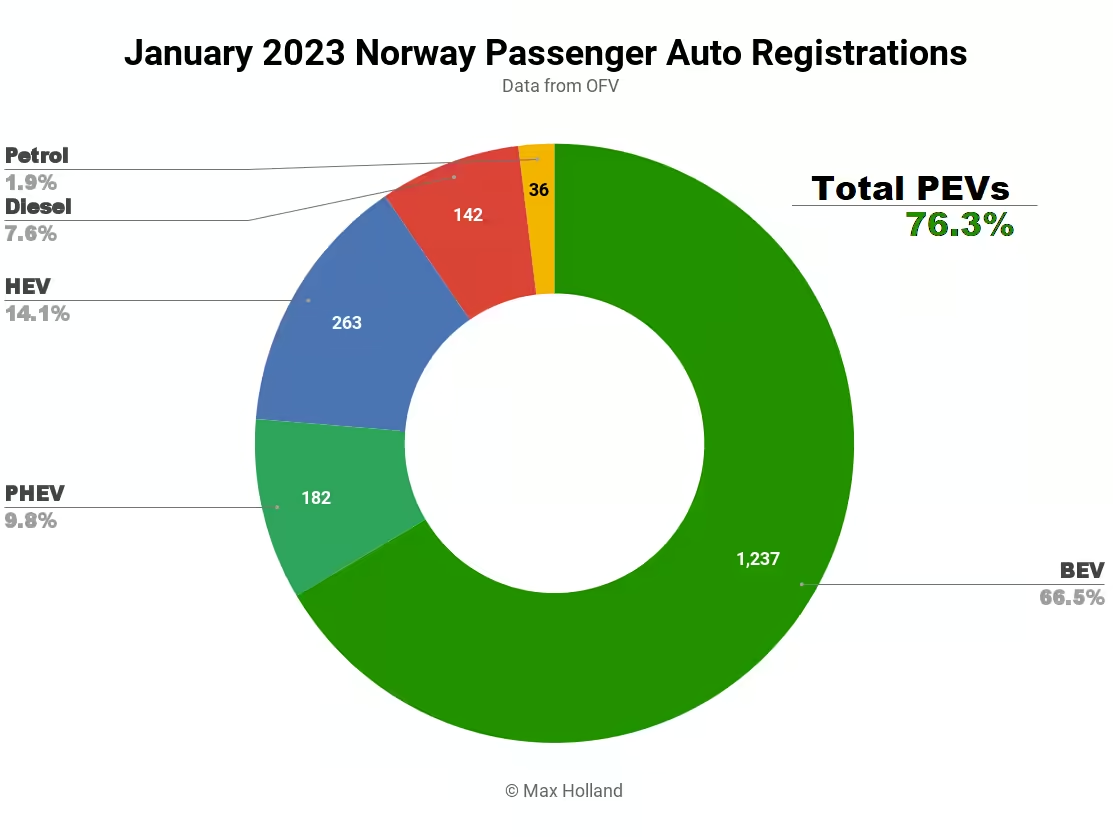

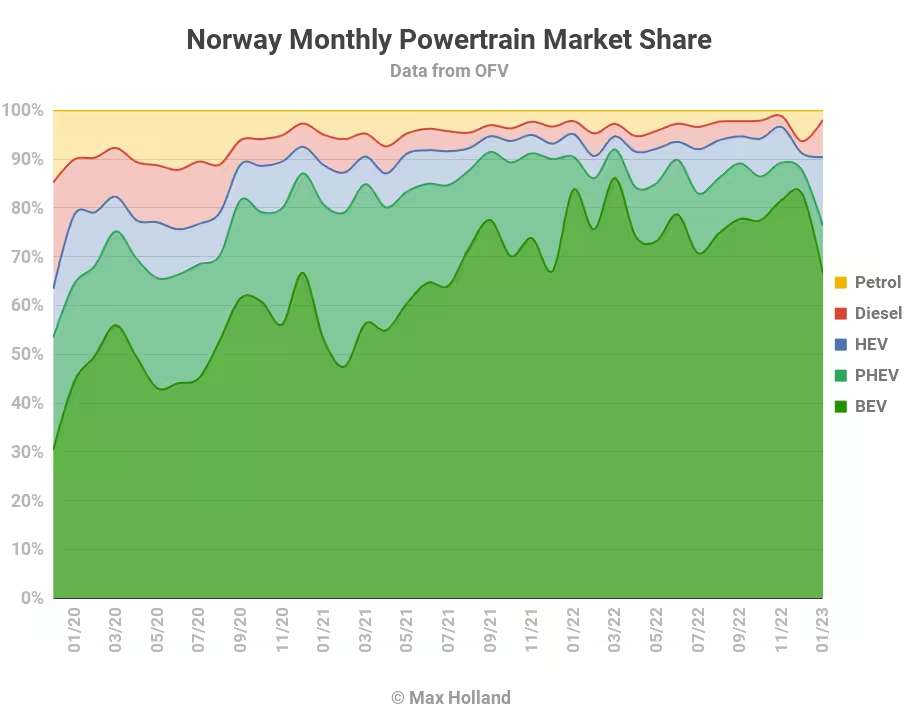

Norway saw plugin electric vehicles take 76.3% share of the auto market in January, down from 90.5% year on year. The January auto market was highly anomalous due to the new year’s introduction of tighter auto emissions and tax increases, which had pulled sales forward into December. Overall January auto volumes were just 1,860 units, under 5% of December’s volume, and the lowest monthly volume in over 60 years! The auto market will resume more typical patterns in the months ahead. January’s bestseller was the Volkswagen ID.Buzz.

January’s combined plugin result of 76.3% comprised 66.5% full electrics (BEVs), and 9.8% plugin hybrids (PHEVs). These compared with respective shares of 90.5%, 83.7%, and 6.8% a year ago.

Due to the anomalous tax discontinuity mentioned above, we have to take January’s picture with a pinch of salt — it doesn’t tell us very much. For a recap on what the new emissions and tax changes involve, take a look back at my summary in last month’s report.

The new policies affect both plugins and non-plugins, although the latter are hit much harder. For example, petrol-only vehicles (with relatively high CO2 emissions) are now taxed much higher in Norway. That’s the reason why there was a December rush of 2,503 petrol-only units, whilst January saw just 36 units, roughly two orders of magnitude less!

For the most popular and affordable entry BEVs, the effective outlay for the consumer is now roughly 5% higher than it was previously. For the midsized SUVs that Norway favours, the additional outlay is roughly 8% to 10%, or more. This is a comparatively light burden compared to all other powertrains, and smaller and less expensive BEVs are (relatively) favoured.

For most auto consumers, who are anyway facing 6 to 12 months of wait time between orders and delivery, these new rules — once “digested” — should even boost plugin share further. We are anyway in a situation right now where December’s and January’s results were shaped NOT significantly by demand side, but by supply side, as manufacturers made a short-term push, to keep customers happy, ahead of effectively higher costs.

I suspect that — once things settle down — we will find that petrol-only sales will have experienced a permanent discontinuity. I don’t expect them to ever get above 2% in the future, excepting further one-off anomalies, and fast heading towards only trace amounts.

Overall, it will be interesting to see what the auto landscape will look like once these new policies become normalized and new consumer preferences (i.e., orders) start to work their way through into the sales results.

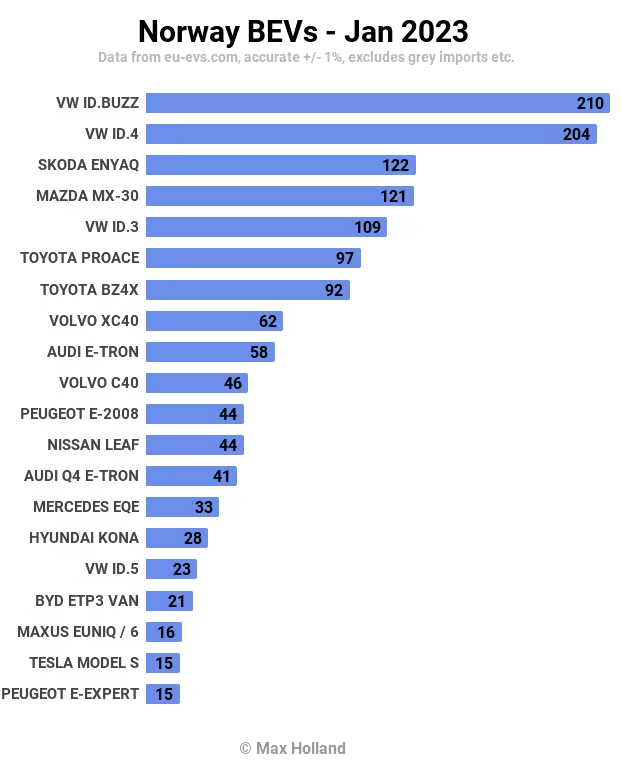

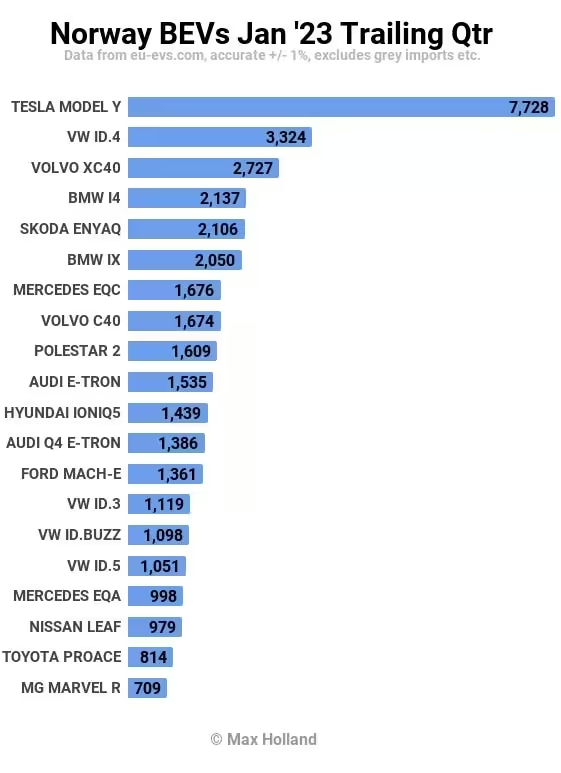

Best Selling BEVs

With the caveat that we can’t read much into January’s tea leaves, the Volkswagen ID. Buzz was the best selling vehicle for the month, fractionally ahead of its sibling the ID.4. Their cousin, the Skoda Enyaq, came in third.

One surprise was the Mazda MX-30, which didn’t see significant drop in supply volume, or registrations, compared to H2 2022. As in neighbouring Sweden, and in other European markets, Mazda is now releasing the range-extender (REx) variant, which may prove popular with folks who might otherwise have shopped for PHEVs or non-plugins. With its modest battery size, and the REx being the in-house “Wankel” design, Mazda should find itself relatively unconstrained in producing this vehicle.

There were no all-new passenger BEV models released on to the Norwegian market in January.

Let’s now look at the 3-month picture, again with the caveat that December and January have been anomalous months:

The Tesla Model Y leads, as it has for most of the past 18 months. Other regular favourites, the VW ID.4 and the Volvo XC40, take 2nd and 3rd.

Given the current anomalies, I hope you don’t mind if I skip a summary of the risers and fallers this month, and likely next month. Once we get to the March report, I will revisit this and compare the Q1 2023 favourites to those from Q3 2022 (before the “madness” set in).

Outlook

As we have seen, the auto market is in the middle of a serious discontinuity just at the moment, due to the policy changes outlined. It will settle down in due course.

Norway’s road transport information agency, OFV, summarizes the situation: “Because from 1 January VAT was expected on new electric cars over NOK 500,000, and in addition a new weight tax was introduced for all passenger cars. This led to a large price increase for the vast majority of new passenger cars, which in turn led to a massive registration rush before the turn of the year.” (Machine translation).

Beyond these policy changes, the Norwegian macro economy generally continues to look healthier than all its European neighbours. Norway is a rare European fossil fuel exporter, most of whose neighbours now consider a relatively preferable supplier, more so than previously. Consequently, the value of Norway’s gas exports nearly tripled in 2022 compared to 2021, and crude oil exports’ value rose by 55%.

However, since most consumer goods, and energy, are internationally traded, price inflation in Europe is also experienced by Norwegian consumers. This will inevitably affect consumption patterns, despite the massive boost in exports at the national level. Let’s see how this combination plays out, especially for the auto market.

What are your thoughts on Norway’s transition to electric transport, and how it might be shaped in 2023 by broader economic factors? Please jump into the discussion below.