Sweden’s June auto market saw plugin EVs take 59.2% share, up from 55.1% year on year. Full electrics grew share at a decent rate, while plugin hybrids retreated slightly. Overall auto volume was 28,283 units, up some 9% YoY, though still below pre-2020 norms. The Tesla Model Y was June’s best selling vehicle.

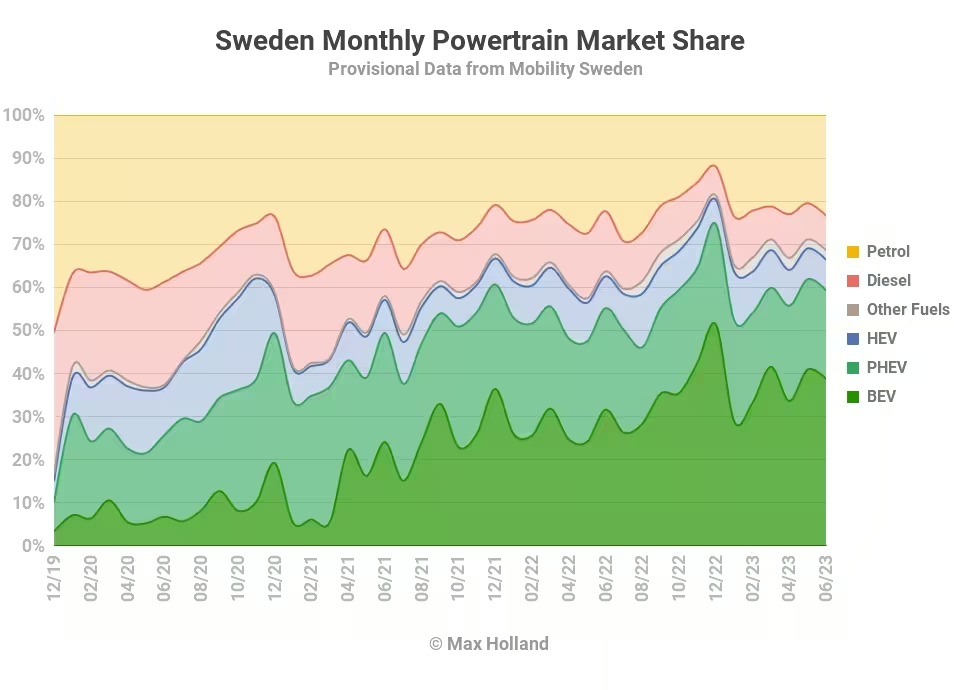

June’s result saw EVs take 59.2% combined share, which comprised 38.7% full electrics (BEVs), and 20.5% plugin hybrids (PHEVs). These compare with figures of 55.1%, 31.6%, and 23.5% a year ago. We can see that BEVs have grown well whilst PHEVs have slightly declined.

Regarding volumes, BEVs grew by 33% YoY to 10,956 units, while PHEV declined by 5% to 5,798 units. All of the overall auto market’s 9% YoY volume growth came from growth in plugins, leaving combined plugless vehicles with a volume drop, albeit with some shift in weighting from diesel to petrol.

Diesel-only volume fell by over 37% YoY, to 2,277 units, and just 8.1% of the market (from 14.0% YoY). The YTD share for diesel is just 9%, and is unlikely to climb back above 10% for any sustained period.

Bestselling BEVs

The Tesla Model Y once again took the top spot in June, making it the leader for 3 of the past 4 months, not just in BEVs, but in the overall market.

The Model Y has firmly toppled the previous regular leader, the Volvo XC40 (now in 4th). Second place went to the Volkswagen ID.4, and the Kia EV6 took third.

There were no new faces in the top 20 (nor even any newcomers BEV models to the overall market), but June saw a few personal-best performances. The BMW i4 saw its highest volume yet (458 units), and climbed to 7th.

The BYD Atto 3 saw its highest volume since the initial big splash in December, with 302 units in June, and 11th place. Close behind, the MG4 maintained the strong volume it pioneered in May, and claimed its highest rank so far, 13th position.

Let’s now step back for the 3 month view:

The Tesla Model Y leads, as we would expect, but at a volume around 2x that of its nearest rival, the VW ID.4. The Volvo XC40 comes in third.

Just below the middle of the table, the relative newcomers, the MG4, the Toyota BZ4X, and the BYD Atto 3 have all now established themselves — and their brands’ BEV-credentials — in the Swedish market. They can build on this foundation with more BEV models in the future.

Outlook

The Swedish auto industry association, Mobility Sweden, points out that H1’s overall auto market was 2% down in volume, year on year, saying “The low registration figures are largely an effect of the current economic situation which affects the car market.” (Machine translation).

What is that economic situation? The Swedish economy is experiencing just 0.6% economic growth, 20% youth unemployment, over 5% YoY retail sales drop, and almost 10% overall price inflation (and 14% food price inflation). Consumer sentiment is obviously suffering as a result, thus the above statement from Mobility Sweden.

Whilst BEVs still offer long term total cost of ownership advantages over ICE equivalents, there’s still a high price of entry to buying any new auto, and the overall market’s volumes are forecast to suffer as a result. In addition, the November 2022 cancellation of incentives for plugin orders placed thereafter, is only now about to become evident in plugin delivery numbers (due to the 6+ month delay between order and delivery). We will likely see some disjunctures in the figures over the coming few months, as a result.

What are your thoughts on Sweden’s EV transition? Please join in the discussion in the comments below.