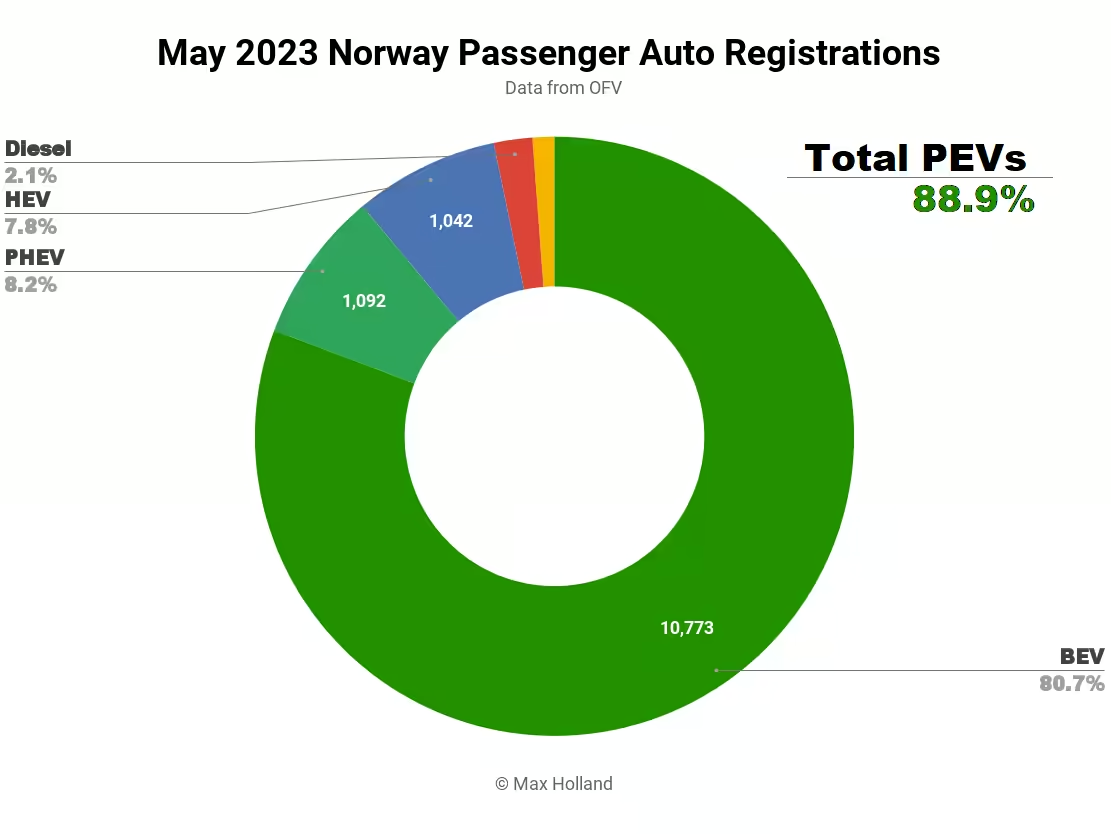

Growth continued for the Norwegian plugin EV market in May 2023, as combined plugin share hit almost 90%, up from 85% a year ago. Full electrics alone took almost 81% share, grabbing 7.5% more of the remaining market than last year. The overall auto market saw volumes of 13.342 units, up almost 16% YoY, and higher than May 2019. The Tesla Model Y was the month’s bestselling vehicle, miles ahead of others in volume.

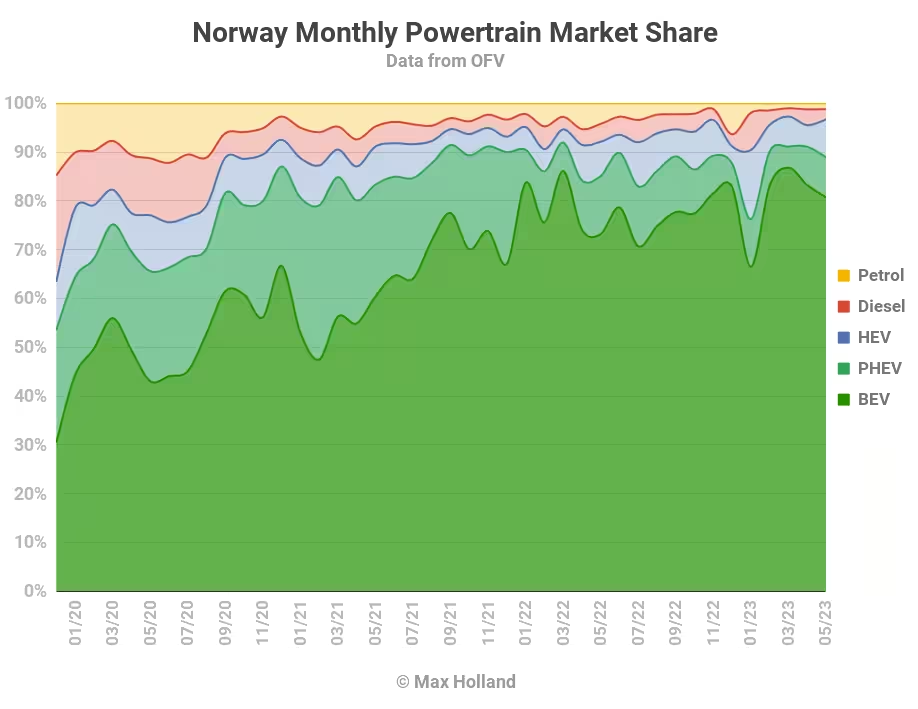

The 88.9% combined plugin total was made up of 80.7% BEVs, and 8.2% PHEVs. A year ago their scores were 85.1% combined, with 73.2% BEV, and 11.9% PHEV. Combined score has just dipped below the >90% maintained over the past three months, but will get back well above 90% in June. The market is still finding its new equilibrium after January 1st incentive changes.

Volume of PHEVs was down only about 20% from May last year (despite much less incentive support), whilst BEV volumes increased by over 27% YoY.

Combined combustion-only share stood at 3.3%, with only March 2023 lower (2.7%). Their combined volume, at 435 units, was less than half that of May 2022.

It is quite likely that from September 2023 onwards, excepting unforeseen anomalies, plugins won’t drop below 90% market share, and combustion-only won’t return above 5% share. For plugins to get consistently above 95% share will require more diverse – and especially, more affordable – vehicle classes to be catered for.

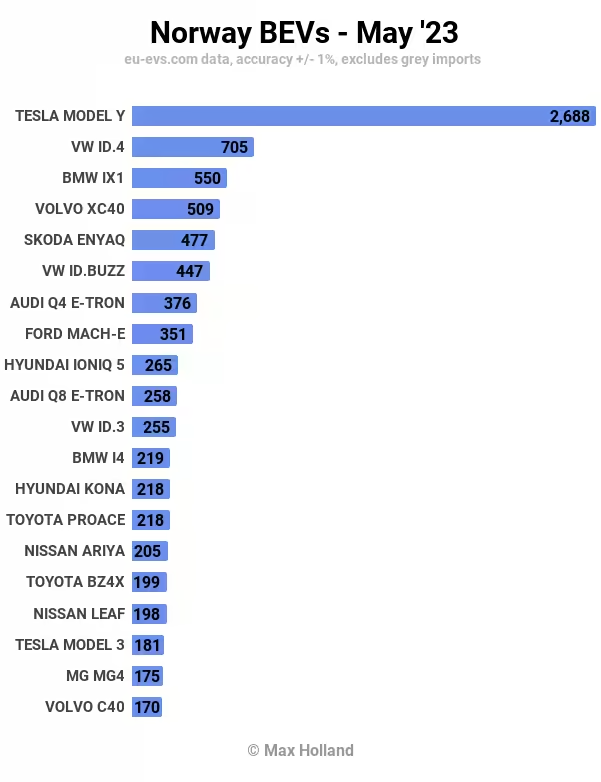

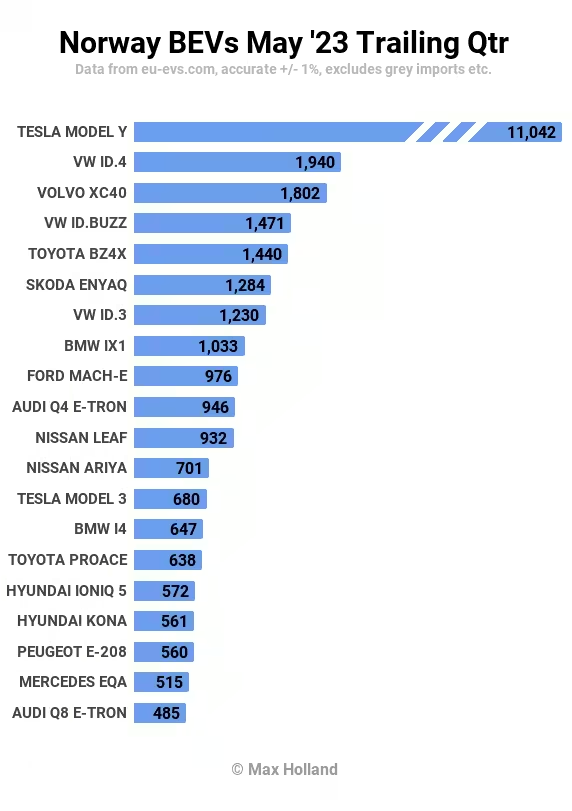

Norway’s May ’23 Bestsellers

There was a time, not so very long ago, that Tesla would rarely overwhelm Norway’s sales charts outside the final month of each quarter, when shipping volumes peaked. That’s no longer the case, largely thanks to steady European supply coming from Gigafactory Berlin-Brandenburg.

May was a case in point, with the Model Y completely swamping its nearest competitors, and matching the volume of the next 5 models combined.

The runners up were the Volkswagen ID.4, and the BMW iX1. Notice that every member of the top 10 is (approximately) a mid-sized SUV or crossover, save for the ID.Buzz.

The BMW iX1 has climbed the ranks fast, from its launch last December, to now hit the #3 spot. Its previous high was #10, just last month. Let’s see what volumes BMW can maintain for this model, their most affordable current BEV. It appears to be in the sweet spot for the Norwegian market.

The only other notable progress in the top 20 was from the MG4, which is slowly cranking up its Norwegian supply, reaching a 175 unit personal best in May. I expect – in terms of demand – the sky is the limit for this model (as it would also be for anything similarly good value from other manufacturers). In reality though, MG’s production capacity is the actual limit, and it remains to be seen how many units Norway can be allocated each month. Whatever they can supply will doubtless be snapped up.

Beyond the spotlight of the top 20, the BYD Atto 3 resumed a steady increase in volume, with 52 units in May. This is still far short of its first big push in December (a one-off 576 units), but a slow and steady increase in monthly supply give us a better read on its long term prospects. BYD has the capacity to supply huge demand – it sold almost 30,000 units of the model in China alone in April.

At a different price point, the Lexux RZ450E stepped up its delivery volume modestly, from its launch of 14 units in April, to 51 units in May. This is essentially the Lexus variant of the Toyota BZ4X, with the same battery and charging, but significantly more powerful motors, and fractionally less range. The Toyota sibling (#16 in May, though #2 in March) has recently received software improvements to charging speed, with more battery capacity unlocked for use (trimming of the reserve buffer). Presumably the same improvements can make it to the Lexus also.

Let’s check up on the longer term rankings (note the graph scale for the Tesla Model Y is trimmed to fit):

In the 3 month view, the Tesla Model Y is even more dominant, almost matching the volume of the next 8 vehicles combined!

The Volkswagen ID. Buzz, in #4, is proving popular – surely the first minivan that has become a regular in the top 5 in Norway. Recall that it only launched in volume in October. I’m interested to see if its current volume reflects the one-time fulfilling of longstanding backorders, or whether it will sustain this over the longer term. Let’s see.

Likewise, from an October (re-)launch, the Toyota BZ4X has done well to climb into #5 spot in Norway. The software tweaks mentioned above can only help its popularity grow.

Based on recent trends, we can expect the MG4 to enter the top 20 chart sometime in the next couple of months.

Outlook

Norway’s EV growth continues to shine, with BEVs steadily filling out the rest of the market. May was the 4th month on the run that saw BEVs take over 80% of the market, which is a strong sign. Their year-to-date share of the market now stands at 83.3% (despite the hangover from the January 1st incentive changes). A year ago, the figure was 79.2%. I would guess that – a year from now – we might be looking at 88% or above.

For the growth to continue briskly into the high 90% range will require a few more good value options to compete with the MG4. This means manufacturers coming with vehicles at a delivery price around (or under) ~€25,000 (~290,000 NOK). They must at the same time offer reasonable competence in range and charging speed.

We know that BYD will eventually come to Europe with the Seagull, but which other manufacturers are willing to step up? Volkswagen has shown an ID.2 concept that may be offered around this price, and an even more affordable ID.1 may come after that. But these are not currently expected until 2025, and 2027, respectively! Perhaps closer are the Renault 5 and Renault 4, currently slated for launch in 2024 and 2025 respectively. Please let us know in the comments which BEVs under a €25,000 price you have your eye on for launch over the next couple of years.

What are your thoughts on Norway’s EV transition overall? Please join in the discussion below.