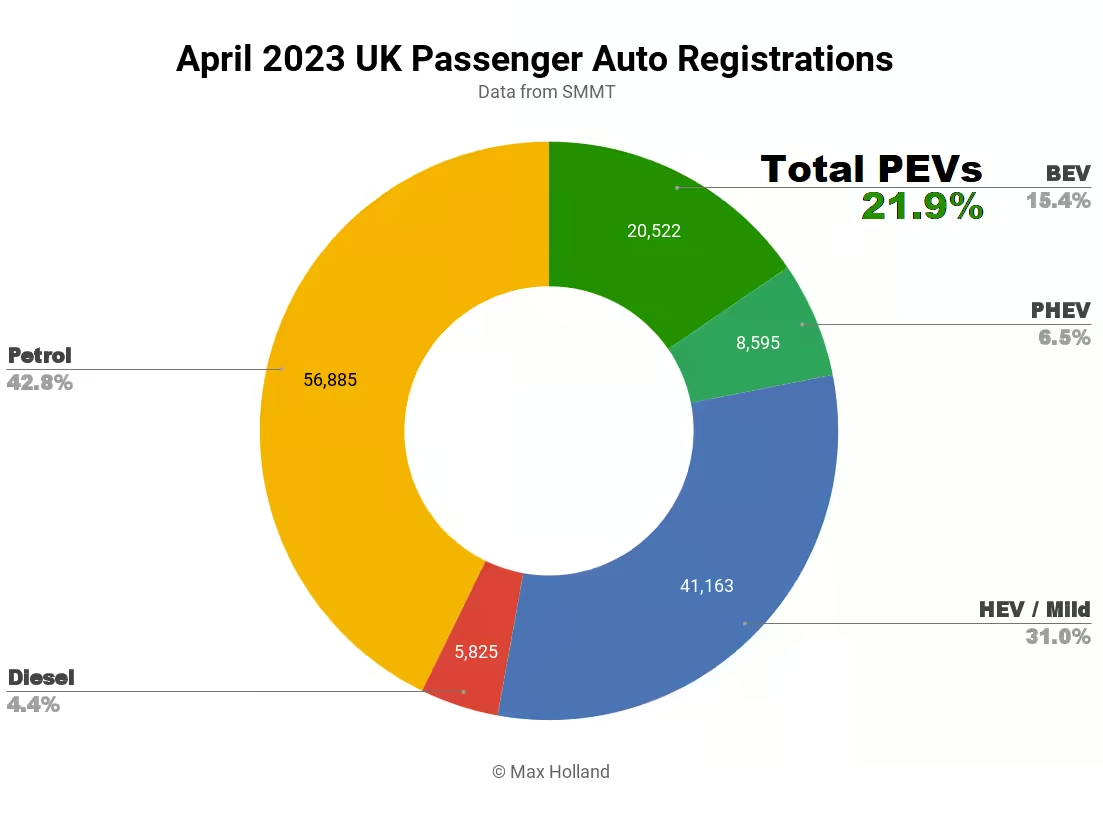

The UK car market saw plugin electric vehicles take 21.9% share of sales in April 2023, up from 16.2% year on year. Full battery electrics grew strongly in both share, and in volume. Overall auto volume was 132,990 units, up 11.6% YoY, though still down from the roughly 170,000 pre-2020 seasonal norm. The UK’s best selling BEV brand in April was Volkswagen.

April’s combined plugin result of 21.9% comprised 15.4% full battery electrics (BEVs), and 6.5% plugin hybrids (PHEVs). This compares with respective YoY shares of 16.2%, 10.8%, and 5.4%. We can see that BEVs have grown share strongly YoY, by over 1.4x.

Looking at volumes, against the backdrop of 11.6% YoY overall market growth, BEVs grew volume 59% to 20,522 units, and PHEVs grew 33%, to 8,595 units.

Most of the auto market’s volume growth, in fact, came from plugins. All other powertrains combined, only grew by 4% in volume YoY, and all non-plugins lost share. Diesel-only vehicles — already a fast diminishing slice of the market — fell in volume by over 13% YoY, to 5,825 units, and just 4.4.% share.

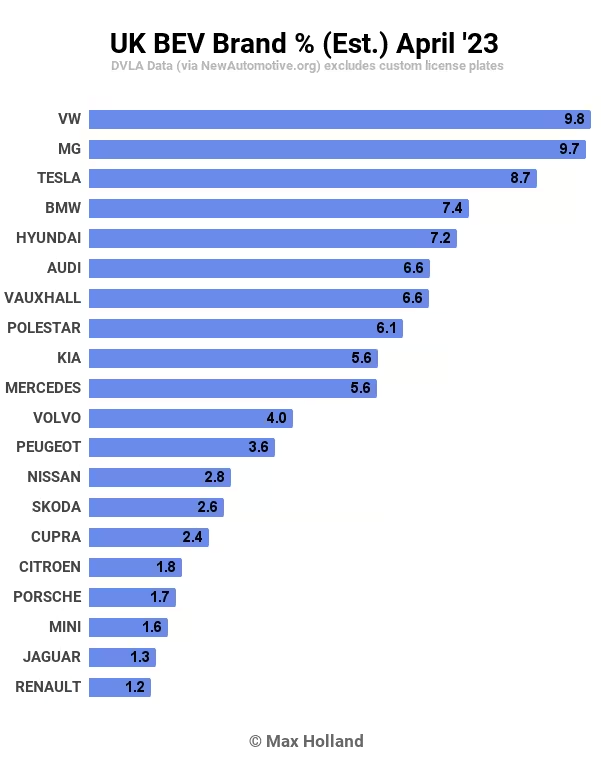

Bestselling BEV brands

Volkswagen was the UK’s bestselling BEV brand in April, led by the ID.3, which has recently been their top selling BEV model (and 4th BEV overall in 2022).

April’s runner up brand was MG, in large thanks to the popular new MG4, arguably Europe’s best value BEV, building on the success of the MG5, and the ZS.

Tesla, the long-term favourite, settled for 3rd spot in April, being in an off-month for international shipments. The Model Y, however, remains the year-to-date best selling BEV in the UK (and 7th overall), with 11,503 sales. Whilst March saw a huge 8,123 units, April dropped off to 1,550 units.

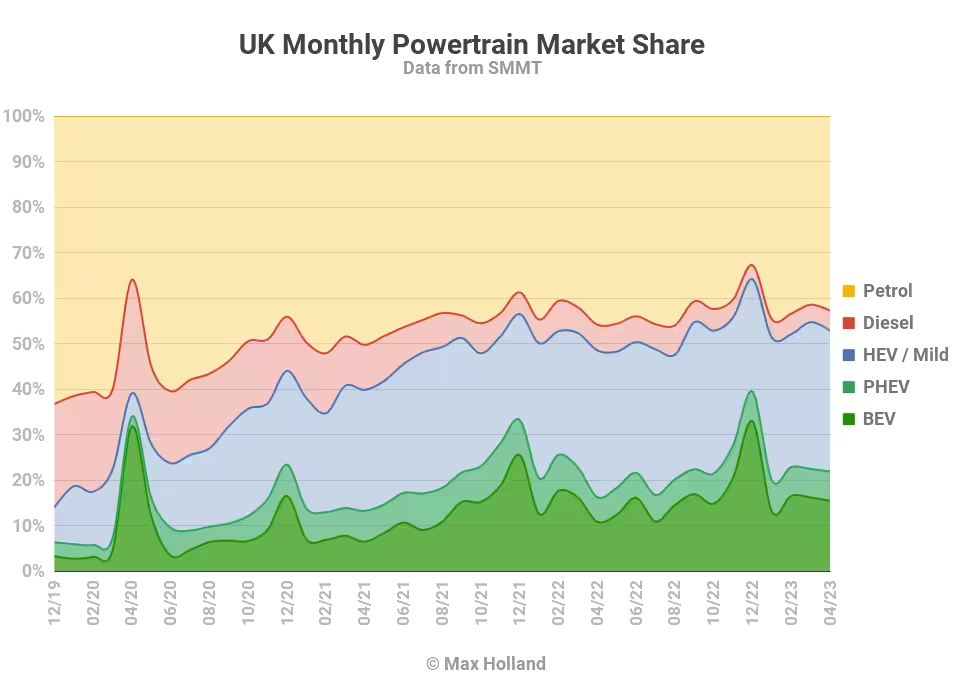

Beyond the normal monthly ebbs and flows resulting from varying international shipping schedules, there were no great changes in the popular brands in April. We can expect Tesla to jump to the top again, with large volumes, in June.

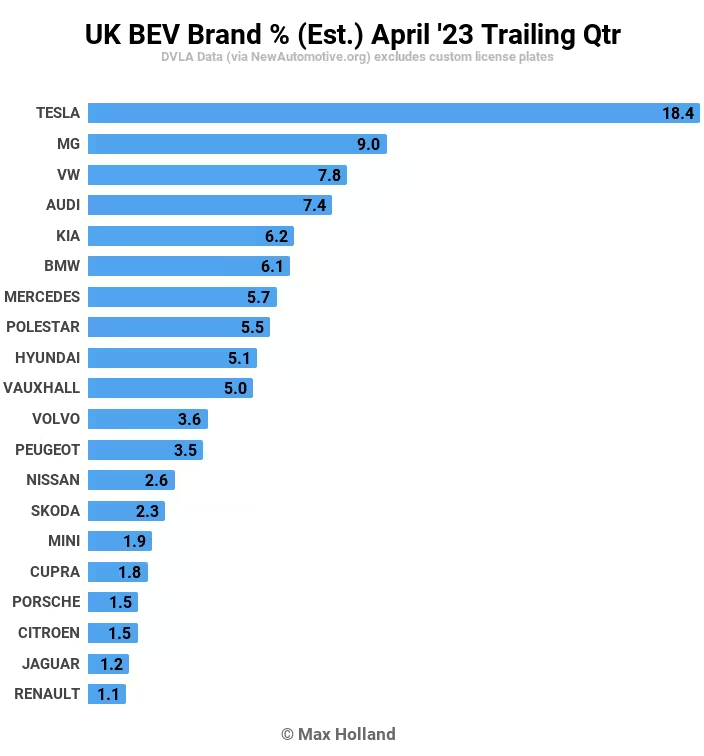

Let’s look at the longer term picture which evens out some of those monthly irregularities:

Here Tesla’s dominance of BEV brands is more clear, with twice the share of the next closest, MG Motor.

It’s a shame to see Renault fall so far from Grace. With the original Zoe, Renault was an absolute pioneer in EVs, regularly in the UK’s first or second spot a decade ago (along with the original Nissan Leaf).

The latest generation Zoe is still available, with a decent range (WLTP 238 miles, 383 km), but its slow charging speed versus rivals like the Stellantis cars (Peugeot e-208 and siblings), the VW ID.3, and now the MG4, is really making it seem technically outdated, especially for occasional longer trips. Renault also made missteps around cutting the Zoe’s active safety systems, leading it to drop its score in the ever-evolving EuroNCAP safety rankings — all important for a family car.

To recover, Renault will either need to quickly grow volumes of the new Megane (which seems unlikely), or need to wait for the upcoming Renault 5 BEV, currently due for European launch next year.

Group partner company Nissan has suffered a similar fate. Let us hope their upcoming CMF-B EV platform, which both the Renault 5, and an upcoming Nissan Micra successor, will be based on, can revive the fortunes of these two early BEV pioneers.

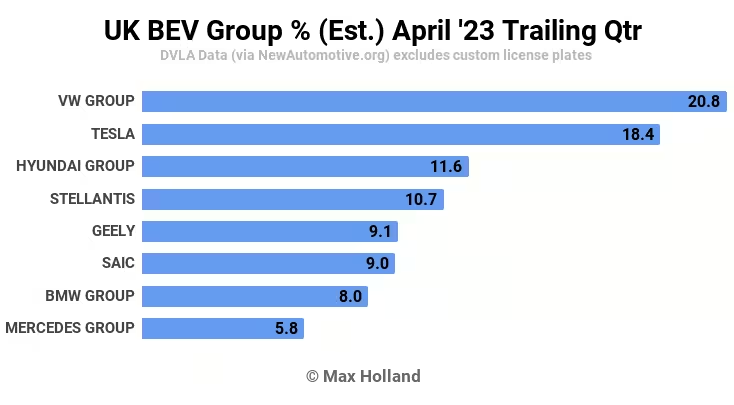

Talking of automotive groups, let’s look at the group performance in the UK BEV market:

Volkswagen group, with BEVs from Volkswagen brand, Audi, Cupra (and SEAT), Skoda, and Porsche (amongst others), is leading the trailing 3 months share, by a small margin over Tesla.

Over a longer time period, Tesla has been doing slightly better than Volkswagen Group until recently. The UK market, with its right-hand drive vehicles, is often delivered to in production batches, and we can only really look at full year results, or a trailing 12 month view, to get a balanced picture. In full year 2022, Tesla was about 19% ahead of Volkswagen Group on UK BEV volume. Over the most recent trailing 12 months to end-of-April 2023, the two are pretty much even. The good news for consumers is that both are growing volumes fast.

Outlook

The UK auto industry body, the SMMT, note that the annual growth in auto sales is one of the bright spots in an otherwise gloomy UK economy. The general UK economic outlook is currently for flat economic output in 2023, with a recent hopeful chance to avoid an outright recession, which is an improvement over how things looked a couple of months ago. It’s still one of the worst outlooks, globally.

For consumer spending, relevant to the auto market and EV sales, very high energy and food price inflation are weighing on consumer pocket books.

The SMMT’s April report notes that the very high electricity prices are now denting the growth trajectory of BEVs in the UK. The body has revised down its forecast for 2023 full year BEV market share, from 19.7%, down to 18.4%. The SMMT also repeats the need to improve UK charging infrastructure.

What are your thoughts on the UK’s transition to EVs? Please join in the conversation below.