June saw plugin EVs take 25.1% of the UK auto market, up from 21.6% year on year. Both full electrics and plugin hybrids grew volume at a healthy clip. Overall auto volume was 177,266 units, up some 26% YoY, but still well below pre-2020 norms. The Tesla Model Y was the UK’s bestselling vehicle in June.

June’s combined plugin result of 25.1% comprised 17.9% full electrics (BEVs), and 7.2% plugin hybrids (PHEVs). These figures compare with 21.6%, 16.1%, and 5.5% in June 2022. Both categories of plugins have grown share at a moderate rate YoY, though PHEVs have done a bit better proportionately.

Looking at unit volumes, BEVs grew a healthy 39.4% YoY, to 31,700 units. PHEVs grew volume by a strong 65.5%, to 12,770 units.

Combined combustion-only share was down to a near record low (43.2%, only December ’22 was lower). Diesel-only vehicles fell in volume by 22.2% YoY, to 6,221 units, and took just 3.5% share of the market.

When will diesel-only vehicles run out of road in the UK? Mild-hybrid diesel vehicles — with 48 volt batteries enabling regenerative-braking, and giving modest torque assistance — are now eating the lunch of diesel-only vehicles. Their sales were typically less than half those of diesel-only vehicles, as recently as 18 months ago, but now they are surpassing them.

Since diesel-only powertrains were anyway not usually sold at the very lowest vehicle price points, the modest extra cost of a mild-hybrid system can be swallowed more easily than it can in the least expensive petrol vehicles. The long-term fuel savings for the customer, and fleet emissions reductions for the manufacturer, make bolting-on a mild-hybrid system apparently economically worthwhile for most former-diesels, for now at least. We can expect mild-hybrid diesels to takeover almost completely from diesel-only powertrains in the next couple of years, give-or-take perhaps a tiny residual fraction of the market (under 1%).

Note that even when we combine the sales of these two diesel-variant powertrains, together they are still declining in volume over time. Year to date 2023, mild-hybrid diesel volume was static compared to the same period last year, while diesel-only volume fell. Combined, they lost 10.2% volume YoY, in the context of a growing overall auto market.

The bottom line is that diesels of all kinds are on the way out, and mild-hybrids — the lowest rung of “electrification” — are just a temporary stop-gap to slow the decline. In time, almost all passenger vehicles in the UK will be plugins, and ultimately, BEVs.

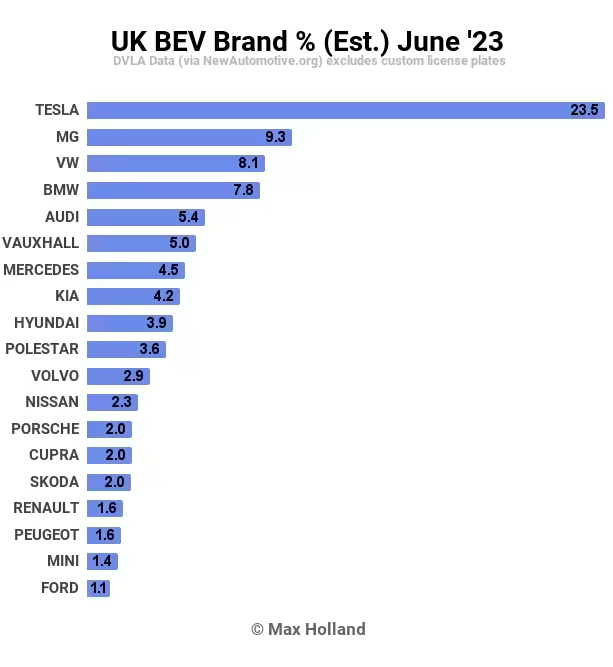

Best selling BEV brands

Tesla was yet again the best selling BEV brand in the UK in June, with around 23.5% of BEV sales, led by the Tesla Model Y. In fact, the Model Y was the UK’s overall bestselling vehicle in June.

In second place was MG Motor, with the MG4 being the second highest selling BEV model in the UK. In third place was Volkswagen brand, with the ID models.

There were no dramatic changes in the brand rankings compared to last month, just some minor shuffling of places.

The Tesla Model Y was both June’s overall best selling vehicle (5,539 units), and the 4th best selling of the year to date, with 19,551 units.

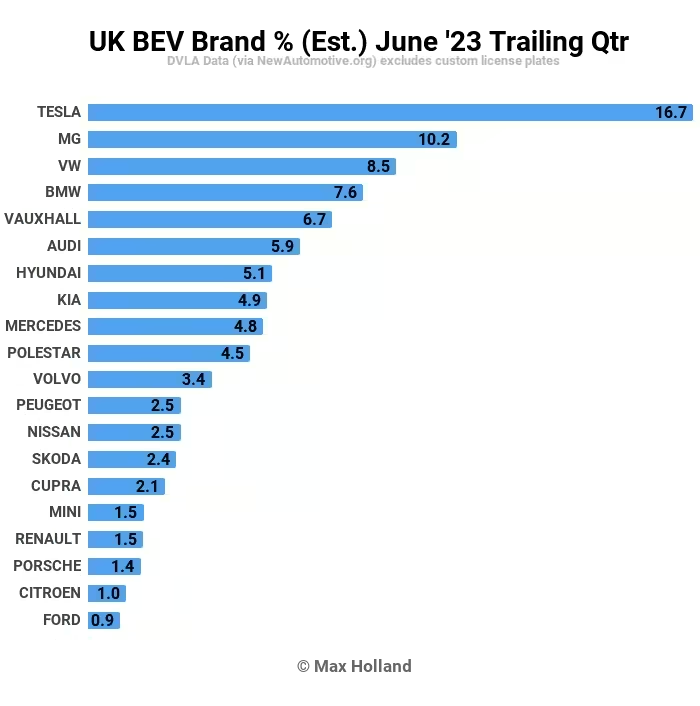

Let’s have a quick look at the brands’ 3-month performance:

In the 3 month view, as expected, Tesla still leads by a large margin, from MG Motor, and Volkswagen.

There are few major changes in the top ranks. One stand-out is Vauxhall (Opel), whose volumes in Q2 doubled over Q1, and the brand climbed from 10th spot, to 5th spot, as a result. Apparently their growth is heavily thanks to the updated Mokka, which has gained a larger battery and much improved efficiency (plus a bit more power). These combine to give around 20% more rated range on the WLTP cycle (now “252 miles”), a useful jump which now makes the Mokka a more viable option for a large portion of UK families.

Outlook

Despite YoY growth in auto sales, most of which is down to plugin growth, the broader UK economy remains weak. Inflation is static (and high) at 8.7%, whilst headline GDP growth has fallen to 0.2%. Real earnings (taking inflation into account) are falling, putting a squeeze on consumer spending, not helped by rising interest rates. The UK auto industry body, the SMMT, refers to this as “a gloomy economic landscape”.

The SMMT is also calling for the UK government to even the playing field for VAT rates on electricity for public charging, which is currently 20%, compared to a 5% rate on domestic electricity for those able to charge at home.

Meanwhile, the UK government consulted over the past 12 months or so on a proposed zero emission vehicle (ZEV) mandate which will require that a certain proportion of brand sales will have to be BEVs (similar to California and China ZEV schemes). There is some wriggle room for trading ZEV credits between brands, and within industry pools, and some amplified credits for certain vehicle classes, but overall this mandate will create a backstop for the rate of the EV transition in the coming years.

At the end of March 2023, the outcome of the ZEV consultation was published. The ZEV proportion for 2024 is set at 22%, and then rising by 5% annually until 2027 (38%). Thereafter, the ZEV proportion increases more steeply, by 16% per year until 2030 (80%). After that it will increase more gently (the top of the s-curve) by 4% per year, aiming for 100% by 2035.

UK car buyers are aware that plugins still offer significant running cost advantages over ICE vehicles, and the demand is there. If the availability of compelling-and-competent BEVs, particularly in more affordable vehicle classes (below £20,000), increases in the coming couple of years, the transition rate specified by the ZEV mandate will likely be comfortably exceeded. The mandate is simply there to make sure that the legacy auto manufacturers don’t drag their feet, and to set a predictable, fair, and level playing field for all.

What are your thoughts on the UK’s transition to EVs? Please jump in to the comments below to join the discussion.