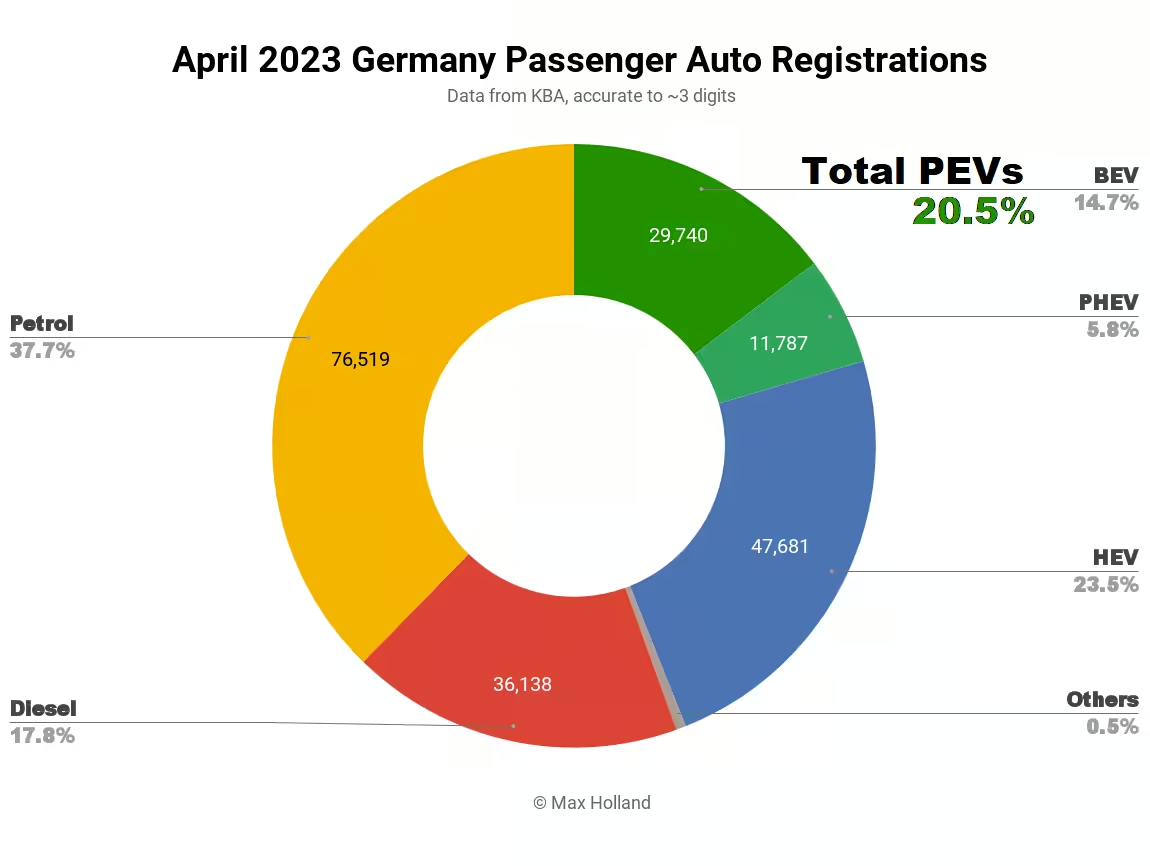

The German auto market saw plugin electric vehicles take 20.5% share in April, significantly down from 24.3% year on year. Full electrics, however, saw increased share, though were outweighed by a halving of plugin hybrid share, a result of recent policy adjustments. Overall auto volume in April was 202,947 units, 12.6% up YoY, though still one third below pre-2020 seasonal norms (around 305,000 units). The bestselling full electric in April was the Volkswagen ID.4 / ID.5.

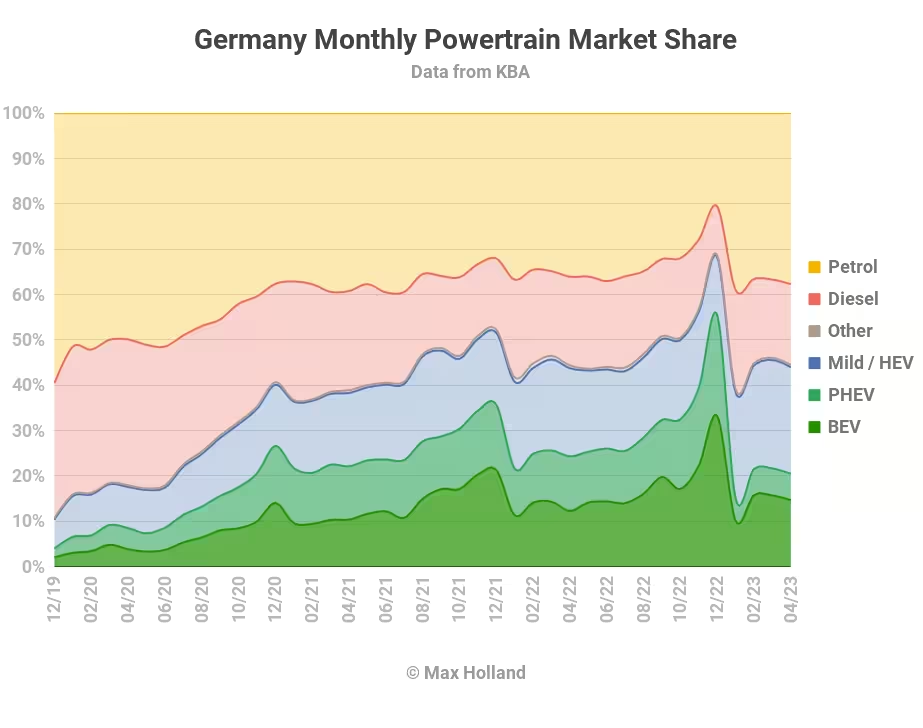

April’s combined plugin result of 20.5% comprised 14.7% battery electrics (BEVs), and 5.8% plugin hybrids (PHEVs). These figures compare YoY with 24.3%, 12.3%, and 12.0%. We see that — against a context of almost equal weighting a year ago — BEVs have since increased their share, and PHEVs have halved theirs.

Recall that Germany adjusted their incentive schemes for plugins, starting from January 1st this year. BEVs saw a modest trimming of support, but PHEVs had their ecobonus support cut entirely, amounting to a roughly 4,000€ effective increase in purchase cost for consumers. It was therefore fully expected that PHEV share would take a fall, and the YoY halving of share in April simply confirms this.

In terms of volume, BEVs outshone the overall auto market, growing 34% YoY to 29,740 units. Only plugless hybrids (HEVs) did similarly well, growing volume 36% YoY. Recall that HEVs are a transition technology that still derive 100% of their motive energy from hydrocarbons, and typically have no more than one or two kilometres of electric range. In the case of mild hybrids, they only have torque assist, not usually an outright electric mode.

As the market continues to settle down from the policy changes, we can expect PHEVs to recover slightly, and for BEVs alone to reach above 20% share by the end of Q3.

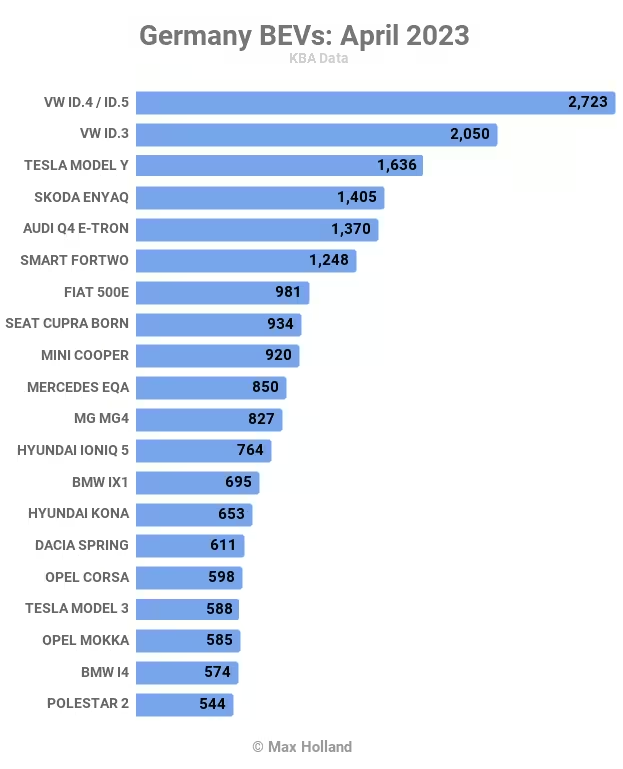

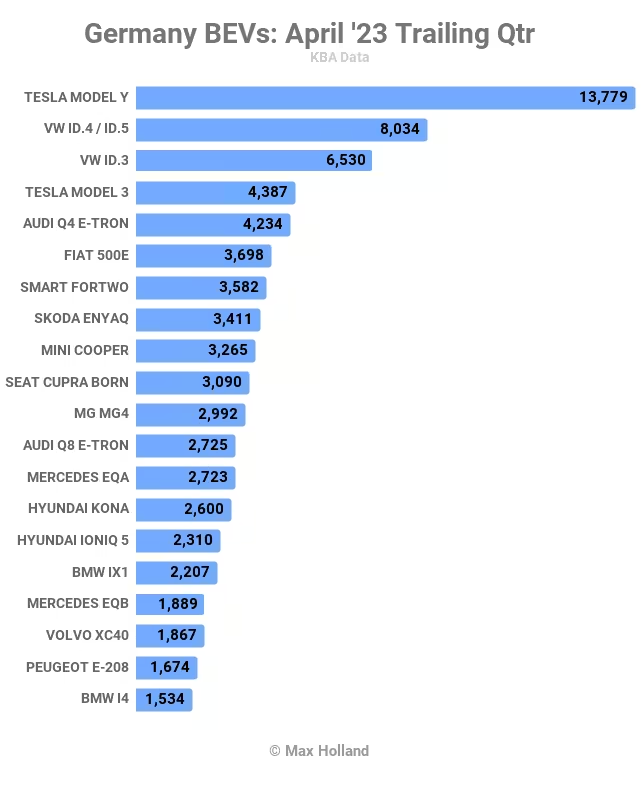

Bestselling BEVs

April’s bestselling BEV was the Volkswagen ID.4 / ID.5. The runner up was the smaller sibling, the Volkswagen ID.3, and the Tesla Model Y came in third.

Apart from some shuffling of already established models, there is not much news to report from the top 20, and no new faces joined. Most models — in line with the overall market — saw more modest volumes in April, than in March.

Further down the rankings, the new Lexus RZ delivered its first 16 units to the German market, the only new BEV model to appear this month. April also didn’t see any fast-ramp-up growth stories from newer BEV models, with cars like the BYD Atto 3, and Smart #1 mainly just treading water (for now at least).

Let’s look at the normalised trailing 3-month model rankings:

Here, the Tesla Model Y shows its popularity, significantly ahead of even the second place Volkswagen ID.4 / ID.5.

There are not many significant changes in the top 20, apart from a couple of newish models that already climbed to claim their position in the rankings. One is the MG4 with, with first units delivered back in September, has now climbed to 11th spot. This is arguably Europe’s most affordable fully-competent BEV, so its fast climb to 11th is no great surprise.

Likewise, the BMW iX1, which debuted back in November, has already climbed to secure 16th spot, and has potential to go a bit higher. With the demise of the i3, the iX1 is now BMW’s most affordable BEV.

Just outside the top 20, currently in 24th, the new Ioniq 6 sedan (debuted in February) is already doing well, and may well regularly feature in the top 20 soon.

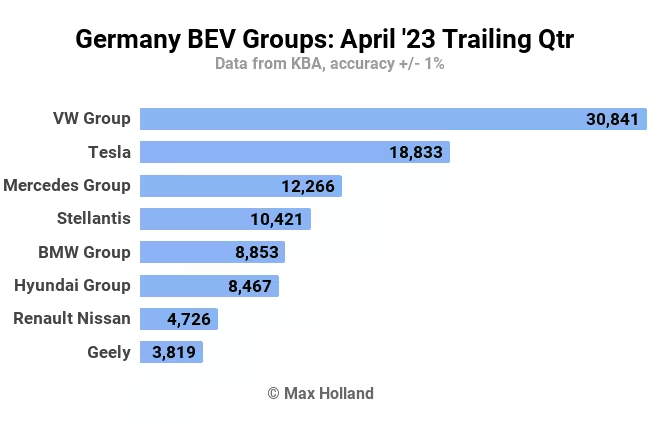

Let’s now check in on the manufacturing group performance:

Here, Volkswagen Group has a strong lead, from Tesla in second, the same top 2 positions as 3 months ago. Yet Volkswagen Group has grabbed an additional 1.8% share of the BEV market since then, while Tesla has maintained fairly steady share.

Mercedes Group leads the pack of followers, in third position, and has improved share of the BEV market, from close to 8% previously, to close to 12% now. BMW has likewise gained, from just over 5% share, to just over 8% share.

Conversely, both Stellantis, and Renault-Nissan, lost share over the period.

Outlook

The overall economic outlook in Germany is still cloudy, according to the latest data. Although February was more positive than had been feared, March was weaker, says ING. Some analysts fear that a decline in factory orders in March may signal a recession coming, even against the backdrop of a decently robust January and February. Overall inflation remains at 7.2%, with food and energy inflation that consumers are exposed to, much higher still.

The auto market’s 12.6% YoY growth was better than most other sectors, and the even stronger YoY growth in BEV share bodes well for the continuing transition to cleaner transport. The question will be whether the high inflation, and weak economy, will put a negative dampener on consumer sentiment. Especially for expensive purchases like cars, including BEVs.

What are your thoughts on Germany’s auto market, and transition to cleaner transport? Please join in the debate in the comments below.