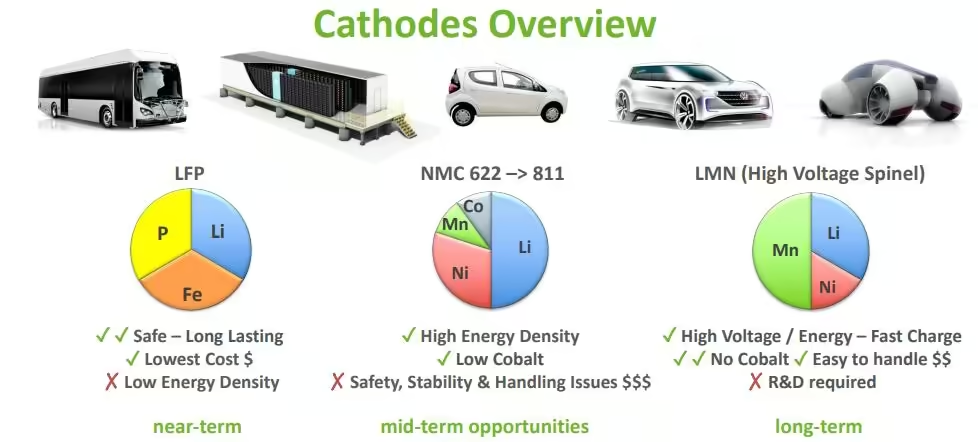

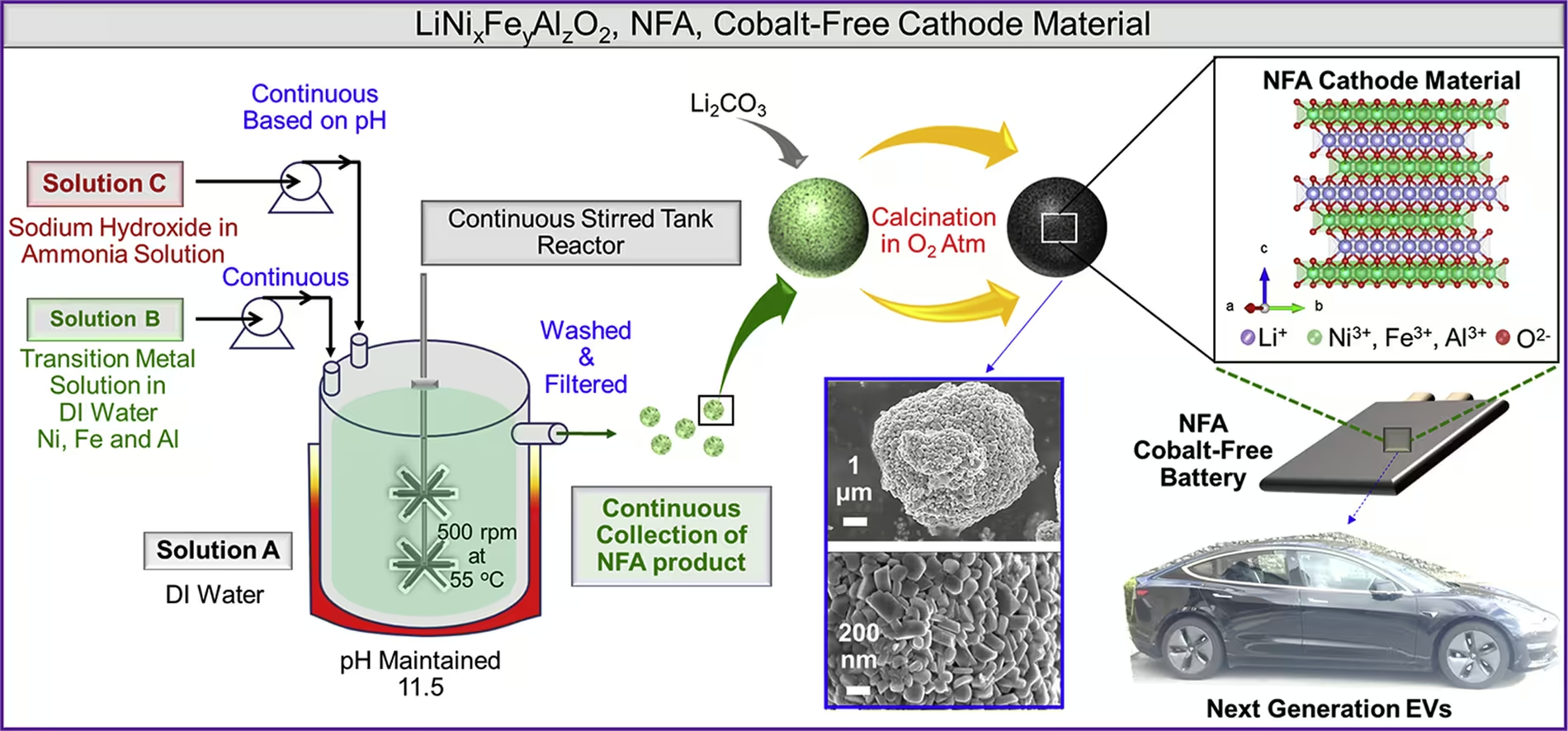

It’s no secret that the massification of electric cars requires batteries made with cheap raw materials, which means that they need to be cobalt free.

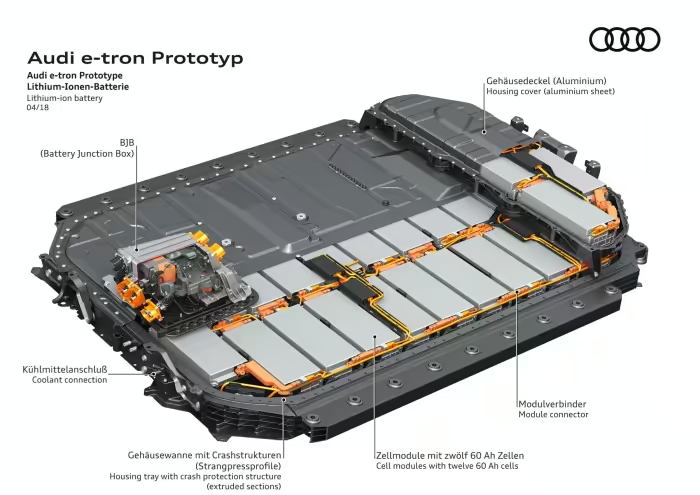

However, cobalt-free battery cells still don’t have great energy density, therefore reducing passive material is crucial to achieve overall good energy density and cost at the battery pack level.

The active material of battery packs is what stores the energy (cells) and its cost is variable (60-90 euros per kWh). The passive material is what assembles and protects the cells (cables, tubes, electronics and case), it doesn’t depend much on battery capacity and its cost tends to be more linear.

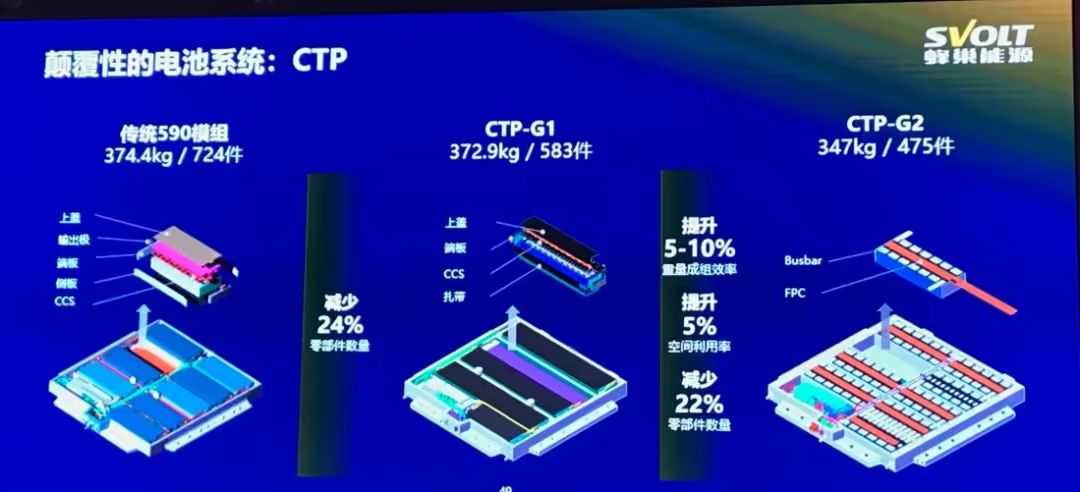

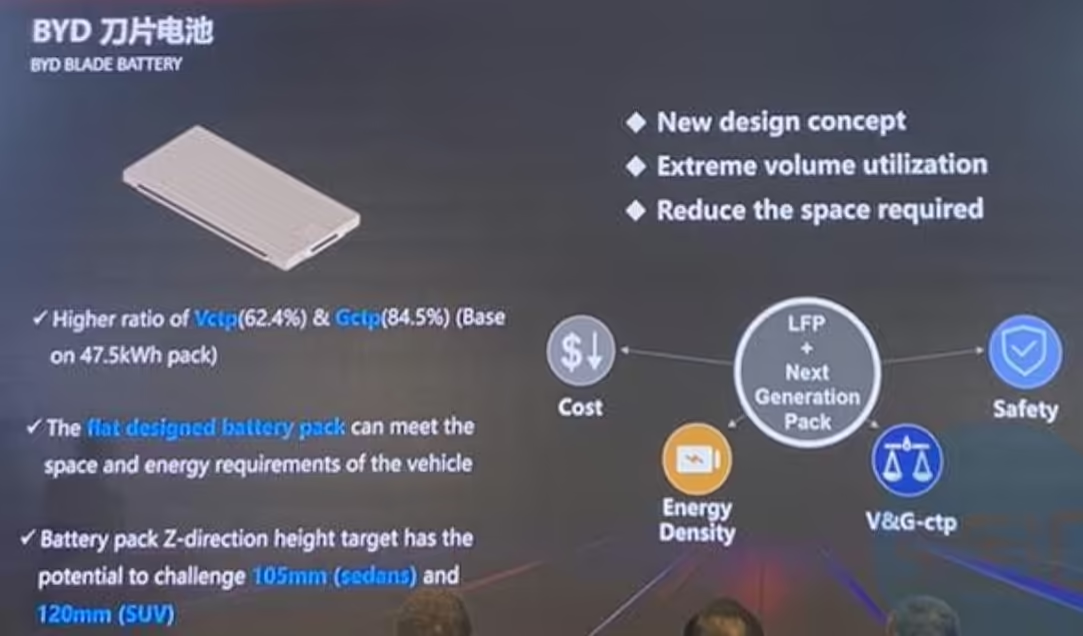

Battery cell makers such as CATL, BYD and SVOLT are developing module-less battery packs with CTP (cell-to-pack) technology. Without modules, the long prismatic battery cells connected in series are put in an array and then inserted into a battery pack, making it as simple as possible.

The simplicity of the CTP technology helps to achieve a good energy density at the battery pack level, even if the energy density of the cells isn’t amazing.

In this article, we’ll compare two alternative cobalt-free battery technologies, one from BYD and other from SVOLT.

SVOLT battery cell specs

- Capacity: 226 Ah

- Nominal voltage: 3,81 V

- Max charging voltage: 4,35 V

- Energy: 861 Wh

- Weight: 3,59 kg (estimation)

- Dimensions: 575 x 21,5 x 118 mm

- Volume: 1,459 L

- Gravimetric energy density: 240 Wh/kg

- Volumetric energy density: 590 Wh/L

- Chemistry: LNMO

Hypothetical battery pack

- Cells: 92 (92s1p)

- Nominal voltage: 350,52 V

- Capacity: 79,2 kWh

- Total cell weight: 330 kg

- Total cell volume: 134 L

- Total pack weight: 391 kg (estimation from a GCTP of 84,5 %)

- Total pack volume: 215 L (estimation from a VCTP of 62,4 %)

- Gravimetric energy density: 203 Wh/kg (estimation from a GCTP of 84,5 %)

- Volumetric energy density: 368 Wh/L (estimation from a VCTP of 62,4 %)

- Active material cost: 5.544 euros (70 euros per kWh)

- Passive material cost: 1.000 euros

- Total cost: 6.544 euros (83 euros per kWh)

Unlike BYD, SVOLT doesn’t mention VCTP (volumetric cell-to-pack ratio) or GCTP (gravimetric cell-to-pack ratio) of its CTP battery packs. I’ll assume 62,4 % for VCTP and 84,5 % for GCTP, which is the same that we get with the BYD Blade battery.

Anyway, previously I thought that SVOLT was using the high-voltage spinel form of LNMO, which has a high operating voltage of 4,7 V and I was wrong! The LNMO battery cell from SVOLT operates at a lower voltage, which means that there’s room for improvement…

Operating at 4,7 V would represent a voltage increase of 23 % and an equivalent energy density increase, reaching 296 Wh/kg and 728 Wh/L.

BYD Blade battery cell specs

- Capacity: 202 Ah

- Nominal voltage: 3,2 V

- Max charging voltage: 3,65 V

- Energy: 646 Wh

- Weight: 3,92 kg (estimation)

- Dimensions: 905 x 118 x 13,5 mm

- Volume: 1,442 L

- Gravimetric energy density: 165 Wh/kg (estimation)

- Volumetric energy density: 448 Wh/L

- Chemistry: LiFePO4 (LFP)

Hypothetical battery pack

- Cells: 110 (110s1p)

- Nominal voltage: 352 V

- Capacity: 71,1 kWh

- Total cell weight: 431 kg

- Total cell volume: 159 L

- Total pack weight: 507 kg (estimation from a GCTP of 85 %)

- Total pack volume: 253 L (estimation from a VCTP of 62,6 %)

- Gravimetric energy density: 140 Wh/kg (estimation from a GCTP of 85 %)

- Volumetric energy density: 280 Wh/L (estimation from a VCTP of 62,6 %)

- Active material cost: 4.266 euros (60 euros per kWh)

- Passive material cost: 1.000 euros

- Total cost: 5.266 euros (74 euros per kWh)

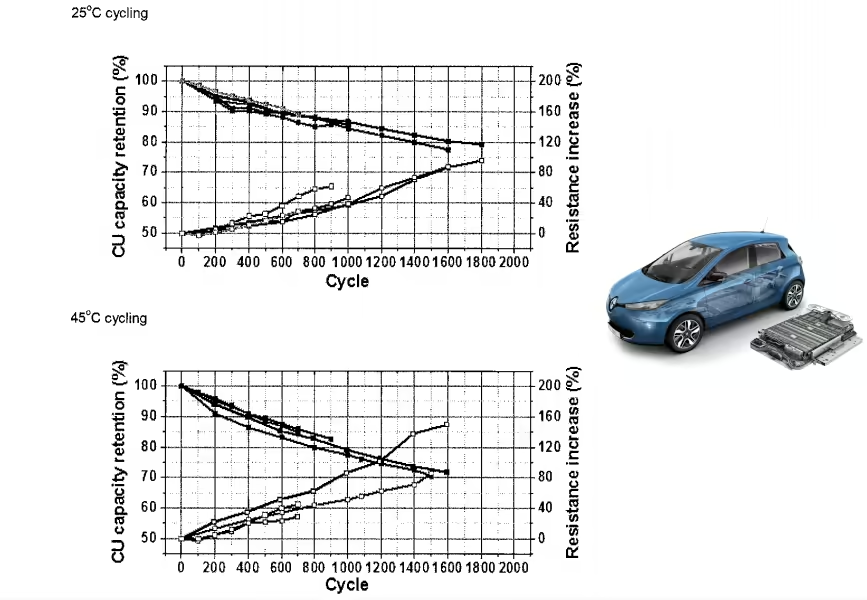

An energy density of 165 Wh/kg and 448 Wh/L is impressive for a LFP battery cell, but here there’s also room for improvement. LFMP is the high-voltage version of LFP and operates at 3,75 V, which represents a voltage increase of 17 % and an equivalent energy density increase. It would reach an energy density of 193 Wh/kg and 525 Wh/L.

Summing up…

We get more energy density with SVOLT’s CTP battery packs made with LNMO cells, but lower cost with BYD’s CTP battery packs made with LFP cells. Nonetheless, both batteries are great and still have room for improvement.

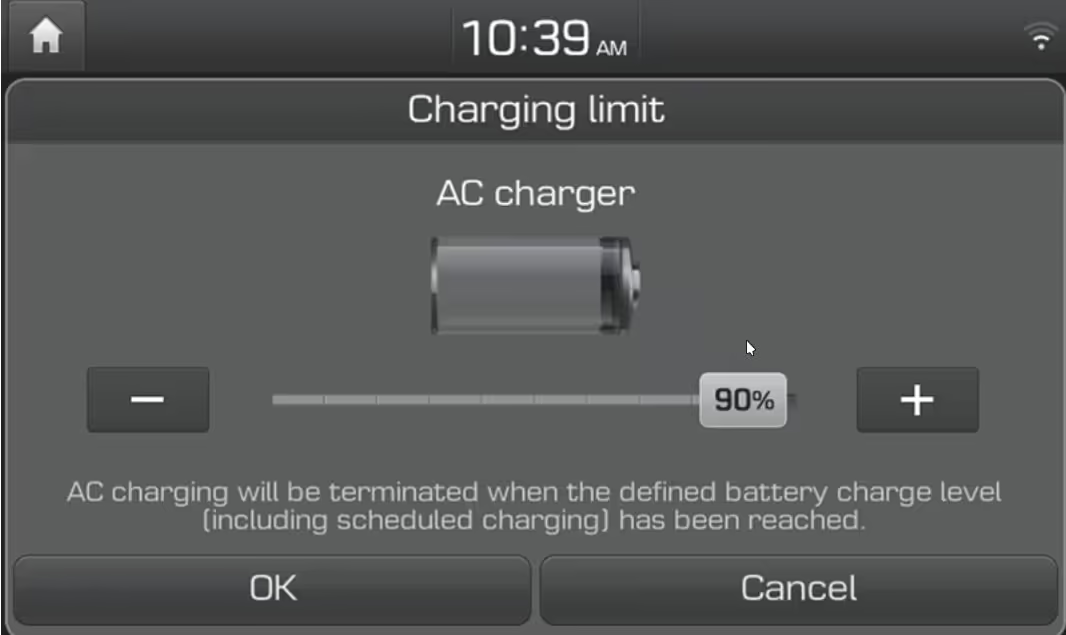

Both battery packs will be able to offer a usable capacity of at least 66 kWh, which would be enough for roughly a WLTP range of 500 km (311 miles) in a Hyundai Kona Electric for example.

Anyway, BYD is already producing its cobalt-free CTP battery packs, but we’ll have to wait a year to see SVOLT do the same…

Now I’m curious to know what CATL’s cobalt-free CTP battery packs will offer and what Tesla will show us in “battery day”. While I doubt that Tesla will ever produce its own battery cells, I wouldn’t be surprised if Tesla gradually replaced Panasonic and its cylindrical cells with CATL’s cobalt-free CTP battery packs… at least in some regions.

If Tesla doesn’t embrace cobalt-free CTP battery packs soon I’ll be extremely disappointed.