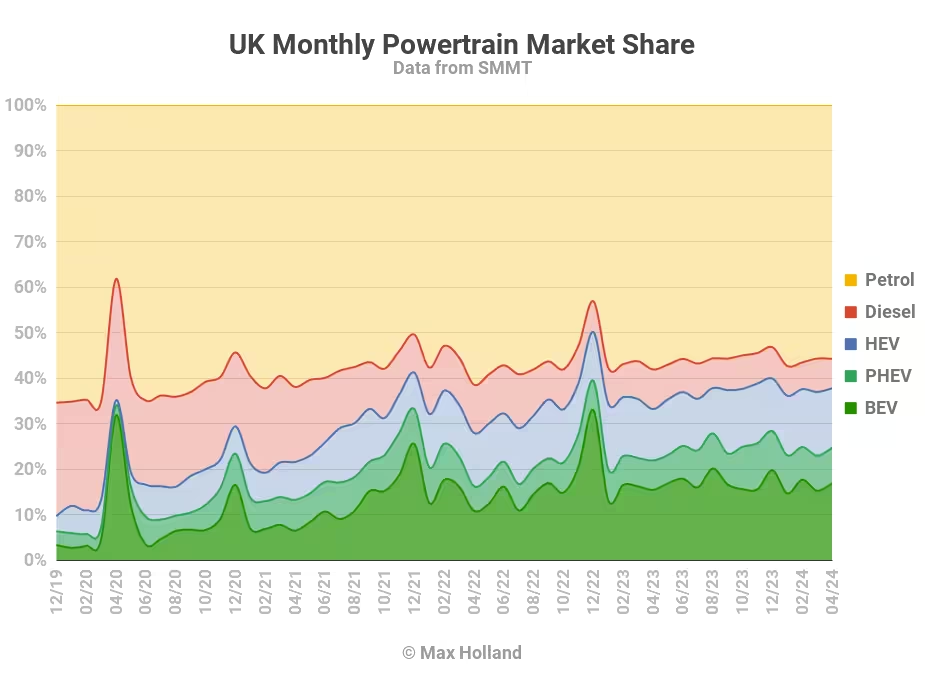

April’s auto market saw plugin EVs take a 24.7% share in the UK, up from 21.9%, year on year. Volume growth was modest for battery-electric vehicles, and decent for plugin hybrid EVs. Overall auto volume was 134,274 units, up just 1% YoY, and remaining far below pre-2020 norms. The UK’s leading battery-electric vehicle brand in April was BMW.

April’s sales saw combined plugin EVs take 24.7% share in the UK, with full electrics (BEVs) taking 16.9%, and plugin hybrids (PHEVs) taking 7.8%. These build on shares a year ago of 21.9% combined, with 15.4% BEV and 6.5% PHEV.

In terms of actual volumes, BEV numbers increased by a modest 10.7% YoY, to 22,717 units. PHEVs saw more rapid volume growth of 22.1% YoY, to 10,493 units.

April was in line with lackluster BEV YoY volume growth so far in 2024, which stands at 10.6%. This is far below the average rate of 83% volume growth across 2021, and 40% across 2022. The growth slowdown had already begun in 2023, with a full year volume increase of 17.8%. More on the unimpressive rate of UK EV growth in the sections below.

Meanwhile HEV sales in April saw a medium volume growth of 16.7% YoY, better than BEV, but not as strong as PHEV. Diesel share (including MHEV) fell 25% YoY to 8,649 units. Petrol share (including MHEV) fell by 3% to 74,877 units.

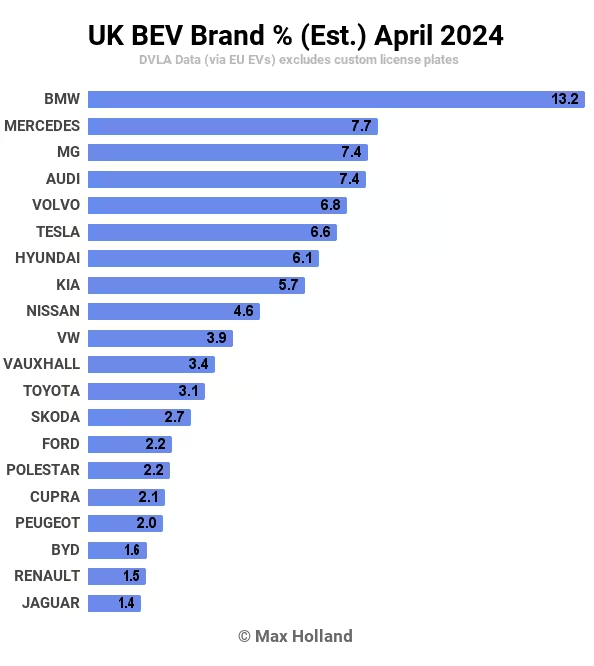

Bestselling BEV Brands

The bestselling BEV brand in the UK in April was BMW, with 13.2% of the UK BEV market, reclaiming the lead it last held in January. BMW has a strong lead over others, with ranks two, three, and four, closely competed with by Mercedes, MG, and Audi.

BMW’s top selling BEV was the BMW i4, which sold over 1500 units in April, well ahead of the BMW iX1 at around 450 units.

Volvo is slowly climbing the ranks, thanks to strong sales of the new EX30, which sold around 700 units in the month.

In terms of new models, the Mini Countryman appears to have debuted in April, with just over 50 units. Let’s see how popular it becomes in the brand’s home market. The Smart #3 debuted in March with about 10 units, and stepped up to 18 units in April.

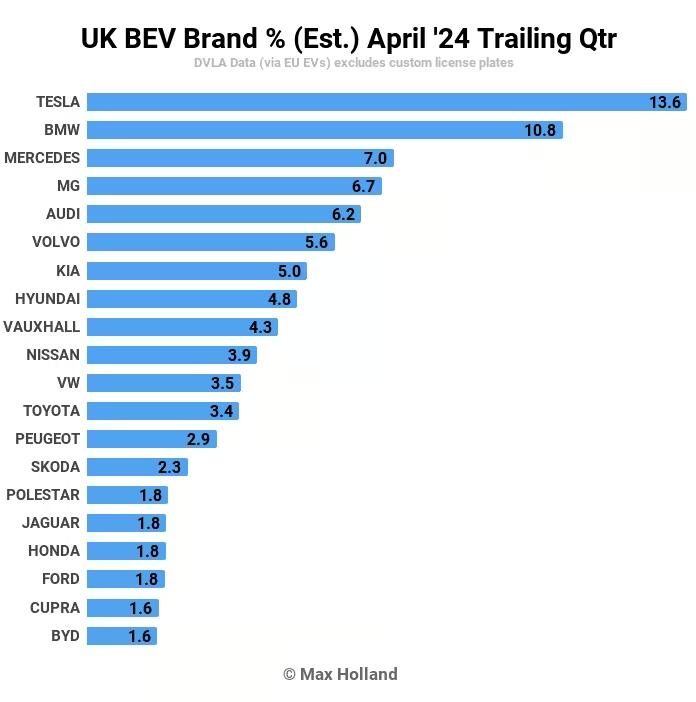

Let’s now check up on the trailing 3-month rankings:

Tesla still has a decent lead over second place BMW, which itself is a long way ahead of Mercedes in third. Tesla and BMW have swapped places since the prior period (November to January).

Audi fell two spots, landing in 5th. It was overtaken by both Mercedes and MG. Volkswagen brand fell 5 places, from 6th to 11th.

Both Porsche and Mini had big falls, from 12th to 25th (Porsche), and from 11th to 29th (Mini). The reason is the same in both cases — their existing models are about to be (or are in the process of being) replaced by significantly technologically-updated models. Once the production of these new models has ramped up, these brands will likely recover their prior ranks.

Leaders & Laggards

As mentioned in the market trends discussion at the top of this report, the overall EV sales figures in 2024 are still “positive” YoY, in the sense of slowly growing volumes by 10.6% (while combustion-only powertrains are losing volumes). But, let’s be honest, the UK’s rate of transition to BEV (like other large European markets and the US and Japan), has become noticeably unimpressive, compared to what we saw in 2021 and 2022.

With battery packs now priced at under $70 per kWh, there is no reason why BEVs in most segments are not competing on sticker price with ICE peers by now, everywhere in the world, as they are doing in China.

Between 2019 and 2020, Europe’s transition pace (with combined EV share going from 3.6% to 11% ) out-accelerated and overtook China (which went from 5.5% to 6.3% share). Europe stayed ahead in 2021 (19% share vs China’s 15% share). But since then, China has continued growing at high speeds with 30% in 2022 and 37% in 2023. Europe, including the UK, has meanwhile moved into the slow lane. 2022 saw Europe at 23% combined share, and 2023 came in at 24% — barely growing at all!

The Chinese auto market is now (during H1 2024) trending to pass a 50% combined plugin share, having grown EV sales at the expected rate. What rate is that? That’s the typical “technology adoption curve” rate that comes with investment in the future, scale-up, learning feedback loops, and cost improvements. These positively-reinforcing factors have historically always accompanied new technology adoption, be that the technology of first early 20th century autos, or refrigerators, TVs, or smartphones.

In the case of the UK’s EV adoption, some auto brands are contributing much more than others. Several auto brands that sell at strong overall auto volume in the UK only have a very weak percentage of BEVs in their total sales.

The biggest BEV laggards visible in the April data are (with % figures approximate); Land Rover at 0% BEV, Suzuki also at 0%, Honda at 3%, Ford 7%, Fiat 7%, Mazda 7%, Volkswagen 7%, Renault 9%, Peugeot 11%, Toyota 11%, Skoda 12%, Mini 12%, and Citroen 15%. It’s a sad state of affairs when the Volkswagen brand is doing worse than the infamous laggard Toyota!

All other major brands (in order of %; Kia, Audi, Vauxhall, Nissan, Hyundai, Mercedes) are at least slightly ahead of the market average BEV share (Kia), or decently ahead (Mercedes).

Stand-out performers are MG at 34% BEV, Volvo at 36%, and BMW at 38%. Tesla, Polestar, BYD, Smart, and Ora, only sell BEVs, in the UK market.

What’s the takeaway here? The laggards are all legacy European, Japanese, or US manufacturers. Meanwhile, remember when Janet Yellen — who frequently claims to be concerned about climate change — recently went to China and had the arrogance to lecture her hosts that China is “overcapacity” in EV production? Now many legacy media are parroting that absurdly upside-down narrative like an obedient choir. “Overcapacity in CleanTech” is like griping about “too many firefighters at a blazing inferno.”

Doing significantly better than the UK market’s “biggest BEV laggards” mentioned above are the Korean brands, along with a very few others. The Korean marques, despite also coming from ICE roots, are now taking the EV transition seriously – and good on them for doing so.

The leading EV brands enabling the transition in the UK are Tesla, Euro-Chinese co-operations (MG, Volvo, Polestar, Smart), Chinese brands (BYD, Ora amongst others), and one legacy “late-starter but now doing well” — BMW. These are all dastardly “overcapacity” troublemakers. Damn them!

Outlook

Beyond the flat YoY auto market, the UK economy remains in recession as of latest data (Q4 2023). Inflation stands at 3.2%, and the interest rate is 5.25%. After a brief up-tick in March, manufacturing PMI turned negative once more in April, at 49.1 points.

The UK’s auto industry lobby, the SMMT, says that “the latest market outlook shows a diminishing share for BEVs despite a growing overall new car market… BEV volumes for this year have been revised downwards by -5.2%, with anticipated market share now 19.8%, significantly below the government target of 22% per manufacturer under the Vehicle Emissions Trading Scheme.”

What are your thoughts on the UK’s pace of EV transition? Please join in the conversation below.