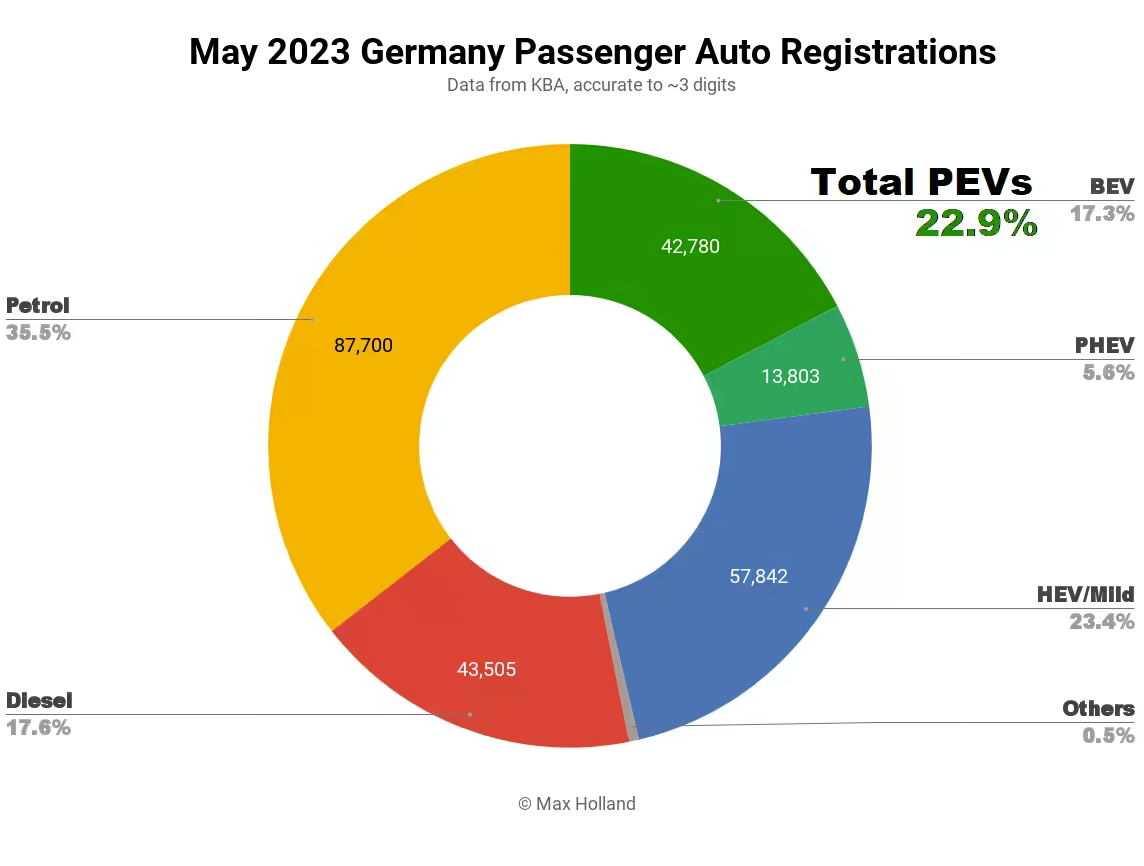

The auto market in Germany saw plugin EVs take 22.9% share in May 2023, down from 25.3% year on year. Full electrics gained share, but were outpaced by the losses in plugin hybrid share, due to recent policy changes. Overall auto volume was 246,966 units, up by some 20% YoY, though down from pre-2020 norms. The bestselling full electric in May was the Tesla Model Y, boosted by domestic production.

May’s overall plugin result of 22.9% comprised 17.3% battery electrics (BEVs), and 5.6% plugin hybrids (PHEVs). These figures compare with May 2022 results of 25.3%, 14.1%, and 11.2%.

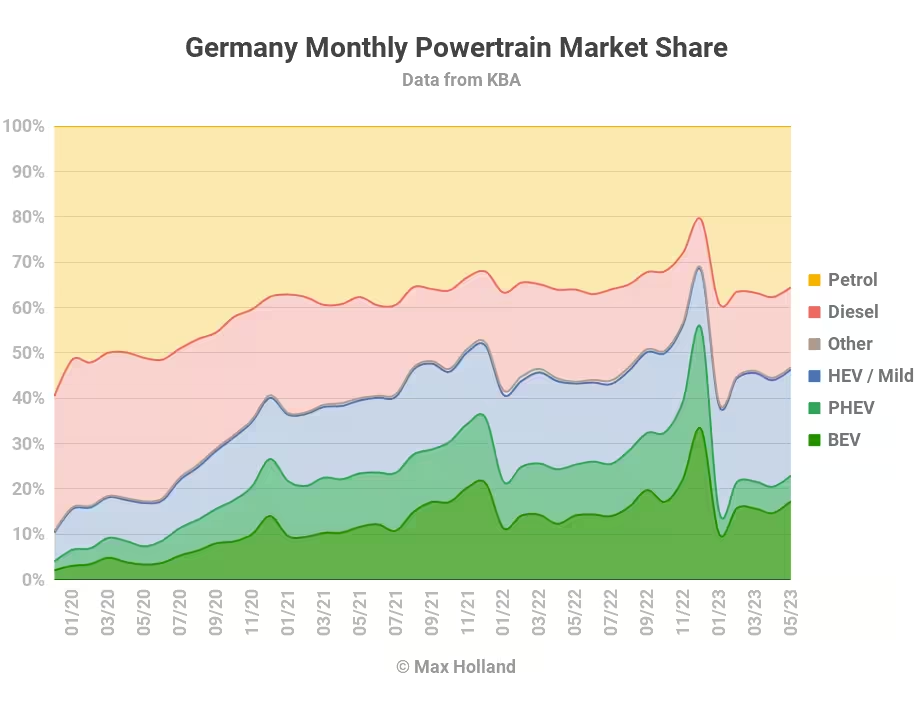

Where the split between BEVs and PHEVs was more balanced a year ago, recent emissions-related policy changes have cut all financial support for PHEVs, leading to a dramatically diminished share. PHEVs have remained in the 5% to 6% share range this year, from 12% to 14% over the same period last year.

Looking at unit volumes, BEVs have grown by over 46% YoY, reaching 42,780 units. PHEVs however fell by 40% YoY, to 13,803 units.

In my view, now that PHEVs are not receiving funds from the public purse, those who continue to buy them are presumably likely to be doing so for the running costs savings. These savings are made by switching most of their driving from combustion to electric, which obviously requires regularly plugging the vehicle in. Purchase bonuses for PHEVs were always a perverse incentive, and for some cynical buyers, replaced the more fundamental economic incentive of actually plugging them in to save on fuel costs.

This perverse incentive is now corrected, but perhaps too late in the technology transition for PHEVs to receive serious attention from consumers and manufacturers going forwards, at least in Germany. With DC infrastructure in most parts of the country (and much of north-west Europe) already quite reliable, and still improving, there are surely fewer and fewer drivers who feel the need for a combustion engine as backup.

May’s combined combustion-only share fell by 3% YoY, to 53.1% of the market. It is tracking to fall below 50% by the end of Q3, and perhaps not climb above 50% thereafter, except on the odd occasion.

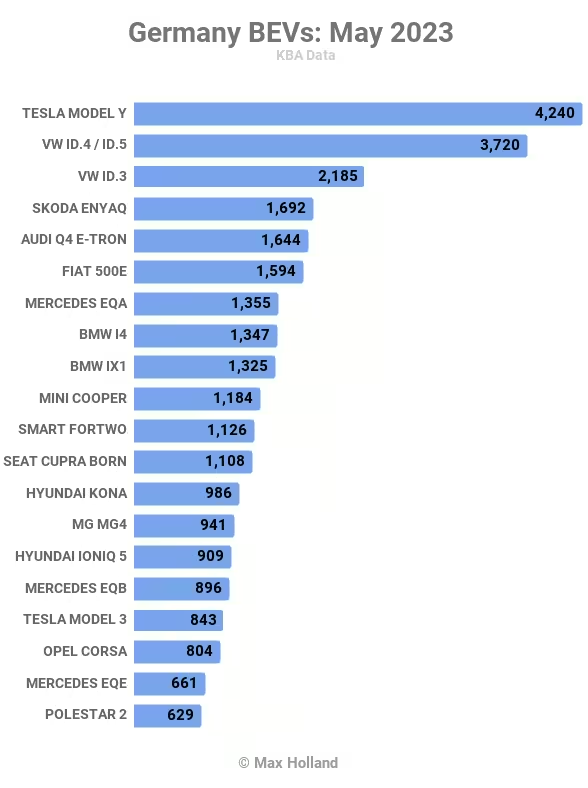

Germany’s BEV bestsellers in May

The Tesla Model Y was again the bestselling plugin in May, at 4,240 units. Runners up were the Volkswagen ID.4/ID.5, and — a long way further back — the Volkswagen ID.3.

Tesla’s gigafactory in Berlin-Brandenberg had ramped peak production rate to over 5,000 Model Y vehicles per week before the end of March (from 4,000 per week near the end of February). This might suggest around 22,000 units (or more) produced for European delivery during May, making the 4,240 units delivered within Germany itself somewhat modest by comparison (and lower than February).

Yet the Model Y still delivered more units than any other BEV. Expect to see huge registration volumes in June.

There weren’t many surprises in the top 20. The BMW i4 saw its best ever monthly volume, at 1,347 units, climbing to 8th place. Likewise did its younger sibling, the BMW iX1 (1,325 units), taking 9th.

In terms of newcomer BEVs further down the ranks, the biggest news was the first appearance of Stellantis’ Jeep Avenger, with a debut of 313 units. I discussed the Avenger in my France report if you want details of this new model. It should do well in Europe.

There were no other absolute newcomers in May. The “Smart #1” climbed to a new personal-best volume of 497 units (from previous best, 313 units in March), and may perhaps enter the monthly top 2o soon.

The BYD Atto 3 continued to tread water, at 49 units in May. I expect BYD is getting customer feedback, establishing after-sales service, and solving any teething problems, before upping volumes in the future.

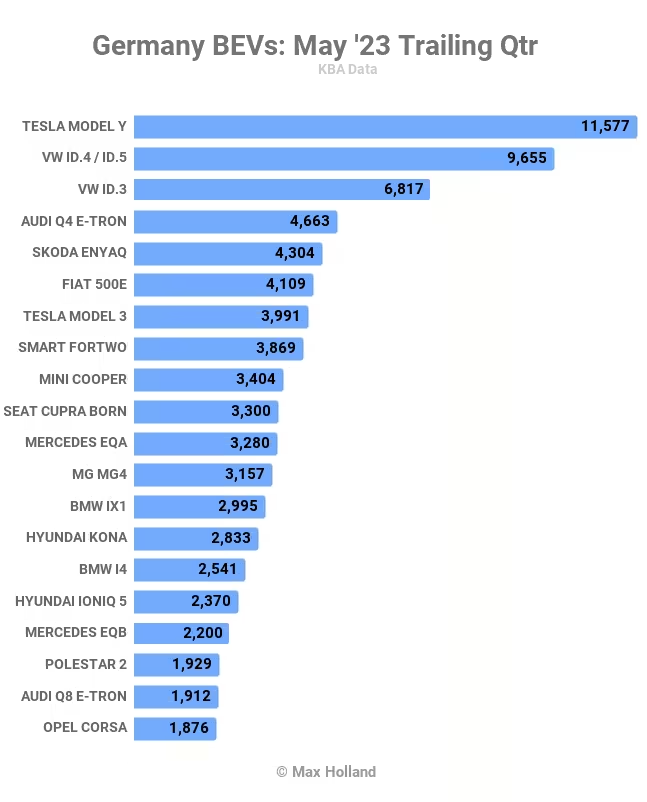

Let’s now look at the longer view:

In the three month view, the Tesla Model Y confirms its dominance. The relative positions of the top three BEVs mirror the May chart above, suggesting the emergence of some stability in the market, in large part thanks to Tesla’s evolution past peak-and-trough shipping schedules.

Again, there are no huge surprises in the top 20. The new entrants are the MG4 (#12, after debut in September), and BMW ix1 (#13, debut in November). Both models have seen steady volume ramps since launch, and both likely have further positions to climb.

Notice the relative evenness of the positions #9 (Mini Cooper) on down. The even distribution trend continues well beyond the top 20, with over 1,000 units delivered by models as far down as rank #36. Again this reflects a maturing of Germany’s BEV market, and the BEV industry overall.

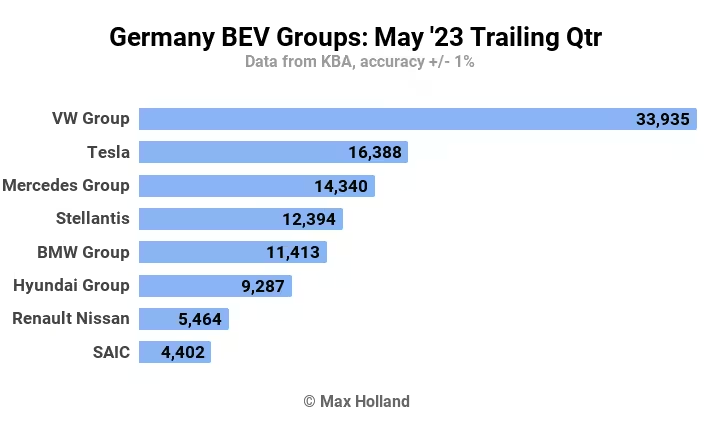

Let’s finally have a quick look at the auto manufacturing groups:

In their home market, Volkswagen Group continue to dominate. Their share of the market in the three months to May climbed to 29.4%, from 27.9% in the three months to February. Tesla’s share on the other hand fell over the same period, to 14.2%, from 19.5%.

Note that we can’t necessarily read too much in to this, since different manufacturers continuously shuffle around supply between various European markets. Germany may be prioritised at different times by different manufacturers. A changing incentive landscape between different countries (often affecting different vehicle price points differently) is one reason for different priorities, for example.

There weren’t many large changes in group rankings, except that Renault-Nissan group continued to drop, from 4th previously, to 7th now. Their share fell from 8.6% to 4.7% over the period.

Outlook

Although May saw Germany’s EVs take 22.9% of the market, the broader German economy, Europe’s largest, has now registered two successive quarters of negative growth. This means Germany is officially in recession, though currently a mild one, by the numbers.

Since a month ago, headline inflation has come down slightly (6.1% from 7.2%) but that’s still very high for a recessionary economy. Inflation is led by energy price and food price inflation, non-discretionary goods which all families must spend on. This means that consumers are facing tightening pocket books, just whilst salary earnings and jobs are potentially under threat.

For big ticket items like car purchases (and especially BEVs), these economic conditions represent headwinds, although the auto market is still one of the brighter spots in the overall economy. This may be because car buyers had put off new car purchases over the past 3 years, and are now conducting “unfinished business from before”, rather than reflecting much positive consumer sentiment about conditions going forwards. We will have to wait and see how it pans out.

Nevertheless, German consumers are now fully aware that plugins, particularly BEVs, offer better long term value compared to combustion-only vehicles. We can thus expect to see plugin share of auto sales continue to creep up, even if overall auto market volumes remain well below pre-2020 levels.

What are your thoughts on Germany’s EV transition? Which BEV models are you looking forward to seeing debut? Please join in the conversation in the comments below.