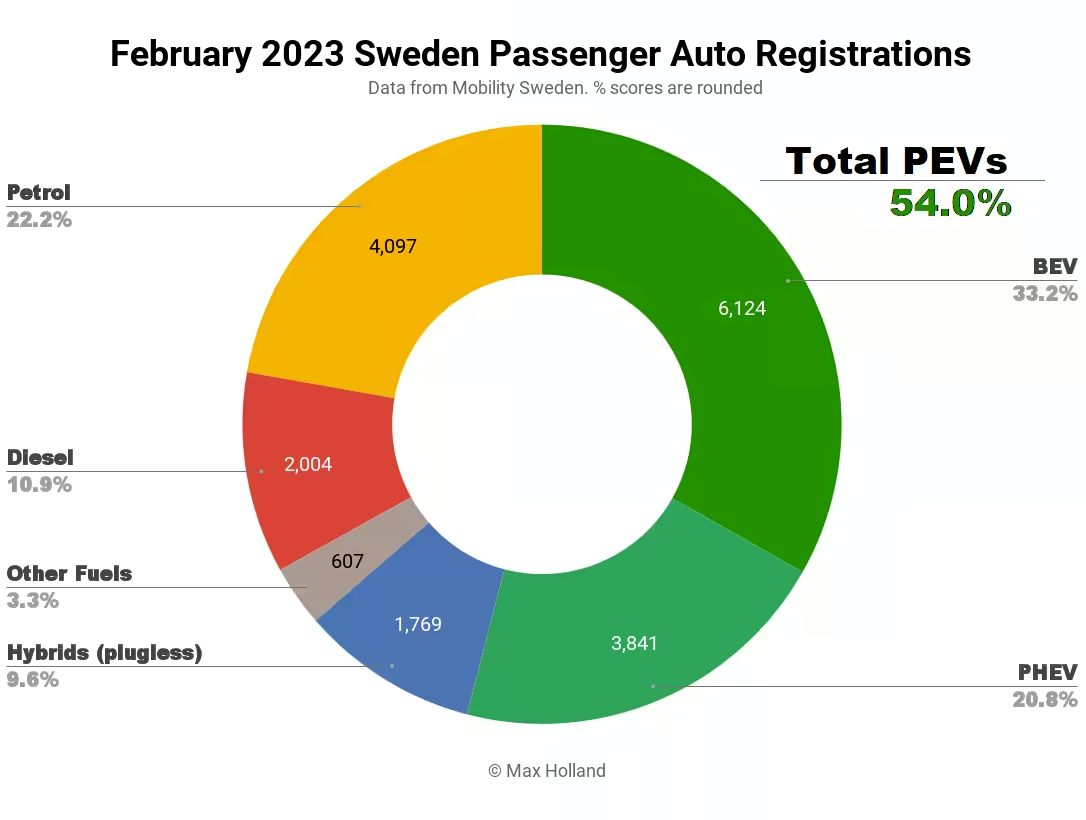

In February, Sweden’s plugin electric vehicles continued to dominate with a 54.0% share of auto sales, up from 51.6% year on year. Full electric share grew substantially, whilst plugin hybrid share decreased. Overall auto volume was 18,442 units, down some 13% YoY. The Volvo XC40 was February’s best selling BEV yet again, holding the lead for the 5th consecutive month.

February’s overall plugin result of 54.0% comprised 33.2% full electrics (BEVs), and 20.8% plugin hybrids (PHEVs). These compare with respective shares of 51.6%, 25.6%, and 26.0%, YoY.

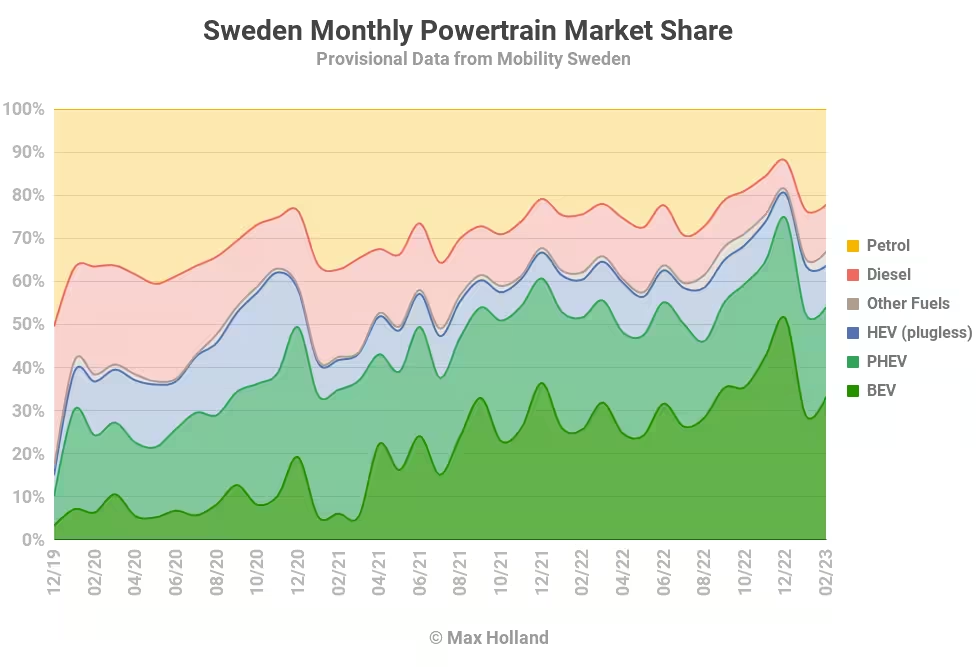

We can see that BEVs are continuing strong growth in share, whilst PHEVs are now declining. This is partly a result of deliberate policy changes that have sought to support BEVs over PHEVs. The plugin market is still re-settling after a strong pull-forward in December, and will take a couple more months to find a new equilibrium.

Plugless HEVs are slowly decreasing, having hovered around 9% share over the past 6 months, from near 15% in 2020. Combustion-only powertrains have averaged under 29% recently, from 53% in 2020. On current trends, we can expect plugins to regularly exceed 80% share a couple of years from now.

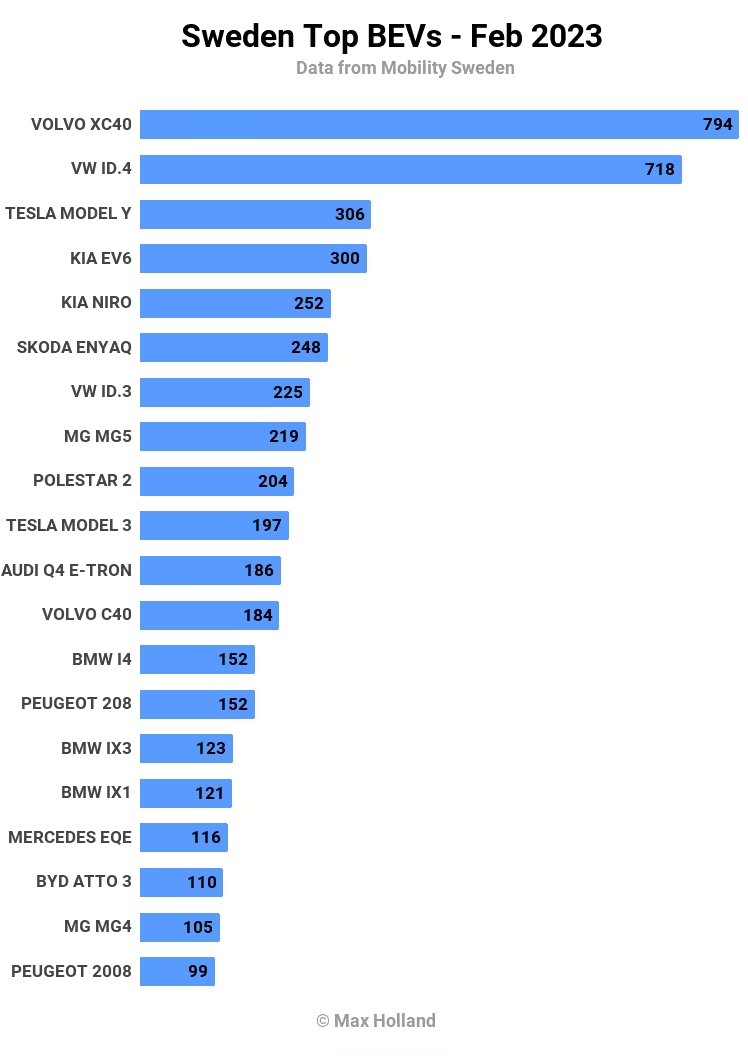

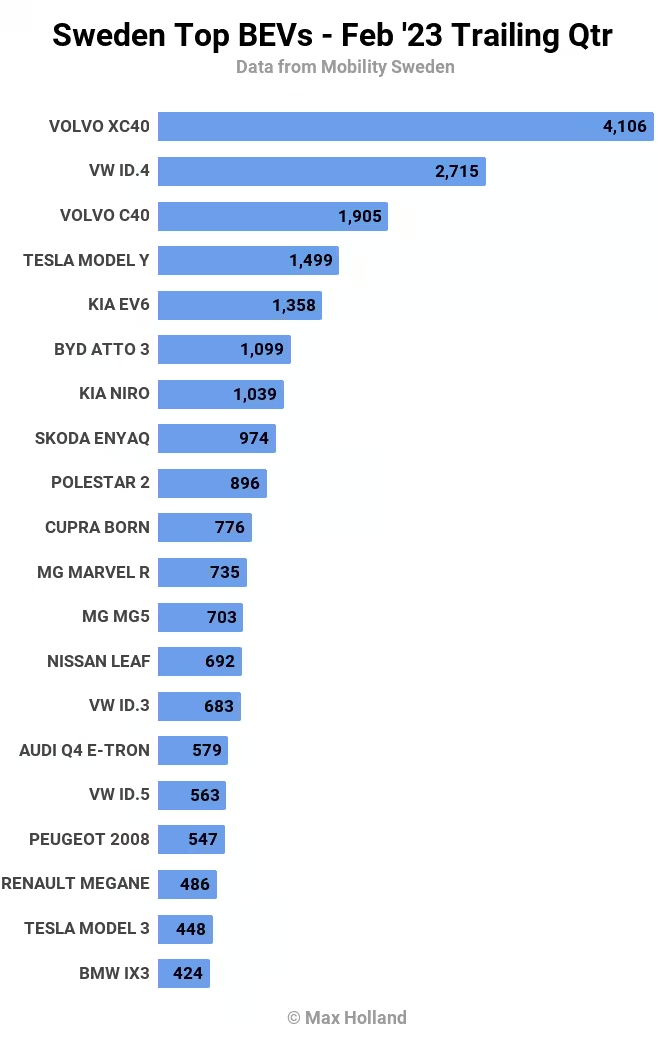

Top Selling BEVs

The Volvo XC40 again took the top spot in BEV sales in February, for the fifth month running. It is looking unassailable for the time being, certainly amongst its similar priced peers, such as the Volkswagen ID.4 (2nd place), and the Tesla Model Y (3rd).

Sweden’s auto buyers have, for years, favoured midsized vehicles, whether sedan or, more recently SUV. This preference is at odds with most European markets, where affordable compacts sell at much greater volumes (e.g. VW Golf, Peugeot 208, and similar). So, even when affordable BEVs in the compact categories start to be available at high volume, and take the lead in other European markets, they aren’t necessarily likely to displace the lead of the Volvo XC40 (or its future successors) in the Swedish market.

There were no outstanding growth stories, or “personal bests” in February’s top 20, just normal jostling in the ranks.

A few newer BEV models were detected much further down the rankings, with the BYD Han registering 20 units, from an initial 8 units in January.

The Nio EL7 recorded its first Swedish sales in February, with 12 registrations. This is a large luxury SUV, with decent range and tech, competing with the BMW iX, the Mercedes EQS SUV, the Tesla Model Y, and similar luxury SUVs priced around €100k (and up).

One of the Nio EL7’s peers, the Hongqi E-HS9, also debuted Swedish sales in February, with a modest 4 units.

Now let’s have a look at the 3-month picture:

Unsurprisingly, the Volvo XC-40 took the top spot, from the Volkswagen ID.4, and Volvo C40. These top 3 BEVs were unchanged from the previous 3 month period.

The main climbers compared to the previous period were as follows:

- Tesla Model Y up from 8th to 4th

- Kia EV6 up from 9th to 5th

- BYD Atto 3 up from 44th to 6th

- MG5 up from 19th to 12th

- Peugeot 2008 up from 33rd to 17th

These models lost ranking:

- Nissan Leaf fell from 7th to 13th

- Ford Mach-e fell from 11th to 24th

- Mini Cooper fell from 18th to 33rd

As usual, most of the changes in rankings reflect manufacturers’ constantly shifting allocation decisions over the limited supply of the most popular BEVs, rather than necessarily reflecting their unconstrained demand.

One thing to watch for is the Tesla Model Y’s continuing ramp up of production (and thus supply) from the Berlin Gigafactory. Last week saw 4,000 units produced, so nearing 20,000 units per month, all of which will go to European consumers. Some thousands of units from Shanghai are also still coming to Europe each month.

Given that mid-sized SUVs are Sweden’s most popular category, it’s no great stretch to envisage that at least 1,000 Model Ys per month could be heading to Sweden in the near future, potentially placing it close to the top of the ranks, and pressuring the Volvo XC-40.

Outlook

Sweden’s auto industry agency, Mobility Sweden, claims that order books for plugins coming from private consumers are currently “cold” due to November 2022’s abolition of incentives, and the broader economic pressures. This will begin to be visible in BEV registrations in late summer.

On the other hand, the majority of Sweden’s plugin orders come via company cars, and from commercial leasing operators, which tend to make decisions based on long term economic calculations, and must try to go about their business despite temporary plugin incentive fluctuations.

The country’s general economic outlook remains troubling, with the national statistics office last week finding that 2022 Q4’s economic shrinkage was slightly greater than initially thought, and inflation continues to grow. Further economic decline is expected in the coming months, with the EU commission predicting that Sweden will see a 0.8% economic recession across 2023 as a whole.

To the extent that spending on new cars will be suppressed, the relative merits of plugins remain strong compared to ICE vehicles, so their share of the auto market may be expected to grow, even if that overall market takes a hit.

What are your thoughts on Sweden’s EV transition? Please jump in the comments below to join the discussion.