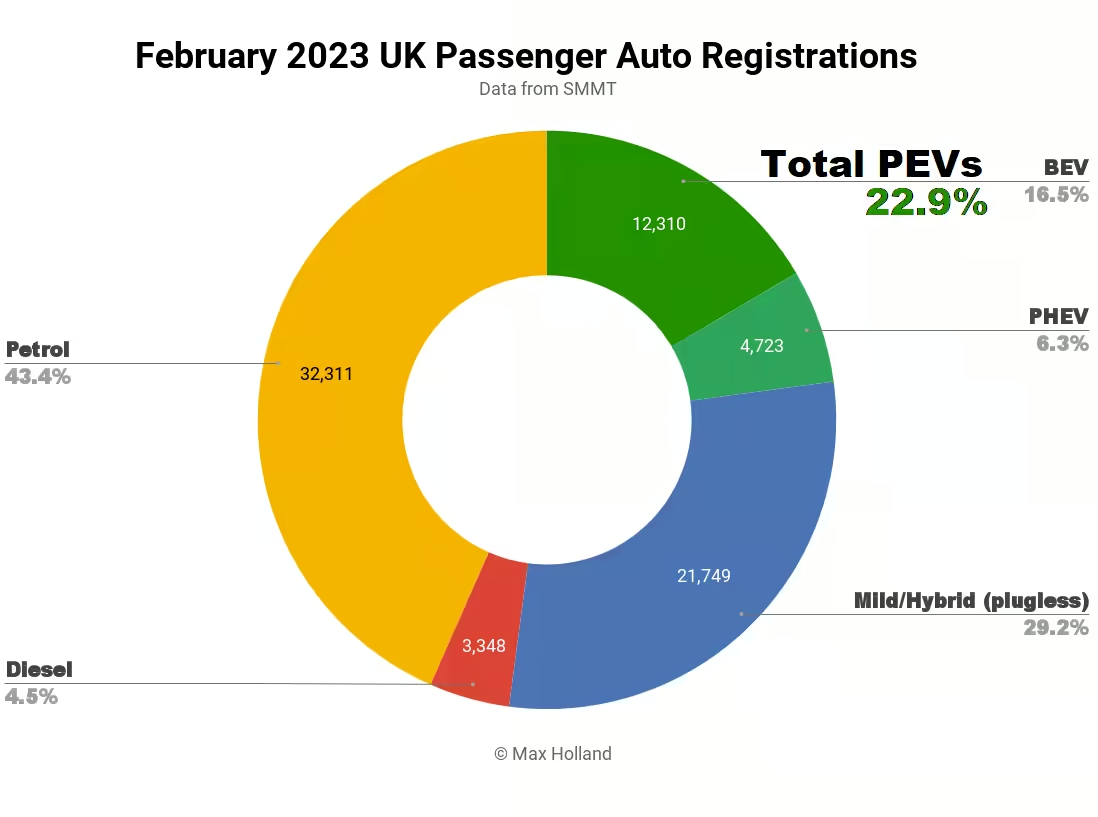

The UK saw plugin electric vehicles take 22.9% share of the auto market in February 2023, down from 25.6% year on year. Overall auto volume was 74,441 units, up some 26% YoY, though still down from the ~81.000 unit seasonal norm, pre-2020. The Tesla Model Y was the UK’s best selling full electric vehicle for the month.

February’s 22.9% combined plugin result comprised 16.5% full battery electrics (BEVs), and 6.3% plugin hybrids (PHEVs). This compares to respective shares of 25.6%, 17.7%, and 7.9% a year ago.

The YoY fall in share of plugins reflects the temporary bounce back of petrol-powertrain volumes YoY (from 23,952 to 32.331 units). This is likely due to dealers wanting to clear a backlog of “old” petrol-car stocks ahead of the new licence plate arriving in March. If so, this suggests a potential snap-back for plugins in the March powertrain shares.

BEVs actually gained YoY volume by roughly 20%, to 12,310 units, but these gains were submerged by the bigger push of petrol sales. PHEV volumes were essentially flat, YoY.

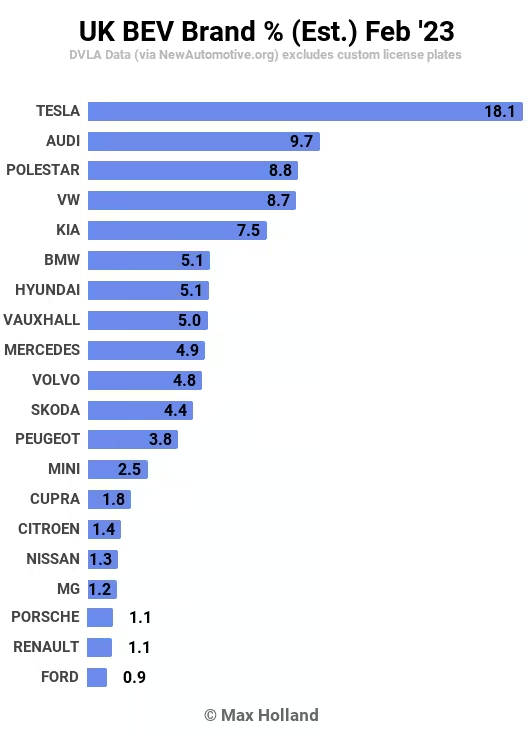

UK Top BEV Brands

From the SMMT’s monthly top ten auto models list, we know that the Tesla Model Y was the overall sixth bestselling vehicle in February, with 1,482 units. This also makes it the best selling BEV model, alone taking 12% of the BEV market, two thirds of Tesla’s total.

Beyond this, the SMMT doesn’t provide dedicated BEV model data, but we do have a summary of a representative portion of brand share data from the DVLA new licence database, gathered via API by New Automotive.

Audi came in 2nd spot, likely mostly thanks to the Q4 e-tron. Polestar came in third (all the Polestar 2). Volkswagen and Kia filled out the top 5 spots.

Other than the habitual monthly volume swings for Tesla, only MG saw a big change, temporarily dropping from 4th spot in January, to 17th in February. Like Tesla, in MG’s case this is mostly down to long distance arrivals of discrete batches that are uneven from month to month.

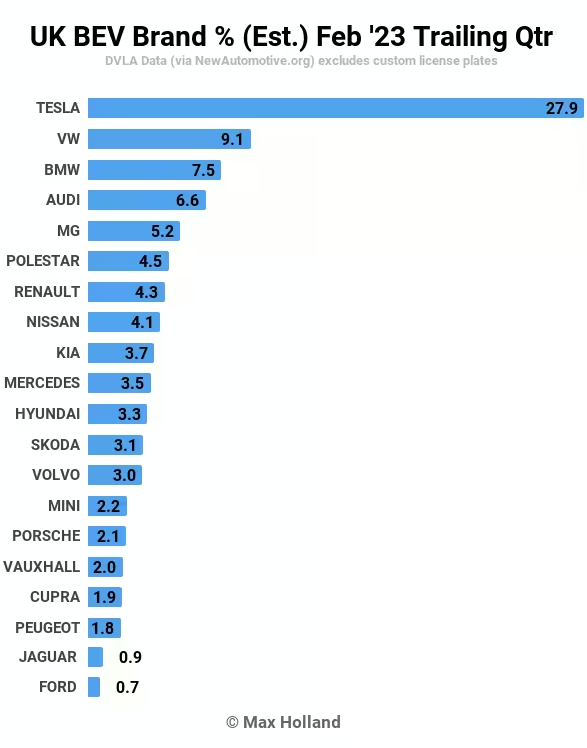

Let’s look at the 3 month landscape:

There were not too many major changes in the top 10 brands, compared to three months ago. Tesla still leads, though Volkswagen has climbed, and BMW fell by one spot.

Audi climbed a bit, as did Polestar and Renault. Mercedes and Hyundai both dropped down the ranks.

Here’s a summary of the main movements compared to the prior period:

- Volkswagen up from 4th to 2nd

- Audi up from 7th to 4th

- Polestar up from 9th to 6th

- Renault up from 17th to 7th

When some go up, others go down:

- MG fell from 3rd to 5th

- Mercedes fell from 5th to 10th

- Hyundai fell from 8th to 11th

Many of the movements are temporary, due to shifting allocation decisions. Polestar has steadily climbed in volumes and ranking since summer 2022, when it was at a low ebb. A year or so ago, Polestar was never consistently in the top 10. This progress is good to see for a newer, BEV-only brand.

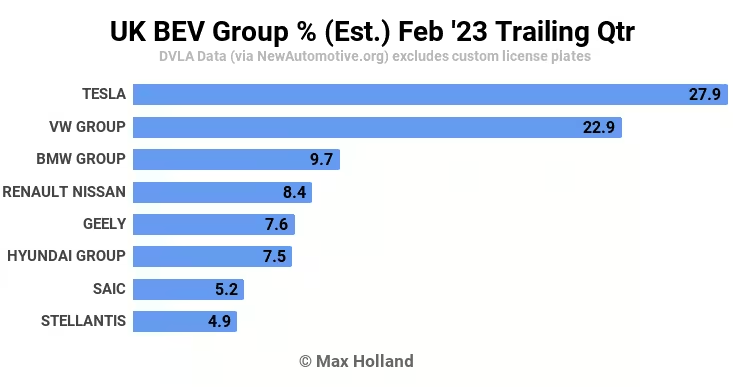

Here’s a brief look at manufacturing group rankings:

The top 3 ranks are unchanged for almost half a year now, with Tesla, Volkswagen Group, and BMW Group, again filling the top spots. BMW however did lose some weighting, whilst both Tesla and VW gained, growing their gap over all the others.

Renault Nissan climbed from 8th (in the 3 months to November) to 4th, despite Nissan losing share. This is likely mostly thanks to the Renault Megane, which started initial UK deliveries in late 2022, and growing volume since. If so, this would also explain the Megane’s recent slight loss of weighting in home market France, where its sales were concentrated for most of last year.

Stellantis fell from 5th to 8th over the period. Other movements in group ranking were relatively minor shuffles.

Outlook

The UK economy is hovering around 0% growth (“stagnation”) over the past 2 quarters, so officially just escaping formal recessionary conditions. Inflation however remains above 10%, so stagflation is present.

The auto market’s recent few months of YoY growth is due to “easing supply chain shortages”, according to the SMMT. This allows an increased ability to work through customer waiting lists that are, in many cases, months long. Beyond existing orders, whether auto demand will continue to rise in conditions of stagflation remains to be seen.

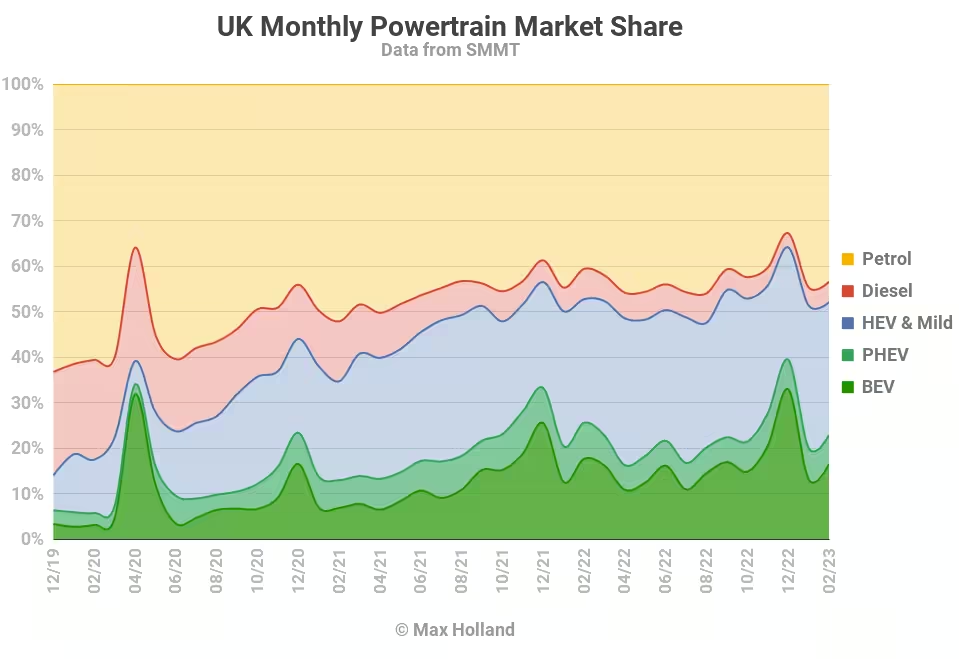

Whatever happens to overall auto market volumes throughout 2023, plugins retain their long term cost of ownership advantages, relatively low depreciation, and experiential advantages, compared to combustion vehicles. In this case, we can expect their share of the market to continue to grow, even if volume growth is lacklustre.

What do you think about the UK’s transition to EVs? Please jump in to the discussion in the comment section below.