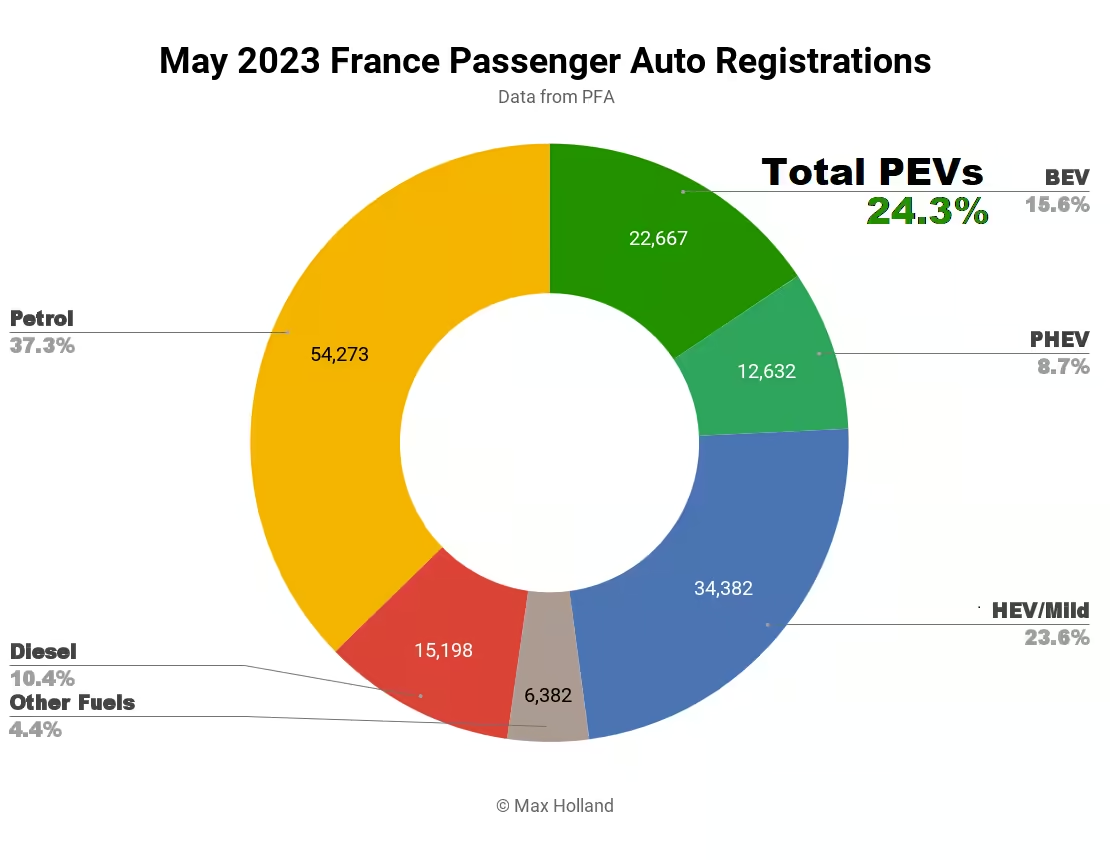

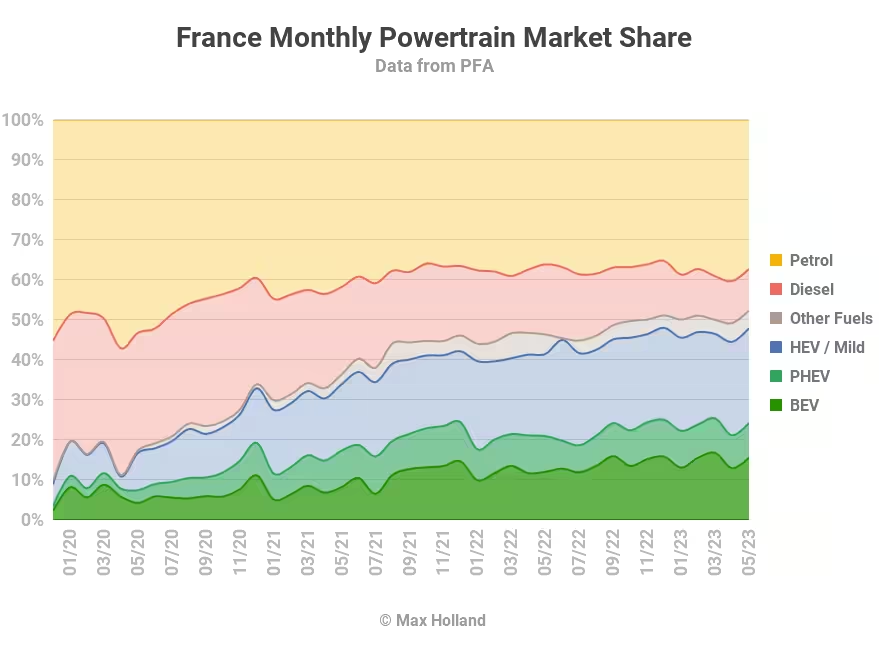

May saw France’s plugins take over 24% market share, up from 20.9% year on year, with new Stellantis BEVs arriving. Full electrics grew from 12.0% to 15.6% share, while plugin hybrids slightly lost share. Overall auto volume was 145,536 units, up some 15% YoY, though still down on pre-2020 norms. The bestselling BEV in May was the Tesla Model Y.

May’s combined plugin result of 24.3% comprised 15.6% full electrics (BEVs), and 8.7% plugin hybrids (PHEVs). These figures compare with 20.9%, 12.0%, and 8.9%, a year ago.

In unit volumes, BEVs grew 49% YoY to 22,667 units, while PHEV grew 12% to 12,632. This is a healthy growth clip for BEVs.

Diesel share dropped from 17.5% YoY, to just 10.4%, the lowest share of the recent decades. We can expect it to dip below 10% in the coming few months, and largely remain below thereafter.

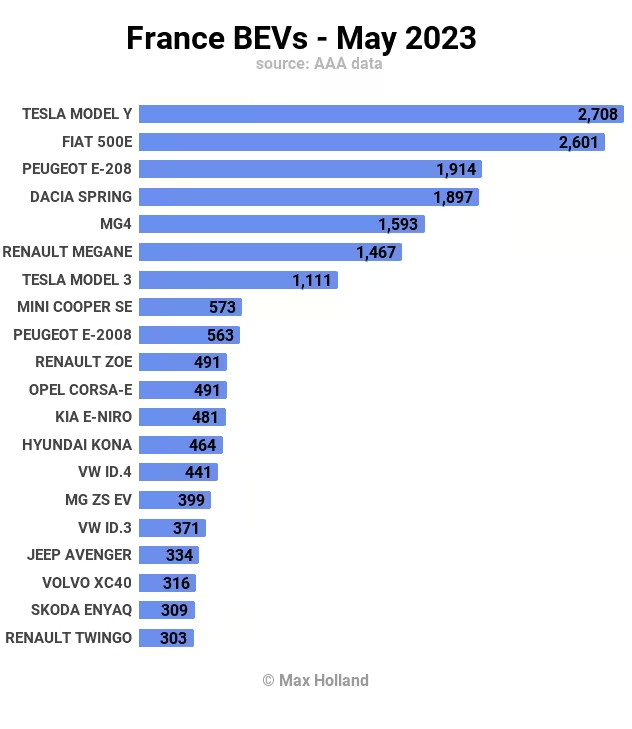

Bestsellers in May

France’s bestsellers in May remained in line with recent trends, with the Tesla Model Y taking the top spot, at 2,708 units, just slightly ahead of the Fiat 500e, at 2,601 units.

Other regular favourites, the Peugeot 208, and the Dacia Spring, took third and fourth.

The MG4 put in a record performance, with 1,593 units, securing 5th spot in May. An impressive feat for the newcomer, which only launched in noticeable volume in October. This was the biggest (relative) volume growth in the top 10 in May, let’s see if MG can sustain this level of supply (there’s no lack of demand).

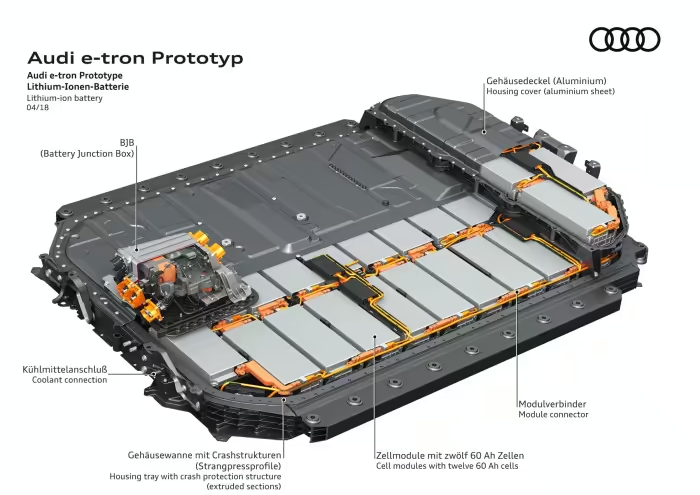

Only one vehicle in top 20 made a bigger splash — the new Jeep Avenger BEV. Jeep is now part of Stellantis Group, and the Avenger shares a powertrain with the updated versions of the Peugeot 2008, Citroen e-C4, Opel Mocha, Opel Astra, and similar Stellantis BEVs. Specs include a 50.8 kWh usable battery (~54kWh gross), and 100 kW peak charging (~26 mins 10% to 80% in ideal conditions). With tweaked efficiency over previous Stellantis BEV generations, and being a relatively light “Small SUV” (B-segment), the Avenger has WLTP combined cycle range of upto 404 kilometres, which — in the mild climates of France and southern Europe — can be enough for many families.

Talking of the Stellantis BEVs, the new Peugeot e-308 also saw its first registered units in France in May, with 40 initial deliveries. It has the same powertrain specs as the Avenger above, but being a lower shaped hatchback (albeit in the larger C-segment), has slightly better rated range of 410 km. The 308 has for years been amongst the top 10 overall bestselling vehicles in France, so presumably the new BEV version should go on to be a regular high performer in out monthly rankings. Let’s see.

Another newcomer to the French Market at significant volume was the new BYD Atto 3, with 60 units in May (it had landed just 6 demo units over the previous two month). Recall that the Atto 3 already started delivering in the Netherlands, Norway and Sweden at the end of 2022.

The Volkswagen ID.Buzz, which landed in France only in April, with an initial 46 units, has already stepped up to 79 units in May. If the ID.Buzz continues to prove (relatively) popular in France, should Citroën release an updated version of the classic Citroën Type H van (above) to compete with it? Answers down below please!

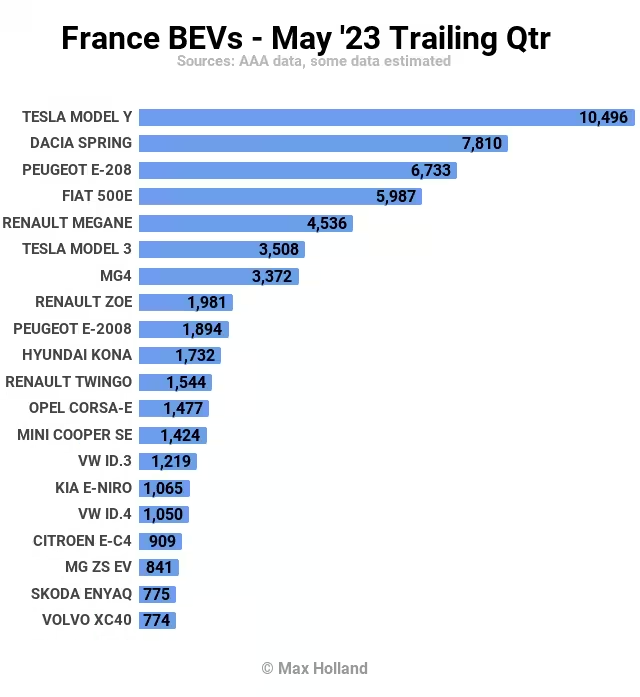

Looking at the 3 month chart, the Model Y is still very dominant (though not as much so in France as we have seen in Sweden and Norway).

Overall the top 15 spots were remarkably static compared to 3 months prior, with only small moves up or down. There were no all-new faces in the top 20.

Outlook

France’s EV transition continues to progress, and although not as headline grabbing as some other markets, is actually doing okay if we look at BEV volume growth. The year-to-date cumulative BEV volume is over 46% ahead of where it was at this point last year – strong growth no matter which way you slice it.

Local heroes Stellantis – responsible for around 27% of all France’s BEV sales – are introducing several new models, and are continuously improving the existing models with greater efficiency and range. They presumably are also increasing production capacity for these BEV models, if nothing else, to compete with the “feared” affordable BEVs from Chinese brands.

PHEVs have evidently hit a plateau at a level of roughly 7% to 9% share over the past 24 months. But BEVs are definitely still growing strongly, and France is taking the task of opening battery gigafactories seriously. There is every prospect that the country’s EV transition will continue at pace.

What are your thoughts on France’s plugins, and EV transition? Should Citroën resurrect the Type H van? Let us know below.