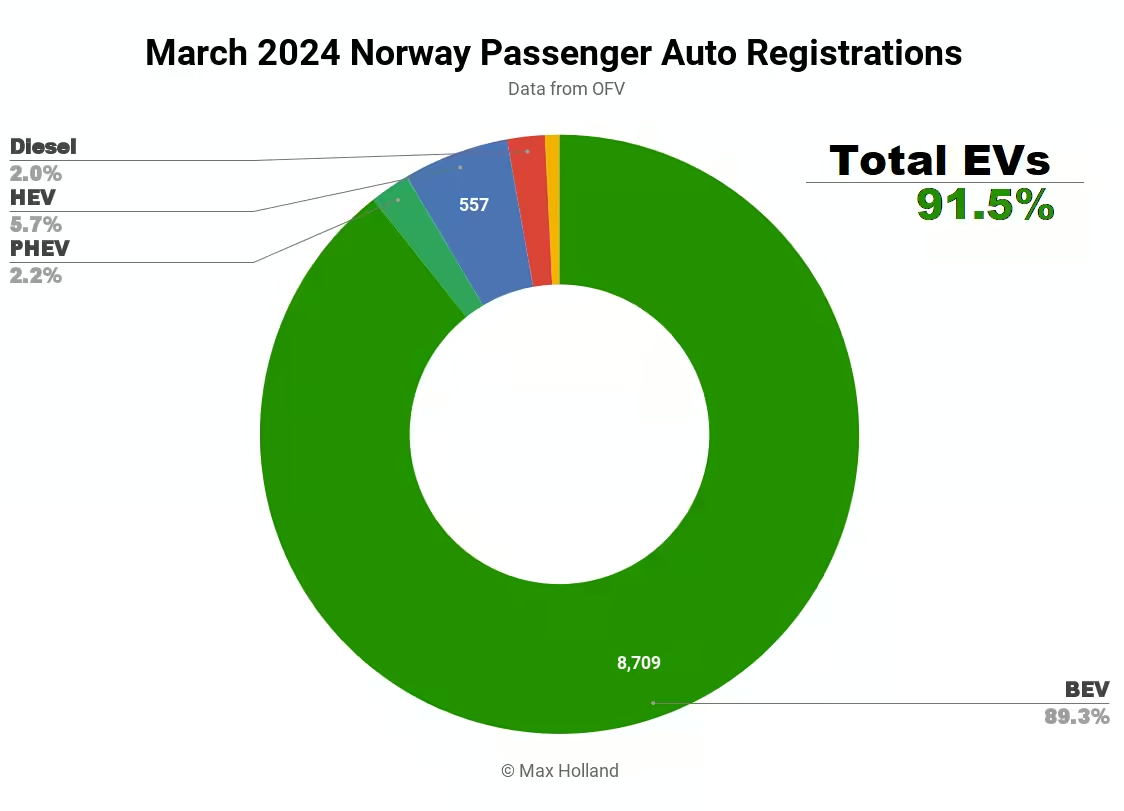

March’s auto market saw plugin EVs take 91.5% share in Norway, up from 91.1% year on year. BEVs alone took almost 90% share. Overall auto volume was 9,750 units, 50% down YoY, and the lowest March in 15 years. The Tesla Model Y was again Norway’s best selling vehicle.

March saw combined EVs take 91.5% share in Norway, comprising 89.3% full electrics (BEVs) and 2.2% plugin hybrids (PHEVs). These compare with YoY figures of 91.1% combined, 86.8% BEV and 4.3% PHEV.

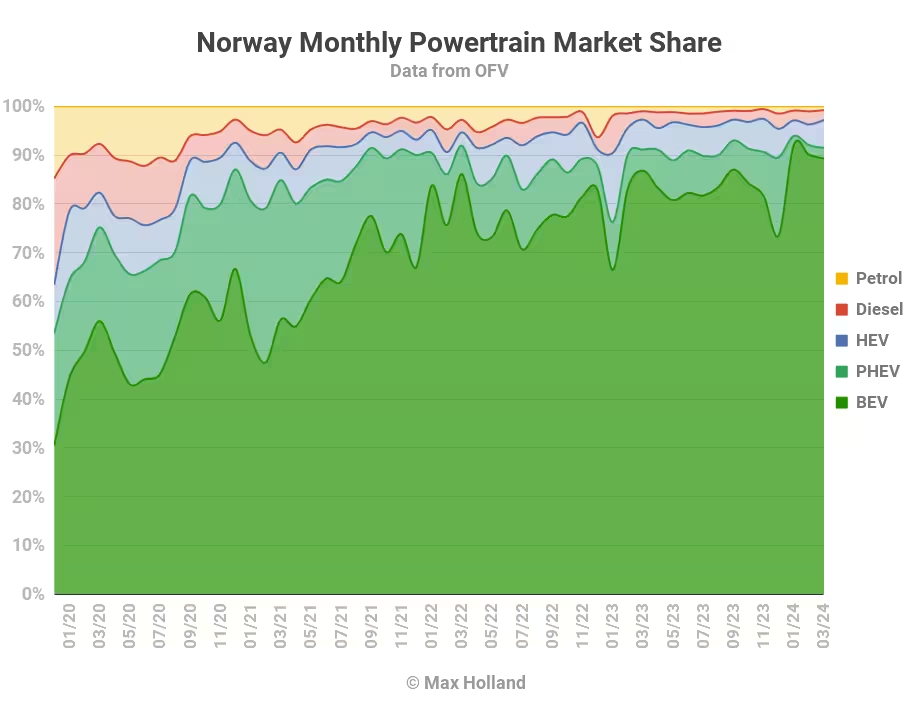

The balance of powertrains is still in a hangover from policy changes that came into effect on January 1, designed to push buyers from PHEVs to BEVs. PHEV sales, averaging 7% share over most of 2023, surged to 16% share in December 2023, ahead of the policy change. Since January, their share has been in hangover, registering 2% share across Q1 2024.

BEV share has, meanwhile, increased to fill the gap, from 83% share over most of 2023 to 90.2% in Q1 2024. PHEV share will recover slightly in the months ahead, but not to prior levels, since the policy is designed to disincentivize them relative to BEVs.

Other powertrain shares are largely unchanged YoY.

In terms of volumes, most powertrains roughly halved YoY, proportionate to the halving of the overall market. PHEVs were an outlier, falling to 25% of their YoY volume.

The overall fall in market volume likely reflects continuing weakness in the broader economy, with both consumer confidence and business confidence strongly negative.

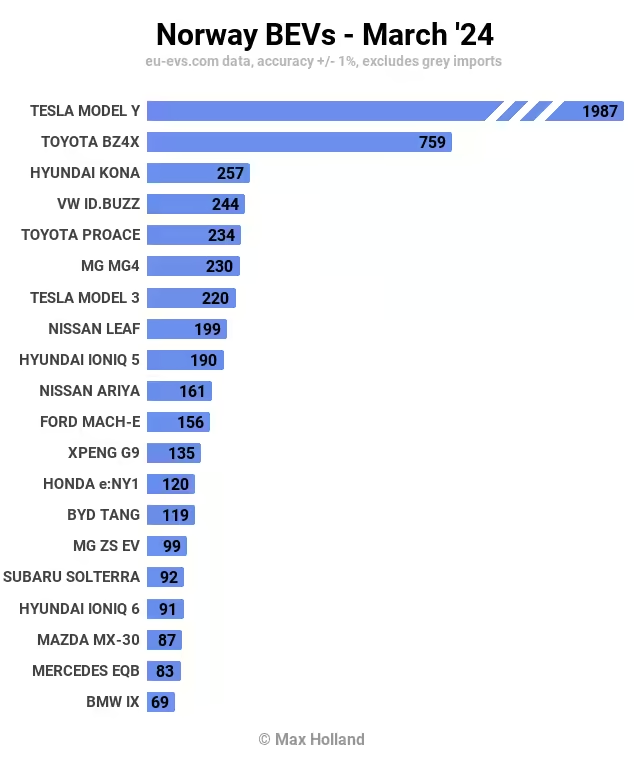

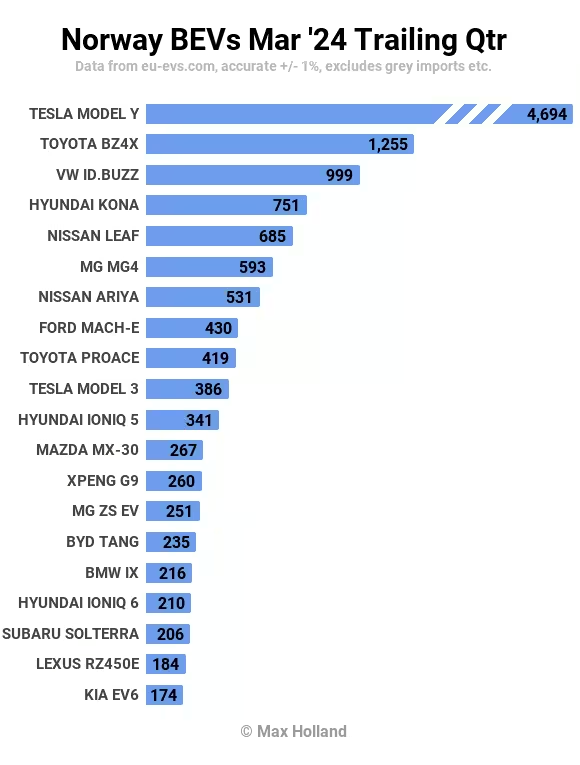

Best Selling BEVs

The Tesla Model Y is once again the best selling vehicle in Norway, its eighth consecutive monthly pole position. Its March volume was almost equal to the next 7 BEVs combined!

In second place was the Toyota BZ4X, with the Hyundai Kona in third.

Most of the top 20 are regulars, with some minor shuffles of rank.

There were a few notable climbers, however. These include the Xpeng G9, which gained its highest rank at 12th from 19th last month, and the Honda e:Ny1, which climbed to 13th (from 74th).

The remaining climbers were the BYD Tang, which got to 14th (from 24th), and the Mercedes EQB, which ascended to 19th (from 45th).

As far as I can tell, there were no new BEV model debuts in March.

The recently debuted BMW iX2 ramped up to 50 units, from 28 last month. The Peugeot 308 remained flat at 27 units, the same as February.

Let’s look at the 3 month picture:

The Tesla Model Y is so far ahead that its 3 month total is roughly the equal of the next six BEVs combined.

The MG4 had a good climb to 6th, its highest rank yet, from 9th in the prior period (Q4 2023).

There were a few significant tumbles compared to Q4 2023, many of them from Volkswagen Group models. The Skoda Enyaq fell 18 spots from 3rd to 21st! Its cousin, the VW ID.4, fell 15 spots from 8th to 23rd. And, yes, their other cousin, the Audi Q4 e-tron, also fell, by 11 spots from 14th to 25th.

Not to feel left out, their junior cousin, the VW ID.3, also fell significantly, down 31 spots, from 17th to 48th!

Has VW Group decided to take a holiday away from Norway this quarter? Jump into the comments if you have insights.

I gave an update on Norway’s fleet transition in last month’s report.

Outlook

I’ve mentioned that Norway’s weak economy is likely responsible for the massive 50% drop in auto market volume, including BEV volumes.

The last GDP update was from Q4, and showed just 0.5% YoY growth, from negative 1.9% in Q3. Inflation reduced slightly to 4.5% in February (latest), from 4.7% in January. Interest rates remained flat at 4.5% (February, latest). Manufacturing PMI worsened to 50.8 points in March, from 51.9 points in February. As I stated earlier, both consumer confidence and business confidence remain historically weak.

Norway’s OFV agrees that the economic conditions are to blame for the massive drop in auto volumes, stating: “New car sales, which are often a kind of temperature gauge on people’s finances, reflect the financial challenges many are experiencing…” (OFV statement, machine translation).

The OFV also says that:

“[N]ow most people choose smaller and more moderately priced new cars than in the past five or six years… this will affect new car sales going forward… Many of the major car manufacturers now see a large market in smaller, less expensive cars, not least electric cars, and are turning parts of their production towards this. … In the future, there will be many new smaller and more affordable electric cars on the Norwegian market. At the same time, there will be cars that satisfy many people’s needs, and that can quickly challenge brands and models that have long been well established in Norway.” (Machine translation)

This is an attractive idea, and regular readers will know that I have been banging this drum for a long time, but I see no signs of it actually happening yet. At least not to the extent it could and should be happening given the rapid fall in prices of BEV batteries and powertrains. An October report from JATO says that 2022 saw the exact opposite trend:

“[European prices] continue to rise…. To buy an EV, consumers would need to spend at least €18,285 in Europe and €24,400/$26,500 in the US. This is 92% and 146% more expensive than what they would pay for the cheapest combustion car available, respectively … largely due to the industry’s continued focus on premium EVs ahead of more widely affordable mid-range [vehicles] … many Western carmakers increased their prices while consumers were made to wait longer for new vehicles. For many OEMs this strategy paid off. In 2022, most of these companies reported fewer units sold, but higher revenue and record profits.” (JATO’s “EV Price Gap” report, October 2023)

As to the OFV’s closing sentiment that this possible emergence of more affordable BEVs may “quickly challenge brands and models that have long been well established in Norway [and Europe]” (and which — I will add — have for decades dragged their feet on the EV transition), well, we can only hope that karma will indeed catch up with them.

What are your thoughts on Norway’s EV transition? Please join in the conversation below.