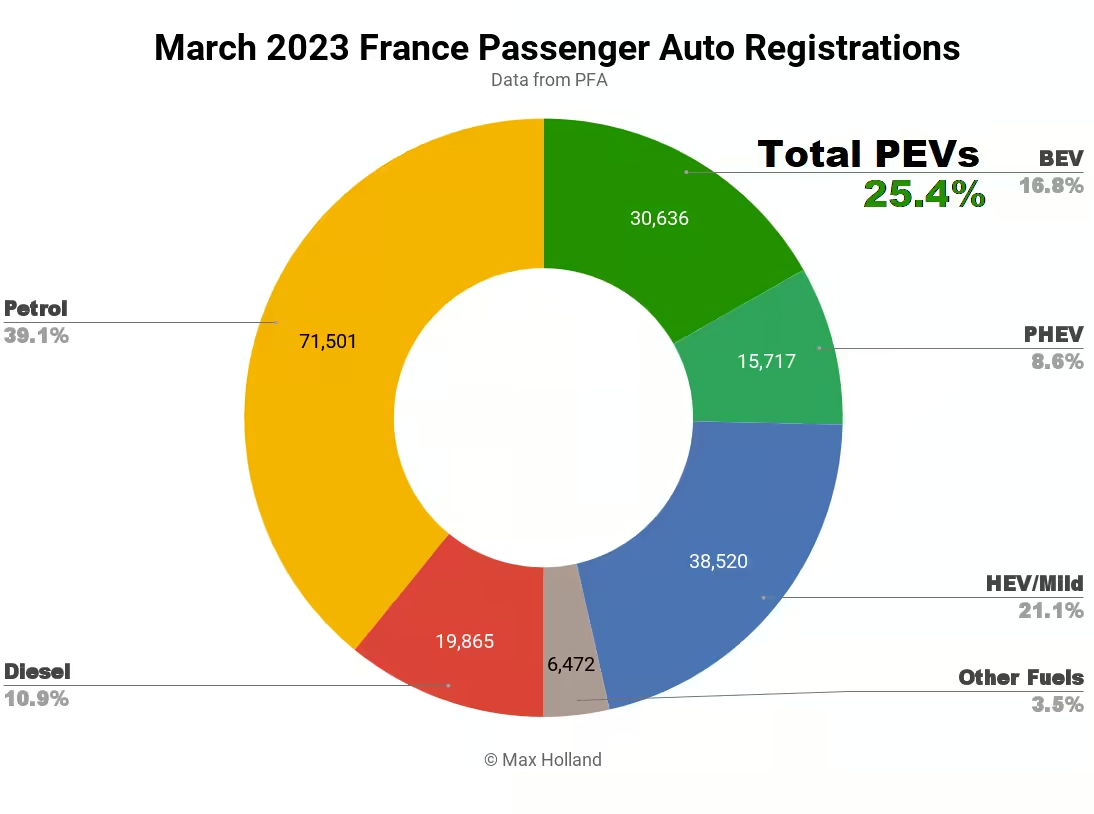

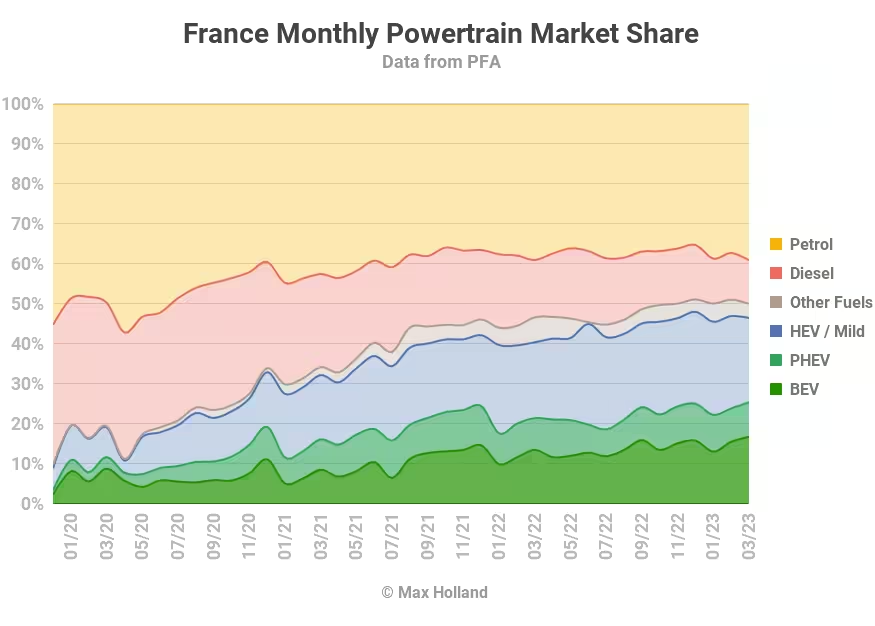

France saw record high plugin electric vehicle share in March, at 25.4%, up from 21.4% year on year. BEVs alone took 16.8% share, a new record. Overall auto volumes were 182,712 units, up some 24% year on year, though still well off the pre-2020 seasonal average (~230,000 units). The Tesla Model Y was the best selling BEV, and 4th highest selling auto overall.

March’s combined plugin result of 25.4% share comprised 16.8% full electrics (BEVs), and 8.6% plugin hybrids (PHEVs). These figures compare YoY with shares of 21.4%, 13.5%, and 7.9%, respectively.

In volume terms, with the overall auto market up over 24% YoY, all powertrains saw some volume growth except for diesel (down 5.7% YoY to 19,865 units). BEVs saw record volume of 30,636 units (up over 54% YoY), with PHEVs at a near record 15,717 units (up 34%).

Combined traditional combustion-only powertrains managed to cling on to 50% share of the market, perhaps for the last time. Diesel alone was down to a record low of 10.9% share in March (from 14.3% YoY).

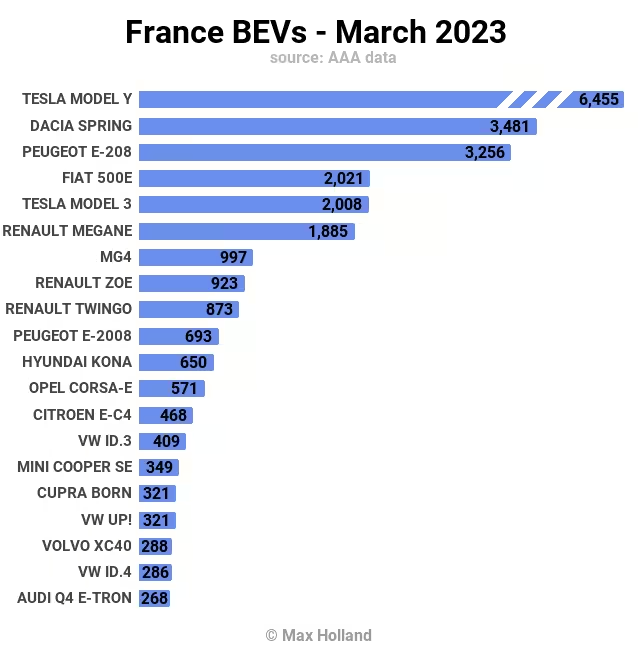

France’s Best Selling BEVs

Tesla’s Model Y took the top spot in March, with 6,455 units. The runners up were the Dacia Spring (3,481 units) and Peugeot e-208 (3,256 units).

The Model Y was also the 4th best selling auto overall (behind the Peugeot 208, Renault Clio, and Citroen C3). Along with 2,008 units of the Tesla Model 3 (5th spot), this was Tesla’s best ever monthly volume in France.

For once, we have fairly full BEV model sales data for March (and for 2023 YTD) from AAA Data, and so we can present a top 20 chart:

With Tesla’s Berlin Gigafactory now ramping production past 22,000 units per month (all for the European market), we can expect the Model Y to be a regular showing at or near France’s top spot.

The other models populating the top 10 are — as usual — mostly relatively affordable compact or small vehicles like the Fiat 500, Renault Megane, MG4, Renault Zoe and Renault Twingo.

Outside the top 20, newer faces that we can detect for the first time in the March data include the Opel Astra, the BYD Atto 3, and Genesis G80. The latter two each only registered a single unit, they will climb from here.

The Opel Astra has already registered 66 units year-to-date (likely mostly demonstration units), and should become one of Stellantis’ high volume sellers, alongside its platform sibling, the upcoming Peugeot e-308. Each of these new models will offer both hatchback, and tourer/estate formats.

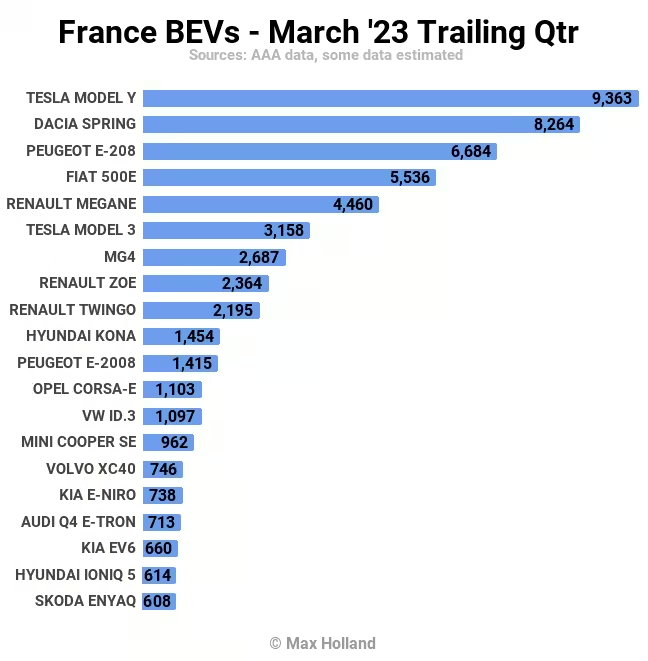

Let’s look at the longer term sales trends:

There have been a few changes since 3 months ago (October-to-December). Whereas previously the Tesla Model 3 had been in the lead, the Model Y has now taken the top spot (from 3rd previously), and the older sibling has dropped to 6th (with under half the previous volume).

Meanwhile, the Dacia Spring, Peugeot e-208, and Fiat 500 have also climbed, while the Renault Megane has fallen. Here’s the summary of the main movers in the top ranks, compared to 3 months prior:

The main climbers:

- Tesla Model Y up from #3 to #1

- Dacia Spring up from #4 to #2

- Peugeot 208 up from #5 to #3

- Fiat 500 up from #6 to #4

- MG4 up from #13 to #7

- Renault ZOE up from #12 to #8

The following models lost position:

- Tesla Model 3 down from #1 to #6

- Renault Megane down from #2 to #5

- Volkswagen ID.3 down from #7 to #13

- Mini Cooper down from #8 to #14

The Tesla Model Y is now looking unassailable (and not just in France, but across Europe, and the wider world). Why? Mainly because it is both a compelling offering (with access to Tesla’s reliable charging network) and is being produced in very high volume. There are plenty of other compelling (and good value) BEVs on the market – in France the MG4 especially comes to mind – but almost none are being produced in anything close to the Model Y’s volume.

Outlook

March saw the 7th consecutive month of YoY auto volume recovery in France, in part due to supply chain constraints lifting. Amongst growing overall auto supply, it’s good to see BEVs making more progress than any other powertrain, and breaking new ground in monthly sales volume (higher even than the recent December peak).

The French National Bank’s deputy governor recently predicted modest (0.6%) overall economic growth this year, and 1.2% next year. Lacklustre, to be sure, but better than many of France’s neighbours who face outright recession this year. Inflation is coming under control (5.6% from 6.3% previously). Ongoing large popular protests across the country, however, may yet throw a spanner in the works of the economy in 2023, including perhaps the auto industry.

For those still able to access cheap time-of-use discount rates for electricity, the relative running costs of plugins remain very attractive, against the prospect of now rising road-fuel prices. This long term total-cost-of-ownership advantage is still driving demand for plugins relative to ICE autos, and will continue to do so. We can thus expect to see plugin market share continue to grow throughout 2023, despite what might happen to over auto volumes.

What are your thoughts on France’s EV transition and outlook? Please join in the discussion in the comments section below.