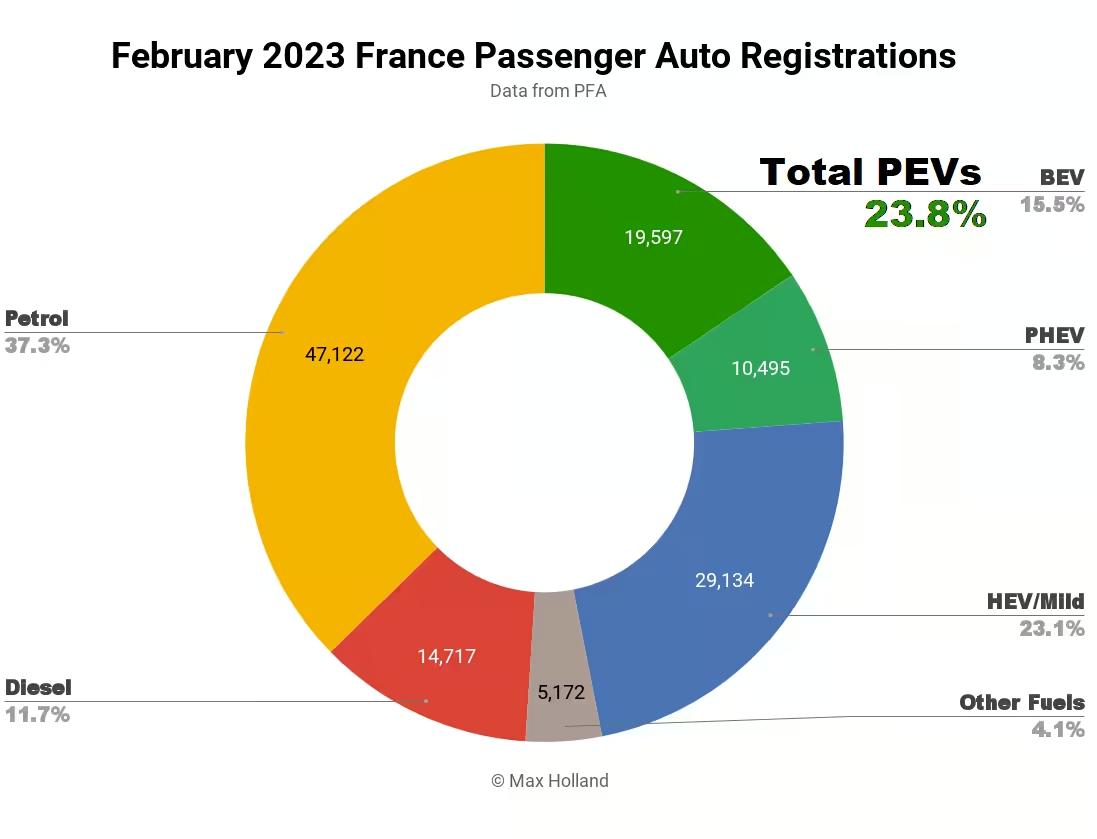

France’s plugin electric vehicle share reached 23.8% in February, up from 20.1% year on year. Full electrics grew share, whilst plugin hybrids remained static. Overall auto volume was 126,237 units, up over 9% YoY. The Dacia Spring was once again the best selling full electric.

February’s combined plugin result of 23.8% comprised 15.5% full electrics (BEVs), and 8.3% plugin hybrids (PHEVs). These respective shares compare with 20.1%, 11.7%, and 8.4%, year on year. All the growth in share has come from BEVs.

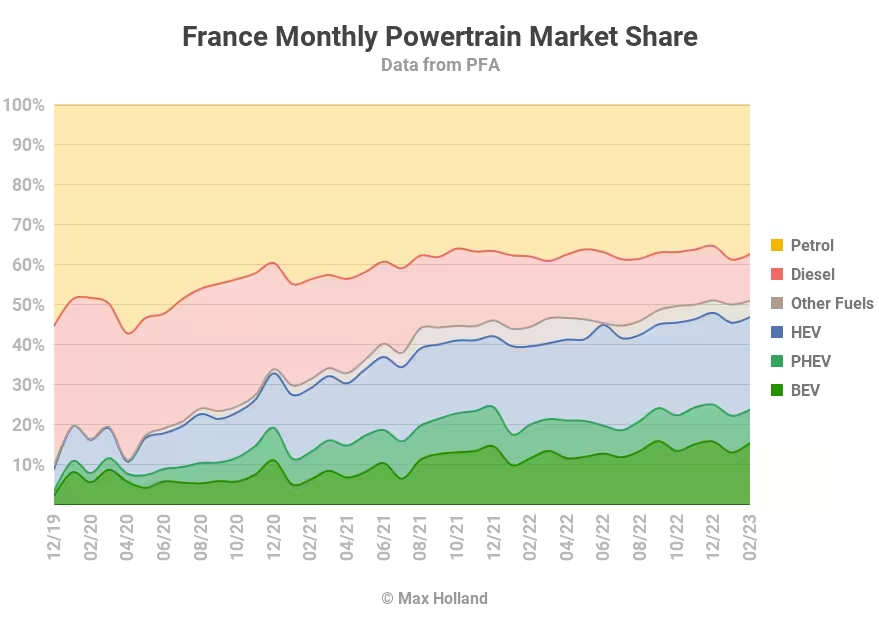

With plugless hybrids (HEVs) also growing share (adding 2.6% YoY), traditional combustion-only powertrains saw their 4th consecutive month at under 50% share of the market (49.0%).

With diesel-only powertrains now standing at 11.7% share, and declining by around 0.5% per month recently, we can expect them to fall to under 10% share sometime over the summer.

Bestsellers

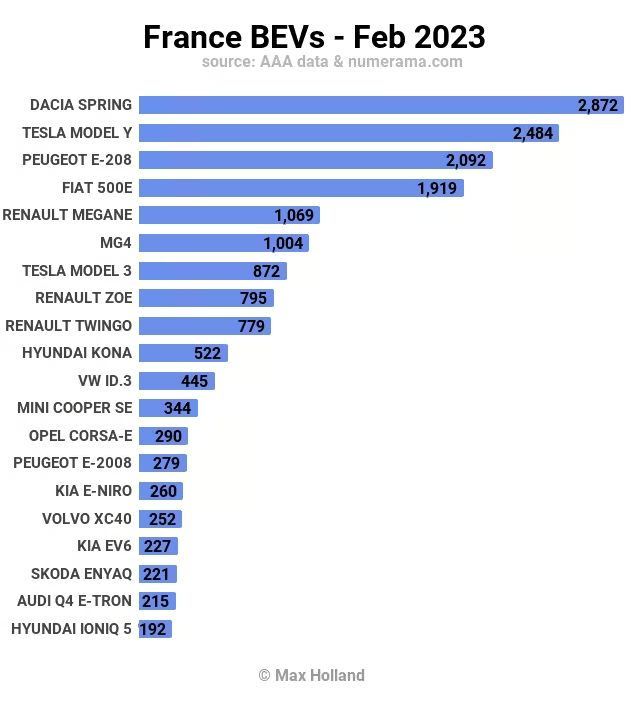

The bestselling BEV in February was again the Dacia Spring, which has held the top spot for the past three months. The runner up was the Tesla Model Y, and the Peugeot 208 came in third.

As usual, we only have partial data for BEV models, so we can’t yet detect the arrival of newcomers at low initial delivery volumes.

Of the “newish” models in the top 20, the Renault Megane continues to be strong, in 5th spot, though not as dominant as it was in H2 2022. The MG4 continues to do well, being inside the top 10 for the third consecutive month, in 6th spot.

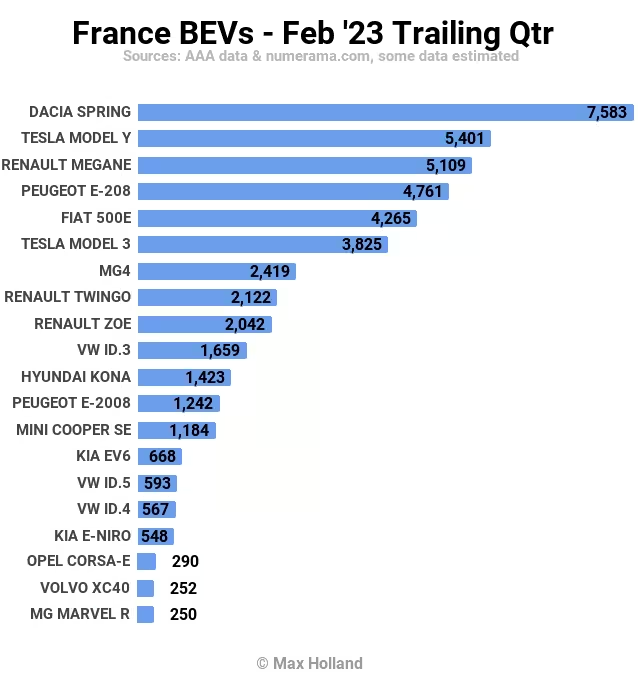

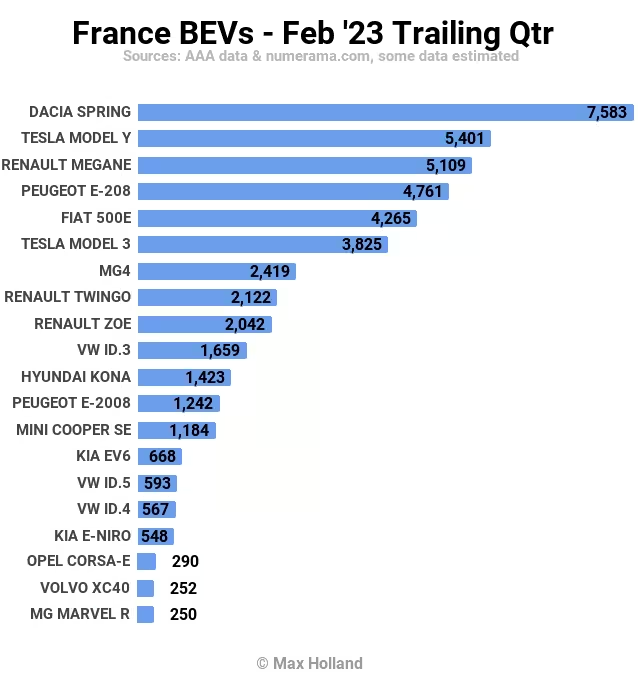

Let’s now step back to view the three month picture:

As usual, we only have partial data for BEV models, so we can’t yet detect the arrival of newcomers at low initial delivery volumes.

Of the “newish” models in the top 20, the Renault Megane continues to be strong, in 5th spot, though not as dominant as it was in H2 2022. The MG4 continues to do well, being inside the top 10 for the third consecutive month, in 6th spot.

Let’s now step back to view the three month picture:

Here, on the strength of its three recent monthly bestseller titles, the Dacia Spring is in the clear lead, a great improvement from its 5th spot over the September-to-November period.

The Spring stands a decent margin ahead of the Tesla Model Y, and Renault Megane.

The Model Y itself has picked up momentum, compared to the prior three month window, when it was in 5th position. The Megane, on the other hand, has dropped two places over the period, from its previous lead.

Here are the main climbers compared to three months prior:

- Dacia Spring up from #5 to #1

- Tesla Model Y up from #4 to #2

- MG4 up from #13 to #7

Here are the models losing rank:

- Renault Megane down from #1 to #3

- Tesla Model 3 down from #2 to #6

Other movements within the top 20 were more subdued.

The Tesla Model Y is now being produced at the rate of around 18,000 units per month at Gigafactory Berlin (and still ramping), all of which will be sold through to the European market. Some additional volume is still arriving from Shanghai.

2022 saw over 138,000 units of the Model Y sold across Europe, by far the best selling BEV in the region. Berlin production will supply perhaps 250,000 units (or more) this year, plus more from Shanghai. This suggests that we could expect a given country’s monthly volumes to approximately double compared to last year — so long as purchasing power can keep up.

Given that waiting times are now just 2 to 4 weeks for some Model Y variants, it may be that Tesla has to tweak the price points a little bit, to balance demand with supply. However, it has plenty of room to do this, and still maintain strong margins.

If supply volumes do indeed roughly double (and assuming the closest competitors in Europe like the VW ID.4 may not be able to quite match this doubling), the Model Y looks unassailable as Europe’s best seller again this year, with an even larger lead than it had in 2022.

As a reminder — this relative strength of a high-price point model (around twice the price of Europe’s historical best selling vehicles) is largely because of continuing relative lack of supply (vis-a-vis demand) of the even more affordable BEVs, like the Renault Megane, and MG4.

In the fullness of time, perhaps years from now, the consumer BEV market will move towards a more classic demand curve, with more affordable vehicles correlating with higher volume, rather than the current anomalous pattern of sales volume distribution, shaped by limited available BEV supply for most models. In the French auto market, the equilibrium demand curve will likely roughly resemble historical patterns, for example with the 2021 median price of €23.2k, plus future inflation. The Nordics support a much higher median (Norway 2021, €34,800), as does Germany (2021 – €33,900) whereas much of southern Europe is lower still (Portugal 2021 – €21,300).

Tesla will of course still be in the mix, with an even more affordable model, which will be available at “Tesla volume”.

Outlook

France’s auto market has seen some recent recovery, with 7 consecutive months of YoY growth. Supply chain issues are slowly and steadily being resolved. However, despite these supply-side improvements, if economic sentiment is negative, the demand side may become the constraining factor, and it remains to be seen where the market’s equilibrium volume will sit.

France’s central bank forecast last month that the country will emerge from the winter having escaped a recession, unlike several neighbouring countries. In large part this is because energy prices have stabilised somewhat (though are still much higher than historical levels), helped by France’s majority nuclear electricity generation, which avoids fossil fuel price fluctuations.

Latest forecasts are seeing 0.2% economic growth in Q1 and Q2 — lacklustre, but better than much of Europe. This being the case, the overall auto market may continue its modest YoY recovery trend.

Since plugin vehicles remain competitive from a long term total cost of ownership perspective, we can expect their relative demand (vs. ICE counterparts) to continue to grow. This will result in plugin share growth in 2023, though it’s hard to say how much.

What are your thoughts on France’s auto market, and EV transition? Please jump in to the comments below, and join the discussion.