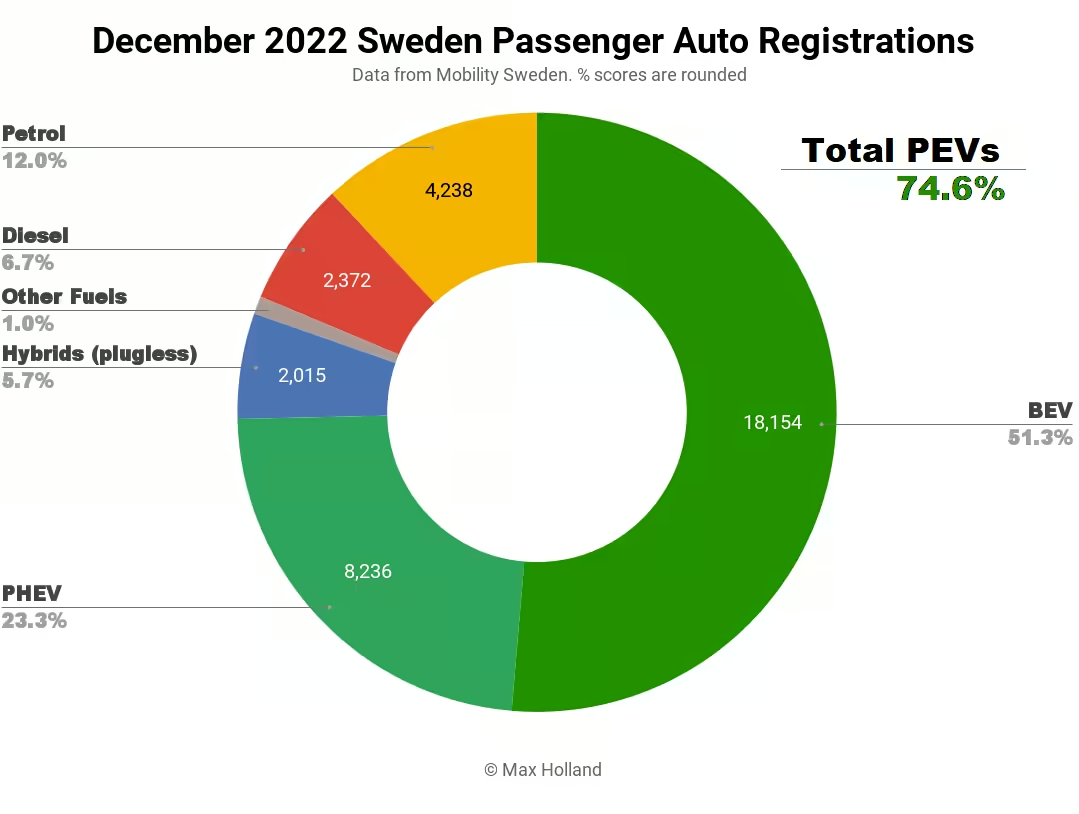

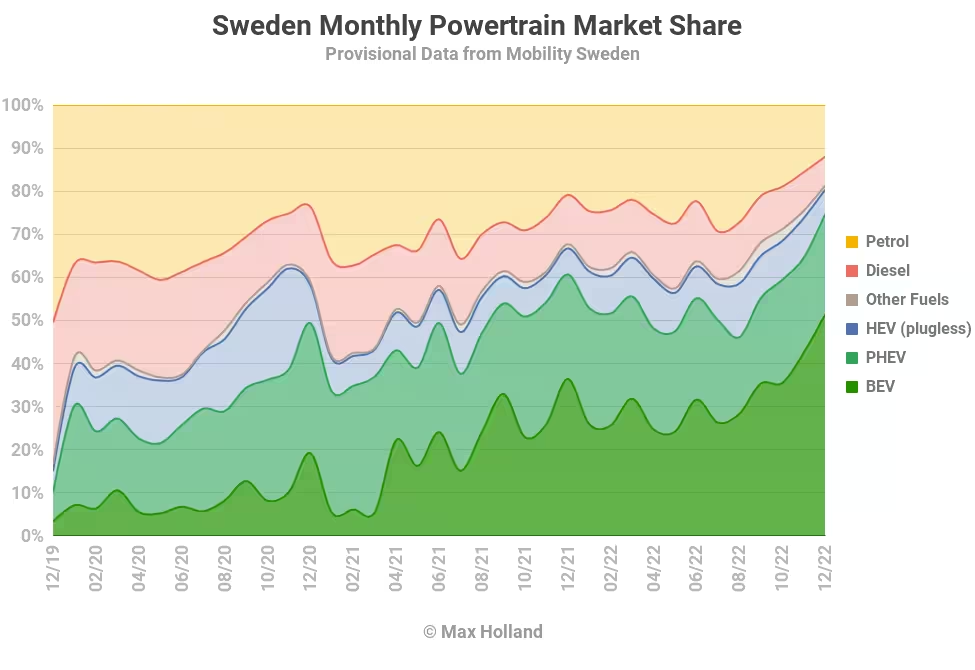

Sweden’s auto market saw plugin electric vehicle share continue to grow strongly in December, reaching a record 74.6%, up from 60.7% year on year. Full electrics alone took a record 51.3% share of the market.

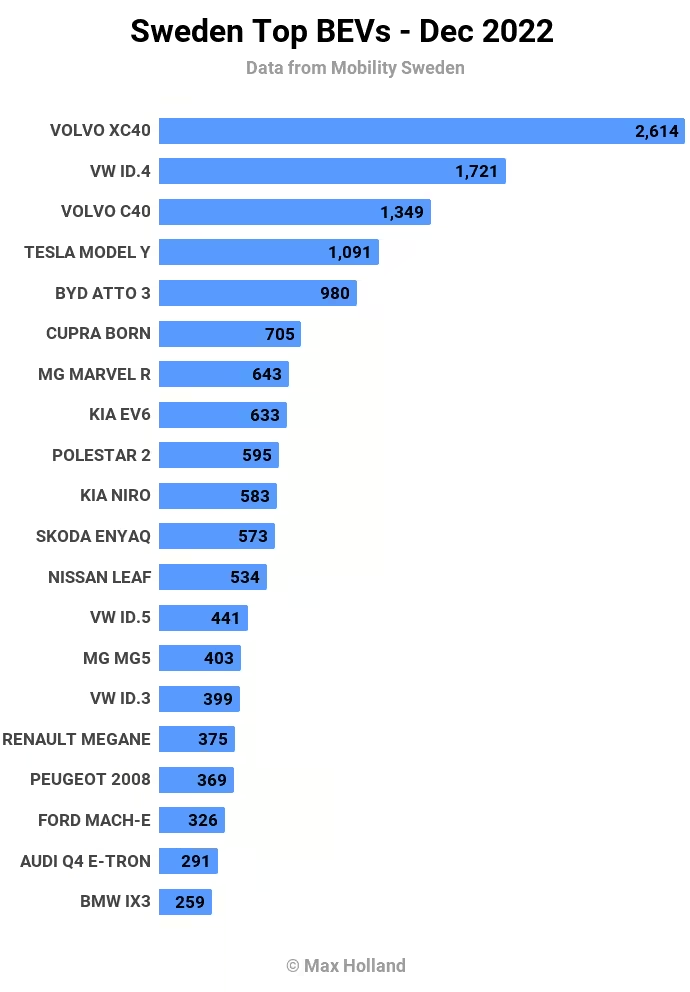

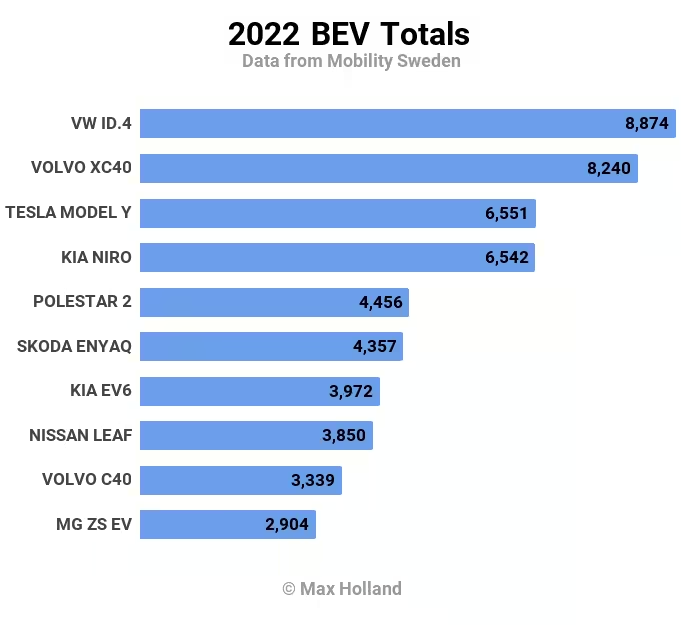

Overall, auto volume for the month was up 28% year on year, but still 18% down from December 2019. Full year 2022 saw auto volumes fall by 4% compared to 2021, and fall by over 19% compared to 2019. December’s bestselling BEV was the Volvo XC40. The full year bestseller was the Volkswagen ID.4.

December’s combined plugin share of 74.6% comprised 51.3% full battery electrics (BEVs), and 23.3% plugin hybrids (PHEVs). Their respective results a year ago were 36.4%, and 24.3%.

Full year 2022 plugin share stood at 56.1%, up from 45.0% in full year 2021. BEVs alone gained 33.0% share of 2022’s sales, up dramatically from 19.1% last year.

December’s volume of BEV sales grew by 81% YoY, to a record 18,154 units. Full year 2022 BEV volume was 94,984 units, YoY growth of 65.3%. PHEV 2022 volume was 66,577 units, a YoY fall of 14.5%.

Combustion-only powertrains’ (petrol and diesel) share in December fell to a record low of 18.7%, compared to 32.3% in December 2021. Their combined volume was 6,610 units.

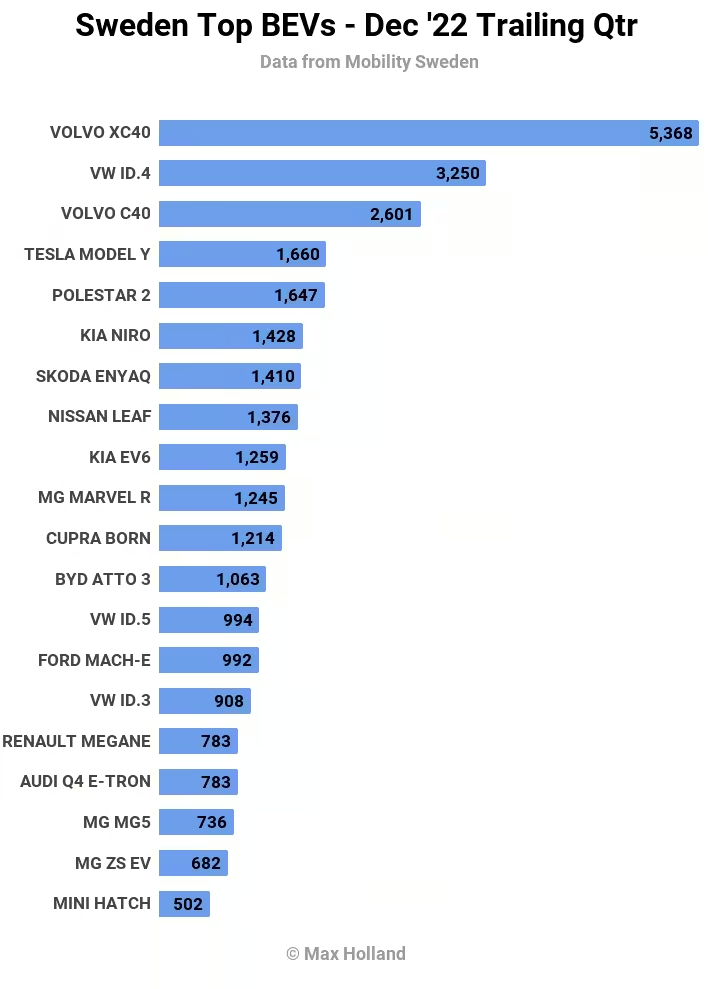

Sweden’s best selling BEVs

December saw the Volvo XC40 take the #1 spot for the 3rd month in a row. The previous regular favourite, the Volkswagen ID.4, once again had to settle for second place. Rounding out the top three was another Volvo, the C40. It’s great to see Sweden’s own local auto brand coming back to strength in the country’s BEV transition. Sister brand, Polestar, took #9 spot for the month.

December’s most notable performances came from the MG Marvel R, the Seat Cupra Born, and the new BYD Atto 3. The MG (#7) and Cupra (#6) climbed higher than any previous month. The BYD Atto 3 came roaring in to a remarkable #5 (and 980 units), having only first appeared in Sweden just last month (83 units). The BYD is a great value package, will see insatiable demand in Sweden, and - if delivery volumes can keep up - may be challenging for the top 3 in 2023.

Lower down the rankings, the new MG4 doubled its MoM deliveries in December, to 199 units. The MG4 is amongst the most affordable “fully competent” BEVs available, so it’s good to see the supply steadily growing.

The new Ora Funky Cat saw its first month of deliveries, with 146 units, and - though starting from a not-super-affordable €37k - is an interesting new offering in the compact premium/tech segment.

The new Aiways U5 mid-sized SUV also saw its first discernible volume (79 units). It is a similar form factor to, and slightly larger than, the popular Volkswagen ID.4, with seemingly more tech/premium bells and whistles, whilst significantly undercutting the VW on starting price (by >20%).

The base U5’s disadvantage compared to the base ID.4 is a smaller battery (60 kWh vs 77 kWh) and thus lower range (WLPT 410 km vs. 506 km) and slightly slower charging. But its powertrain specs will still be acceptable for many families, especially at the competitive price point.

Tesla’s Models S and X both finally made a reappearance in December, after a two year absence. With much more competition in the high priced premium segments now than when they were previously on sale, their advantage remains relatively short delivery times of just two or three months, compared to 6 to 12 months (or more) for many other BEVs.

Let’s now smooth out the monthly shipping variations and look at the 3-month picture:

Other than the recovery of the Volvo and Polestar models, there are no other big surprises in the top 10. Notice that the BYD Atto 3 has already achieved 12th spot from effectively just a single month of volume deliveries. Here’s a summary of the major movements compared to the rankings 3 months earlier:

- Volvo XC40 up from 9th to 1st

- Volvo C40 up from 20th to 3rd

- Polestar 2 up from 11th to 5th

- MG Marvel R up from 16th to 10th

- Renault Megane up from 33rd to 16th

Here are the models that fell in ranking:

- Tesla Model 3 fell from 7th to 37th

- Skoda Enyaq fell from 2nd to 7th

- MG ZS fell from 3rd to 19th

- MG5 fell from 10th to 18th

- BMW i3 fell from 13th to 55th

I’m not sure what’s happening with the Tesla Model 3. Orders placed today (for any variant) are supposed to deliver in less than 3 months, so it doesn’t look like there is an issue with limited supply for Sweden. Perhaps Swedish auto buyers are simply moving away from the low-slung sedan form factor (the above tables of best sellers certainly suggests so). All of the other vehicles in the above lists have more practical fully opening tail-gates, rather than the Model 3’s smaller rear aperture.

With regard to the full year 2022 model performances, below are the top 10 best selling BEVs. Note that - since BEV are a rapidly developing market, with new and more affordable models appearing all the time (BYD Atto 3, etc.) - we should likely regard the latest 3-month rankings (above) as much more indicative of future success, than the full year rankings:

Outlook

Sweden’s plugin incentive landscape has changed a couple of times over the course of 2022. Since the most dramatic recent (and out-of-the-blue) change on November 8th, the current situation is that there are no longer any “carrot” incentives (the “climate bonus”) for newly ordered plugin vehicles (neither PHEV nor BEV).

Existing yet-to-be fulfilled orders that were placed before November 8th will be grandfathered in, and still get the prior bonus payment (up to roughly €4,000 per vehicle) once finally delivered and registered for road use. With long delivery times for BEVs, in many cases the actual registration of these early November 2022 orders may happen as late as autumn 2023.

However, the “stick” side of the bonus-malus policy remains in place, since new ICE vehicles are still subject to higher road tax for the first 3 years after registration, whereas EVs (now classified as vehicles with emissions below 30g of CO2/km) pay no road tax (for now at least). The amount of ICE road tax is linked to emissions rating (CO2/km), and can amount to thousands of euros per year for the most inefficient autos.

This being the case, there is still effectively an economic policy incentive for consumers to avoid ICE vehicles, and instead choose the most efficient plugins (mostly BEVs), on top of the long term energy cost savings for consumer who drive plugins rather than ICE vehicles.

We won’t have a clear picture of how the cancellation of the bonus will shape continuing plugin demand until next summer/autumn. Sweden’s transition to plugins will doubtless continue over the long run, though there may be some short-to-mid-term discontinuities.

Perhaps by autumn 2023 even more affordable BEVs, like the BYD Dolphin, will be starting to be offered in the Swedish market, and be able to compete on overall value with ICE vehicles in their own right.

What are your thoughts on the prospects for Sweden’s EV transition in the years ahead? Please share your perspective in the comments section.