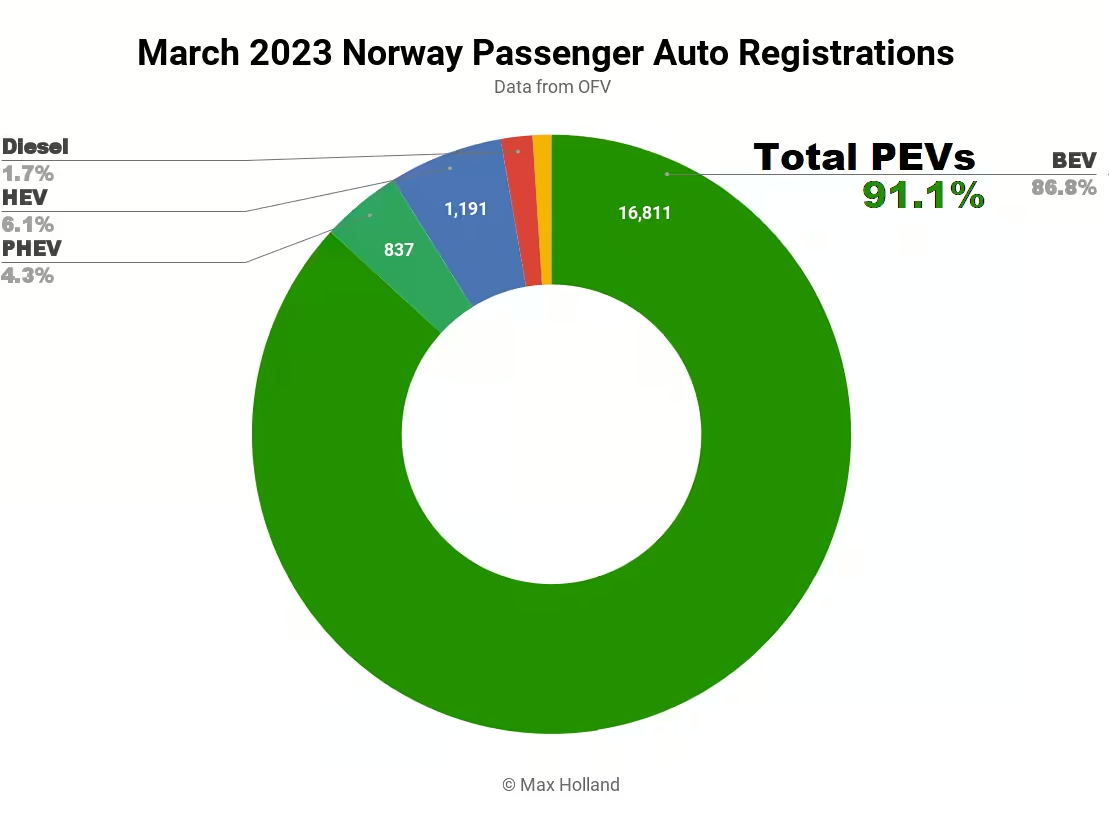

Norway’s plugin electric vehicles took 91.1% share of the auto market in March, down from 91.9% year on year. The slight dent in share came from a drop in plugin hybrid volume, against overall market growth. Overall auto volume was 19,366 units, up some 19% YoY, and the highest March sales since at least 2016 (though compensating from a hangover earlier in Q1).

The Tesla Model Y broke all records, with the highest monthly sales of any vehicle in Norway’s history, with 7,445 units registered, and over 38% of the entire auto market.

March’s combined plugin result of 91.1% comprised 86.8% full electrics (BEVs), and 4.3% plugin hybrids. Their respective shares a year ago were 91.9%, 86.1%, and 5.8%.

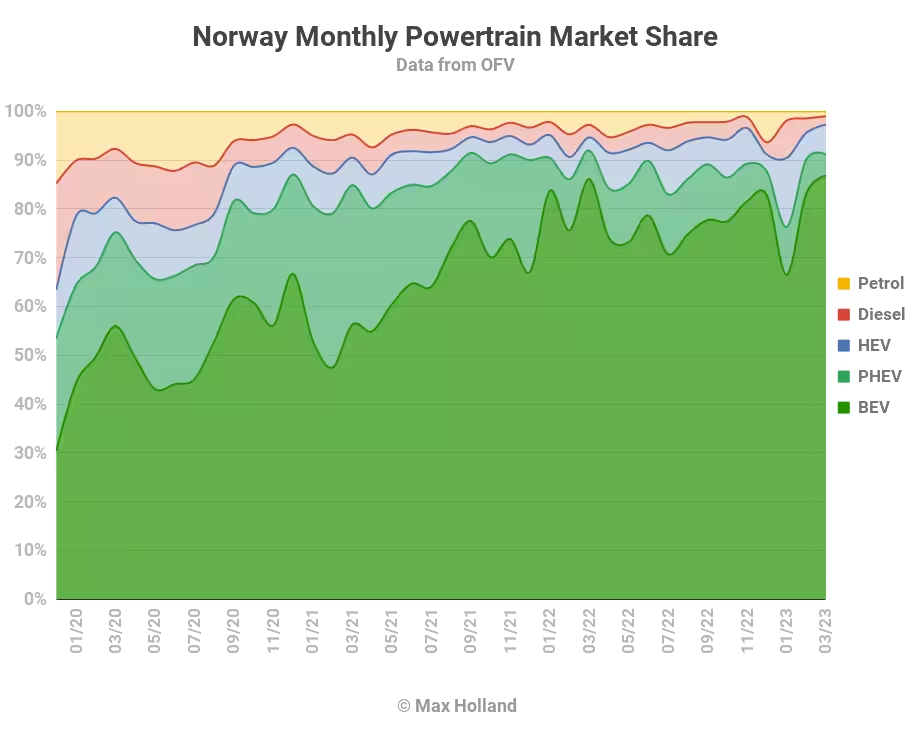

Plugless hybrids (HEVs) did better than PHEVs, growing their share from a year ago (6.1% from 2.7%). This is likely a temporary blip, the result of a resettling of the market following regulatory changes that came in on January 1st. Overall, HEVs have been on a long term decline since mid 2020.

Petrol-only vehicles saw their lowest share in modern history, taking just 1% of the market. Even adding in diesel-only vehicles, the combined ICE-only share was at a record low of 2.7%, from 5.3% YoY.

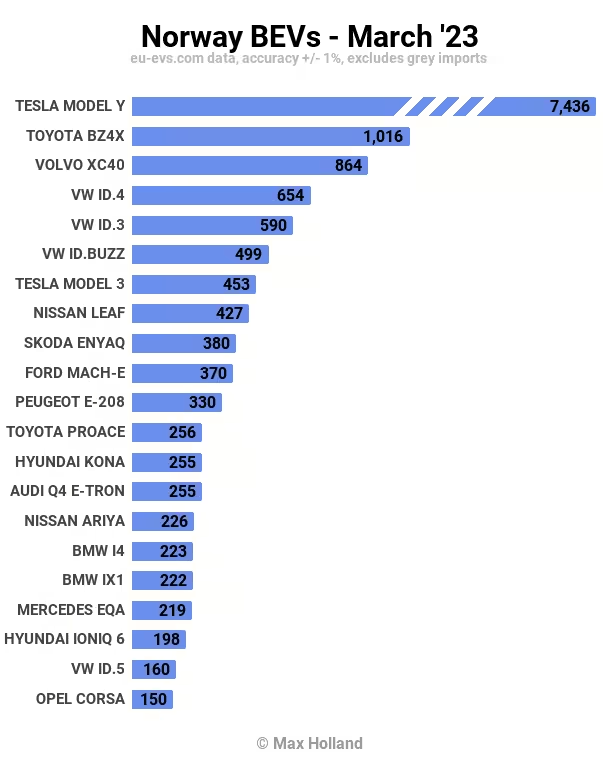

Norway’s Best Selling BEVs

The Tesla Model Y broke all records in March, with the OFV recording 7,445 units registered. This even exceeds the shock result of the Tesla Model 3 from March 2019 (5,315 units), in both volume, and in market share. The Model Y alone took over 38% of Norway’s new passenger auto registrations in March.

To give a sense of the scale of the Model Y’s achievement – consider that it sold almost the same volume as the rest of the top 20 BEVs combined!

Note that the performance of these other BEVs was not weak in absolute terms, it was roughly in line with March 2022. In the immediate shadow of the Tesla were the runners up, the Toyota BZ4X (repeating its 2nd place, first achieved in February), and the Volvo XC40, in third.

[Clarification: the unit numbers we use for our ranking charts use a different counting methodology from the OFV, so model totals differ slightly, typically within 1%].

The Volvo XC40 jumped ahead of the Volkswagen ID.4, and ID.3, pushing them down to 4th and 5th spots, respectively. The ID. Buzz saw its highest volume since December, and took 6th.

In other notable news, further back in the pack, the Peugeot 208 had its highest ever monthly volume (previous best was way back in August 2020), registering 330 units, and taking 11th spot. A similar personal best was gained by its slightly lower volume sibling, the Opel Corsa, just outside the top 20.

In terms of the progress of newer models: the Nissan Ariya (which debuted in August ’22) saw its highest ever monthly volumes (226 units), and climbed to 15th spot. The new Hyundai Ioniq 6 sedan build upon its debut last month, with a decent climb to 198 units, and 19th spot.

Finally, the Nio ET5 made its Norway debut in March, registering a healthy 41 initial units (for info on this new model, see my Sweden report).

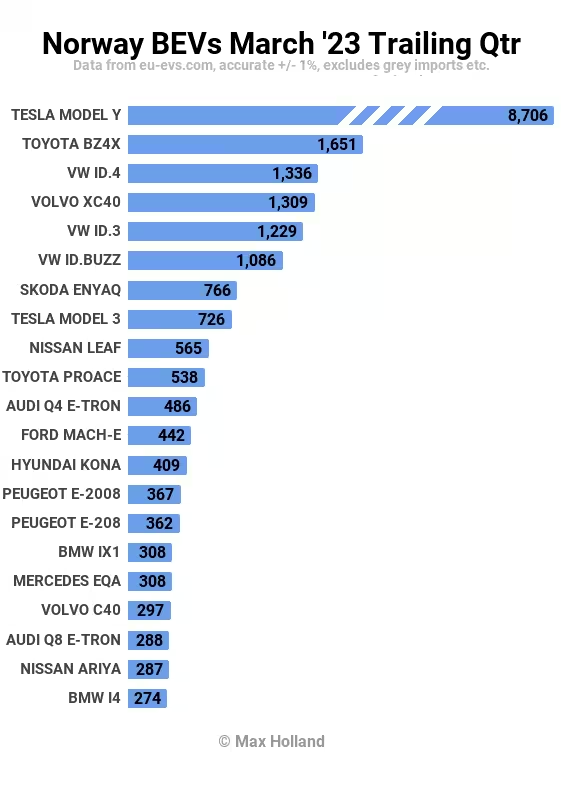

Let’s now step back for the broader view:

Thanks to the blowout performance in March, even over a 3 month timeline, the Tesla Model Y is heavily dominant!

The other notable climbs are by relative newcomers. After two decent months in Norway, the Toyota BZ4X — having suffered plenty of initial snafus — is now doing well, and has consolidated 2nd place, from 22nd in Q4 last year.

This seems to be a result of Toyota strongly tilting its supply towards Norway, more than any other country (even than the much larger German BEV market), and catching up on a long (delayed) queue of back-orders. We will have to see how it performs across Europe as a whole (as well as in other regions).

Another great climb has been seen for the new ID. Buzz, going from 18th in Q4, to 6th in Q1. Finally, another relative newcomer, the BMW iX1, has seen great progress, from its very first deliveries in December, climbing to 16th rank in Q1.

After the untimely demise of the BMW i3, the iX1 is the most affordable BMW BEV on offer, and we should expect it to be the brand’s bestseller over the medium term. For those keeping records, the iX1 a is mid sized SUV (almost the same length as the VW ID.4).

Here’s a brief summary of the largest top 20 movers since Q4:

Climbers:

- Toyota BZ4x up from 22nd to 2nd !!!

- VW ID.3 up from 14th to 5th

- VW ID. Buzz up from 18th to 6th

- Tesla Model 3 up from 52nd to 8th

- Hyundai Kona up from 30th to 13th

- Peugeot e-2008 up from 40th to 14th

- Peugeot e-208 up from 48th to 15th

- BMW iX1 up from 34th to 16th

- Nissan Ariya up from 32nd to 20th

Sliders:

- Skoda Enyaq down from 4th to 7th

- BMW iX down from 5th to 58th

- BMW i4 down from 6th to 21st

- Volvo C40 down from 7th to 18th

- Mercedes EQC down from 8th to 48th

- Polestar 2 down from 9th to 25th

- Audi Q8 e-tron down from 10th to 19th

- Hyundai Ioniq 5 down from 12th to 23rd

In a smaller market like Norway, a month or two of deliveries made (or paused) can be the equivalent of an on-or-off tap in influencing a model’s short term ranking. It doesn’t necessarily reflect the longer term relative demand for a model.

Outlook

Norway’s economy is escaping some of the worst of the fate of other European neighbours. We saw in yesterday’s report that neighbouring Sweden is now in an inflationary recession (“stagflation”). Norway has escaped this, partly due to its substantial fossil fuel exports (giving its current account a record surplus in 2022), against the backdrop of European energy supply disruption.

According to a recent forecast from the country’s central bank, Norges Bank, the economy is on track for modest 1.1% growth in 2023. Since energy and food are internationally traded, Norwegian consumer prices have also been exposed to Europe’s inflationary trends in recent months, despite the country’s overall balance of trade benefiting overall from the higher energy prices (via exports).

Much of the energy price inflation that Norwegian consumers are exposed to has been offset by an electricity subsidy scheme funded by the government (and its ballooning national surplus). So overall, the long term running cost advantages of plugin vehicles remain attractive, relative to ICE vehicles.

This being the case, combined with Norway being a relatively small auto market in terms of the volume to be satiated, we can expect the market share of plugin vehicles, especially BEVs, to continue the steady upward climb. The past 6 months have seen BEVs take more than 83% of auto sales. For BEV share to consistently reach into the 90% range, may require decent supply of a variety of compelling small, affordable models (BYD dolphin anyone?) These will be needed to displace the stubbornly continuing sales of HEV autos, like the Toyota Yaris, and Toyota Corolla (which together sold almost 1,000 units in March).

What are your thoughts on Norway’s EV transition and its likely end-game? Please jump in to the discussion below.