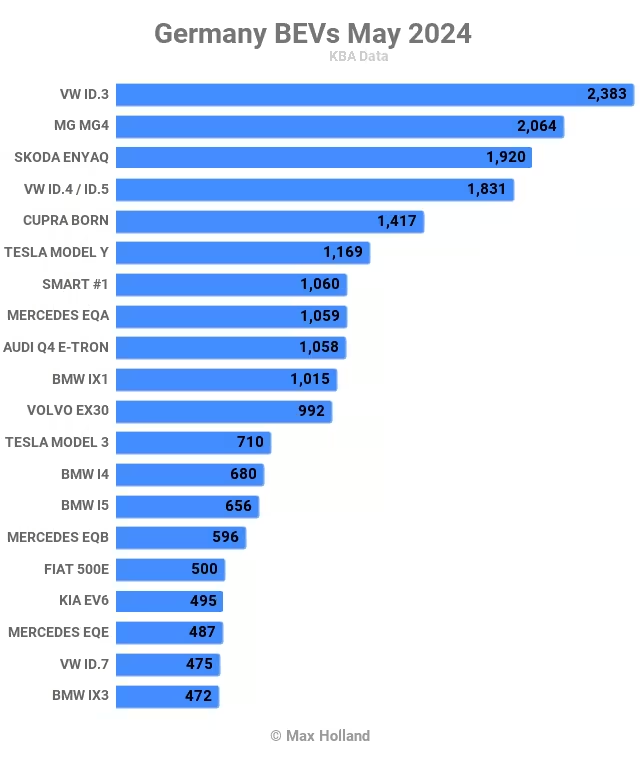

Best Selling BEV Models

The best selling BEV model in May was the Volkswagen ID.3, with 2,383 units. This is the first time the ID.3 has taken the top spot since August 2021. Welcome back.

In second place was the MG4, with 2,064 units. The Skoda Enyaq took 3rd, with 1,920 units.

The MG4’s second place finish repeats its previous best ranking from February, but with a personal best volume — up 120% YoY. Although mid-month of quarter is the typical MG4 shipping peak into Germany, some of the volume is also likely diverted from the French market, where popular non-European models like the MG4 have recently lost access to the eco-bonus.

I don’t have any explanation for the ID.3’s rare push to the top spot, except perhaps that it is more affordable than most other MEB vehicles, so the recession may be giving it (relative) favour. Its May volume of 2,383 units is 9% up YoY. The ID.4/ID.5 volume (1,831 units) was less than half that of a year ago (3,720 units). Supporting this “choose the cheaper MEB” hypothesis is the fact that the Cupra Born was also up in volume, by 28% YoY, and the Audi Q4 e-tron was down by 36% YoY.

The Smart #1 also did relatively well in 7th, a personal best rank, up from 10th in April. Its sibling, the Volvo EX30, is also now stable in or near the top 10, at 11th in May.

As for new arrivals on the German market, May saw five debutants. The new Peugeot 3008 saw its first deliveries, 67 units. See the Sweden report for more details on this new model (on a new platform).

Next up was the new BYD Seal U, an SUV brother to the Seal sedan. It saw an initial 31 deliveries in May. This is a Tesla Model Y competitor, but priced a bit lower, from €42,000 vs. €45,000 for the Tesla. More details are in the Sweden report.

At the same price as the Seal U, a sleek new sedan from GWM Ora has arrived (10 initial units), called the ORA 07, with a shape reminiscent of a Porsche Panamera. These 10 units may be dealer samples for now — we will keep an eye on it.

Finally, the Mercedes-Benz G-Wagon BEV saw 6 initial units registered in May. Marketed as the “Mercedes G 580 EQ,” this is an expensive retrofit of the classic G-Wagon boxy SUV shape which has been around since the 1970s. Priced from €143,000 in Germany, this new electric variant won’t move the needle on BEV volumes, and hasn’t usurped the petrol and diesel variants — though, may displace some of their sales.

Xpeng registered 5 units of the P7 sedan in May (see Maarten’s review for more about this model). The P7 has been around at modest volumes in Europe for a couple of years already — these 5 units may be an initial testing of the waters in the important German market. We will keep an eye on it.

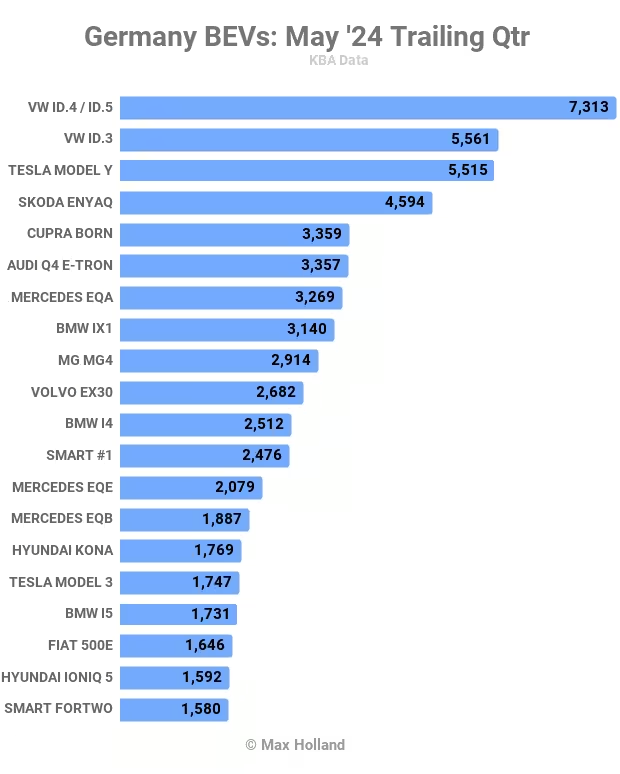

Let’s see what’s happening in the longer term rankings:

The Volkswagen ID.4/ID.5 is in the lead, a good improvement from the third position it took in the prior 3-month period (December to February). This model has barely been out of the monthly top three in more than a year.

Thanks to strong performance in May and April, the VW ID.3 has climbed to second place, from 10th place prior. Its volume has climbed 88% over the period.

Meanwhile, the Tesla Model Y has fallen to 3rd place, from 1st in the prior period, with volume falling by 48%. Let’s see how much ground it will recover in the end-of-quarter push in June.

The biggest climber in the top 20 chart is the Volvo EX30, which — after debuting back in December — has arrived in 10th place, from 29th in the prior period. There is every chance that the young Volvo can climb another couple of spots over the coming months.

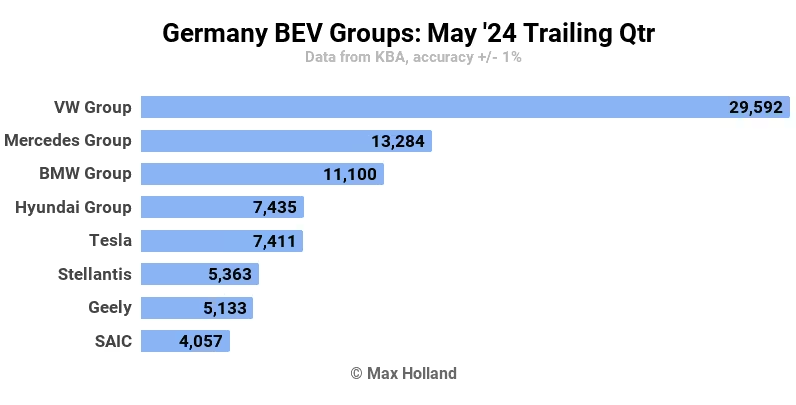

Let’s quickly look at the manufacturing group rankings:

Here Volkswagen Group is obviously still holding its ground, and share has actually increased to 33% of the BEV market, from 27% prior (December to February).

Mercedes Group has climbed strongly over the period, increasing share from 11% to 14.8%. Its close rival, BMW Group, dropped a spot to 3rd, and lost share from 14.6% to 12.4%.

Tesla lost share from 12.7% to 8.3%, dropping from 3rd to 5th. Stellantis lost share from 11.8% to 6.0%, falling from 4th to 6th. Thanks in part to the success of the Volvo EX30, Geely has now increased share from 3.5% to 5.7%, and climbed from 9th to 7th, overtaking SAIC, whose share remained flat.

Outlook

The 4% decline in auto sales year on year is in keeping with the broader economic climate in Germany, with Q1 data showing negative 0.2% economic growth year on year, from a Q4 figure also of -0.2%.

Inflation has crept back up to 2.4% in May, from 2.2% in April. ECB interest rates fell to 4.25% in early June, from 4.5% prior. Manufacturing PMI improved to 45.4 points in May, from 42.5 points in April.

Higher inflation is not going to help consumer pocketbooks. I’ll repost the statement that was made last month by the auto industry association VDIK: “the decline in fully electric vehicles that has been observed since the beginning of the year is becoming more pronounced. The BEV segment is currently suffering a crisis of confidence, which was primarily caused by the decision to abolish the electric bonus at short notice.” [Machine translation.]

As discussed above, I would add high BEV prices, and the weak economy, to the list of negative influences.

What are your thoughts on Germany’s auto market and the transition to EVs? Please jump into the comments section below and join the discussion.