Tata Nexon EV is an affordable Indian electric car that was revealed on 19 December 2019 and is already being delivered to customers in India.

This electric car looks good and has decent specs for its starting price of 1.399.000 Indian rupees (16.163 euros). In some ways it’s similar to the upcoming Dacia Spring.

Let’s see what the Tata Nexon EV has to offer.

- Length: 3.993 mm

- Wheelbase: 2.498 mm

- Width 1.811 mm

- Height 1.606 mm

- Curb weight: 1.400 kg

- Boot space: 350 L

- Motor: 95 kW and 245 Nm of torque

- Acceleration: 0-100 km/h in 9,9 seconds and 0-60 km/h in 4,6 seconds

- Max speed: 120 km/h

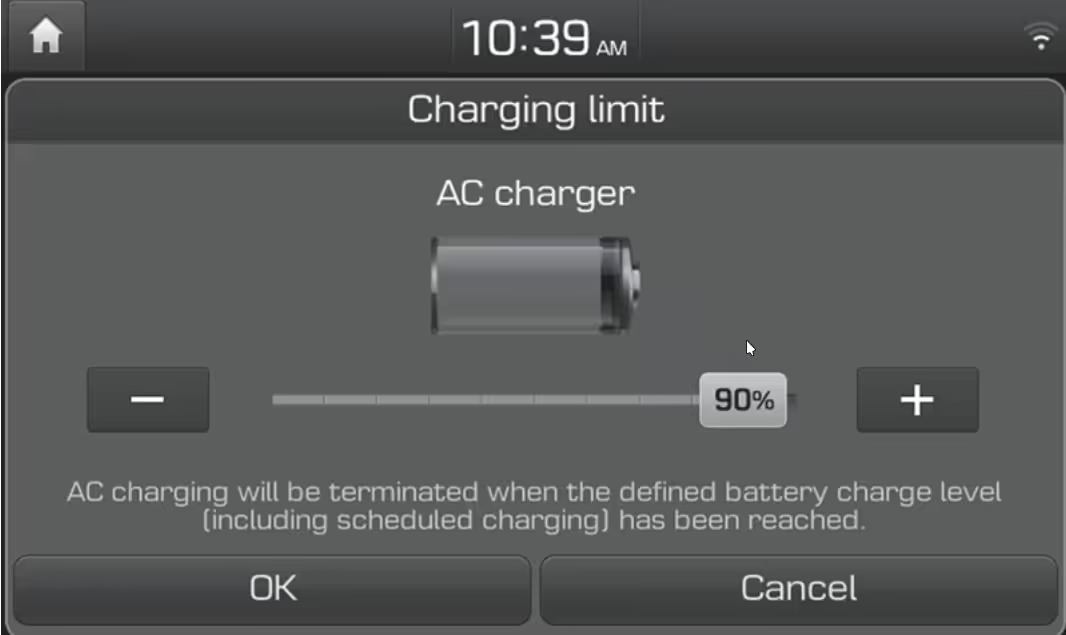

- On-board charger: 15 A, charging 10-90 % in 8 and half hours

- DC fast charging: 0-80 % in 60 minutes via CCS 2

- Battery: 30,2 kWh (liquid cooled)

- Range: 312 km (MIDC)

- Motor and battery warranty: 8 years or 160.000 km

- Vehicle warranty: 3 years or 125.000 km

Notice that the MIDC (Modified Indian Driving Cycle) is even more unrealistic than the now obsolete Europe’s NEDC. In the more realistic WLTP test cycle the range would be around 200 km and the consumption around 17 kWh/100 km.

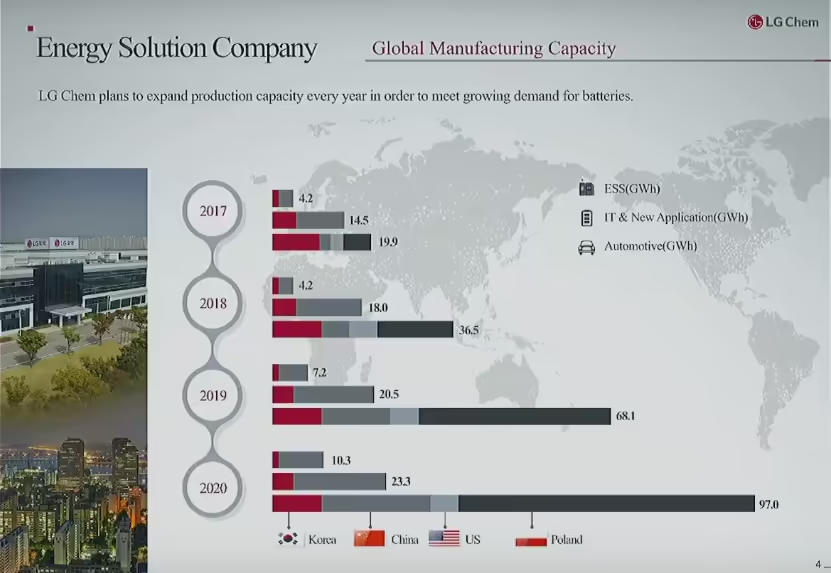

While not confirmed, it seems that the 30,2 kWh battery of the Tata Nexon EV uses NCM battery cells made by LG Chem.

Tata made sure that the Nexon EV complies with more demanding international safety standards (NCAP), this might indicate that the automaker will eventually export this electric car to EV-hungry markets like Europe. China is less probable because of high import tariffs and this market already has a lot of affordable electric cars available.

Anyway, next week we’ll have more details on the Dacia Spring. Based on the Renault City K-ZE it’ll probably get a 30 kWh battery (26,8 kWh usable), a WLTP range of 200 km and a starting price of 15.000 euros before government subsidies. While it seems to be a good price for the European market, it’ll still cost twice as much as the popular ICE (Internal Combustion Engine) car Dacia Sandero…

If the Dacia Spring gets decent specs, availability and price it might prevent the imminent arrival of affordable Chinese and Indian electric cars in Europe. I know that Chinese and Indian automakers are eager to get a slice of the European affordable electric car market, especially now that Volkswagen left the segment unattended by discontinuing the triplets.

After dominating the affordable electric car segment and building up trust with their customers, Chinese and Indian automakers can then move to more profitable segments. This is a smart strategy that was successfully applied by Chinese smartphone makers like Huawei, Xiaomi or Oppo.

This is why I think that European automakers are risking a lot by ignoring the affordable electric car segment and leaving an open door for competitors… Volkswagen will regret its decision very soon.

I’ll leave you with a video review of the Tata Nexon EV. I like it, do you?

More info:

https://nexonev.tatamotors.com/

https://www.tatamotors.com/press/tata-motors-announces-its-cutting-edge-ev-technology-brand-ziptron/