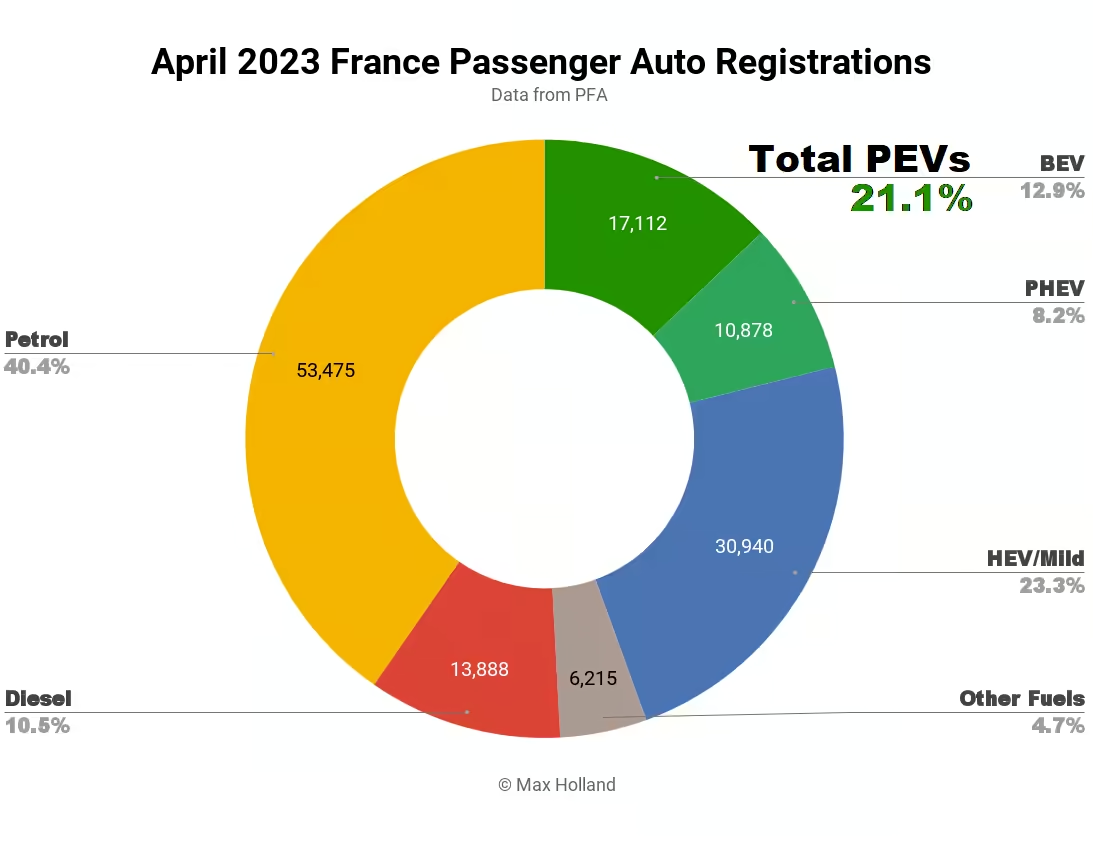

France saw plugin electric vehicles take 21.1% share of the auto market in April, flat year-on-year, in a growing overall market. Full battery electrics, however, grew share, whilst plugin hybrids dropped share. Overall auto volume was 132,509 units, up some 22% YoY, though still far below pre-2020 seasonal norms (~183,000). The bestselling plugin was the Dacia Spring.

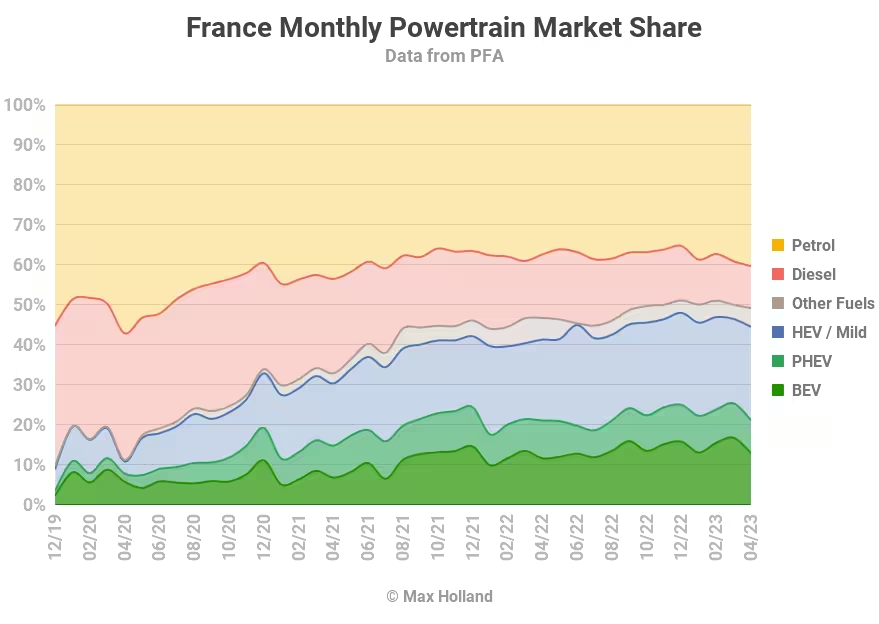

April’s combined plugin result of 21.1% comprised full battery electrics (BEVs) at 12.9%, and plugin hybrids (PHEVs) at 8.2%. These compare with respective YoY figures of 21.1%, 11.7%, and 9.4%. We can see that BEVs are still growing decently, whilst PHEVs are sliding.

In volume terms, against an overall market up 22%, BEV volume grew almost 35% YoY, to 17,112 units. PHEVs only grew volume by 6% YoY (to 10,878 units), trailing broader market growth, and thus losing share.

Diesel share shrank to a new record low of 10.5% (from 15.8% YoY). Petrol share however took up some of the slack, and grew to 40.4%, the highest level seen since July 2021! This is temporary, the clear long-term trend remains declining combustion-only share over time.

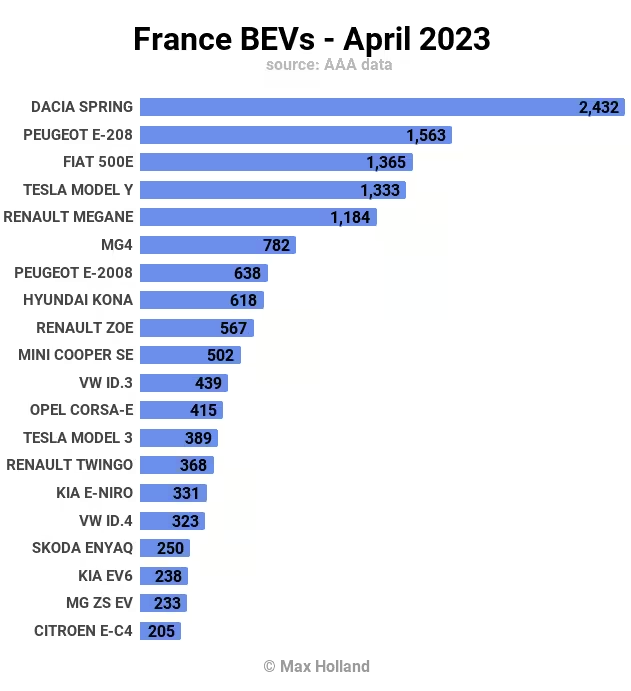

Bestselling BEVs

After Tesla’s record French volume push in March, other brands had a chance to shine in April. The diminutive Dacia Spring was back on top, with 2,432 units, followed by the Peugeot 208 in second, and the Fiat 500 in third.

There were no newcomers in the top 20, and most models saw a decline in sales volume compared to the end-of-quarter push in March. In fact, the only notable newcomer to the French market was the BYD Atto 3, with just 5 initial units for sampling. We will have to wait till later in the year for new models to be launched in volume.

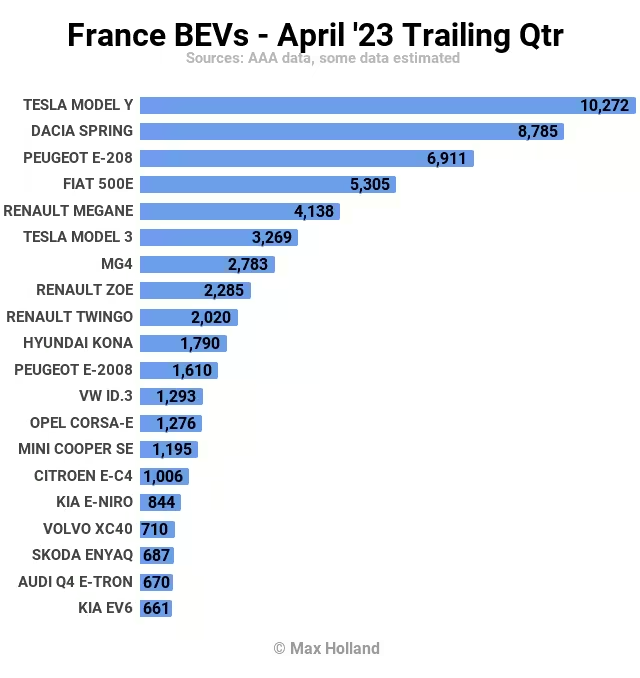

Let’s now look at the trailing 3 months:

Here we find most of the usual faces, with some mild shuffling of ranking. The Tesla Model Y remains on top, largely thanks to its March performance. The Renault Megane has dropped off slightly in rank (and volume), from second to fifth, though mainly because the limited factory production is no longer just concentrated in the domestic market, but is now being shared across several European markets.

The movements in model ranking are modest and unremarkable, so I will skip the snakes-and-ladders analysis this time around.

That the Tesla Model Y is now dominating the French BEV market, remains remarkable. This is 1.5x to 2x the price of most other BEV models in the top 10, and almost 3x the price of traditionally popular vehicles. This goes to show the importance of — not just offering a compelling value BEV (as others in the top 20 are also, e.g. the MG4) — but producing it in large enough volume to meet all potential demand and avoid long wait queues.

Outlook

The French economy is not in a great place, but better than many of its neighbours. Inflation remains high but somewhat stable at just under 6%. Economic activity remains sluggish, with just 0.6% growth forecast for 2023.

The auto market, with 22% YoY growth in April, is thus outperforming other areas of the economy and is a relative bright spot. Much of this is of course a rebound from the constrained auto supply chains of the past year or two. After the backlog of delayed orders is worked through, let’s look again at the auto market trend to see how it compares with the broader economy.

For those vehicle owners able to access time-of-use electricity rates, and able to afford the up-front price premium of a plugin vehicle, they remain better long-term value propositions than combustion alternatives. Continued growth in plugin market share will depend on energy price trends and consumer purchasing power — both shaped by the broader economic conditions.

What are your thoughts on France’s transition to EVs? Please jump in to the conversation below.