Lithium Australia subsidiary VSPC developed a new cobalt-free LFMP battery cell. LFMP is the high-voltage version of LFP (LiFePO4) and is expected to become its successor.

Let’s see some highlights of the press release.

VSPC – developing the ‘safe’ lithium-ion battery

HIGHLIGHTS

- Safety and cost are driving lithium-ion battery (‘LIB’) technology in the direction of lithium ferro phosphate (‘LFP’).

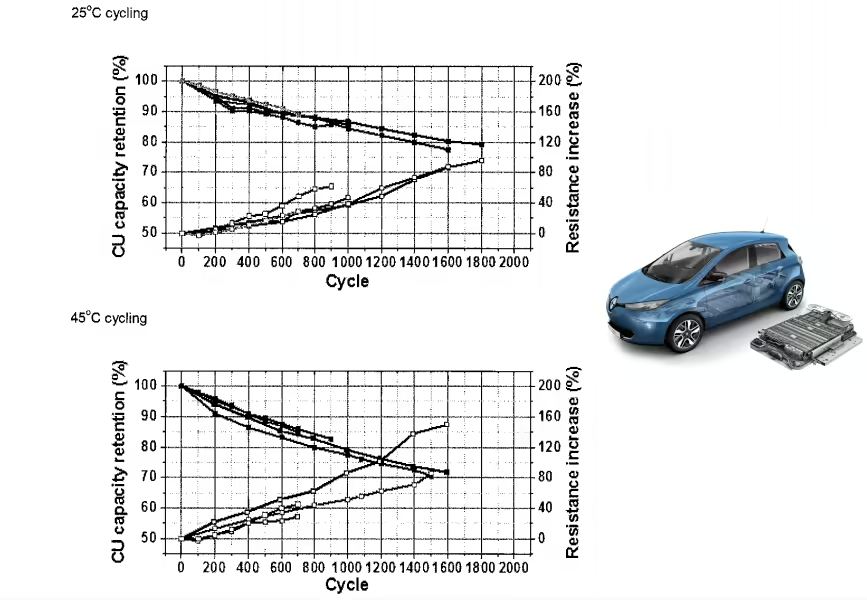

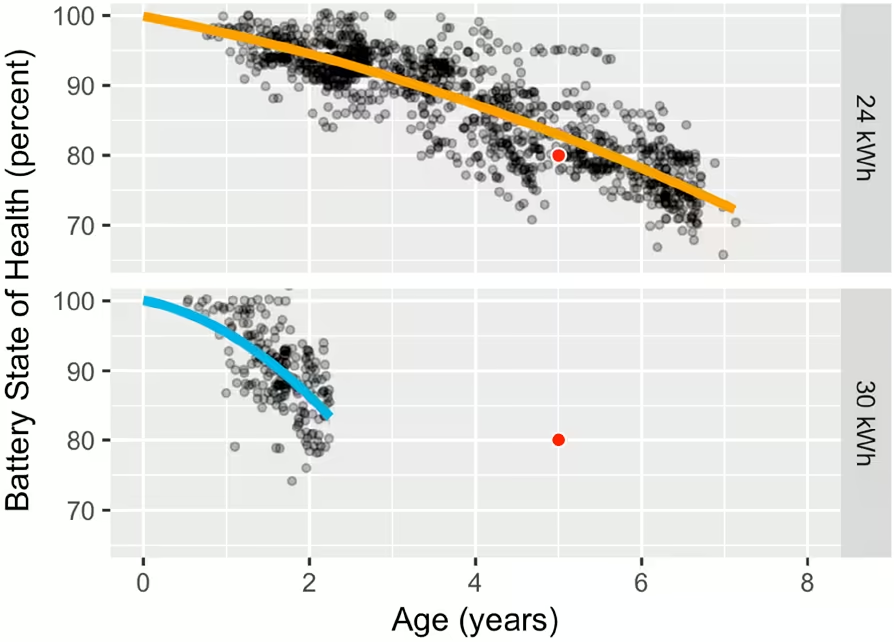

- LFP and its derivatives provide far more duty cycles than competing nickel- and cobalt-based LIBs.

- The addition of manganese to LFP (producing ‘LMFP’) improves LFP energy density while retaining its superior attributes.

- Lithium Australia NL (ASX: LIT) 100%-owned subsidiary VSPC Ltd (‘VSPC’) has successfully produced LMFP cathode powders that demonstrate improved performance.

Overview

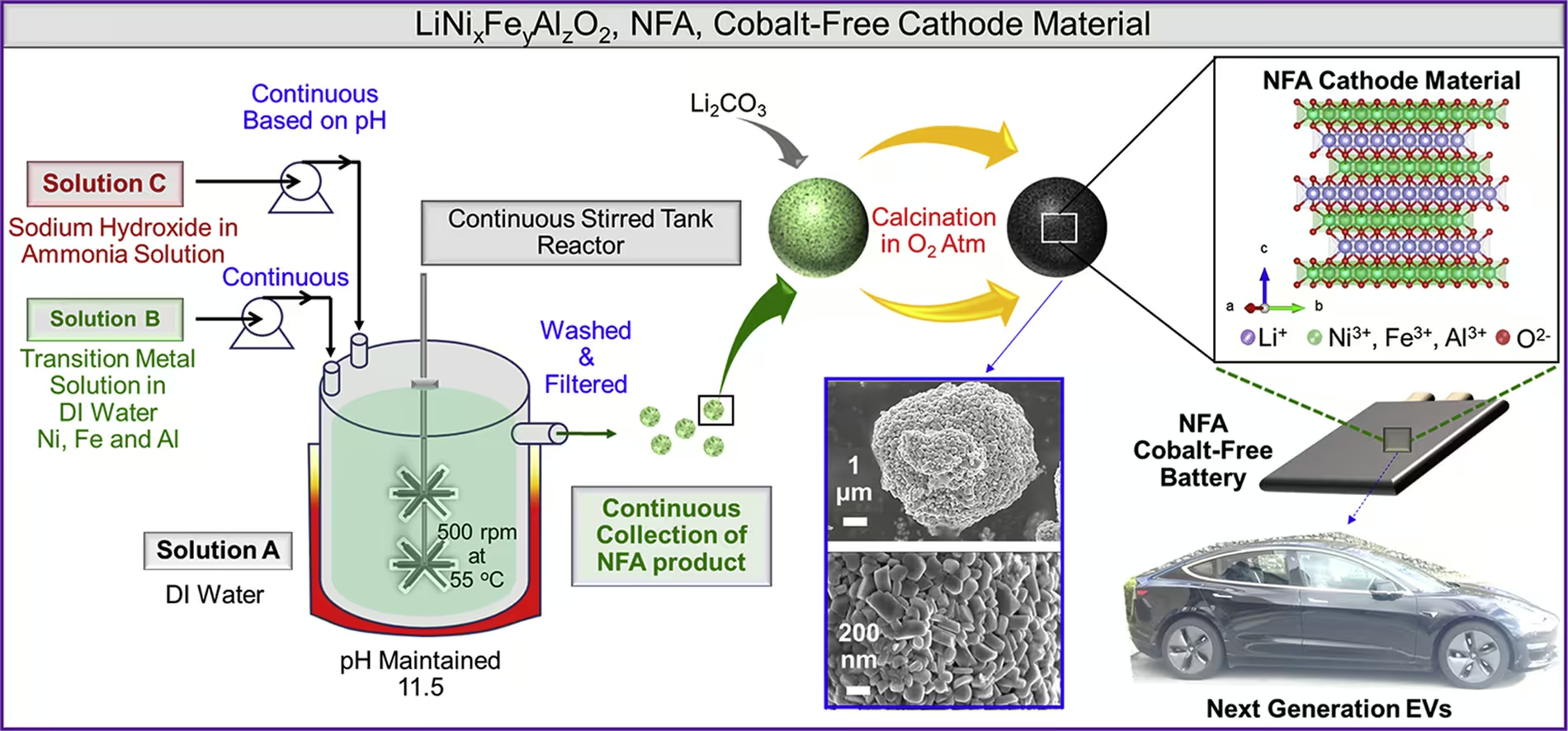

VSPC has made significant progress towards improving the energy density of LFP LIB cells by adjusting its proprietary manufacturing processes to incorporate manganese into the cathode active material during production.

Improving on LFP performance

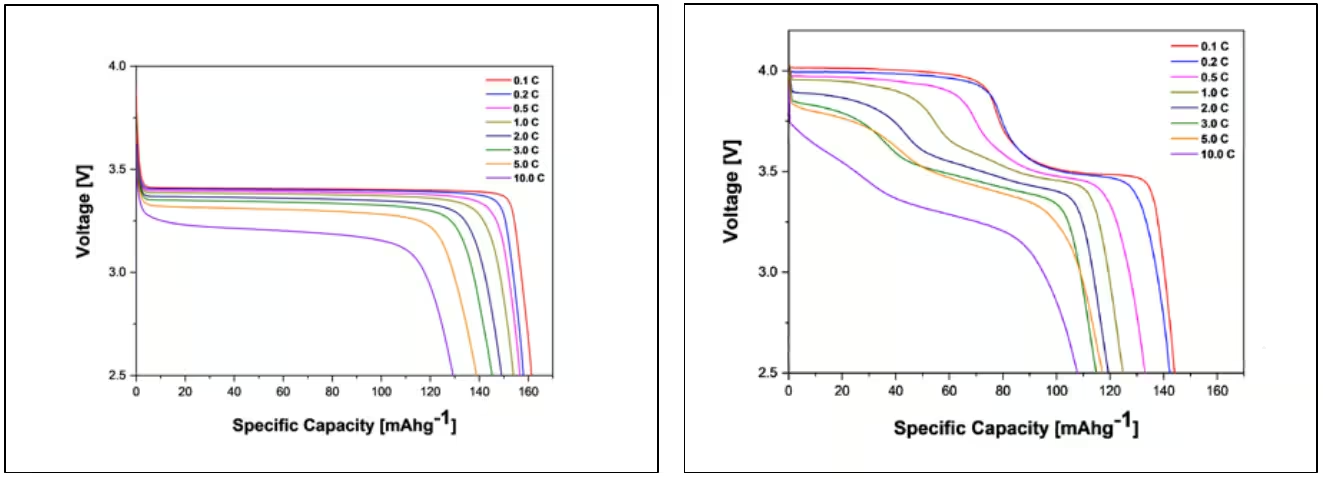

VSPC has successfully produced LMFP battery cells for testing. These cells, by virtue of their higher voltage, provide greater energy density than that of standard LFP cells. The discharge curves below are for cells manufactured from VSPC-produced LFP (left) and VSPC-produced LMFP (right). The higher voltage delivery of the LMFP cells results in an energy density increase of up to 25% when compared with the LFP cells. Globally, major LFP cell producers are striving to achieve similar increases in energy density by introducing manganese as a component of their cathode powder.

Safety considerations

LIBs can be divided into a number of categories based on the crystal structure of the cathode materials they contain. Currently, the types of LIBs most commonly used in electric vehicles (‘EVs’) are nickelcobalt manganese (‘NCM’) and nickel cobalt aluminum (‘NCA’). Both NCM and NCA have a spinel (oxide) structure characterised by relatively low-strength chemical bonds. LFP and LMFP, on the other hand, are composed of phosphates (olivine-like crystal structures) with exceptionally high bond strengths. It is this fundamental physical property that results in the superior characteristics (including thermal stability and long service life) of LFP- and LMFP-type LIBs. Prelude to rapid- charge batteries for transport applications VSPC plans to develop a rapid-charge battery for transportation applications (see announcement 12 February 2020). Its recent success in testing LMFP cells demonstrates the potential for VSPC’s patented manufacturing process to synthesise LMFP for these applications. Due to its higher energy density, LMFP should reduce the ‘range anxiety’ associated with standard LFP formulations designed for EVs.

Low-cost raw materials

Being able to produce high-performance LIBs without the requirement for nickel or cobalt has many advantages, safety being paramount. Beyond that, the use of common bulk commodities such as manganese, iron and phosphorus reduces costs. Access to much more reliable supply chains is a further advantage.

The ESG advantage

Commercialisation of LMFP for the production of LIBs would eliminate the requirement for materials from regions in which human rights abuse (including the use of child labour) is rife. Moreover, as noted, using materials derived from industrial waste materials and spent batteries to create precursors for new LFP- or LMFP- type LIBs can enhance sustainability and reduce supply chain risk.

The discharge curves of battery cells with LFP and LFMP cathodes are very different. While LFP battery cells maintain a flat voltage curve from almost full to almost empty, LFMP battery cells have a big voltage drop at around 50 % of SoC (State of Charge).

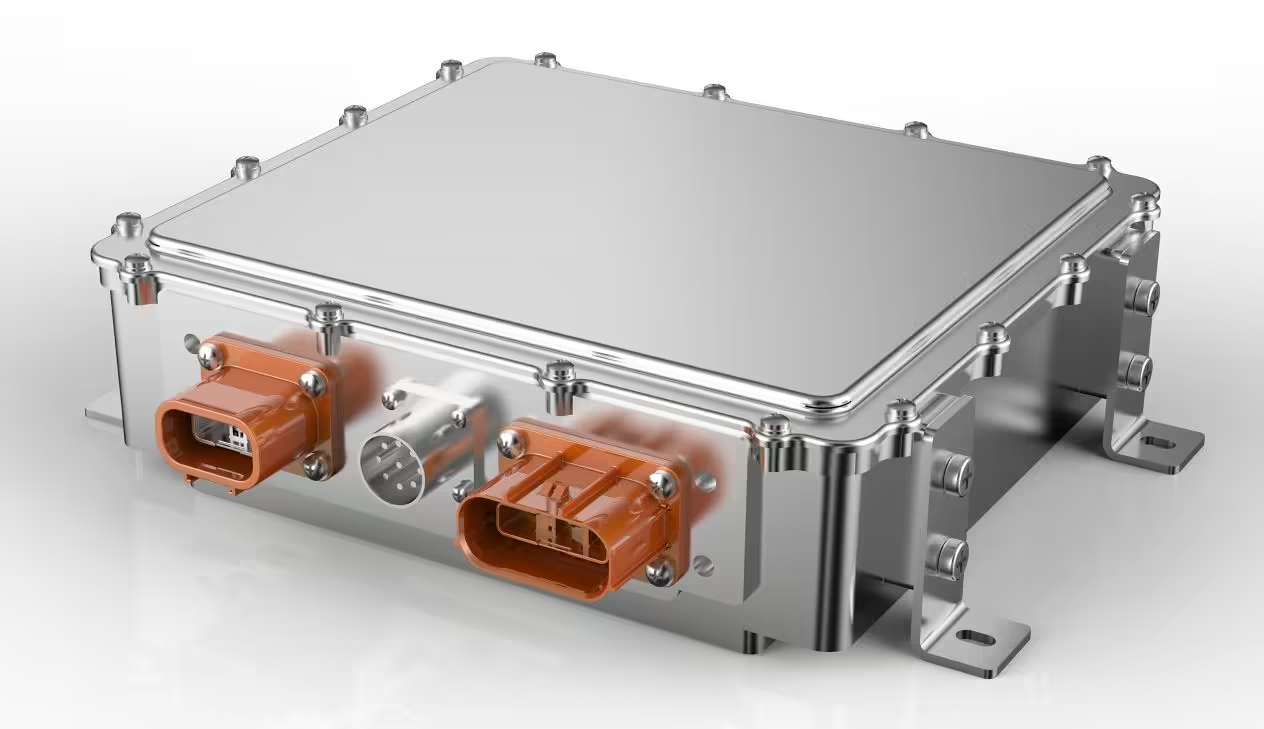

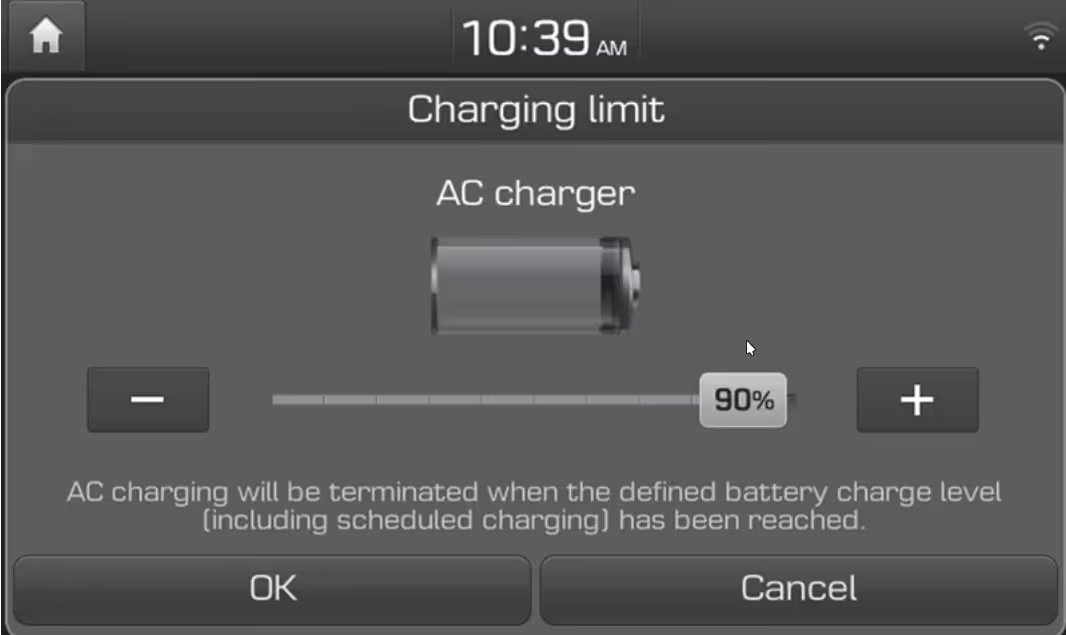

When battery cells have different discharge curves they also require different BMS (Battery Management System) and GOM (Guess-o-Meter) algorithms. This is something that recently has become quite clear in the Tesla Model 3 SR+ made in China.

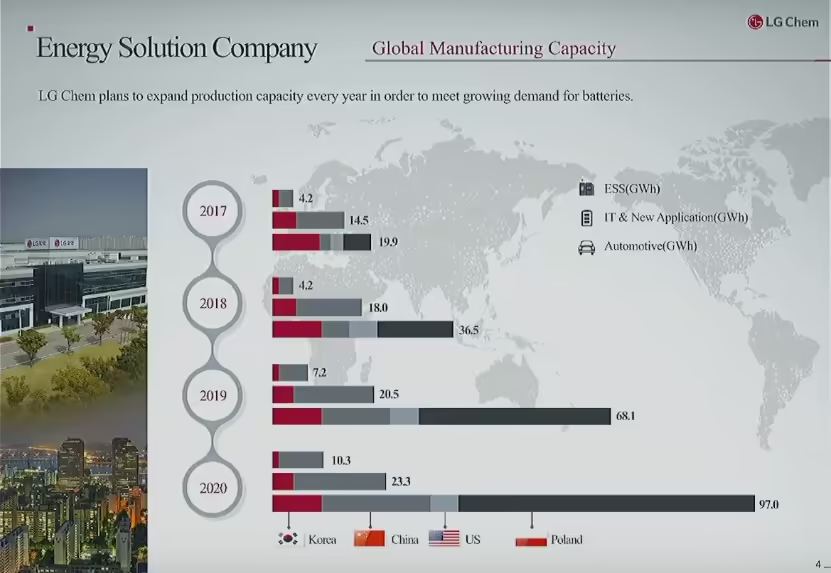

The Tesla Model 3 SR+ MIC had its initial NCM 811 battery cells from LG Chem replaced by LFP battery cells from CATL and now the GOM doesn’t give reliable range estimations. Now Tesla needs to gather data from the new cars to make some adjustments to the BMS and GOM, then it can solve this issue with a OTA (Over-the-Air) firmware upgrade.

Anyway, LFMP and LNMO are the two most promising cobalt-free battery technologies for the near future and are expected to become available already next year. They are extremely safe, affordable and have decent energy density. Nonetheless, LFP batteries are getting better and with their proven reliability I expect them to be around for sometime to come.

More info: