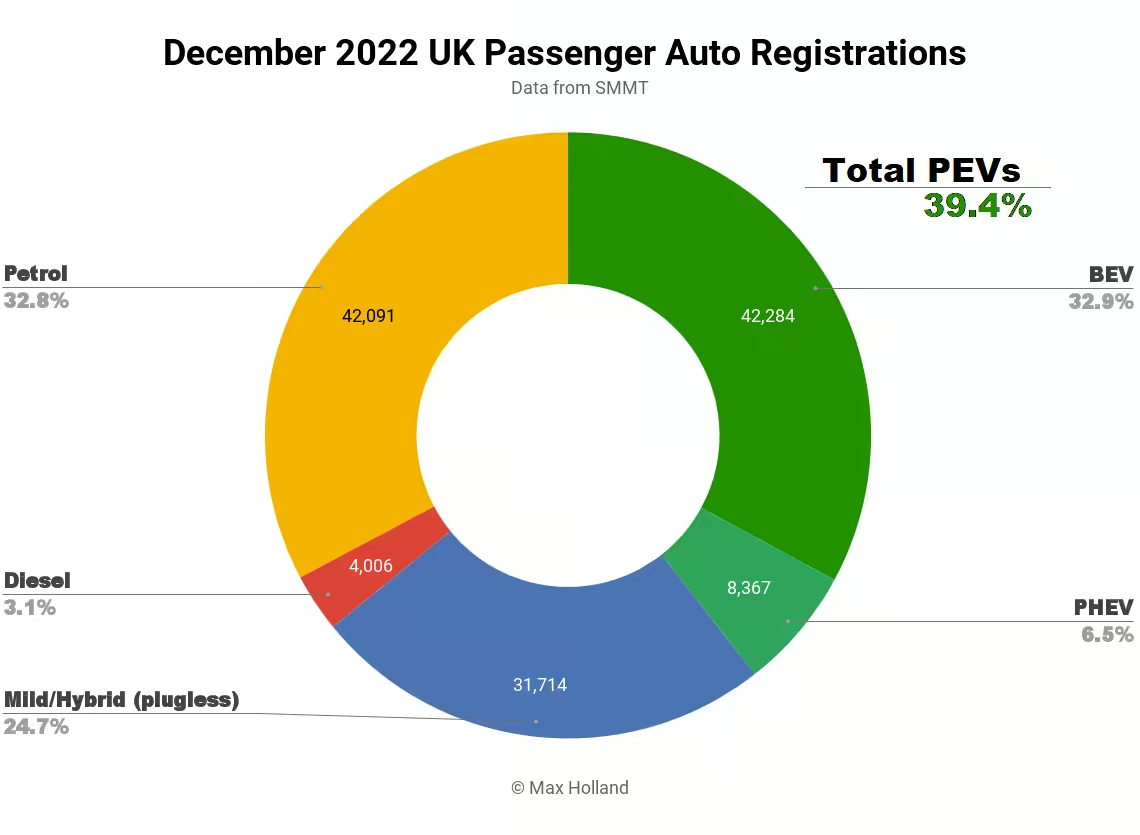

The UK’s auto market saw plugin electric vehicles take 39.4% share of new sales in December, a new record, up from 33.2% year on year. Full electrics alone took almost a third of the market. Overall auto volumes were up 18% year on year in December, but still down compared to pre-2020 norms. The Tesla Model Y was the UK’s overall 3rd best selling vehicle in 2022, and the top seller in December.

December’s combined plugin share of 39.4% comprised 32.9% full battery electrics (BEVs), and 6.5% plugin hybrids (PHEVs). The respective shares in December 2021 were 33.2% plugins, 25.5% BEV, and 7.7% PHEV.

In terms of volumes, December saw BEVs grow 1.53x from a year ago, to 42,284 sales. PHEV volumes were essentially flat year on year, with 8,367 sales.

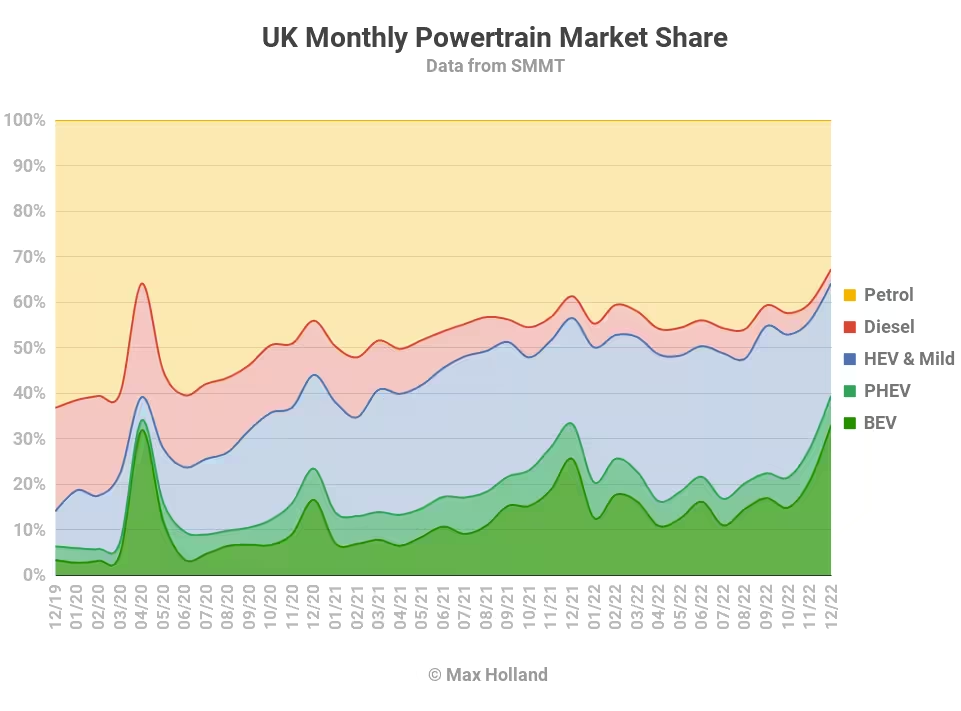

The full year 2022 plugin share amounted to 22.8% combined, composed of 16.6% BEVs, and 6.3% PHEVs. This compares to full year 2021 results of 18.5% combined, with 11.6% BEVs, 6.9% PHEVs.

The 16.6% result for BEV share represents an annual rate of growth in share of 1.43x, which is a calming from the higher growth rate of 2021 over 2022, which was 1.76x.

The volume in full year 2022 amounted to 267,203 BEVs, up 40% from 2021, and 101,413 PHEVs, down 11.5%. This comes against a background of overall auto sales down by 2.0% in 2022 compared to 2021.

Full year 2022 diesel-only vehicles’ share amounted to 5.1%, down from 8.2% in 2021. For petrol-only vehicles, 2022 saw 42.3% share, down from 46.3% in 2021. Expect petrol’s rate of decline to accelerate in the coming years, once diesel sales have effectively ended.

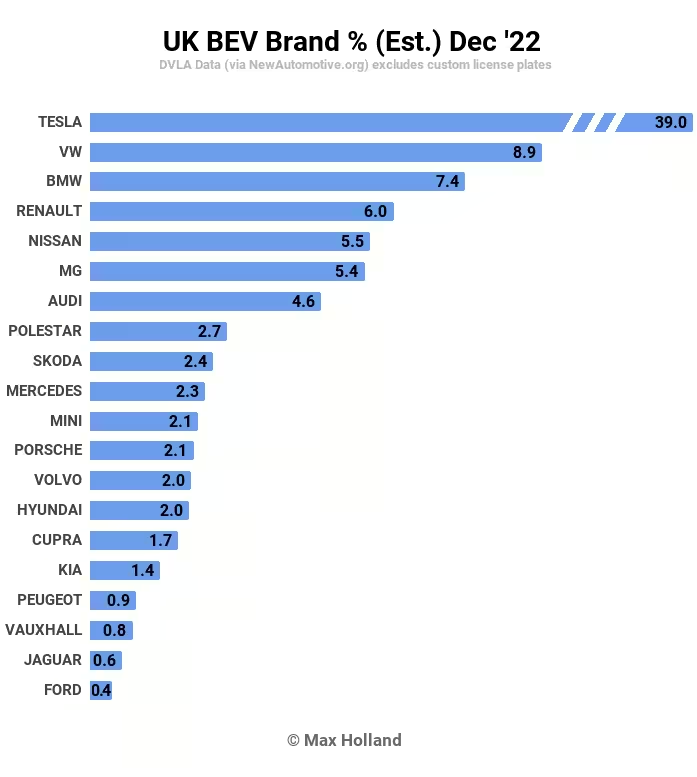

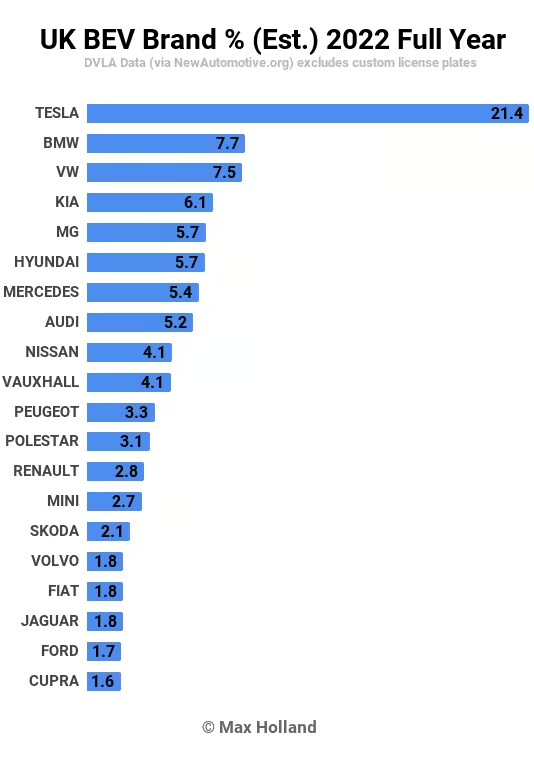

UK’s bestselling BEV brands

Tesla made their habitual end-of-quarter huge push in December, with the Model Y (10,664 units) and Model 3 (5,704 units) actually taking the overall top two bestselling autos (of any powertrain) for the month. Note, however, that Tesla’s delivery volumes are so uneven that December alone represented almost one third of the Model Y’s total 2022 sales.

Behind Tesla, the Volkswagen brand (mainly the ID.3 and ID.4) took December’s second place in BEV market share, and BMW (led by the i4) took 3rd.

In terms of movements, Renault jumped up significantly in December, to #4 spot (from #18 the previous month), likely thanks to the Megane, which seems to have recently started volume deliveries in the UK. Porsche and Skoda brands also climbed the ranks by a few spots compared to November.

Far outside the top 20, the Ora brand saw a few initial deliveries in the UK (just around 20 units for now), which we can deduce must have been the new Ora Funky Cat hatchback. This is a decent value offering in the premium hatchback segment, so let’s see how high Ora can climb.

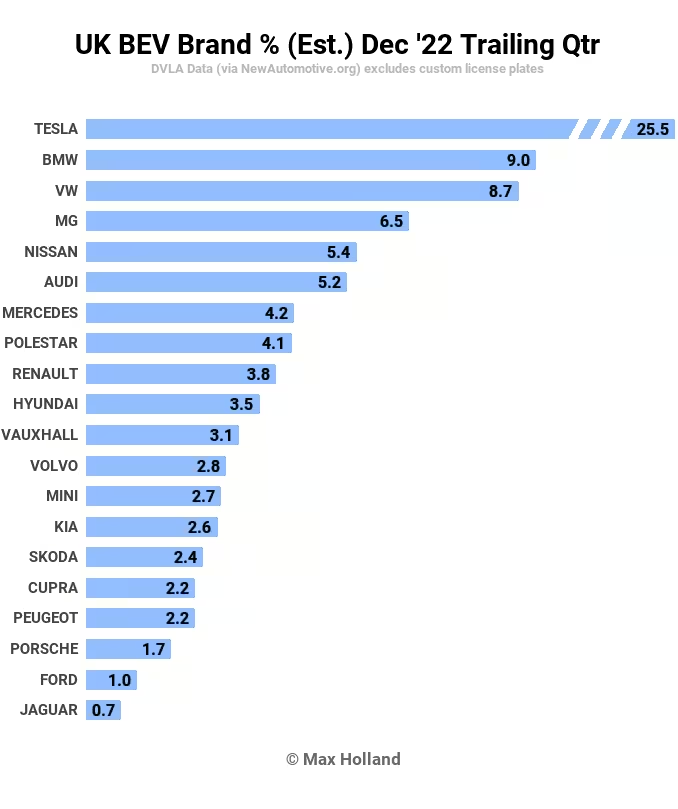

Let’s now look at the trailing 3-month brand results:

Here Tesla still has a massive lead, though this is again partly due to the brand’s habit of back-loading deliveries towards the end of the year (see the longer-term full year brand shares below).

Brands which saw gains in Q4 compared to Q3 include Polestar (17th position to 8th position), and Volvo (20th to 12th). Renault also did well (15th to 9th), and Nissan climbed from 9th to 5th. On the flip side, Kia dropped from 7th to 14th, and Hyundai from 3rd to 10th.

As usual, much of the movement is temporary, due to shifting allocation priorities of popular models across many European (and global) markets, where overall demand for BEVs outstrips supply. In the case of the UK, this is even more deliberative, due to the need to batch production of right-hand drive models for this market.

Finally in our UK brand analysis, let’s look back at the full year performance:

Here we can see that Tesla was still very strong, though not quite to the same degree as in those months and quarters where it biases deliveries. BMW and Volkswagen brands took second and third spots. Note Ford’s weak performance in BEVs, and the fact that Toyota doesn’t appear at all in the top 20 (and, by my calculation, only took 0.2% of the UK’s BEV sales in 2022).

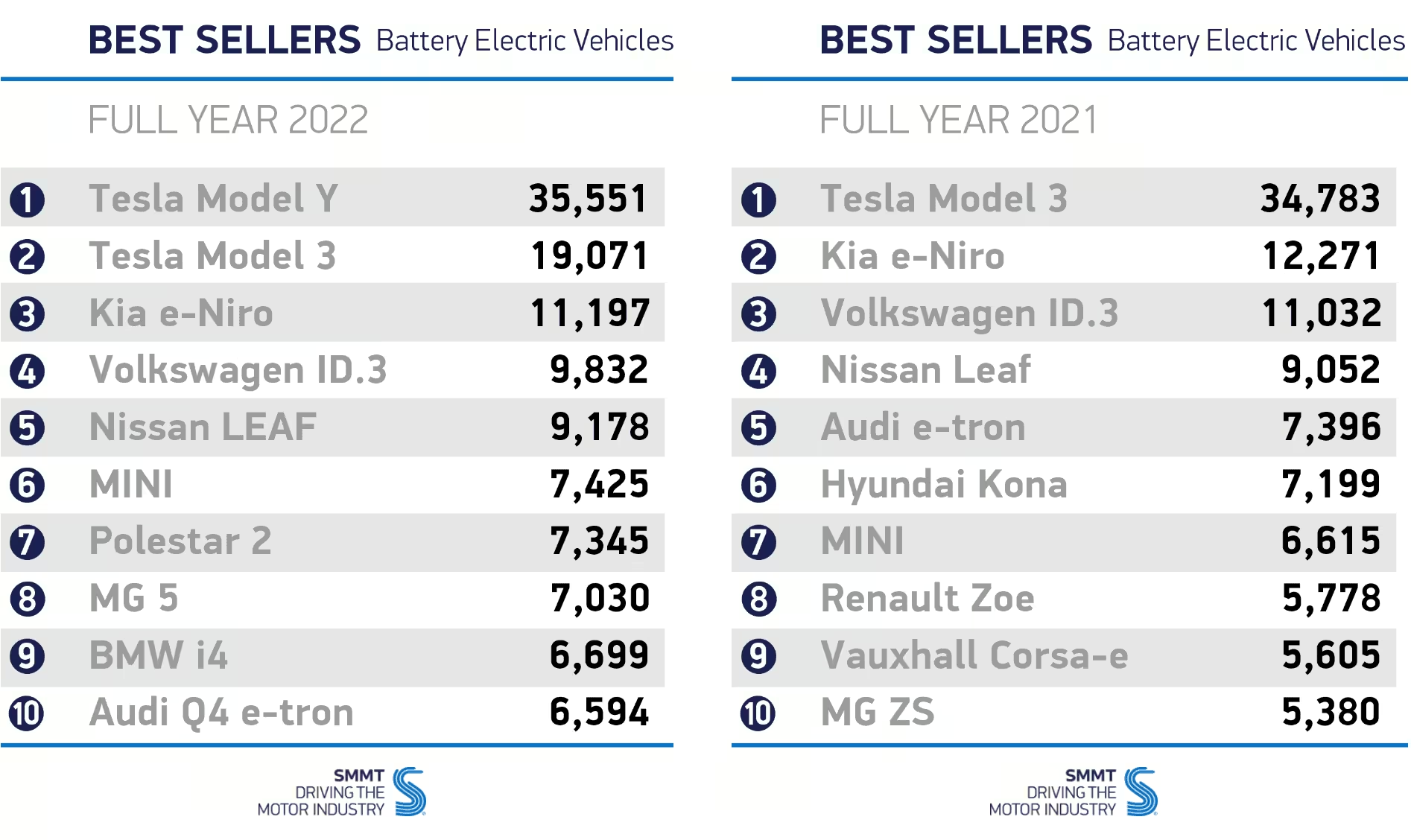

Since we reached the end of another year, the UK auto industry association, the SMMT, provided a top 10 chart of the bestselling BEV models for the year. We can compare the 2022 list (on the left) with the same list from 2021 (on the right):

As we saw above, the Tesla Model Y (which started UK deliveries in February 2022) has immediately proved the most popular BEV, and jumped into the top spot.

Notice, however the general consistency in popular models between 2021 and 2022. The top 4 from 2021 shuffled down one place to make way for the Model Y, but otherwise kept their relative rankings. However, the Tesla Model 3 took a volume dip, which points to sibling “cannibalisation” from the Model Y. Yet across the two models, Tesla’s combined volume grew by 57% year on year — faster volume growth than the UK’s overall BEV market (40% YoY growth).

Tesla’s relative strength in the UK can be seen by the fact that some the other popular BEV models (the Kia Niro, VW ID.3, Nissan Leaf) saw 2022 volumes roughly flat, or slightly dipped, compared to 2021.

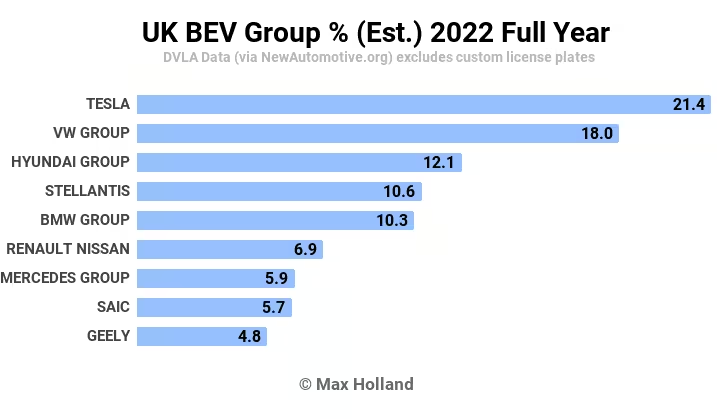

Manufacturing group rankings

Now let’s take a look at manufacturing group performance, first over the Q4 period:

Compared to Q3, Tesla and VW Group maintained their positions at the top. BMW Group climbed from 5th to 3rd, and Renault-Nissan climbed from 6th to 4th.

The biggest gainer was Geely (owner of Volvo and Polestar) which climbed from 9th to 5th. On the flip side, Hyundai Motor Group fell from 3rd to 6th, and Stellantis fell hardest, from 4th to 8th.

Let’s finally look at the groups’ full year results, and compare with last year.

I have partial and indicative data for 2021 (though not 100% complete or 100% accurate). In 2021 VW Group had the overall lead, with Tesla in second. In 2022, VW Group lost market share, whilst Tesla gained share, and took the lead.

It seems that the remaining ranking positions are the same as last year. The market share weightings have improved a bit for Tesla, BMW Group, and Geely, at the expense of lost weightings for Hyundai Motor Group, Stellantis, and VW Group.

As Tesla have shown, the introduction of a competitive new model, backed up by relatively unconstrained production volumes, can change the leadership charts. That means there’s everything to play for in 2023 if other manufacturing groups can step up.

Outlook

The Model Y was the UK’s overall bestselling BEV in 2022, and, remarkably the third best selling vehicle overall. This is an amazing result given that even the base variant (only offered from late August ’22) costs some £52,000, around twice the price of other vehicles in the UK’s overall top 10.

It is true that, starting from mid December, Tesla UK temporarily offered 6000 miles of free supercharging to incentivise deliveries taken before the end of the month (confirmed by Tesla).

This was likely to try to meet an end-of-year symbolic milemarker in Tesla’s global headline sales, rather than indicating any issue with ongoing UK demand. This temporary incentive may have pulled forward into December some low-thousands of deliveries, which would anyway otherwise have been made in January. Even without this, though, the Model Y would have been the UK’s 4th or 5th overall bestseller for 2022, a great result for BEVs.

Despite the UK’s overall auto market shrinking by 2% year on year (and still being 30% down on pre-2020 norms), BEVs continue to grow strongly, up 40% in volume YoY.

The overall auto market did see 5 consecutive months of YoY growth in the latter part of the year, and the SMMT are currently forecasting some 11% overall growth in 2023, saying “supply chains are beginning to stabilise and although the shortage of semiconductors is expected to ease, erratic supply will likely impact manufacturing throughout 2023.”

PHEVs now appear to have lost momentum in the UK. If Norway and Sweden can serve as guides, PHEVs will keep selling but not grow share by much overall (unless perhaps compelling new BEV+Rex models come available). Plugless hybrids, recently buoyed by “quick emissions fix” mild hybrids, seem to be now slowing their growth.

The only powertrain type with decent growth prospects from here on is BEV.

The long-term total cost of ownership proposition of BEVs is still compelling compared to ICE, even though the differential is temporarily suffering due to extreme electricity price inflation in recent months. New car buyers are aware of the BEV advantages, and we can expect BEV share to continue to grow in 2023, perhaps reaching above 40% of the market at the end of the year.

The actual growth rates for BEVs are now primarily influenced by the volume of supply, rather than by limited demand. 2023’s result will thus primarily depend on manufacturers making decent volumes of BEVs available to the UK market.

What are your thoughts on the UK’s auto market, and the transition to EVs? Please share your perspective in the discussion section below.