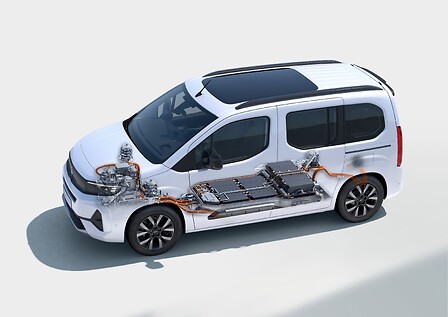

The cobalt-free battery chemistry LFP (LiFePO4) continues to dominate the battery production in China and its market share keeps growing every month.

Let’s see the data.

Battery production in China (May 2021)

- LFP: 8,8 GWh (63,8 %)

- NCM/NCA: 5 GWh (36,2 %)

- Total: 13,8 GWh

Last month in China LFP battery production increased by 317,3 % compared to May last year.

It’s clear that the Tesla Model 3 MIC (Made in China) is currently one of the biggest drivers of the increased demand for LFP battery cells.

Moreover, local media is reporting that the Tesla Model Y MIC is expected to receive a more affordable version with a LFP battery starting next month. If confirmed, it’ll be another big push for cobalt-free batteries.

Currently, the Tesla Model Y in China starts at 347.900 yuan (44.901 euros), but it needs to get below 300.000 yuan (38.719 euros) to become eligible for government subsidies.

Next year, LNMO, which is another cobalt-free battery chemistry, should also get some traction.

Tesla and Volkswagen expect LFP and LNMO to become the standard battery chemistries in electric cars, relegating high-nickel content chemistries - such as NCMA - to niche electric vehicles that require extra range.

Anyway, I wonder how long will it take before electric cars made in Europe get cobalt-free batteries. Hopefully the battery cell plant currently under construction in Germany by CATL starts producing LFP cells very soon and at full speed.

More info: