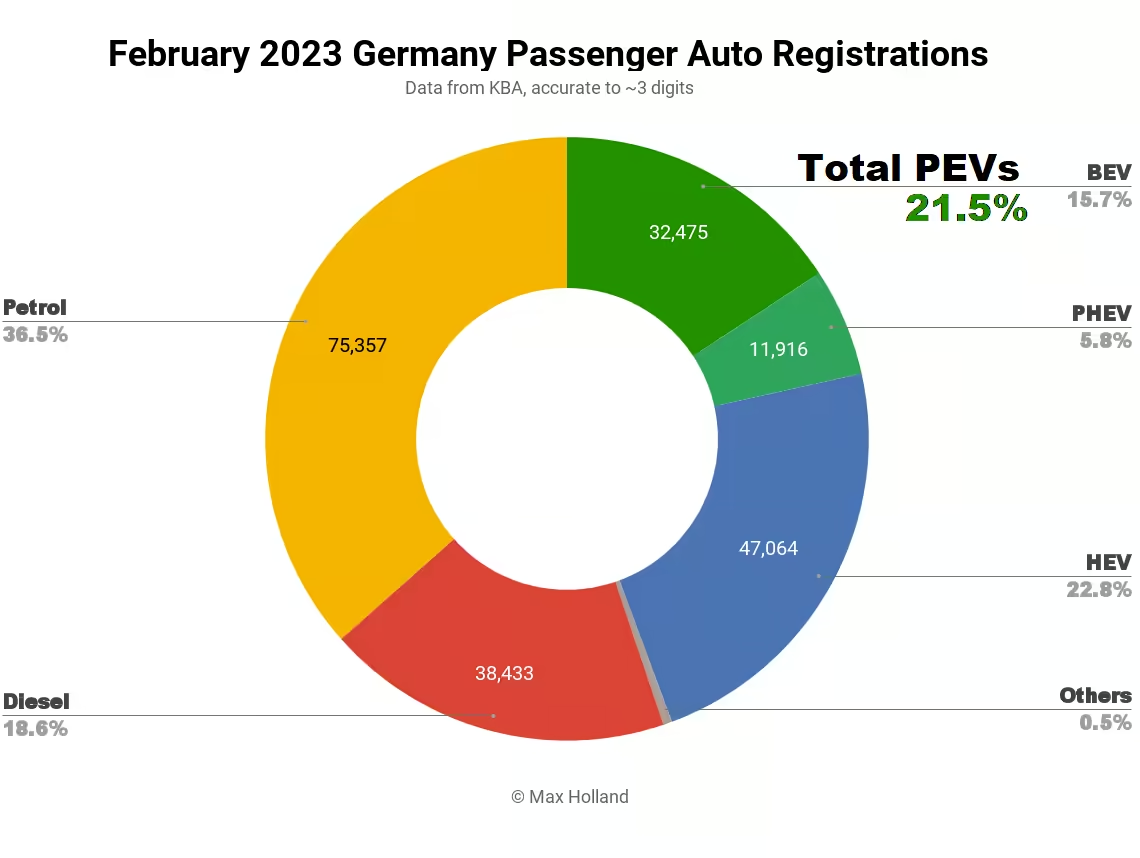

Germany, Europe’s single largest auto market, saw plugin electric vehicles take 21.5% share of sales in February 2023, a drop from 24.9% year on year. Full electric share grew, but plugin hybrid share almost halved. Overall auto volume was 206,210 units, up by some 3% YoY, but still some 18% down from pre-2020 seasonal norms. The Tesla Model Y was the month’s bestselling plugin, and second overall auto (behind the VW Golf).

February’s 21.5% combined plugin result comprised 15.7% battery electrics (BEVs), and 5.8% plugin hybrids (PHEVs). This compares to YoY shares 24.9%, 14.1%, and 10.8%, respectively. BEVs have grown share modestly, but PHEVs have lost significantly.

Overall auto market volume growth came on the back of sales growth of HEVs, BEVs, and Petrols. HEVs were the biggest winner proportionally, growing volume 24.2% YoY. BEVs grew volume by 14.7%, and Petrols by 8.9%.

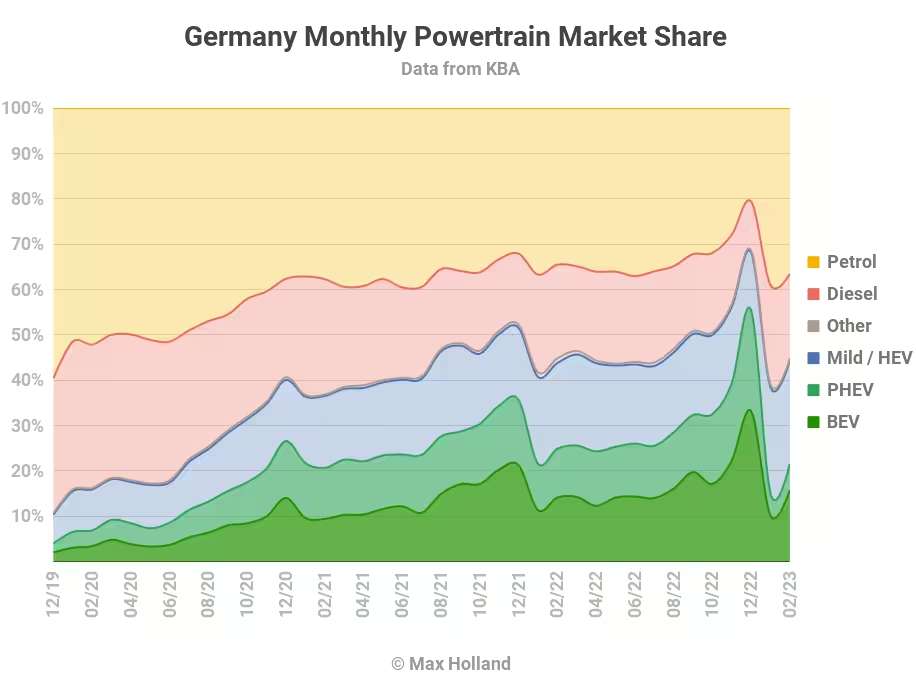

Recall that these ups and downs represent a resettling of the market after the large pull-forward in November and December (ahead of incentive changes). It will be another few more months before a new normal in powertrain share is clear.

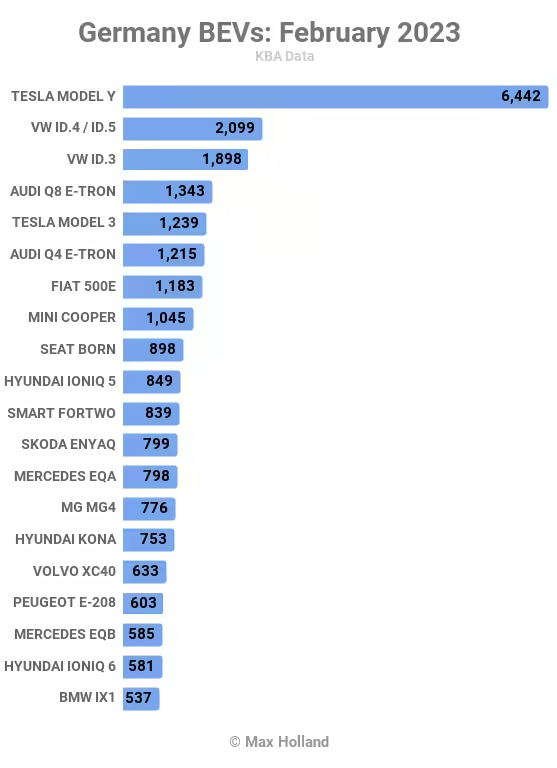

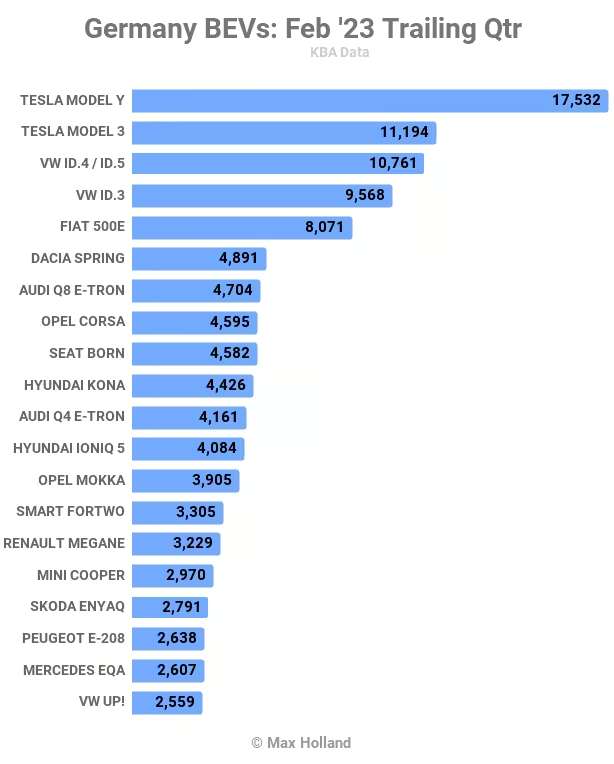

BEV bestsellers

With the local Tesla Gigafactory now cranking out 18,000 units per month (and climbing), the Tesla Model Y saw a huge 6,442 registrations in February, its 3rd highest volume ever (from 2022 September, and December). Note that this isn’t even an end of quarter month, Tesla’s habitual peak.

Across all powertrains, the Tesla Model Y was second only to the Volkswagen Golf in Germany (7,655 units). It was also over 3× the volume of the runners up, the VW ID.4/5 (treated as one model, two variants in the KBA data), and the VW ID.3.

Aside from the Model Y, most others in the top 10 had lacklustre volumes, well below their trailing 3 month average. The only exception was the Mini, which was in line with that recent average.

The same lukewarm performance is true for much of the top 20, with a couple of exceptions. The new MG4, down in 14th place, saw 776 units, a new monthly record, and 1.6× its recent average. The new Hyundai Ioniq 6 sedan saw its first ever countable customer deliveries, with an impressive 581 units.

The BMW iX1 also did relatively well, with 537 units, its second highest month after December. This is now BMW’s bestselling BEV in Germany, and should retain that position going forwards.

Outside the top 20, there were several new models introduced. Following on from Genesis’ deliveries of the first GV60 midsize SUV in January, this month they also delivered initial volumes of the larger GV70 SUV (20 units), and also of the G80 sedan (10 units). All are compelling vehicles, already very popular in their home market of South Korea.

Two other newcomer BEVs were visible, the Nio ET7 sedan (8 units), and the Ora Funky Cat hatchback (5 units), both already well established in their home market of China.

Let’s keep an eye on how all these newly released models progress in Germany over the coming months.

We now zoom out for the longer term perspective:

Compared to the previous time period (September-to-November), the top two spots are the same, both going to Tesla. The VW ID.4/5 has climbed into 3rd, swapping ranks with the Fiat 500. The ID.3 has stayed steady in 4th.

Here are the latest quarter’s main climbers compared to the previous period:

- VW ID.4/ID.5 up to 3rd from 5th

- Opel Corsa up to 8th from 22nd

- Smart Fortwo up to 14th from 20th

Here’s a summary of the significant drops in ranking:

- Fiat 500 fell from 3rd to 5th

- Opel Mokka-e fell from 6th to 13th

- Polestar 2 fell from 14th to 35th

Note that the regular caution about over-interpreting these single-country movements is nicely illustrated by the Polestar 2. Its German volumes have slid recently, whilst its UK volumes (and those in other European markets) have steadily climbed. Overall it has gained volume and share in Europe, and its fate in Germany turns out to be anomalous.

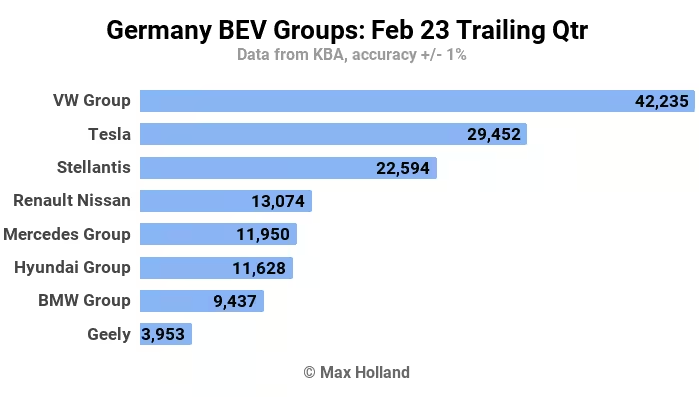

We can step back even further, and look at the manufacturing group performance:

Compared to the previous period, the top 8 ranks remain exactly the same, but the weightings have changed.

Volkswagen Group has added 1.5% share of the market, from 26.6% of the market previously, to 28.1% now. Tesla has lost 1.2% share of the market, to 19.6% share. Stellantis, in third, has gained 0.7%.

The other changes are more marginal, except for Geely in 8th place, which cut its share more significantly, from 4.4% to 2.6%. This is in line with what we discussed regarding the Polestar 2, above.

The top 3 spots look fairly stable for now, but there’s potential movement in the 4th to 7th rankings, being much more closely competed.

Outlook

Germany’s economy is currently in economic decline, with Q4 showing YoY shrinkage, and Q1 forecast to show the same, Germany’s federal bank said recently. Inflation also remains high at a recently stable 8.7%. Recession and inflation are a miserable combination for consumers.

Against this background, the auto market will struggle to see significant growth this year. There may be supply chain improvements compared to the past two years, which will help speed a backlog of long awaited orders through, juicing the volumes a bit compared to last year. But future growth in new orders seems unlikely in recessionary conditions.

Nevertheless, plugins are still relatively attractive from a long term cost of ownership perspective, compared to ICE. BEVs’ diversity of model offerings is growing, and their technology (charging, range, cold weather efficiency) is steadily improving. Infrastructure is growing and becoming more reliable. Against this backdrop, we can expect to see the market share of plugins to continue to grow overall, even if 2023’s overall auto volumes may turn out to be weak.

What are your thoughts on Germany’s auto industry outlook in the months ahead? Please join in the discussion in the comments section below.