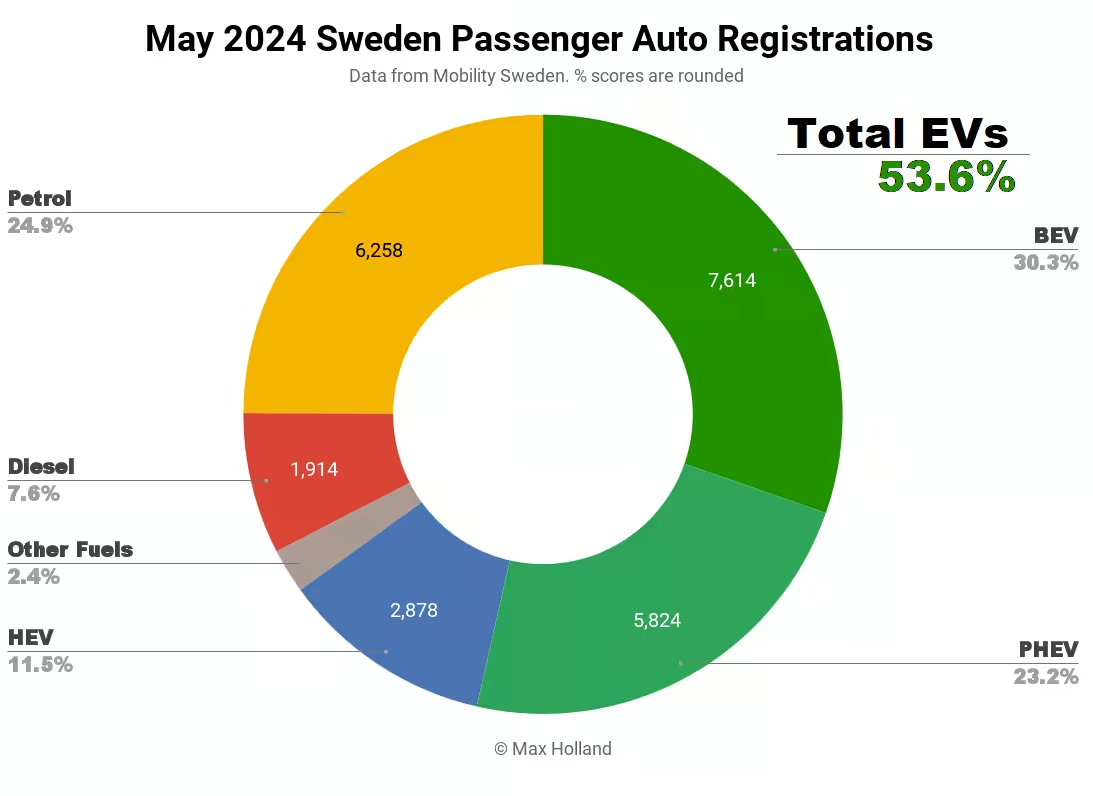

May’s auto sales saw plugin EVs at 53.6% share in Sweden, down YoY from 61.9%. Plugin volumes were down YoY by 24%, with BEV faring worse than PHEVs. Overall auto volume was 25,094 units, down 12% YoY. The Tesla Model Y was May’s bestselling BEV.

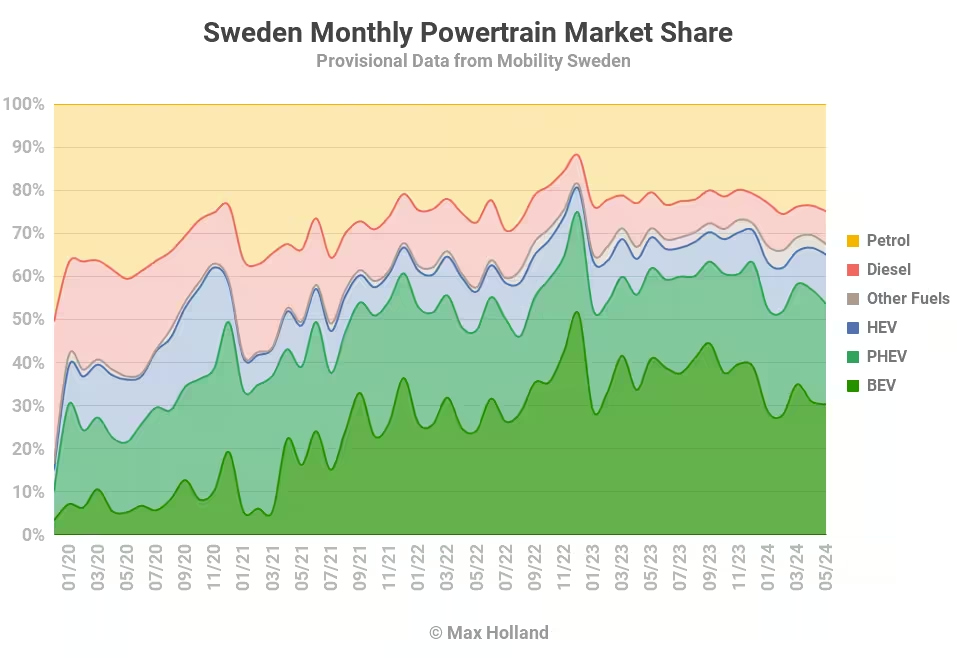

May saw combined EVs at 53.6% share in Sweden, with full battery-electrics (BEVs) at 30.3% and plugin hybrids (PHEVs) at 23.2%. These figures are down YoY, with 61.9% combined in May 2023 — 40.9% BEV and 21.0% PHEV.

BEVs in the high-volume vehicle segments are still greatly overpriced in Sweden relative to ICE peers (with, e.g., the Peugeot 208 BEV being over twice the price of its ICE version). These BEVs are thus especially vulnerable to budget cutting as belts tighten during the prolonged economic squeeze the country is experiencing.

BEVs’ YoY volume comparison is also not helped by the absence of purchase incentives in 2024, in contrast to their availability (though already dwindling) a year ago.

Because of all these factors, we see BEV volumes down in volume 35% YoY, to 7,614 units in May. This was the main contributor to the overall auto market’s 12% YoY drop.

PHEVs are doing better, roughly flat in YoY volume. This is still relatively weak compared to petrol and HEV, which both saw volumes grow YoY!

Diesel continued to lose share, with 7.6%, from 8.2% YoY, and just 606 units registered.

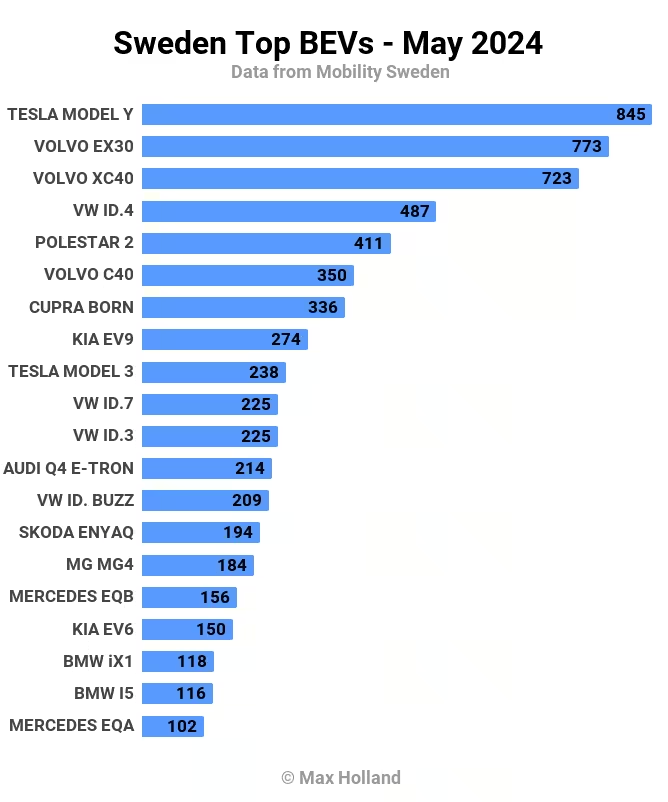

Best Selling BEVs

The long-term favourite, the Tesla Model Y, was back to the top spot again in May, with 845 units sold. It displaced last month’s winner, the Volvo EX30, back down to second place, with 773 units. In third spot was the older sibling, the Volvo XC40, with 723 units.

Those top three were head and shoulders in front of the other models.

There were no great surprises in the top 20. Though, note the BMW i5 has entered for the first time, outselling its smaller sibling, the BMW i4, in May. This is a temporary effect of batch shipping, rather than an indicator of fundamental demand differences. Year to date, the i4 is ranked 16th, while the i5 is ranked 28th — still impressive for an expensive large sedan.

Debutants

May saw a few new BEV models making their debut on the Swedish market. The highest volume of them was the Renault Scenic, with its first customer deliveries, 58 units. The Scenic shares a platform with its already established BEV sibling, the Renault Megane (and the Nissan Ariya). The Scenic has a compact SUV/CUV shape, with length of 4470 mm (about 10 cm longer than the Megane).

It is priced from 465,000 SEK (€40,850), only 3% more than the Renault Megane. Though, this may be temporary promotional pricing. The base Scenic has a 60 kWh usable battery with 430 km rated range (WLTP) and 35 minute charging 10–80%.

Another debutant was the Peugeot e-3008, which saw 38 units in May. This is the first Stellantis BEV to employ the new dedicated EV underpinnings, the “STLA Medium” platform. This platform will be used by other upcoming BEVs, like the Peugeot e-5008, Opel Grandland, Citroen C5, and Jeep Compass.

The e-3008 is a different, and larger, vehicle from Stellantis’ first generation BEVs, which are built on the much older “multi powertrain” PSA EMP2 platform. Those include the Peugeot e-208, e-2008, e-308, Citroen e-C4, Opel Astra, and others, with batteries topping out at 55 kWh (gross). The new platform allows the e-3008 to come with batteries of between 77 kWh and 103 kWh (gross).

The Peugeot e-3008 is an SUV, with a length of 4,542 mm, a good bit longer than the 4,367 e-308 hatchback. The base e-3008 is priced from 600,000 SEK (€52,700), though temporary promotional pricing shaves about 6.5% off. It has a battery of 73 kWh usable, with 510 km (WLTP) of range, and can recharge 10% to 80% in 36 minutes. Being more expensive than the base Tesla Model Y, it is hard to see the Peugeot selling at volume unless it is heavily discounted.

Another debutant that competes in a similar class is the new BYD Seal U, which saw 26 registrations in May. This is an SUV with length of 4,785 mm, so is close to the Tesla Model Y in size and a step bigger than the Renault Scenic and Peugeot e-3008.

The base Seal U has a price of 524,900 SEK (€46,000), though has a launch promotion price 5% lower. The base variant comes with a 71.8 kWh (usable) LFP Blade battery, with 420 km (WLTP) of range and 42 minute charging 10% to 80%. At this size and price point, the Seal U is competitive. Let’s see how it gets on.

Let’s now turn to the 3 month rankings:

Here, the top 3 models are the same as in the monthly chart, but the Tesla Model Y’s lead is more substantial. This is the second month that the Volvo EX30 has been in the #2 spot, from 3rd in March.

Is there any prospect of the EX30 displacing the Tesla to become the long term leader? Not at current monthly volumes, which are vectoring towards an average of around 800–900 per month based on recent trends. The Tesla is almost able to match that in its “quiet” months, but often sees volumes of 2000+ units in the last month of each quarter.

The EX30 could perhaps adjust pricing in the future to win more volume, but I would guess that the company is happy with European volumes for now.

It’s interesting to see both the Kia EV9 and the Volkswagen ID.Buzz closely competing for 11th place. Both are large vehicles, but the EV9 already comes in a 7 seat option, whereas the ID.Buzz is still waiting for that configuration to launch in Sweden. Perhaps when that one arrives, the Buzz may overtake the EV9?

Outlook

Beyond the 12% year on year drop in auto volume, Sweden’s economic trajectory improved from its previous negative trends. The Q1 2024 figure was revised from a provisional calculation of negative 1.1% (which I reported on in last month’s report), to now being recalculated at positive 0.7%. This major revision of Q1 into positive territory rescues the economy from being negative in four consecutive quarters.

The inflation rate moderated to 3.9% in April (latest data), from 4.1% in March. Interest rates finally reduced to 3.75% in early May, having been flat at 4% for the previous seven months. Manufacturing PMI improved to 54 points in May, from 51.9 in April.

The industry association, Mobility Sweden, notes that BEV registrations are still predominantly supported by business buyers. Although, presumably, this includes fleets and leasing companies whose leasees are, in turn, private consumers in some cases. The association is still lobbying the government to reintroduce some incentives to push the BEV market back into a growth trajectory.

What are your thoughts on Sweden’s EV transition? Is it likely to return to positive growth rates anytime soon? Please jump in to the comments section and join the discussion.