CALB (China Aviation Lithium Battery) aims to become a top battery cell maker very soon, but right now world’s biggest EV battery cell maker is CATL by a large margin, as we can see from the Q1 2021 results below.

Global electric vehicle battery application in Q1 2021

- CATL: 15,1 GWh (31,5 %)

- LG Energy Solution: 9,8 GWh (20,5 %)

- Panasonic: 8 GWh (16,7 %)

- BYD: 3,2 GWh (6,8 %)

- Samsung SDI: 2,5 GWh (5,3 %)

- SK Innovation: 2,4 GWh (5,1 %)

- CALB: 1,3 GWh (2,7 %)

- AESC: 1 GWh (2,1 %)

- Guoxuan: 0,9 GWh (1,9 %)

- PEVE: 0,6 GWh (1,3 %)

While the Japanese and Korean companies are slowly losing ground, multiple Chinese companies are aiming to reach the top 3 in few years.

BYD, CALB and Guoxuan are the Chinese battery cell makers better positioned to reach the top 3 in a year or two.

Here is CALB’s battery cell production capacity roadmap.

- 2020: 30 GWh

- 2021: 100 GWh

- 2022: 200 GWh

- 2025: above 300 GWh

Notice that 200 GWh represents 4 million battery packs with 50 kWh each.

Regarding energy density, during current year CALB expects to reach 225-240 Wh/kg at the battery pack level, enabling electric cars to achieve a NEDC range of 800-1.000 km (around 600-750 km in WLTP).

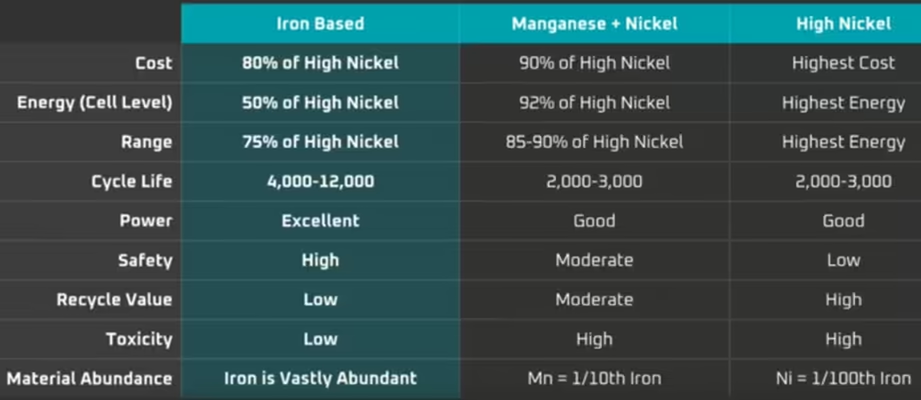

While the previous uncontested market leaders - Korean and Japanese battery cell makers - are still focused solely on high energy density chemistries (NCM/NCA/NCMA), Chinese companies can also produce cheaper cobalt-free batteries in large quantities, thanks to the LFP (LiFePO4) chemistry.

However, this advantage of Chinese battery cell makers can be short-lived, since other battery cell makers are also expected to produce their own cobalt-free batteries anytime soon. I expect LG Chem to announce the introduction LNMO battery cells before 2022, to regain its position as world’s biggest battery cell maker.

Some published research papers suggest that LNMO is the cobalt-free battery chemistry Koreans and Europeans are developing. Moreover, Tesla and Volkswagen already stated that LNMO is expected to become the battery chemistry used for high volume production, relegating LFP to entry-level versions and NCMA to premium niches.

More info:

http://www.calb-tech.com/news/127.html