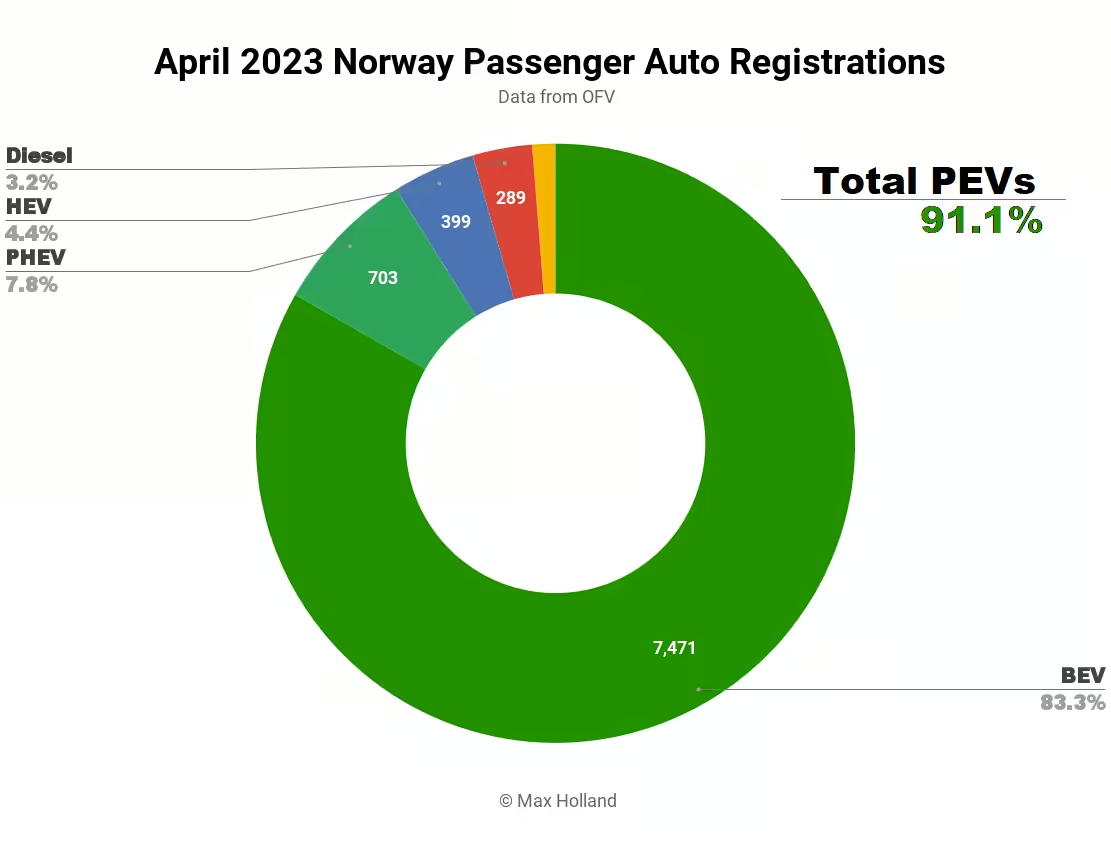

Norway increased its plugin electric vehicle market share to 91.1% in April 2023, up from 84.2% year-on-year. The auto market is still settling down after policy changes that came in at the start of the year. Overall auto volume was 8,976 units, down 7.7% year-on-year. The bestselling vehicle was, again, the Tesla Model Y.

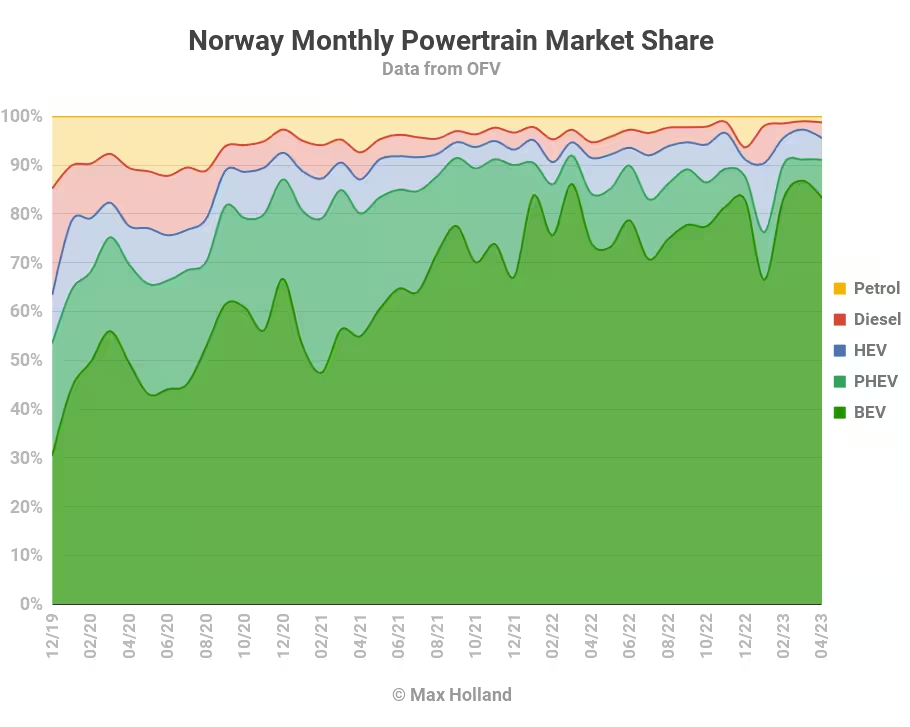

This is the first time Norway has seen 3 consecutive months with combined plugin share staying above 90% (see graph below). April’s combined share of 91.1% comprised 83.3% full battery electrics (BEVs), and 7.8% plugin hybrids (PHEVs). This compares to respective YoY scores of 84.2%, 74.1%, and 10.1%. We can see that BEVs have continued to grow, whilst PHEVs have been squeezed.

Looking at unit volumes, against the background of a 7.7% overall market drop YoY, BEVs grew volume by 3.7% to 7,471 units. PHEVs shrunk in volume by some 28%, down to 703 units.

All other powertrains lost volume YoY, with petrol-only vehicles at their 2nd lowest volume of the modern era (just 112 units), and 3rd lowest share ever, just 1.25% of the auto market.

As we noted for the neighbouring Swedish market, plugless hybrids (HEVs) are now passée in Norway, such is the country’s advanced stage of the EV transition. Their share dropped from 7.3% to 4.4% YoY.

Recall that new tax changes have applied from January 1st. Although these introduced some BEV taxes for the first time, mostly falling on heavy and expensive BEV models, taxes fell harder still on vehicles with CO2 emissions. This is why, for example, we are seeing petrol-only models taking a steeper dive, relative to the diesels (and HEVs) which typically have slightly lower per-kilometre emissions ratings. PHEVs, with their middling emissions ratings, are taxed somewhere in between.

The auto market pattern should mostly resettle sometime in Q3, but there is also the confounding factor of the long time period between placing orders and taking deliveries (registrations). This can be 6 to 12 months or more in some cases (especially for BEVs), so the 2023 market will continue to be somewhat shaped by orders placed under the previous tax regime, perhaps into Q4 2023, or even Q1 2024. Nevertheless, we should get a decent sense of the new trend in powertrain shares, by the end of Q3 this year.

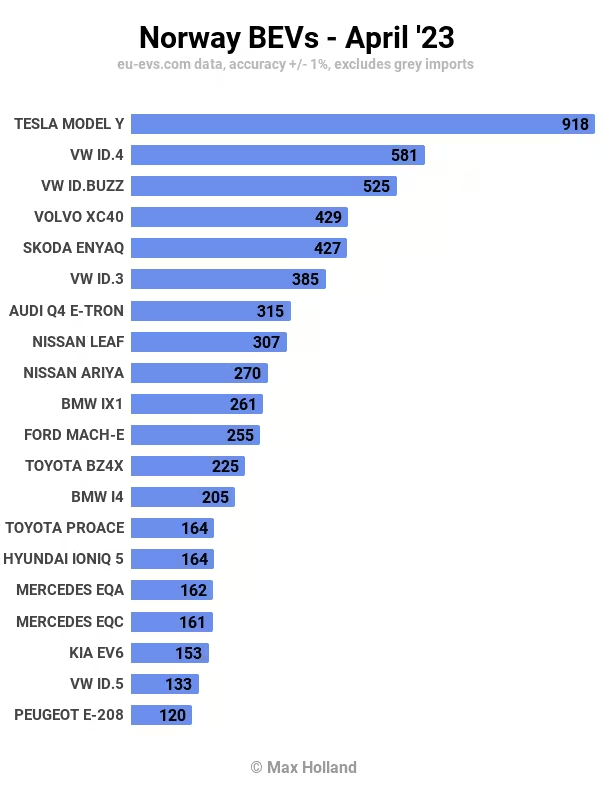

Bestselling BEVs

The Tesla Model Y took the top spot in April — the first time it has done so in the initial month of a new quarter. This is down to Tesla’s improved shipping logistics, thanks to increasing steady European supply coming from Gigafactory Berlin-Brandenburg. We can expect this pattern of more even monthly deliveries to continue to improve, though the Shanghai units, that continue for now to comprise a significant portion of Europe’s supply, will still arrive in peaks and troughs.

In second place was another favourite, the Volkswagen ID.4, and the third spot was taken by its sibling, the ID.Buzz.

In terms of notable performances, in the middle of the table, the Nissan Ariya registered its highest monthly volume to date, with 270 units, and may still have more room to grow.

Conversely, the Toyota BZ4x, which had claimed second place in March (with 1,016 units), seems to be suffering from international logistics irregularities (à la Tesla-of-old), and was back down to 225 units (and 12th spot) in April.

As for newcomer BEV models, just as we saw in neighbouring Sweden, the Toyota’s group sibling, the Lexus RZ450e made its debut in Norway in April. Although sharing most of the same underpinnings, the Lexus is slightly bigger, heavier, and a bit more powerful than the BZ4X, with more luxury (and price), at the cost of slightly lower range.

Due to having a relatively modest battery for a large-ish SUV (64 kWh usable), and underwhelming efficiency, the real-world range is not class leading, but may be enough for some folks, given Norway’s well developed DC infrastructure. Let’s see how it gets on.

We will now take a look at the longer term rankings:

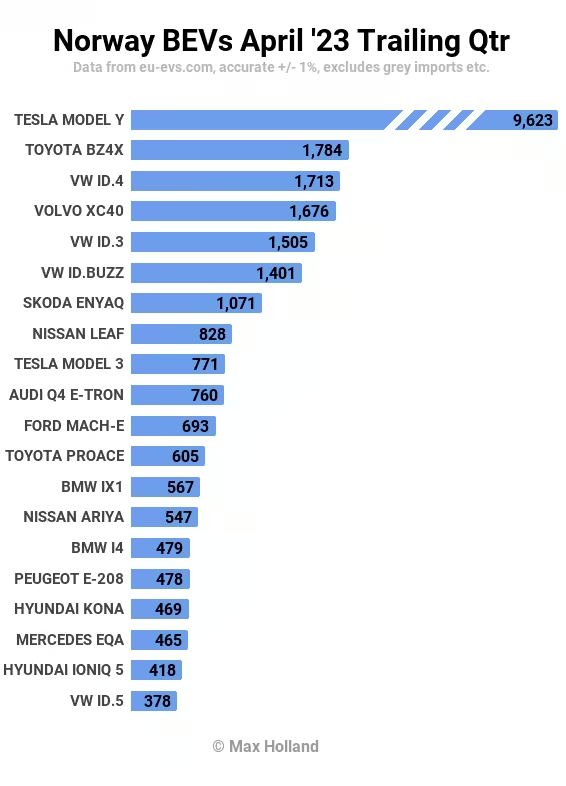

In the trailing 3-month picture, the Tesla Model Y’s overall dominance is more clear to see (note that the Model Y still has to be trimmed to fit on the graph)! It has 5.4 times the volume of the runner up, Toyota BZ4X. Other models in the top 20 are mostly familiar faces, with no great surprises.

It’s interesting to see the Volkswagen ID.Buzz quickly becoming so popular, as the first “Minivan” BEV that is designed for families and private consumers (rather than commercial use, and taxis). It is looking like Volkswagen may succeed in its dream to reboot the popularity of the classic “transporter” van/bus that first launched with the “T1” way back in 1949.

Outlook

As we have discussed previously, having quickly become a more important fossil fuel exporter to Europe over the past year, Norway’s macro-economic situation is much more positive than that of its European neighbours. However, price inflation of traded products, including fuel and fuel, still affects the pocket-book of Norwegian consumers and families, including those considering auto purchases. Yet this is unlikely to put a noticeable dent in Norway’s EV transition in the medium to long term.

As discussed above, the auto market is currently resettling from the January 1st policy changes, and we will be able to get a sense of the new pattern by Q3. I would expect that — after September 2023 — plugins will only very rarely drop below 90% of the market. December should see closer to 95% than 90%, for the first time. In my view, the remaining few percent will still depend on new BEVs in the affordable sub-compact class (BYD Seagull anyone?), and a few other small niches (sports cars, farmers’ pickups, and others) to be filled out with compelling and relatively affordable BEV offerings.

What are your thoughts on Norway’s EV transition? Please join in the discussion below.