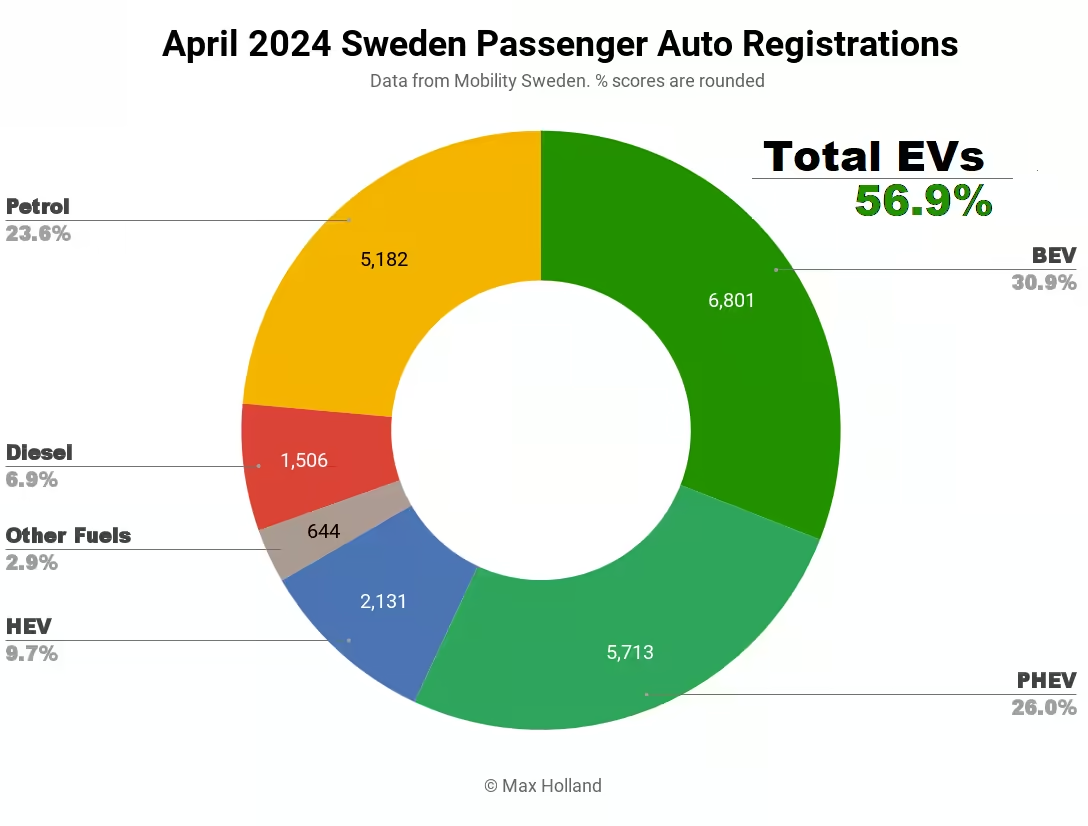

April saw plugin EVs take a 56.9% share in Sweden, up modestly YoY from 55.7%. The BEV share fell slightly YoY, while PHEV share climbed higher. Overall auto volume was 21,977 units, up some 7% YoY. The new Volvo EX30 was March’s bestselling BEV, its first time in the top spot.

April’s result saw plugin EVs take 56.9% share in Sweden, with full battery-electrics (BEVs) at 30.9%, and plugin hybrids (PHEVs) at 26.0%. These shares compare YoY against 55.7% combined, with 33.7% BEV and 22.1% PHEV in April 2023.

Looking at volumes, BEVs were some 2% down YoY against a growing overall market, thus the fall in market share. PHEVs, however, were up in volume by some 26% YoY, far more than the overall market average, and thus took a strong 26% share. How strong? This is the highest share for PHEVs in over two years.

PHEVs’ relative strength is keeping plugin share afloat so far this year, as BEVs have actually lost volume YoY. Year to date, BEVs have sold 25,265 units, down 15.3% from 29,832 units by this point in 2023.

Although the overall market is also down, BEVs are underperforming. Their cumulative share so far in 2024 is 30.9%, down from 35.6% at the same point in 2023. PHEVs have taken up the slack, such that combined plugin share year to date is 55.2%, only modestly down from 56.3%, a year ago.

Why are BEVs performing so poorly? It’s a combination of incentives now being absent (whereas they were still in effect, to the tune of around €4000, a year ago), the consumer economy being weak, and most importantly, many BEVs remaining absurdly overpriced relative to ICE peers.

The best examples of overpriced BEVs are the Stellantis models, with the Peugeot e-208 having an MSRP of SEK 489,900 (€42,470) — over €21,500 more than its ICE-powered version. Since the net BEV battery and powertrain manufacturing cost premium is now at most €5,000 compared to the ICE version, this massive price premium is completely unjustified (for more on BEV component costs, see last month’s report). Stellantis’ overpricing is deliberate, they simply don’t want to sell BEVs in Sweden right now.

In April last year, the combined sales of the BEV versions of Stellantis passenger cars — the Fiat 500, Opel Mokka, Opel Corsa, Citroen C4, Peugeot 208, and Peugeot 2008 — amounted to 188 units. Modest, but at least present. In April 2024? A grand total of 2 (yes, two) units.

Was this a shipping anomaly that just affected April 2024? Hardly — their combined passenger BEV sales over the last 3 months have amounted to an almost equally dismal 33 units, from 958 units over the same period of 2023.

Perhaps the reason is that Stellantis is simply pulling out of Sweden altogether? No. The combined sales of Stellantis non-BEV passenger cars in April 2024 was over 1,200 units, increased from around 1,100 in April 2023. So they have grown their sales of non-BEVs, at the same time as smothering their sales in BEVs. Thanks Stellantis!

Whilst Stellantis is the worst offender, Renault and Nissan have likewise dropped their BEV volumes YoY, by over 90% for Renault and over 75% for Nissan.

Most other brands and manufacturing groups have seen YoY BEV sales shrinking more modestly, in line with the average 15.3% drop in BEVs year to date, suggesting that the more general pressures are at play — the consumer economy squeeze, and incentive-cuts. Tesla volumes are almost unchanged YoY.

Geely (Volvo, Polestar, Smart, Lotus) is one of the few manufacturing groups with growing BEV volumes, seeing nearly 80% more sales in April 2024 (1,946 units) compared to April 2023 (1,093). Fitting then that the new Volvo EX30 is the best seller.

In a bit of positive news, diesel-only share was down YoY to 6.9% in April 2024, from 10.1% in April 2023.

Best Selling BEVs

Having launched only in December, the new Volvo EX30 has had an impressive ascent, and is now at the top of the charts, having sold 698 units in April.

In second place, the long term favorite Tesla Model Y sold 625 units. The Volvo XC40 rounded out the top 3, with 536 units.

The top 20 saw mostly minor shufflings in rank. A few models saw decent gains compared to the previous month, including the Volkswagen ID.3, Kia EV6, MG4, and BMW iX1. The Skoda Enyaq, Tesla Model 3, and Honda e:Ny1 dropped rank from their positions in March.

There were a couple of notable BEV debuts in April. The Polestar 4, a CUV coupe with a length of 4,839 mm, launched with 23 registrations. Though slightly larger, this potentially competes with the Tesla Model Y, Sweden’s bestselling BEV over the past year.

The Polestar 4 is priced from SEK 700,000 (€60,000), which is substantially more than the entry Tesla Model Y (SEK 574,170). Vehicles at these price points have already mostly transitioned to BEV, so this isn’t going to move the needle on the rate of EV transition in Sweden.

The other notable debut was the new Mini Countryman BEV, with 16 sales. The Mini Countryman is a compact crossover, with length of 4,433 mm (close to that of the Kia Niro), and a bit longer than the Volvo EX30 (4,233 mm).

Unlike the previous Mini Cooper electric, this one has a decent sized battery of 64.7 kWh (usable), with 30 minutes charging, and can thus tackle longer journeys and potentially serve as an only vehicle for many folks. It is priced from SEK 489,400 (€42,000), which undercuts the Niro by about 10%, so may sell reasonably well.

There were also some initial registrations for the Smart #1 and Smart #3, although at just 7 units each, these may still be dealer samples for now. We will look at these again when they step up to higher volumes.

The new Polestar 3, which saw just 9 units in March, has now stepped up to customer volumes, with 30 units in April. This is a large SUV, with length of 4,900 mm, just slightly shorter than the Volvo XC90 and its BEV twin, the EX90. It is higher riding and less “coupe” shaped than the Polestar 4 discussed above. It is priced from SEK 960,000 (€82,500), so won’t move the needle on BEV volumes.

Let’s now turn to the 3-month performance:

Although it was overtaken on April sales, the Tesla Model Y is still very dominant in the longer term chart, with more volume than the next two models combined.

The Volvo EX30 has now overtaken its older brother, the XC40, and grabbed second place. Three months ago, it wasn’t in the top 20.

Another notable climber is the Cupra Born, which is now in 7th spot, a big step up from 25th in the prior period. It’s not clear why Volkswagen Group are pushing sales of the Born in Sweden while the volumes of the Volkswagen-branded ID vehicles have generally fallen back over recent months. Please jump in to the comments if you have thoughts on this.

Outlook

The 7% annual growth of the auto market was a highlight against the backdrop of a broader economy which is continuing along in negative territory. We now have the GDP figures from Q1 2024, which show a negative 1.1% contraction YoY. Sweden has thus spent the past year in continuous recession. The inflation rate has lowered, at 4.1% in March (latest data), from 4.5% in February. Interest rates have remained at 4% since September. Manufacturing PMI, however, remained mildly positive, with 51.4 points in April, from 50.4 points in March.

Mobility Sweden’s chief economist, Sofia Linder, said “We see a cautious optimism in the market, driven by the expected interest rate cuts which can give new impetus to car sales. However, it is clear that policy instruments are needed to stimulate the private market for electric cars, where companies still account for three quarters of new registrations.”

One suggestion of Mobility Sweden is to remove VAT on electricity rates at public chargers.

My suggestion is to implement a ZEV mandate (like that newly implemented in the UK) to ensure a floor of BEV sales for the large auto manufacturers. This is the only way to prevent the intentional laggards like Stellantis from deliberately smothering their own BEVs sales (via blatantly overpricing them), while continuing to increase their ICE sales.