If you ever had the suspicion that there are BEVs that international automakers sell in China but don’t want to offer to those of us in other markets, well … you were right.

China is currently the epicentre of the global EV revolution, representing 60% of the world’s plugin vehicle sales in 2023.

It’s also by far the most price-competitive plugin vehicle market, with BEVs, PHEVs, and EREVs (BEVs with a range-extender generator) already competing on price with traditional combustion vehicles across most segments of the auto market.

Plugins are even overtaking sales of combustion-only vehicles in the most affordable segments — those segments with price points under 80,000 RMB (under €10,500 or $11,250). I recently covered some examples of great BEVs in these affordable segments.

In short, not only is the Chinese auto market by far the world’s largest, but it is also one of the most advanced in the EV transition. International automakers thus have no choice but to offer BEVs if they want to stay relevant in this crucial market. That’s the case even for auto brands which are dragging their feet on offering BEVs elsewhere in the world.

For example, Honda is planning to offer compelling new BEVs “in China, for China”, even whilst the company has a reputation as a notable laggard in the global EV transition, with meagre BEV offerings in the rest of the world’s auto markets.

In this article, we’re going to look at the many BEVs that international automakers already sell in China but don’t want to offer to consumers in other markets. Some of these may start to be offered in China’s neighbouring regions, but ironically, not in the automakers’ own home markets.

Some of these may surprise you.

Buick (General Motors)

Did you know that General Motors already makes and sells Buick BEVs?

The Buick Velite 6, at 4,673 mm (184 inches) long, is roughly the size of the Tesla Model 3, and comes with over 200 miles (320 km) of range from a 50 kWh LFP battery. Its MSRP is 112,800 RMB, which is under $16,000 (under €15,000)!

These Buick BEVs are not just some fly-by-night GM concepts, or marketing experiments. The Buick Velite 6 has been on sale for over a year already, and it currently sells close to 10,000 units per month!

The Buick Velite 6 recharges from 30% to 80% in 30 minutes, so is capable of longer journeys if required.

The interior is fairly modern looking, and well appointed:

What’s that, you say? 50 kWh is not enough for you? How about the Buick Electra E4, which is a bit bigger (4,818 mm or 190 inches), with battery options from 65 kWh to 80 kWh and real-world range of close to 300 miles (500 km):

The Electra E4 sells for an MSRP from 159,000 RMB (€21,000 or $22,400). It has been on sale since July 2023, and like its smaller sibling, it too has a pretty nice interior:

If that’s still not big enough, there’s the Buick Electra E5, on sale since June 2023, which is a few inches longer and with a more boxy rear, starting from 169,900 RMB (€22,333 or $23,800):

If, on the other hand, you want something much, much, smaller, remember that General Motors is one of the owners of the SGMW Wuling brand, which dominates the sub-compact BEV market in China, with the likes of the Wuling Mini. The Mini starts from an MSRP of 32,800 RMB (€4,330 or $4,620).

Still small, though more suitable for all-around tasks (including occasional highway trips), is the newer Wuling Bingo, which is 3,950 mm long (156 inches), with a battery up to 37.9 kWh and an MSRP from 88,800 RMB (€11,700 or $12,500):

Stepping up in size to something “compact” rather than “small” is the Wuling Baojun Cloud, at 4,265 mm (168 inches) in length, close to the size of the 1st-gen Hyundai Kona. The Cloud has battery options up to 50.6 kWh, capable of 200+ miles of real-world range, for an MSRP of 115,800 RMB (€15,300 or $16,300):

Finally, if you like GM but want a more premium feel, you can always go for the Cadillac Lyriq (from $41,900) or Optiq (now launching in China, no pricing info yet). Although, these Cadillac models aren’t exclusive to the China market.

A quick note on Ford. The company does sell the Mustang Mach-e BEV in China, at a volume of around 100 units per month. It also offers its electric Transit van (starting from October 2023). Although, this hasn’t seen any traction so far, in terms of sales. In 2020, Ford launched an electric version of its Territory compact SUV, but it never really got much interest and has sold just 2 units in 2024.

Japanese Brands: Honda, Toyota, Nissan

Moving on from the US brands, how about BEVs from Japanese brands? It’s true that many of the Japanese brands have been slow walking the EV transition (despite Nissan being an early pioneer). But since China is the world’s largest auto market and the transition is already well advanced, they have to get on with making and selling BEVs in order to stay relevant. As a result, there are indeed several BEVs that Japanese automakers sell in China but not elsewhere.

As mentioned earlier, Honda plans to launch 3 new BEVs in China (and only in China) in the coming year or so. Like several other Japanese brands, Honda has a reputation for dragging its feet on BEVs, still focused on traditional hybrids whilst dreaming of a (now fast evaporating) future of hydrogen fuel cell vehicles.

Honda has been selling the e:Ny1 in China, as it has been doing in other markets, although the vehicle is renamed the “e:Ns1” in China. It sells for an MSRP starting from 175,000 RMB (€23,100 or $24,650).

Exclusive to China, however, is the already selling Honda M-NV, a compact SUV (4,324 mm or 170 inches) — again, similar in size to the 1st-gen Kona. The M-NV has a 61.3 kWh battery, good for 250+ miles of real-world range, for an MSRP of 149,800 RMB (€19,800 or $21,100):

The Honda M-NV can recharge from 30% to 80% in 30 minutes, so is suitable for occasional longer journeys. It has been on sale in its current form since September 2023.

The interior is fairly elegant, if simple:

Toyota is famously hostile to BEVs, having been stuck in a decades-long accumulating sunk-cost fallacy regarding hydrogen fuel-cell vehicles. Only recently has Toyota started to acknowledge that the EV transition is happening despite its dogmatic resistance, and has (reluctantly) made moves to try to catch up.

In mid 2022, Toyota started selling its first serial production BEV, the bZ4X SUV, in several regions globally. The model is also sold in China (from the end of 2022). With a length of 4,690 mm (184.6 inches), and a base battery option of 50.3 kWh, the bZX4 has a starting MSRP of 199,800 RMB (€26,300 or $28,000).

In the Chinese market, however, there is another Toyota BEV on sale, this one a sedan, and less expensive than the bZ4X. With customer deliveries starting in April 2023, the Toyota bZ3 sedan has an entry 50 kWh battery option for an MSRP of 169,800 (€22,400 or $23,900), and a larger 65.3 kWh option for 189,800 RMB (€25,000 or $26,700). The bZ3 is a bit longer than the bZ4X, at 4,725 mm (186 inches).

Interestingly, the bZ3 sedan far outsells the bZ4x SUV in the Chinese market. March saw it shifting almost 4,300 units, compared to just 23 units for the SUV.

Here’s a side by side comparison of the Toyota BEV siblings:

The interior of the bZ3 looks decent:

If the Toyota brand isn’t fancy enough for you, Lexus also sells the RZ in China. Though, this one is of course also sold in global markets.

Rounding out the Japanese brands, Nissan also offers many more BEVs in China than it does in other auto markets. Nissan does sell the international model, the Ariya SUV, in China, though not the LEAF. The Ariya starts from 199,900 RMB (€26,400 or $28,150) for the entry 65 kWh battery, and 224,900 RMB (€29,700 or $31,700) for the larger 90 kWh battery. The Ariya sells in the low hundreds of units per month in China.

Besides the Ariya, however, Nissan also sells a sedan and two other SUVs in the Chinese market. Nissan’s Venucia D60 EV sedan is 4,774 mm long (188 inches) and has a base battery of 47 kWh, starting from 139,800 RMB (€18,500 or $19,700).

Over the past year, the Venucia D60 EV has sold around 2,000 units per month, and is about to be refreshed. The interior does now look a little bit dated:

There’s also a smaller SUV than the Nissan Ariya, the Venucia T60 EV. This has a length of 4,415 mm (174 inches), fractionally longer than the current generation Kia Niro. It is currently offered in a single variant, with a battery of 60.7 kWh and an MSRP of 189,800 RMB (€25,000 or $26,700).

The T60 EV has only been selling around 100 units per month, perhaps because the pricing is too high relative to competitors.

If, on the other hand, you are looking for something slightly larger than the Ariya, there is Nissan’s recently launched Venucia VX6, which measures 4,658 mm (183 inches). This comes with a 62 kWh battery, with an MSRP from 169,800 RMB (€22,400 or $23,900).

Due to the more competitive pricing, this one already outsells its older, smaller sibling, the Venucia T60 EV. The VX6 sold almost a thousand units in the month of December. In contrast to its more traditionally furnished siblings, the VX6 has a somewhat minimalist interior:

How about other Japanese brands? Mazda offered its first BEV, the underwhelming MX-30, for sale in some global markets in late 2020, years behind most legacy auto brands.

In the case of Mazda, consumers outside China are not in fact missing out. As in the rest of the world, the Mazda MX-30 is still the only Mazda BEV on sale in China, although it is simply called the CX-30 EV here (an arguably more honest name).

Subaru doesn’t do much business in China, only selling 268 passenger vehicles in March. No BEV is offered. Mitsubishi is in a similar position, with only 86 cars sold in China in March, and no BEV.

Suzuki has not operated in China since 2018. Daihatsu stopped operating in China even earlier, in 2009. The latest to fall by the wayside is Mitsubishi, which stopped making cars in China in March 2023, and confirmed their withdrawal from the market in September.

The existence of BEVs exclusive to the China market doesn’t end with US and Japanese brands. There are several BEVs that European automakers sell in China which aren’t available in their home markets. Kia doesn’t (yet?) have BEVs exclusive to the Chinese market, but does offer models in China and in Korea long before they are offered in other auto markets.

To reiterate the context that we mentioned before, “not only is the Chinese auto market by far the world’s largest, but it is also one of the most advanced in the EV transition. International automakers thus have no choice but to offer BEVs if they want to stay relevant in this crucial market. That’s the case even for auto brands which are dragging their feet on offering BEVs elsewhere in the world.”

Some European brands are already offering a decent selection of BEV models in their home region, but are also selling BEVs which are exclusive to the Chinese market. We are going to look at Volkswagen, Audi, BMW, and Renault.

Volkswagen Group, Including Audi

The Volkswagen ID.4 was the world’s 9th bestselling BEV in 2023, with close to 200,000 units sold. So of course the ID.4 is VW’s lead seller in the Chinese market as well as elsewhere. Even though it is not a China-exclusive model, let’s set the price context for the China-only models in this report by having a quick look at how the ID.4 is positioned in the Chinese market.

Two versions of the ID.4 are sold in China, reflecting VW’s local partnerships with both FAW and with SAIC. The former partnership produces a version called the ID.4 Crozz, and the latter partnership produces the ID.4 X. You would be hard-pressed to tell them apart at a glance, though the ID.4 X has a different shaped front bumper giving it 20mm (< 1 inch) extra length.

The starting MSRP for both variants is around 195,000 RMB (€25,300 or $26,900) for the base battery (around 55 kWh). The FAW “Crozz” version actually has a fractionally larger base battery and a fractionally lower starting price, which may be why it has sold more, close to 4,000 units per month, over the past year. The SAIC “X” version has been selling at close to 2,500 per month.

As well as the other international BEVs, the ID.3, and the more recent ID.7, the Chinese market also gets a 3-row seat ID model not sold elsewhere. This is the ID.6, and again comes in “Crozz” (FAW) and “X” (SAIC) variants, which are virtually indistinguishable:

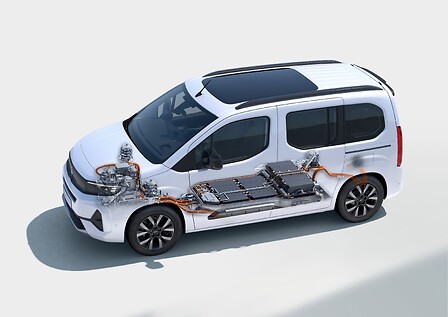

The ID.6 started customer deliveries from mid-2021 onward. Like most Volkswagen BEVs, the ID.6 is built on the MEB platform, although here the wheelbase is stretched 200 mm (8 inches) longer than in the ID.4. The overall vehicle length is around 300 mm (12 inches) longer for a total length of 4,891 mm (193 inches). The added length accommodates a modest third row of seats in the rear, mainly suitable for kids or teenagers.

Here’s the layout of the seating (this image is actually of the very similar Audi version, which we will discuss later):

The interior cabin design aesthetic of the ID.6 is closely in line with VW’s other ID. models:

The pricing of the ID.6 is a step up from the smaller ID.4, and starts from 258,900 RMB (€33,600 or $35,700) for the entry 63 kWh battery option. This makes the MSRP around 33% more than the ID.4. In busy months, the combined ID.6 X and Crozz sell well over a thousand units.

One could argue that, since the Chinese market doesn’t get allocated the ID.Buzz, the provision of an alternative BEV with three rows of seats makes sense. However, Volkswagen no doubt figures that the ID.Buzz might struggle to sell well in China (there was no hippie VW bus phenomenon in the 1960s to fondly reminisce about). In fact, given China’s automotive history, the ID. Buzz is more likely to be perceived as a strange, overpriced, commercial vehicle. See this piece on the history of “bread loaf vehicles” (面包车) to understand why.

Conversely, the same kind of marketing risk would not be a factor were the ID.6 to be offered in Europe (or other markets). Larger families in Europe and other markets would no doubt love to have such a 3-row SUV available (for a digestible 33% premium over the ID.4’s local pricing), and not have to opt for the ID.Buzz just to get three rows (which is 60% more expensive than the ID.4, in e.g. Germany).

Talking about premium pricing, staying within the Volkswagen Group, there is a China-exclusive Audi version of the ID.6, called the Q5 e-tron.

The Audi Q5 e-tron is basically the same shape, size, and wheelbase as the VW ID.6, and launched in late 2021 a few months after the VW version. The Q5 e-tron only comes with a 83.4 kWh battery, however, and has a higher starting MSRP of 298,500 RMB (€38,700 or $41,200).

The Audi’s interior is a bit more traditional, and well furnished, compared to the ID.6:

Interestingly, while we saw above that the ID.7 is 33% more expensive than the ID.4, that’s not the case for the Q5 e-tron compared to the Q4 e-tron (the ID.4’s equivalent). With the larger Audi, the price premium is only 3% more than the Q4 e-tron (which has an MSRP of 289,900 RMB).

As you might imagine, the Audi Q5 e-tron sells fairly well in the Chinese market, in some months even outselling the combined ID.7 models. Would the Audi Q5 e-tron — offering 7 seats with a premium interior — sell well back in Audi’s home region of Europe, if it was priced only 3% above the smaller Q4 e-tron? No prizes for the correct answer!

This is not the end of the story for Audi’s exclusive BEVs in China. While the smallest BEV the company offers in most of the world is the Audi Q4 e-tron, it also sells a much smaller BEV in the Chinese market — the Audi Q2L e-tron. How much smaller? The Q2L is 4,268 mm (168 inches) in length, which is over a foot shorter than the Q4 e-tron’s 4,590mm (181 inches), and almost exactly the length as the VW ID.3.

Rather than being built on the MEB platform, however, the Q2L e-tron, which dates from late 2019, shares a platform with the 7th generation VW Golf, the VW T-Roc, and the Audi A3 (3rd gen). The Q2L e-tron has a modest 44 kWh battery, for around 200 miles of range, and has an MSRP of 243,800 RMB (€31,550 or $33,600). The market price is much lower, however, with deals under 17,000 RMB (€22,400 or $23,500).

As with other Audi BEVs, the interior is fairly traditionally furnished, and looks premium:

In a fast moving market, since the little Audi is now approaching 5 years old, its sales have been fading, with just a few dozen units per month over the past year or so.

Before we leave behind Volkswagen Group, via the relationship with FAW and the Volkswagen Anhui company, the group has another brand in China called Sehol, which also offers BEVs.

I covered the Sehol E10X “Flower Fairy” small hatchback in a previous report. The E10X is a competitor in the Dacia Spring’s class, and has a 30.2 kWh battery for an MSRP of 71,900 RMB, (€9,304 or $9,920). It has been recently selling around 400 units per month.

There’s also a Sehol Sedan BEV, the Sehol E50A. This has a length of 4,770mm (188 inches), about the same as the Tesla Model 3. The E50A has a 50 kWh battery for a 200+ mile range and can charge 30% to 80% in 36 minutes, so can make the occasional longer journey. It has an MSRP from 152,900 RMB (€19,800 or $21,100):

The Sehol E50A has been on sale since mid 2020, though it has had a styling refresh since then. The interior of the E50A is fairly minimalist:

Recently the Sehol E50A has been selling around 250 units per month. This is not too bad for an older model, but is about 10x less than the leaders in this BEV size-and-price segment, the GAC Aion S Plus (sedan), and the BYD Song Plus (SUV), which slightly undercut it on price while offering significantly larger batteries.

Are there any other German brands that offer China-exclusive BEVs?

BMW offers the BMW i3 BEV in China. Sounds familiar? But this is not the same BMW i3 as sold in the rest of the world:

This BMW i3 has been on sale in China since mid 2022 and is based on the 3 series sedan platform. It has a length of 4,872 mm (192 inches), slightly longer than the Tesla Model 3. There is a 70 kWh battery option, good for around 300 miles of range, which has an MSRP of 353,900 RMB (€45,600 or $48,800). Deals can be found for a lot lower however, with a market price from around 200,000 RMB (€25,800 or $27,600).

The BMW i3 sedan is popular, typically selling close to 6,000 units per month. The interior has the premium styling that folks expect from a BMW:

Let’s now leave the German brands behind, and move on to the French brand Renault. As part of its JMEV venture (with JMC), Renault sells a BEV sedan in China, the Renault JMEV Yi, with length of 4,675mm (184 inches).

The Yi has several battery options, with a base 60 kWh version with 240+ miles of range having a starting MSRP of 145,800 RMB (€18,900 or $20,100).

The interior of the Yi is more modern and more premium than Volkswagen Group’s older Sehol E50A that we discussed above. It has a wide dashboard infotainment screen at a good height, as well as physical controls for HVAC.

The Renault JMEV Yi went on sale in late 2021, and has been selling a couple of hundred monthly units recently.

Renault did try to bring the Yi to Europe in small numbers in early 2023, positioning it only as a commercially leased vehicle (“Mobilize Limo“) targeting taxi drivers and similar “ride-hailing professionals,” as they put it.

This didn’t work out too well, mostly because the monthly leasing cost of the car to the ride-hailing service drivers was — somewhat inexplicably — reported to be up to €1,499 per month on a 36-month contract! In other words, Renault was trying to charge in one year of leasing in Europe, the equivalent of almost the entire MSRP retail price of the car in China, and then keep the contract spinning at that rate for another 2 years!

If you ever needed a clear illustration of the extent to which some legacy automakers are trying to extort extract excess profits out of car buyers in Europe and other regions, well, there it is. Thanks Renault!

Renault JMEV also participates in the small urban-focused BEV segment in China, with the Little Kirin. This is a 3,500mm (138 inch) hatchback, roughly the size of the first generation Honda Civic, or first generation Ford Fiesta – so certainly a small car, but not quite as small as microcars like the Wuling Mini (3,064 mm).

The Kirin is a simple and inexpensive urban or local-duty car with a small battery (16 kWh) and no DC fast charging, so is not suitable for longer journeys. With 80 miles of range at urban speeds, however, it can easily handle local commutes and urban errands, and the price is right, with MSRP from 49,900 RMB (€6,400 or $6,900). The Kirin sells over 500 units per month in China.

For more context, the Kirin has a significantly lower MSRP in China than the Citroen Ami microcar’s price in Europe (€7,990), despite the Kirin having over twice the range, over twice the top speed, and twice the number of seats. The Kirin also has actual interior furnishings, air conditioning, an infotainment system, as well as a driver’s binnacle display, and — you know — windows that actually wind down.

The more expensive Citroen Ami has none of these things, and yet still sells hundreds of units per month in Europe.

Rounding Up

Some people claim that vehicle safety standards are much higher in Europe than in China, and this explains the much higher cost of autos. This claim does not really hold water, as many of the new Chinese brands actually excel in Euro NCAP safety tests. In fact, some European industry analysts expect Chinese automakers to move ahead of European peers in certain safety tests by 2026, mainly thanks to a faster roll-out of smart communication-alert safety systems.

So why aren’t these reasonably priced BEVs sold in China by European automakers also available in Europe? In short, unlike in China, where margins are tight, there are frequent price wars going between brands to win customers, and BEVs are already competitive on price with combustion vehicles — Europe does not have genuine price competition for BEVs.

In my last Norway market report, I quoted from a recent JATO study regarding the uncompetitive pricing of BEVs in Europe across 2022:

“[European prices] continue to rise… To buy an EV, consumers would need to spend at least €18,285 in Europe and €24,400/$26,500 in the US. This is 92% and 146% more expensive than what they would pay for the cheapest combustion car available, respectively … largely due to the industry’s continued focus on premium EVs ahead of more widely affordable mid-range [vehicles] … many Western carmakers increased their prices while consumers were made to wait longer for new vehicles. For many OEMs this strategy paid off. In 2022, most of these companies reported fewer units sold, but higher revenue and record profits.” (JATO’s “EV Price Gap” report, October 2023, my emphasis.)

To me, this constellation of factors strongly suggests collusion between European auto manufacturers on pricing. The fact that most European carmakers increased their prices, effectively simultaneously, suggests to me a potentially coordinated effort, rather than independent market strategies.

The European auto industry’s continued focus on premium EVs, and an almost complete lack of budget options (even though battery prices, at $55/kWh, are now low enough to allow that, and BEVs can already outcompete ICE in China), to me could indicate a shared strategy to maintain high prices. Especially in the context of most European auto companies reporting record profits in 2022, even while selling fewer units.

Finally we have the European politicians recently planning to take protectionist measures and seeking justifications to restrict actual competition on affordable BEVs in Europe, from manufacturers in China — even though those BEVs may be made in China by international car makers. In the context of everything else in the JATO study quoted above, this suggests to me collusion between politicians and a united industry that doesn’t want to disrupt its excess profits with actual competitively priced products from outside.

The irony of course is that protectionism for already mature industry players just means they become even less competitive in international markets over time. And of course, local consumers in the home market suffer from uncompetitive pricing, and — in this case — the European EV transition has slowed to a crawl, and is even going backwards in some large markets.

T&E recently made a similar argument that overpriced BEVs are slowing the transition, but the T&E stance is less critical in tone, since the organization runs policy campaigns, and the folks there sometimes have to mingle with policymakers.

So yes, we have learned that there are indeed BEVs that international automakers sell in China, but don’t want to offer to those of us in other markets.

What are your thoughts about this situation? Please join in the discussion below.