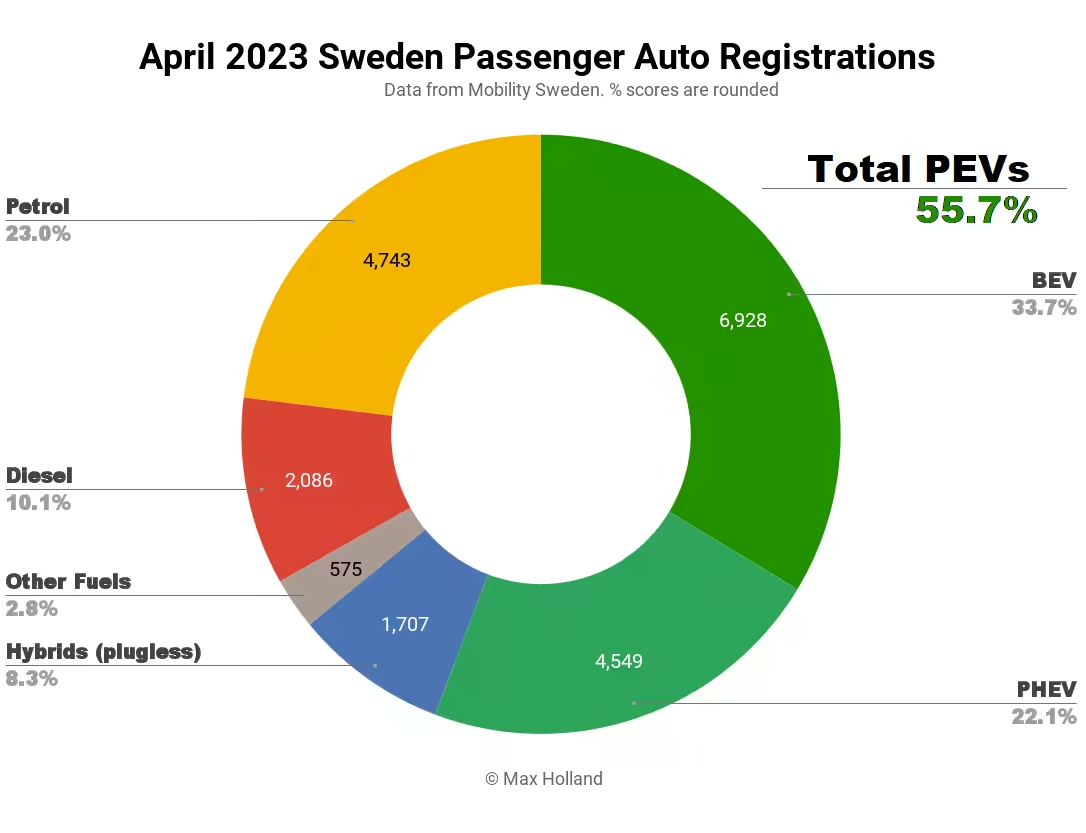

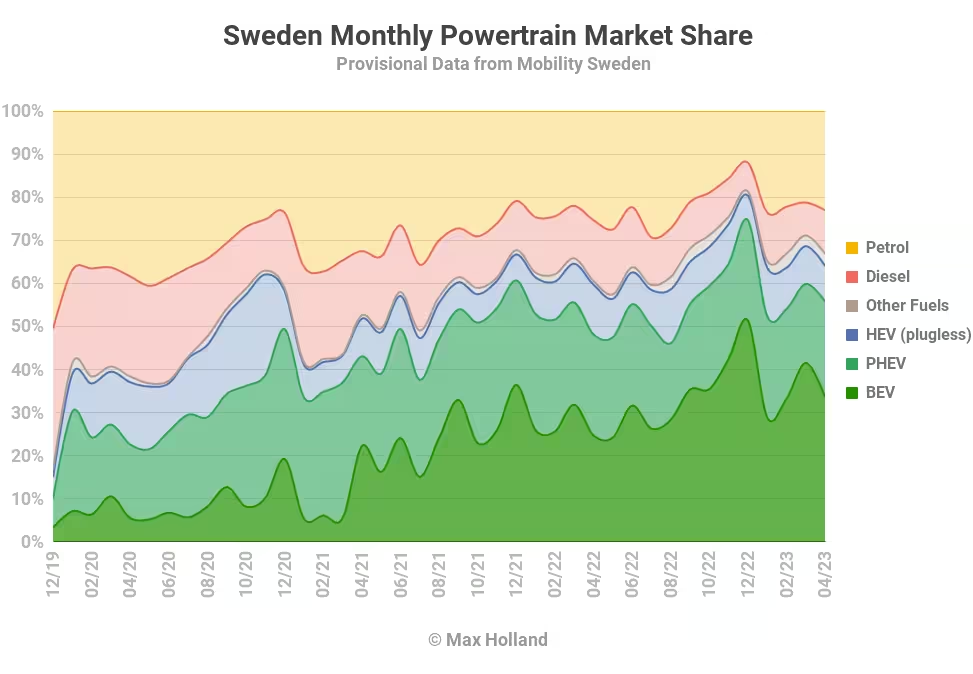

Sweden’s plugin electric vehicle share reached 55.7% of the auto market in April, up from 48.2% year on year (YoY). Full electrics grew share strongly, whilst plugin hybrids lost share slightly. Overall auto market volume was 20,588 units, down some 6% YoY, and down 35% from pre-2020 seasonal norms. The bestselling full electric vehicle was the Volvo XC40.

April’s combined plugin result of 55.7% comprised 33.7% full battery electrics (BEVs), and 22.1% plugin hybrids (PHEVs). These shares compare, respectively, with YoY figures of 48.2%, 24.7%, and 23.4%. Thus, BEVs have grown share at a healthy clip, whilst PHEVs saw a slight trimming.

In terms of volumes, against a 6% shrinking overall market, BEVs increased YoY volume by some 28%, to 6,928 units. PHEVs lost just over 6% volume, thus shedding market share overall.

Whilst some other regions, less far along the EV transition, are seeing a rise in HEVs (plugless hybrids — a temporary transition technology), in Sweden (and Norway), this category is already becoming passé. Sweden’s HEV share dropped YoY from 11.5% to 8.3%.

Diesels also dropped share YoY, from 14.1% to 10.1%.

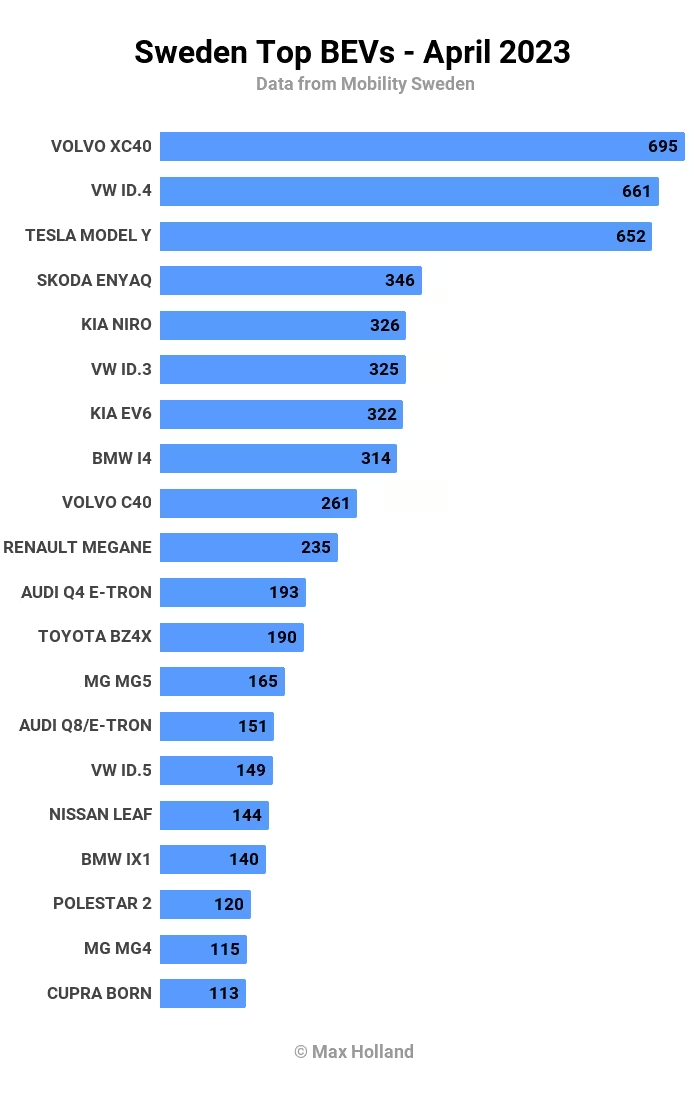

Bestselling BEVs

April’s bestselling BEV was the Volvo XC40, registering 695 units. This is the 5th time in the past 6 months the XC40 has taken the top spot.

The runners-up are the Volkswagen ID.4, and the Tesla Model Y, both close behind the Volvo.

Further down the rankings, the Toyota BZ4X — after 8 months of hiatus to resolve teething problems — has recently stepped up volume in Sweden, and hit a new high of 190 units in April (12th spot). The Lexus-brand variant of the BZ4X, called the Lexus RZ, also made its debut in Sweden in April, with a modest 12 units registered. It shares the same format and underpinnings as the BZ4X, but has greater motor power, is slightly larger and heavier (4805 mm long, and 2296 kg), with slightly less real-world range, and a higher price tag (from 67,000€ and up).

There was no other news about BEV newcomers. The Nio ET5, which first appeared last month with 6 units, is still just treading water for now, with 3 units in April.

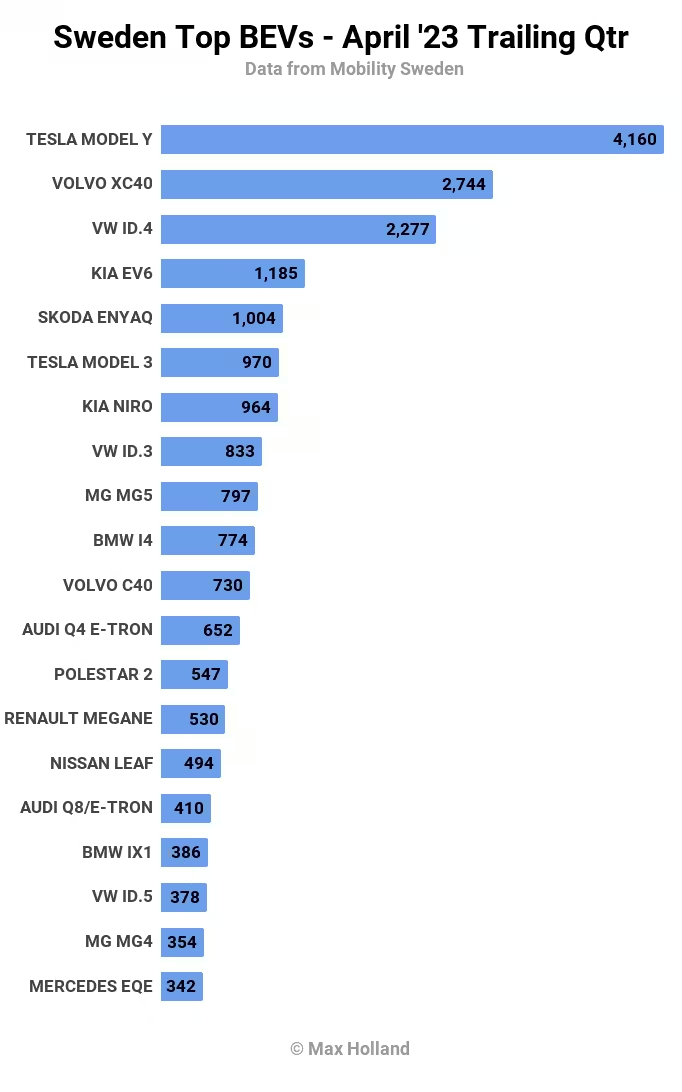

Let’s look at the longer term sales charts:

Tesla significantly leads the trailing 3-month chart, with over 50% greater sales than the second placed Volvo XC40, thanks to a huge volume in March.

It is good to see a relatively affordable touring (or “estate”) BEV in 9th, the MG5. It seems this format may still be popular in some parts of Europe, though the MG5 is the only BEV example available so far.

The still-somewhat-new BMW iX1 (the brand’s most affordable BEV since the phasing out of the i3 in most markets) continues to make quiet but steady progress in Sweden. Since its November debut, it has already climbed into the top 20, and has recently posted monthly registration numbers between 120 and 150 units, with potential to climb further.

With few other new models arriving in volume, there are no major changes or large surprises in the charts since last month. Let’s keep an eye open for which, if any, new BEV models — in what volumes — might arrive later in the year and be able to shake up the rankings.

Outlook

The Swedish economy got a slight reprieve in Q1 with the Riksbank finding a (provisionally calculated) 0.3% growth YoY. This appears to point to a shallower and later economic downturn in 2023 than was previously expected. Despite this, consumer sentiment remains generally low, which will affect purchases in the auto market. This has already been mentioned by Mobility Sweden as the main reason for the 6.2% auto market shrinkage in April (and 9% decline YTD).

This climate combines with the November 2022 changes to the environmental bonus for plugin vehicles, which should start to be felt in Q3, once earlier backorders are worked through. We will have to see what happens to plugin volume after that. As always, the long-term economics of plugins still has advantages, relative to plugless alternatives, at least for those consumers who are able to afford the higher initial entry-price.

What are your thoughts on Sweden’s EV transition and outlook? Please share your perspective in the comments below.