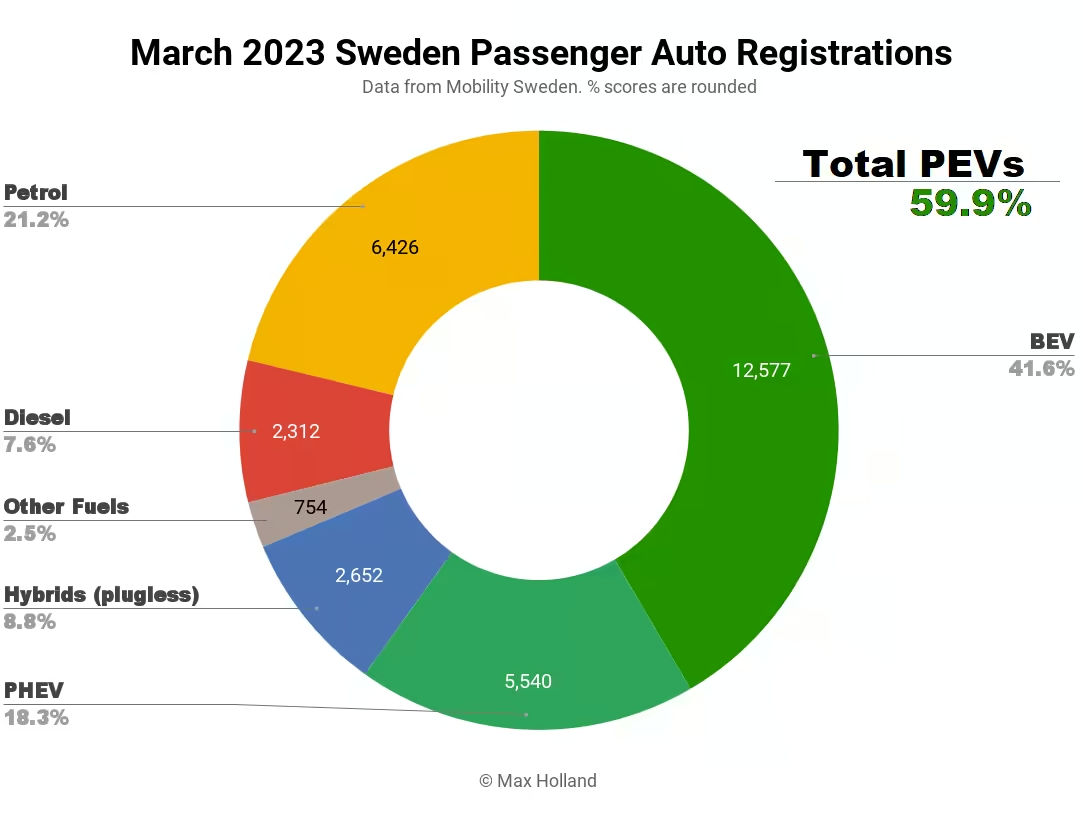

Sweden’s plugin electric vehicles took almost 60% of the auto market in March, up from 55.6% year on year. BEVs alone took 41.6% of the market, up from 31.8% YoY. Overall auto market volume was 30,261 units, up some 5% YoY, though still below historical seasonal norms. The Tesla Model Y was the overall best selling vehicle of any kind, taking 10.6% of all passenger auto sales!

March’s combined plugin share of 59.9% comprised 41.6% full electrics (BEVs), and 18.3% plugin hybrids (PHEVs). These shares compare YoY with 55.6%, 31.8%, and 23.7%, respectively.

It terms of volumes, BEVs were up nearly 38% YoY, while PHEVs were down by some 19%. Petrol-only vehicles, and HEVs, were essentially flat YoY, and diesels were down by over a third.

Diesel share of the market reached a near record low of 7.6% (only December ’22 was lower, at 6.7%). Petrol share looks set to regularly slide under 20% in Q3 or Q4 this year. Excepting the potential of anomalous logistics events, it is unlikely that non-plugins will ever get near to 50% share of the market again (and soon, 40% will be a stretch).

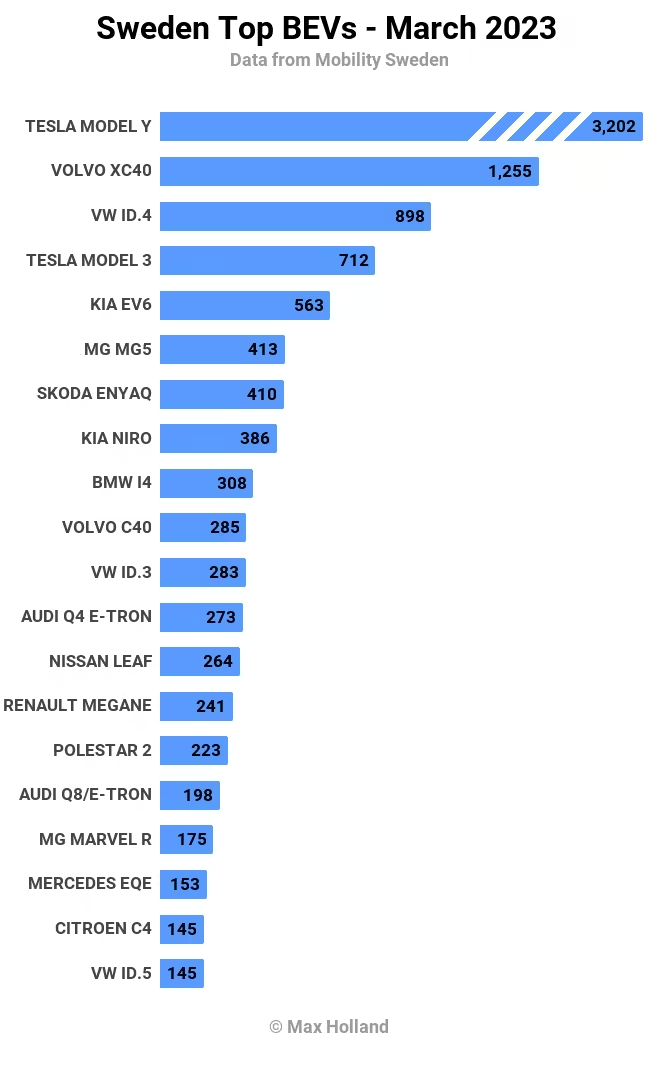

Sweden’s Best Selling BEVs

Tesla’s Model Y was (by far) the best selling BEV in March, and in fact the best selling of any auto, with a massive 3,202 units. This was 10.6% of the entire passenger auto market! Only the Volvo XC40 BEV has come close to this performance, taking 7.4% of the auto market last December.

This time around, the XC40 had to settle for second, with 1,255 units, far behind the Tesla. The Volkswagen ID.4 came in third (898 units).

There were no big surprises in the top 20, though let’s give a shout out to the good value MG5 for setting its volume record (413 units) and grabbing 6th spot.

Outside the top 20, a newcomer BEV model, the Nio ET5, showed its face for the first time with an initial 6 units registered. The ET5 is a premium priced, mid sized sedan, with long range, battery swapping, and with a tech focus. For comparison, its monthly lease cost is about 10% more than the Tesla Model 3 Dual Motor, and is around 10cm longer in size, with similar performance.

At this price point, the Nio will obviously remain a niche vehicle, but may push innovation in this upper end of the market, and may perhaps get Nio closer to releasing more affordable future vehicles.

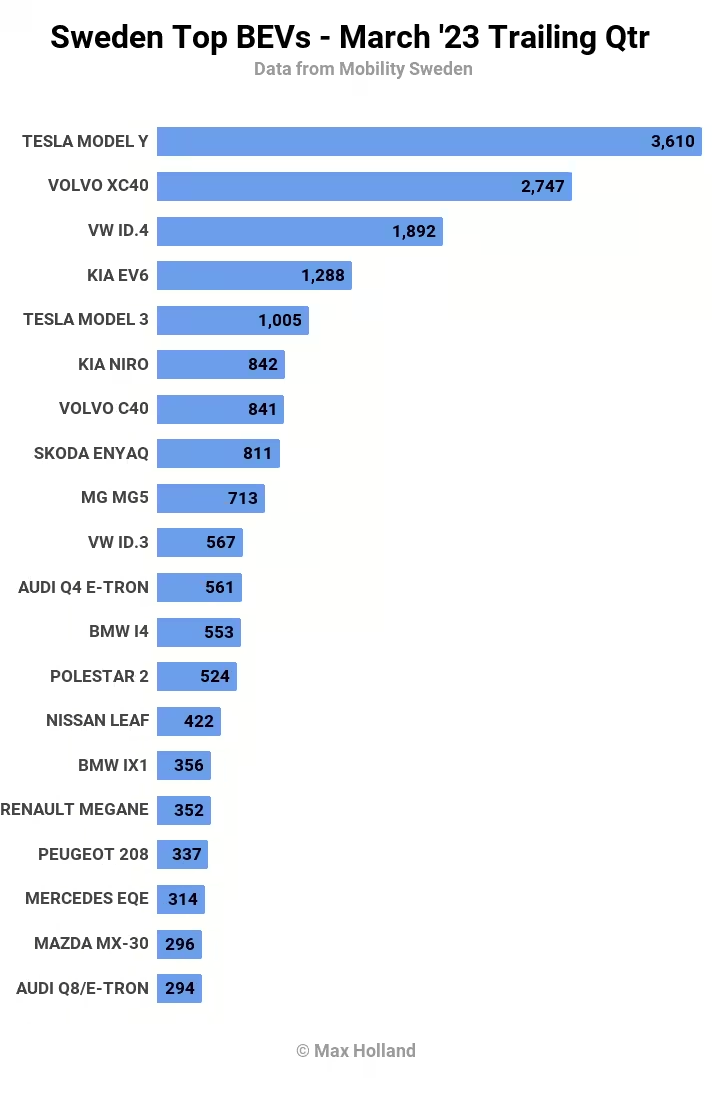

Let’s look at the 3-month view:

The Tesla Model Y has now jumped up into first place, from 4th as recently as last quarter. The former leader, the Volvo XC40, has been displaced, now in 2nd, and the VW ID.4 has likewise been shuffled down a spot, into 3rd.

Let’s summarize the main climbers compared to the previous (October-to-December) period:

- Tesla Model Y up from 4th to 1st

- Kia EV6 up from 9th to 4th

- Tesla Model 3 recovering from 37th to 5th

- MG5 up from 18th to 9th

- BMW i4 up from 23rd to 12th

These models were amongst those dropping back:

- Volvo C40 fell from 3rd to 7th

- Polestar 2 fell from 5th to 13th

- Nissan Leaf fell from 8th to 14th

With Tesla’s local European production now passing 22,000 units per month (and still climbing), and with Shanghai production still supplementing that, the Model Y is now looking ever harder to displace from the BEV lead across almost all European markets.

In markets already well down the path of the EV transition, the Model Y has a decent chance to be the overall best selling vehicle. This despite its price tag of €45,000 to €48,000, for the entry variant!

Outlook

Sweden’s auto industry organization, Mobility Sweden, has recently downgraded its overall auto sales forecast for 2023, from 290,000 down to 265,000 units. It cites the overall economic conditions for consumers, as well as the cancellation of plugin incentives in November 2022.

“In recent times, the Swedes have been hit by higher interest rates, inflation and generally increased living costs” said CEO Mattias Bergman (Machine Translation).

The inflation rate stands at 12% (and is still on an upward trend), whilst house prices are falling, and the economy has recently been forecast to recess by 0.6% this year.

Obviously this will put a brake on consumer orders for new autos, potentially including BEVs. Since there is a large order backlog of autos, and especially BEVs, it may only be in late Q3 that any downturn in sales becomes clear, so we will have to wait and see.

As usual, those who have enough upfront capital to pay the premium for a plugin are then able to access better overall value in total costs of ownership, due largely to energy cost savings. Depending on how hard consumer spending gets hit, we should expect the relative demand for plugins, especially BEVs, to remain stronger than that of non-plugins, throughout much of 2023.

What are your thoughts on Sweden’s EV transition? Please jump in to the discussion below.